Last updated on February 10th, 2022 , 07:05 pm

What is Options Trading? The Ultimate Beginner's Guide to Options

Jump To

As someone who teaches options trading, the questions I get to hear the most are – “What is options trading?” and “how can I get started as a beginner?” Today, I’ll answer both.

Options trading might seem a very difficult thing to learn, as there are many moving parts and many concepts to learn simultaneously. In this blog, my goal is to bring you from zero to hero, even if you don’t know anything about options trading.

We are going to explore the world of options through various examples, graphical illustrations, and in-depth explanations simplified as much as possible. Our goal here is to provide you with an overview of the biggest options trading concepts and get you to a point where you understand those concepts intuitively.

Now since teaching the basics of options trading isn’t a job to be completed in one post, we decided to divide this into three parts. The first part that you’re reading right now covers all the basics regarding what options trading is, what the two option types are, and how they work.

TAKEAWAYS

- Unlike stocks, all options eventually expire.

- The “Strike Price” of an option is the price at which shares can be purchased (calls) or sold (puts) if that option were to be exercised.

- One options contract almost always represents 100 shares of stock.

- Call options profit in a bullish market.

- Put options profit in a bearish market.

- Option do not need to be exercised to make a profit.

What Are Options + Basic Characteristics

An option gives the buyer the right (not obligation) to buy or sell an underlying asset at a pre-determined price, between now and the expiration date. There are two types of options, a call option and a put option, we’ll talk about them in detail later.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Basic Option Characteristics:

1. All Options Expire

All options have an expiration date which makes it different from shares of stock. An option may expire in a week or 3 years. So when you are trading options, you have to choose a timeframe for your position. When investing in stocks, you don’t have a time limit. You can hold the shares as long as the company is publicly-traded. Options and stock differ widely.

2. All Options Have a “Strike Price”

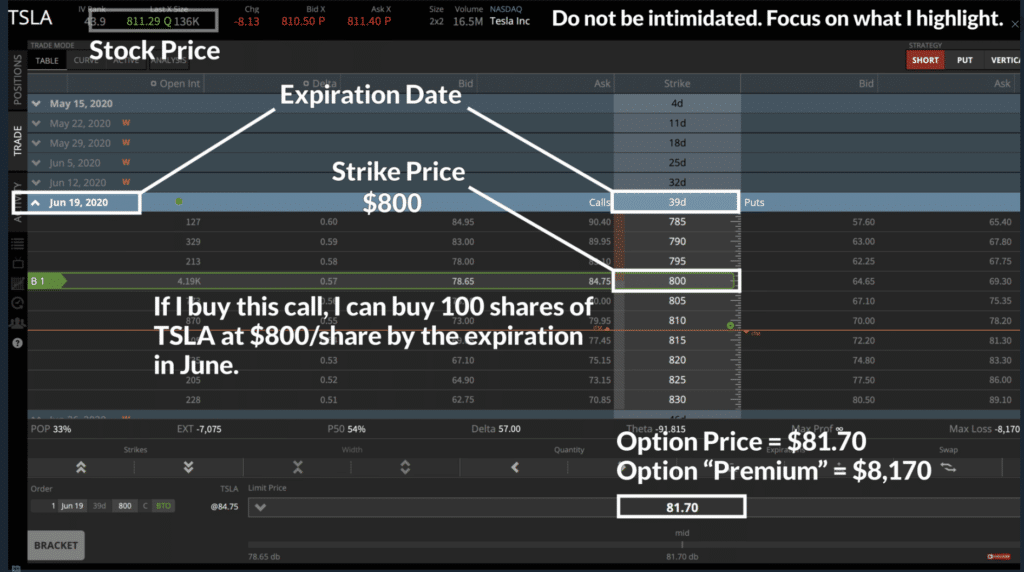

The strike price is the price at which the options can be converted into shares of stock. In simple terms, it is the price at which you can buy/sell shares of stock if you “exercise” your option. Say you buy a call with a strike price of $105 and one week later the stock jumps to $120. You’ll still be able to buy the $120 stock at the strike price of $105 by exercising your call option. We’ll go through more examples in a bit.

3. The Option Contract Multiplier

A stock of $100 can be purchased with $100, but when it comes to option prices, you have to pay 100x the ‘listed price’ of the option. For example, say on the same $100 stock, the option price is shown as $5. You can’t purchase that option for $5 in cash, you’ll need to spend $500 on it. Why is this? Because most option contracts in the U.S. can be converted into 100 shares of stock, which is called the “multiplier.” This allows options great leverage. To calculate the actual value or “premium” of an option, multiply the listed option price by 100:

Call Option With Example

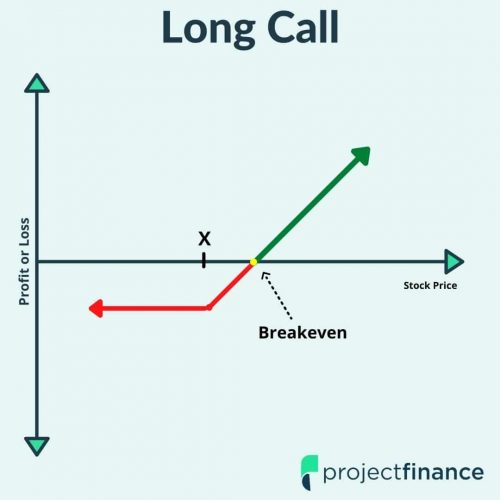

The first option type is called a call option. A call option gives you the ability to buy 100 shares of a stock at the strike price of the option. Call option prices move with the stock price. When the stock price increases, the call price increases, and when the stock price decreases, the call price decreases as well.

This makes call options extremely profitable when the stock price increases above the strike price, and lose value when the stock price decreases below the strike price. Let’s take an example to get a better grasp of it.

Call Option "House" Analogy

Say there’s a house and the current value of it is $200,000. I am interested in buying the house because I think the value of the house will appreciate significantly in the coming years, however, I’m not ready to buy it in full right now.

What I’ll do instead is buy a “call option” on this house which gives me the ability to buy the house at the strike price of $200,000 anytime in the next 2 years. To buy this call option, I pay $10,000 in premium right now to lock in the deal. So here’s what it looks like:

House value: $200,000

Strike Price: $200,000

Option Expiration Period: 2 years from now.

Option Premium: $10,000

Now, only two things can happen 2 years down the line. Either the value of the house appreciates or depreciates over the two year time frame. Let’s say the former case turns out to be true and after 2 years, the house is now valued at $350,000. Quite a significant increase!

Since I still have the option in my possession, I can exercise the option and buy the house at its strike price of $200,000, making a sweet profit of $140,000 in the process.

Why $140,000? Because if I buy the house for $200,000 via my call option and the house is worth $350,000, I have a $150,000 gain on the difference between the market value of the house and my purchase price. But since I paid $10,000 for the option initially, the net gain is $150,000 – $10,000 = $140,000.

But what if the second case happens to be true and over the next 2 years, the house value depreciates to $150,000? Well, in that case, my call option becomes worthless because there’s no point in buying a $150,000 house at the $200,000 strike price. It’s an option, which means I don’t have to use it if I don’t want to. And if it does not provide any benefit to me, then I won’t use it. If the contract isn’t used and doesn’t have any real value at the time of expiration, I lose the entire premium paid for the option.

So what happens to my $10,000 premium that I paid? Whoever sold me the option keeps that as profit, and they also keep the house.

But keep in mind that if I purchased the house outright at its initial value of $200,000, I’d lose $50,000 if the house price fell to $150,000. With the option purchase, I only lose $10,000, even if the house price falls to $0.

The above description is exactly how options on stocks work, except a call option can be used to buy 100 shares of stock at the call’s strike price, not one house.

Put Option With Example

If you understood the concepts of call options thoroughly, then it will be a cakewalk for you to get put options. Because the basics are exactly the same except everything is flipped on its head.

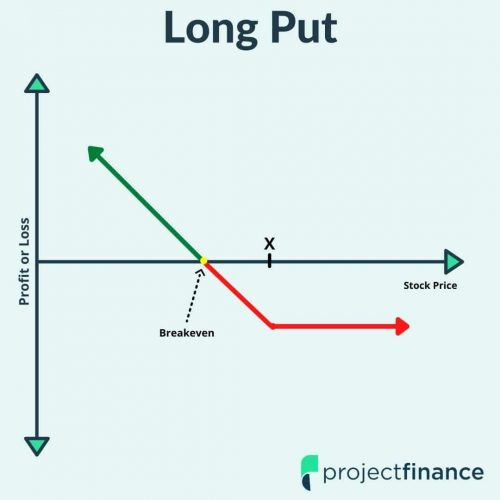

A put option gives the buyer the ability to sell 100 shares of stock at the strike price on/before the expiration date.

Remember how call option prices move in the same direction as the stock price? Well with put options, its the opposite. When the stock price increases, the put option price decreases, and vice versa.

Don’t worry if you still don’t understand it, because we’re going to take an example which will make the concept crystal clear.

Put Options Example

Since we’ve already taken a hypothetical example with a house, now let’s take a real-life example with real stock.

Say INTC (Intel) closes at $50 showing a downward trend. A trader thinks that the trend will continue in the upcoming weeks and buys a put option in INTC with an expiration date in the next 2 weeks. The strike price of the put is $50, and the trader pays $2.50 to buy the option (a premium of $250).

After a couple of weeks, INTC actually loses value and ends up at $45. This will generate a profit for the trader because now their put option can be used to sell 100 shares of stock at $50/share, which is $5 higher than the current share price. Because of that, the put’s value will be at least $5.00, or have a premium of at least $500. In this scenario, the trader will have doubled their money from the decrease in the share price. The trader can simply sell the put option at the now higher price to secure profits on their options trade.

Let’s take another example but this time with a different stock, say NVDA (Nvidia) is trading at $485 and a trader buys a put option with a strike price of $485 in NVDA because they think the stock will sink in the future.

To their surprise, NVDA ends up climbing up to $500, and is well above the put option’s strike price of $485 on the expiration date. In this case, the put option that was bought by the trader earlier will become worthless. The trader would not want to sell a $500 stock at the strike price of $485, and the put option’s price would reflect the lacking value of that ability.

Do You Have to Exercise an Option to Make a Profit?

Till now, wherever we’ve talked about making a profit, we said you exercise the option to buy/sell shares at the option’s favorable strike price, producing a profit. But in real life when you trade options, you’ll almost never exercise an option to realize the profit because you don’t have to.

The reason we described the above examples like that is because as an options trader, you have to understand where the prices are coming from and why the price changes make sense. An option’s value is directly tied to its ability to buy/sell shares of stock at the option’s strike price, right now or in the future.

In reality, you never have to exercise the option to secure a profit. Because here’s the thing: an option will always include the benefit it provides to the owner in its price. In simple terms, the option price will embed any profit that can be made by exercising it. If I own a call option with a strike price of $450, but the stock price is at $500, the option can be used to make a $50 gain per share. This means the option’s price will be at least $50, or have a premium of $5,000 ($50 gain x 100 shares = $5,000 gain).

So when you want to take a profit on an option position, you don’t need to exercise it, you can just sell the option at its higher price to secure a profit. If you buy an option and pay $300 in premium for it, and its value increases to $500, you can sell the option and realize a $200 profit on the trade.

Final Word

That wraps it up for this part of our ultimate beginners guide to options trading. We hope we were able to explain to you what options trading is, what the option types are and how they work.

Recommended Reading

projectfinance Options Tutorials

Additional Resources

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.