Last updated on February 14th, 2022 , 08:10 am

In a recent interview with CNBC, Jeffery Gundlach, AKA “The Bond King”, surprised investors with his minimal concern for commodity-based inflation. Gundlach doesn’t believe commodity inflation is here to stay but stressed particular concern about the sticky nature of wage inflation.

In this article, projectfinance explores wage push inflation in detail. We will look at how rising wages played out in the 1970s, the current signs that wage inflation is here to stay into 2022, as well as review a few sectors that historically perform well during inflationary times.

Highlights

- Wage push inflation could be a catalyst to broad inflation.

- The 1970s showed us how bad wage push inflation can become.

- Lower labor force participation exasperates wage inflation.

- Wages are soaring in 2021, particularly in retail.

- Gold, crypto, robotics, and emerging markets may be winners from US inflation.

Fewer Workers = Higher Prices

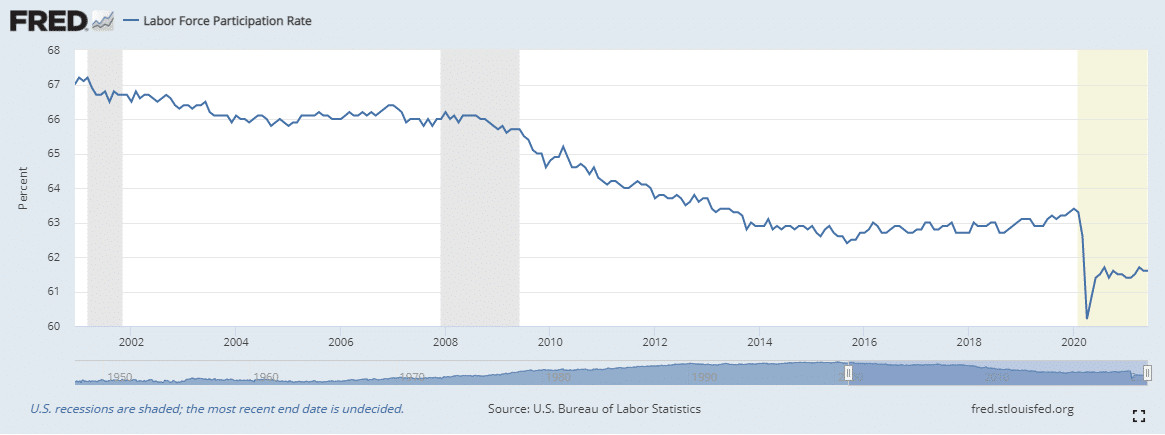

Just about every American who has left their homes in the past few months has seen the numerous “help wanted” signs peppering main streets. Because of enhanced unemployment benefits, health worries and child day-care concerns, the labor force participation rate has plummeted. The below chart from the St. Louis Fed shows us just how much.

One of the results of this unprecedented exodus from the labor force is inflation. With less supply comes higher prices. Of particular concern is wage inflation, which may prove to be less transitory than, say, the price of a barrel of oil. Why?

It’s a lot easier for Chevron to decrease the price of a gallon of gasoline by a dollar than it is to decrease the hourly salary of that employee pumping the gas by the same amount. Wage inflation, as remarked about by Gundlach in an interview on CNBC, is “Hard to slow down once it starts.”

Gundlach on Wage Inflation

Wage inflation is dangerous because of its long-lasting, and wide-sweeping reverberations on overall inflation. If you have to pay your workers more, who is going to absorb that cost? Generally, (and if possible), those costs are pushed on to the general public in the form of increased prices. This leads to something called “wage push inflation”.

Every American who lived through the 1970s knows how this story plays out.

If History Repeats Itself...

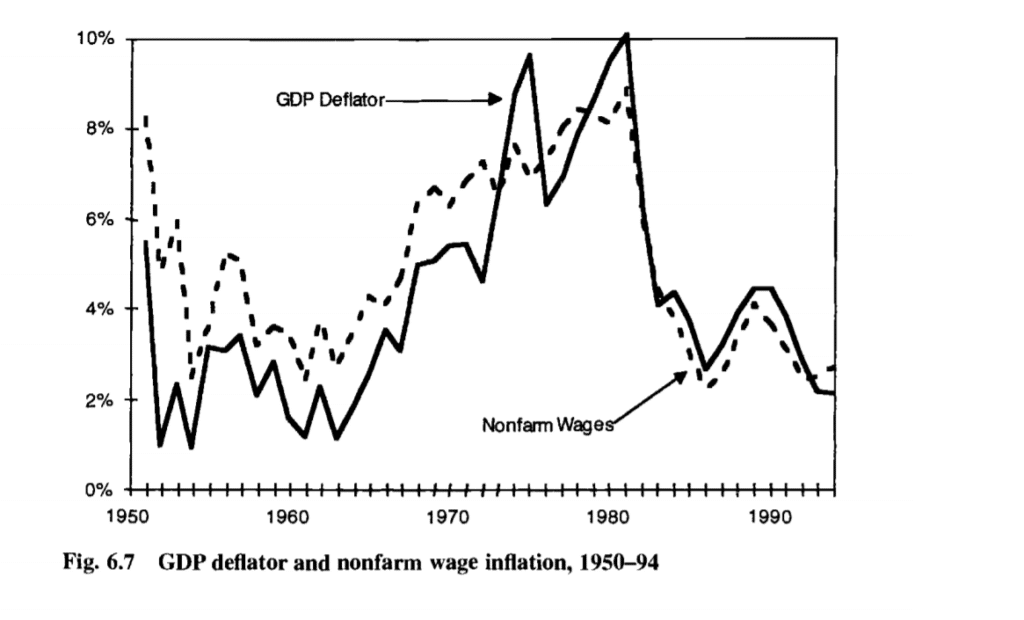

American prosperity soared during the 1960s. On the tail of this party came the great hangover of the 1970s, a decade in American history with unparalleled inflation and a stagnating stock market. Of particular concern during this time were skyrocketing wages. Take a look at the below graph from the National Bureau of Economic Research.

NERB: J. Bradford De Long

The economic setup that led to the above graph has an uncanny resemblance to the modern, post-pandemic boom. What makes today’s situation perhaps even direr is the artificial competition created by the government: in the 1970s, employers didn’t have to compete with massive stimulus packages.

But that isn’t to say there was no government intervention during the 1970s.

The Nixon administration failed quite miserably in its attempt to appease runaway inflation. These attempts may be seen as a portent of what may come in the modern economy. On August 15, 1971, during a televised address, Nixon proclaimed the following:

All increases in wages and prices would soon have to be approved by a board. Sound dictator-esque?

As predicted by Milton Friedman, the president’s efforts were in vain. Prices continued to spiral out of control after the measures were removed. A run on the dollar followed. This precipitated doing away with the gold standard, which turned the dollar into a fiat currency (backed only by the promise of an economy).

This isn’t to say these dire times will happen again. It is rare for history to actually repeat itself, but variations on a past theme are incredibly common. For today’s promenaders of both main street and wall street, notes of that old melody are certainly being heard.

Wages Soaring in 2021

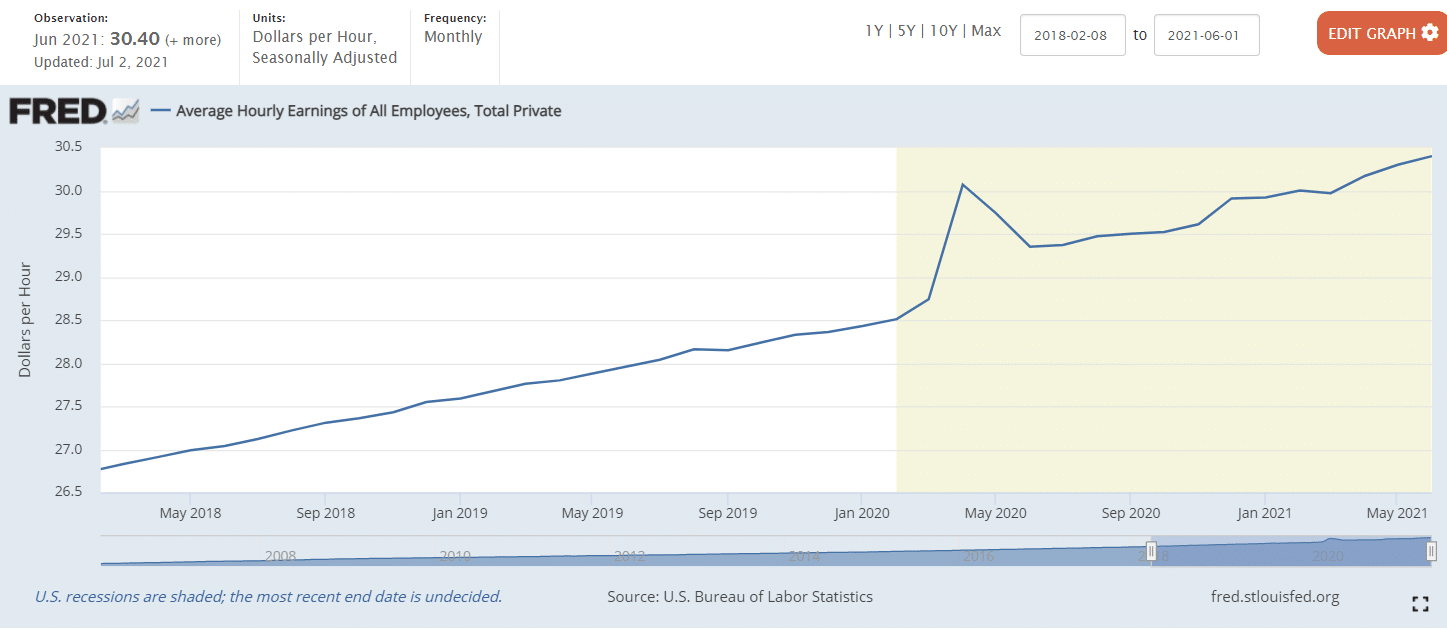

The above chart, from the St, Louis Fed, shows the dramatic increase in hourly earnings for all employees in the US since the pandemic began (in yellow).

This image should give investors concern that inflation may not be temporary after all. Of particular worry are the Retail and Leisure/Hospitality industries. In 2021, these industries have accounted for half of the jobs added in 2021.

Wages in the retail sector are up over 8% since their pre-pandemic levels. But these industries are still starved for employees.

Monster bonuses and incredibly high starting wages are beginning to bring back workers, but not fast enough to ease enticing pay. For many employers, this increase in pay is not merited by an increase in profitability. Many businesses are hanging on by a thread simply to keep their doors open.

As of right now, inflationary pressure on wages is reduced to a few sectors. The hope is that inflation will be contained, and, eventually (post-enhanced benefits) be abated altogether.

But it certainly isn’t heading in the right direction, and all the right ingredients are in place for it to continue and spread. Here are a few of the more pertinent ones:

Recipe for Inflationary Disaster

- Very strong demand for commodities and products/services

- Broad shortage in supply

- Money to Burn

So how long will wages remain elevated, and at what point will they curtail, if ever?

All Eyes on September

On September 6th, 2021, enhanced unemployment benefits in the entire US will terminate. Though 25 states have already opted out of government aid, the largest states (including California, New York, and Illinois) will all be “on their own” beginning September 6th.

How will this play out in the labor force?

If there is a mad rush to get a job before the enhanced unemployment benefits end, what will that mean for wages? Will employers reduce starting salaries drastically? And if so, what about the wages of those employees who were hired during the boom? Will their salaries be reduced?

That is a tricky subject and a sure nightmare for HR professionals.

Companies will most likely be unable to keep salaries at their current levels for new employees. Additionally, the salaries of existing employees will likely go down or stagnate. All of this is a great recipe for deflation, which is often synonymous with a recession.

But these are strange times.

The upward trend in wages is condensed to a few sectors. The worry is that the increase in wages will seep out into other sectors, and we truly won’t know how this will play out until post-September 6th. Due to government interventions, all of the traditional gauges to measure inflationary risk are out of whack.

It is also worth noting that we still have time until that deadline; that wage prices could continue their inexorable rise in the interim, making the situation even messier later on.

Wage Inflation and the Stock Market

Wage inflation can not stand by itself; a general increase in prices must follow. How else can producers pay elevated salaries?

Keeping in this vein of thought, projectfinance has combed through different sectors to find a few potential winners an inflationary economy may produce.

Wage Inflation Winners

Traditional winners of inflation have been tangible assets, particularly commodities and real estate. But both of these sectors are priced at frightfully high levels. If inflation comes off just a little bit, they could equally get squashed.

So what other investments can you make to hedge your portfolio against inflation?

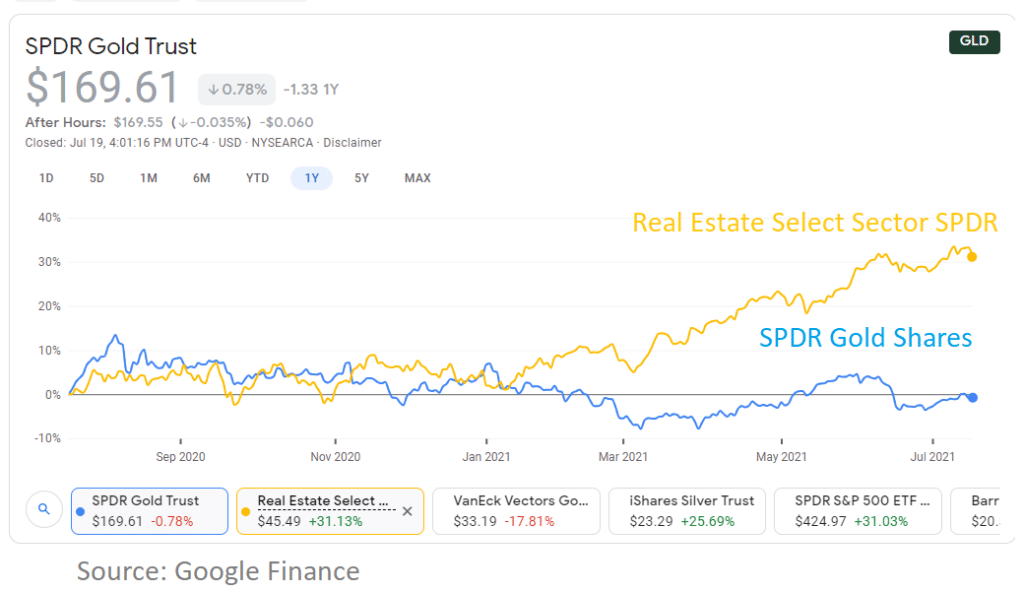

Gold

Why such a massive discrepancy between two historically inflationary aligned products? Perhaps cryptocurrency has something to do with it. Let’s explore crypto next.

Cryptocurrency

Photo by Alesia Kozik from Pexels

The market cap of gold is currently $11.50 trillion. The market cap of all cryptocurrencies is currently $1.25 trillion. This number reached nearly $2.5 trillion during the cryptocurrency euphoria of early 2021. It is very reasonable to assume that crypto has been stealing some of golds thunder.

Though incredibly volatile, it may be a good time to invest in crypto as it is currently trading way off its highs. A bitcoin ETF makes it easier than ever.

Another option could be investing in “stable coins”. Stable coins are much less volatile than other speculative cryptocurrencies because they are “pegged” to a fiat currency, typically the dollar.

BlockFi is currently paying an interest rate of 7.5% on the popular Gemini stable coin (GUSD).

Robotics/A.I.

Wage inflation will only precipitate the rise of Artificial Intelligence (AI). Companies are beginning to discover they no longer require “someone” to fill a role, but “something”. Though scary, A.I. and the advancement of robotics are here to stay. A great robotics play ETF is ROBO, which is offered by ROBO Global Robotics and Automation Index ETF.

Emerging Markets

Emerging markets, though typically seen as the riskiest of equities, can sometimes be a great hedge against US stocks during inflationary times. That is if (and it’s a big if) inflation doesn’t spread on a global scale.

Why? Inflation often leads to the devaluation of the currency. If the value of the US dollar goes down, that means dollar-denominated debt (which emerging economies are leaden with) will be cheaper. Lower borrowing costs leads to higher revenue.

If this is confusing, just think of it this way: would you rather pay interest on a dollar conversion of $1.50/ local currency or $1.30/local currency?

Additionally, emerging markets have been underperforming. They may have some catching up to do.

If you’d like great low-cost exposure to emerging markets, Vanguard’s FTSE Emerging Markets ETF (VWO) is a great option.

Wage Inflation Losers

Just as inflation has winners, there will be losers.

Retail and Hospitality / Leisure

The most likely loser of inflation brought on by wages will probably be those sectors that are currently paying through the teeth for employees. Retail and hospitality, as well as leisure, are paying more than ever for labor because of what is being called “The Great Resignation“. Here are two good reasons to avoid investing in these businesses post-pandemic:

- In addition to these companies competing with the government for employee pay, they are also competing with motivation. More and more employees are leaving dead-end jobs to make a career for themselves.

- If inflation does persist post-pandemic, it will most like be the most “sticky” in this industry. Companies like Microsoft have not had to increase employees’ wages nearly as much as retail businesses like Darden Restaurants.

Growth Stocks

Growth stocks are forward-looking in that they tend to earn the majority of their cash flow in the future. During inflationary times, this model historically underperforms the market.

Final Word

Wage push inflation is a real concern in 2021. Although many hope it will be transitory, the reality is lowering wages is much harder than lowering other prices. It will be important for investors to keep an eye on how things pan out post-enhanced benefits this fall to so they can adjust their portfolios accordingly.

To read more about inflation in 2021, make sure to read out article, Inflation and the Stock Market: 5 Sectors to Consider