Last updated on April 14th, 2022 , 10:22 am

In options trading, delta hedging is a derivative-based trading strategy used to balance positive and negative delta so their net effect is zero. When a position is delta-neutral, it will not rise or fall in value when the value of the underlying asset stays within certain bounds.

For options traders, this means their position is protected in the short term from price movements in the underlying stock, ETF, or index. When executed correctly, a delta neutral position can help offset changes in volatility.

However, maintaining a delta neutral position is an ongoing battle, and the transaction costs from constantly rebalancing can easily reduce the temporary benefits this strategy gives.

Care to watch the video instead? Check it out below!

What is Delta Hedging?

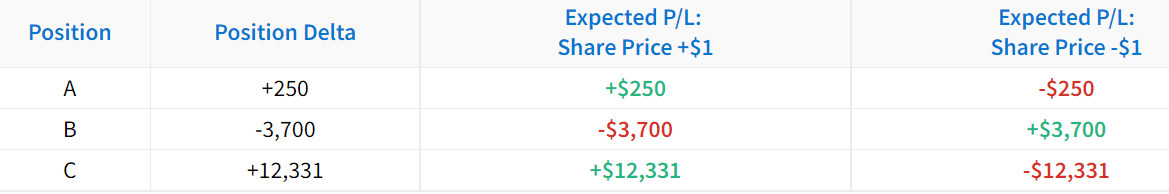

Consider the following option positions:

In each of these option contract positions, the position delta may be large or small depending on the trader who has the position. In each of these scenarios, there may come a time when the trader wants to reduce the directional exposure.

For bullish positions (positive delta), directional exposure can be reduced by adding negative delta strategies to the position.

For bearish positions (negative delta), directional exposure can be reduced by adding positive delta strategies to the position.

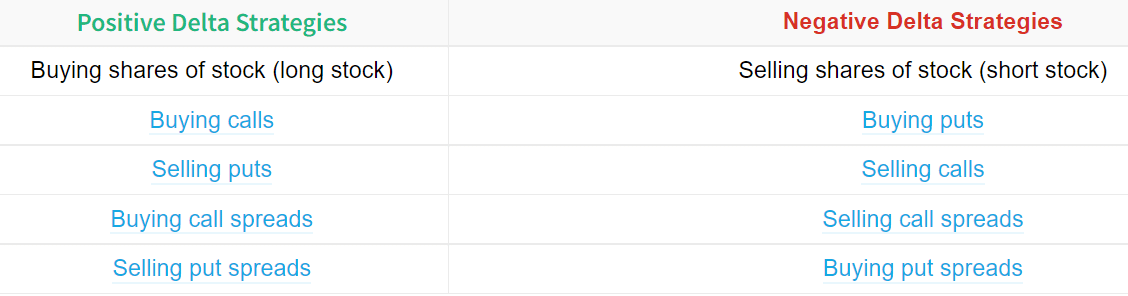

Here is a list of strategies that can accomplish either one of these hedging goals:

Basic Delta Hedging Example

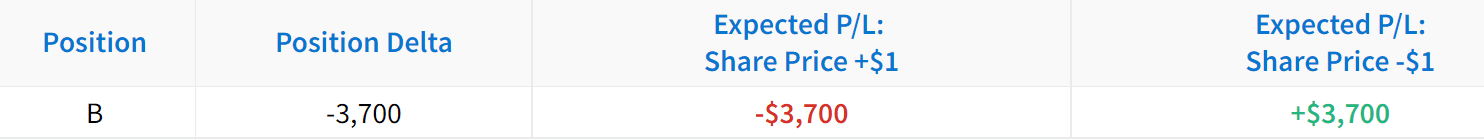

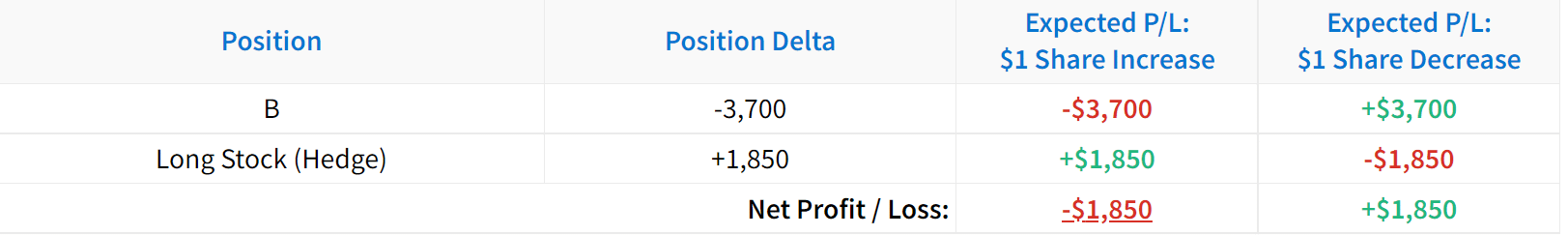

To demonstrate how delta hedging can be accomplished, consider Position B from the previous table shown above:

Position B has a delta of -3,700, which is bearish because the position is expected to profit by $3,700 when the stock price drops by $1. Alternatively, the strategy is anticipated to lose $3,700 when the stock price increases by $1.

In order to reduce the directional exposure of this position, the trader will have to add positive delta strategies to the position.

Let’s say the trader wants to buy shares of stock to hedge the position with a delta of -3,700. If the trader wanted to decrease the directional risk in half, the trader would have to buy 1,850 shares of stock.

Why 1,850?

The trader needs to reduce their delta from -3,700 to -1,850 (a 50% reduction), which can be done by adding 1,850 deltas to the position. Each long share of stock has a delta of +1, so buying 1,850 shares will add 1,850 deltas to the position, therefore reducing the -3,700-delta position to a -1,850 delta position: -3,700 + 1,850 = -1,850.

With a new position delta of -1,850, the trader is expected to lose $1,850 if the stock price increases by $1, which is 50% less than the initial -$3,700 loss per $1 share increase. Here is how the hedge works:

Delta Hedging in Detail

So, as we can see here, the trader still has the full exposure from Position B. However, the long shares offset the P/L of Position B by 50%. Because of this, delta hedging reduces the risk of a position, but the reduction in risk comes at the cost of less potential reward.

At this point, you may be wondering why you wouldn’t always delta hedge a position. The answer is that hedging is expensive because it reduces your overall potential reward by the cost of the hedge. Additionally, constantly needing to hedge positions may be an indication that the initial trade size was too large.

In the next section, we’ll explore two real scenarios where a delta hedge might be implemented, as well as visualize the performance of the position with and without the hedge.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Visualized Delta Hedging Examples

To demonstrate how a delta hedge might work in practice, let’s take a look at two common scenarios where options or stock can be used to hedge the directional exposure of a position. First, we’ll look at a long stock position that is hedged with long puts.

Trade Example #1: Hedging Long Stock With Long Puts

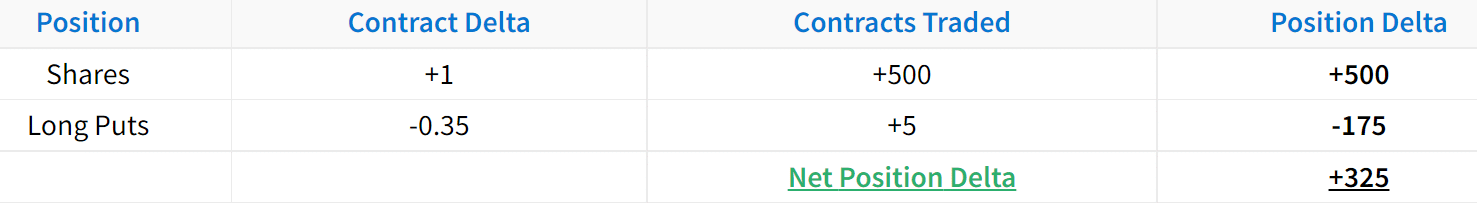

In this first example, we’ll look at a scenario where a trader owns 500 shares of stock. Being long 500 shares of stock results in a position delta of +500. If the trader wanted to reduce this directional exposure, they would have to add a strategy with negative delta. In this example, the negative delta strategy we’ll use is buying puts.

Since the trader is long 500 shares of stock, we’ll purchase five -0.35 delta put options against the position. Here is how the position looks at the start of the period:

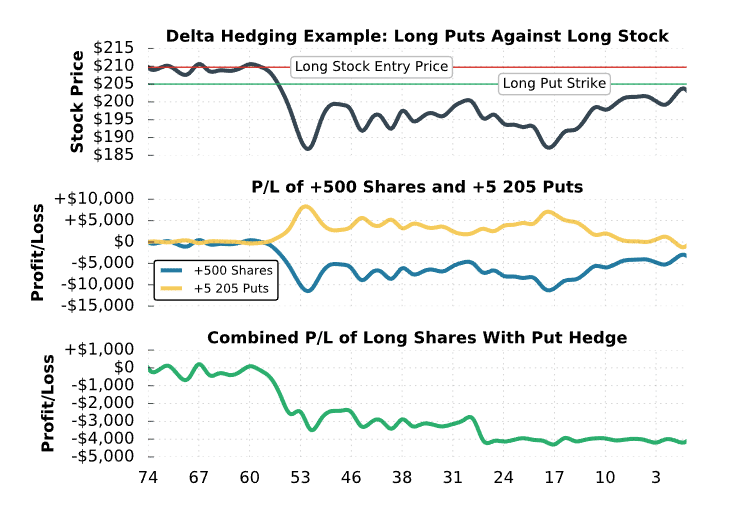

As we can see here, buying five -0.35 delta puts against 500 shares of stock reduces the delta exposure by 35%. Let’s take a look at the P/L of each of these positions when the stock price falls:

The key takeaway from this chart is that the stock position by itself experiences a drawdown greater than $10,000. However, with the long puts implemented as a delta hedge, the combined position only experiences a $4,000 drawdown at the lowest point. By adding the negative delta strategy of buying puts to the positive delta strategy of buying stock, the directional exposure is less significant.

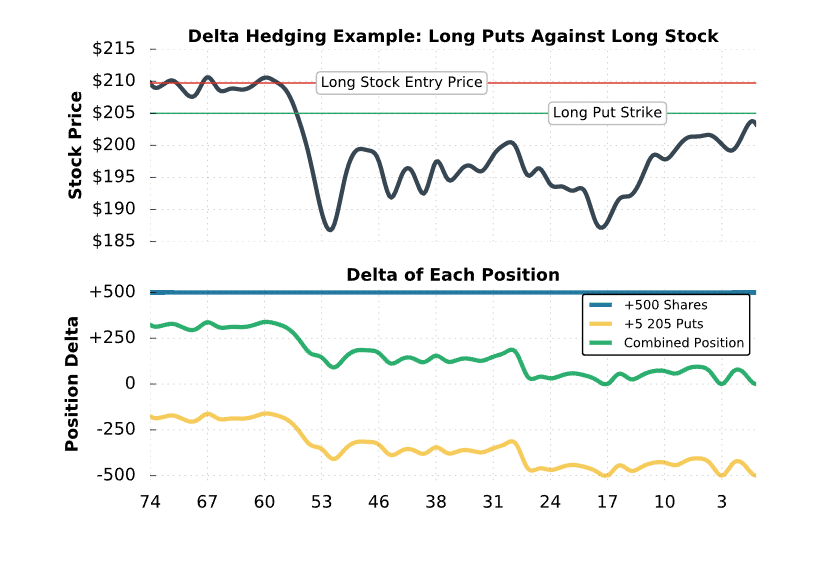

Let’s take a look at what happens to the actual deltas of each position as the stock price changes:

At option expiry, the 205 put’s delta was -1, resulting in a position delta of -500 for five long puts. Because of this, the delta of each position cancels out to zero. With a position delta near zero, the long stock and long put combination will experience very little P/L shifts when the stock price changes. When revisiting the first graph, you’ll notice that the P/L fluctuations in the last half of the period are insignificant when compared to the initial P/L changes.

Alright, so you’ve seen an example of how long puts can be used to delta hedge a long stock position. Next, we’ll look at buying calls against a short stock position.

Trade Example #2: Hedging Short Stock With Long Calls

In the final example, we’ll look at a scenario where a trader shorts 300 shares of stock sold at market price. Being short 300 shares of stock results in a position delta of -300. If the trader wanted to reduce this directional exposure, they would have to add a strategy with positive delta. In this example, the positive delta strategy we’ll use is buying calls.

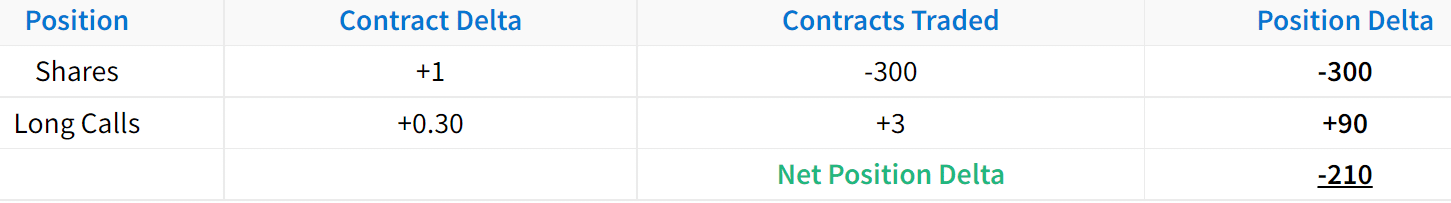

Since the trader is short 300 shares of stock, we’ll purchase three +0.30 delta call options against the position. Here is how the position looks at the start of the period:

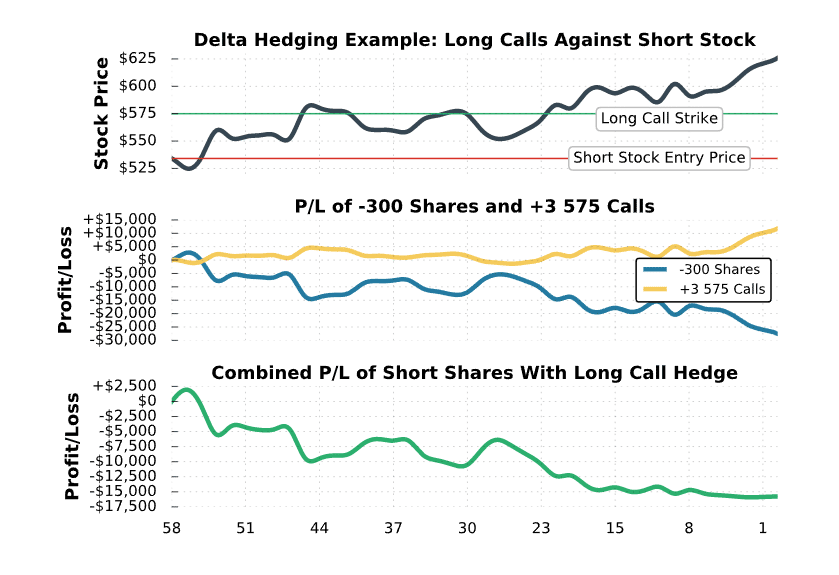

As we can see here, buying three +0.30 delta calls against -300 shares of stock reduces the delta exposure by nearly 33%. Let’s visualize the performance of these positions when the stock price rallies:

The key takeaway from this chart is that the short stock position by itself experiences a drawdown of nearly $30,000. However, with the long calls implemented as a delta hedge, the combined position only experiences a $15,000 drawdown at the lowest point. By adding the positive delta strategy of buying calls to the negative delta strategy of shorting stock, the directional exposure is less significant.

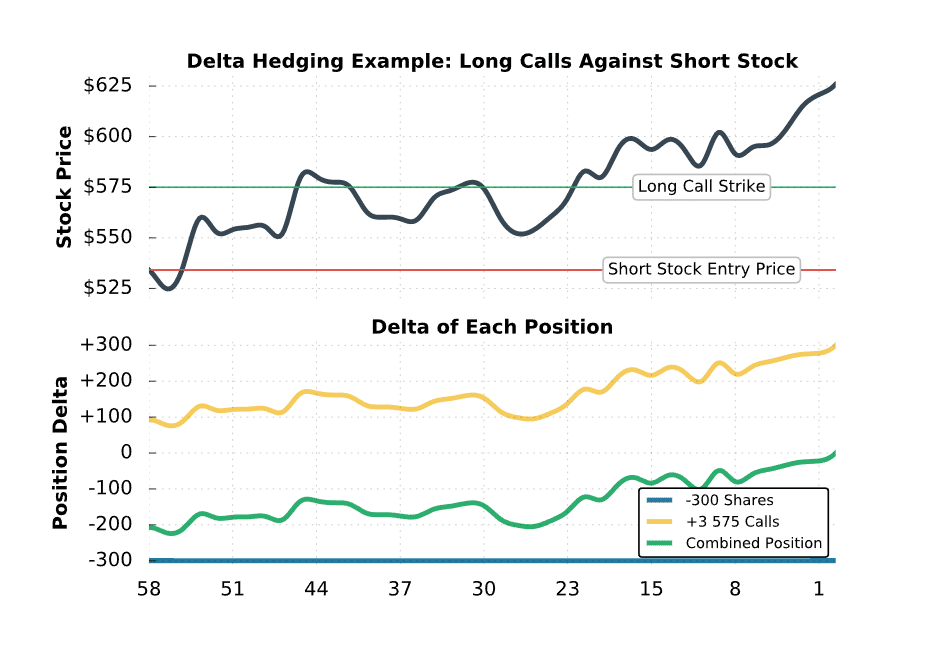

Let’s take a look at what happens to the actual deltas of each position as the stock price changes:

As we can see here, the position delta of shorting 300 shares is always -300 because the delta of a share of stock is always +1. However, the delta of a call option will change as the stock price changes and time passes. As the stock price rises, the call option’s delta gets closer to +1. Since this example tracks the delta of three calls, the most significant position delta of the calls is +300.

At the expiration date, the 535 call’s delta was +1, resulting in a position delta of +300 for three long calls. Because of this, the delta of each position cancels out to zero. With a position delta near zero, the short stock and long call combination will experience very little P/L shifts when the stock price changes.

If you revisit the first chart, you’ll notice that the P/L variations near the end of the period are much less significant than the beginning of the period. This can be explained by the long call position delta growing closer and closer to +300, resulting in a net position delta closer to 0.

Delta Hedging FAQs

When executed properly, delta hedging can help traders offset short term market risk. This risk can be in the form of earnings, interest rate and economic data. Delta hedging works more on securing current profits (or preventing further losses) from swings in the price of the underlying stock or underlying security than being profitable in itself.

Delta hedging helps traders offset risk in both stock and options by neutralizing directional exposure. Delta hedging is accomplished by either buying or selling shares of the underlying security to offset the market exposure of option positions.

Delta is the option Greek that represents the expected price move of an option based on a $1 move in the underlying security. Delta hedging involves trading shares of stock to offset the risk of trading options.

Next Lesson

Additional Resources

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.

2 thoughts on “Delta Hedging Explained (Visual Guide w/ Examples)”

Such good info – one q: So it sounds like delta hedging is better suited for active traders rather than passive investors? Is there any reason for passive investors to use it?

Thanks for the comment Meg! Delta hedging is definitely reserved for active traders who have a solid understanding of how both options and the Greeks work. If you’re of the “set-it-and-forget-it” mentality, I would not recommend this hedging strategy. – Mike