Last updated on February 10th, 2022 , 07:29 pm

One of the appeals of options trading is that you can trade strategies with high success rates (90% of higher in some cases).

This is especially true when you sell options and take profits at small profit percentages. In fact, one of our iron condor research reports found that managing iron condors at 25% of the maximum profit potential realized a 93% success rate. Unfortunately, that high success rate was met with the lowest profit expectancy of all the management approaches.

In this post, we’ll discuss why win rates alone mean nothing.

Jump To

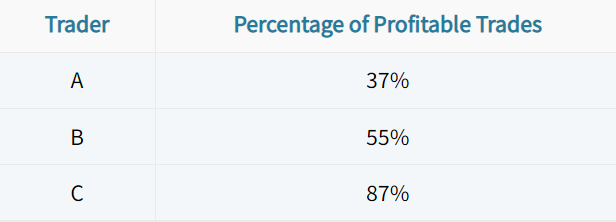

Percentage of Profitable Trades Comparison

Let’s look at three hypothetical traders and their percentage of profitable trades over the past year:

Based on these profit percentages, which trader did the best?

It might be easy to say that Trader C performed the best, but we actually have no idea how any of the traders performed. We need two other pieces of information to find the answer.

Success Rates, Average Profits, & Average Losses

Without knowing the average profits and average losses of each trader’s positions, the percentage of profitable trades means nothing and doesn’t tell us anything about the success of each trader’s approach.

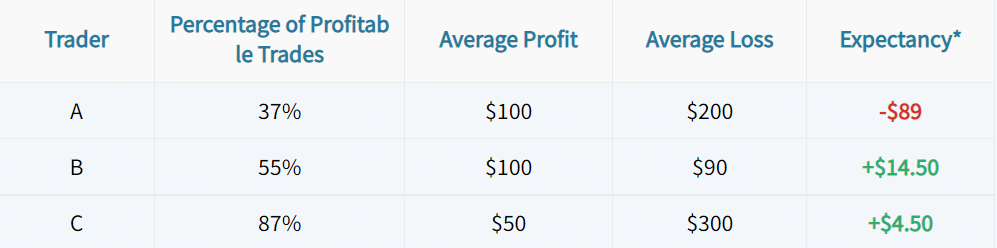

Let’s look at the same table from the previous section with the added information of average profits and losses:

*(Average Profit x Win Rate) – (Average Loss x Loss Rate)

With more information, we can now see that Trader B had the best performance, despite having a “middle of the road” percentage of profitable trades.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

What’s the Point?

There are two reasons for bringing up this topic:

1. Just because a strategy has a low realized success rate, it doesn’t mean it’s a bad strategy.

2. If a strategy has an extremely high success rate, it’s not necessarily a great strategy.

What truly matters is each strategy’s performance relative to what’s required to break even over time, based on average profits and average losses.

Long Premium Example

As an example, let’s say your strategy is to buy $1,000 worth of options and sell them when the options double in price (100% return). Otherwise, you’ll let the options expire worthless (100% loss).

If we assume either outcome, you’d need a 50% success rate to break even over time:

(100% Return x 50% Win Rate) – (100% Loss x 50% Loss Rate) = $0

To achieve positive trade expectancy over the long-term, one of three things needs to occur:

1. Achieve a success rate greater than 50%

2. Realize losses smaller than 100% (with the same success rate and average profits)

3. Realize profits greater than 100% (with the same success rate and average losses)

Of course, a change in one variable is likely to have an impact on the others, but the bottom line is that a strategy will only be profitable if its realized success rate exceeds the required success rate determined by the average profits and losses.

Short Premium Example

In regards to a short premium approach, let’s say you plan to take profits at 50% of the maximum profit potential or take losses when the option prices doubles (100% loss relative to the credit received).

Based on a 50% profit or 100% loss, you’d need a 66.6% success rate to break even over time (assuming all trades are sized similarly):

(66.6% Win Rate x 50% Profit) – (33.4% Loss Rate x 100% Loss) = $0

To achieve positive trade expectancy over the long-term, one of three things needs to occur:

1. Achieve a success rate greater than 66.6% (same average profits and losses)

2. Realize losses smaller than 100% (with the same success rate and average profits)

3. Realize profits greater than 50% (with the same success rate and average losses)

Same as before, a change in one variable is likely to have an impact on the others, but the bottom line is that a strategy will only be profitable if its realized success rate exceeds the required success rate determined by the average profits and losses.

The Bottom Line

The bottom line is that it’s very easy to be deceived by the percentage of profitable trades when analyzing trading strategies.

Don’t be fooled.

The success rate matters, but only relative to the required success rate as determined by the average profits and average losses over time.

Concept Checks

Here are the essential points to remember about the percentage of profitable trades:

1. Option strategies can have extremely low or high percentages of profitable trades, but the success rate alone means nothing | |

|---|---|

2. The combination of the percentage of profitable trades, average profits, and average losses can be used to determine the “best” trading strategies. | |

3. Starting from a baseline expectancy of zero, positive trade expectancy can be achieved by increasing the win rate (with the same average profits and average losses), increasing profits (with average losses and success rate being the same), or decreasing losses (with average profits and success rate being the same). |

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.