Last updated on May 4th, 2022 , 05:21 am

The ProShares Ultra VIX Short Term Futures ETF (UVXY) is a great product for traders looking to both speculate and hedge on short-term volatility. Unlike most volatility products, UVXY provides 1.5x leveraged exposure to the daily performance of the S&P 500 VIX Short-Term Futures Index.

Worth noting here is the word “daily.” Over time, because of contango loss (more to come on this) and time decay, UVXY persistently sheds value. It is because of this UVXY is not designed for long-term traders. In both neutral and bullish markets, UVXY will collapse in value.

Should you trade Proshares Ultra VIX ETF? For most traders, UVXY is not worth the risk. Let’s break down this ETF to see why.

TAKEAWAYS

- UVXY tracks the short-term VIX Futures index on a 1.5x leveraged basis.

- UVXY uses “Swaps” to achieve its 1.5 leverage.

- UVXY decays in value over time because of “contango.”

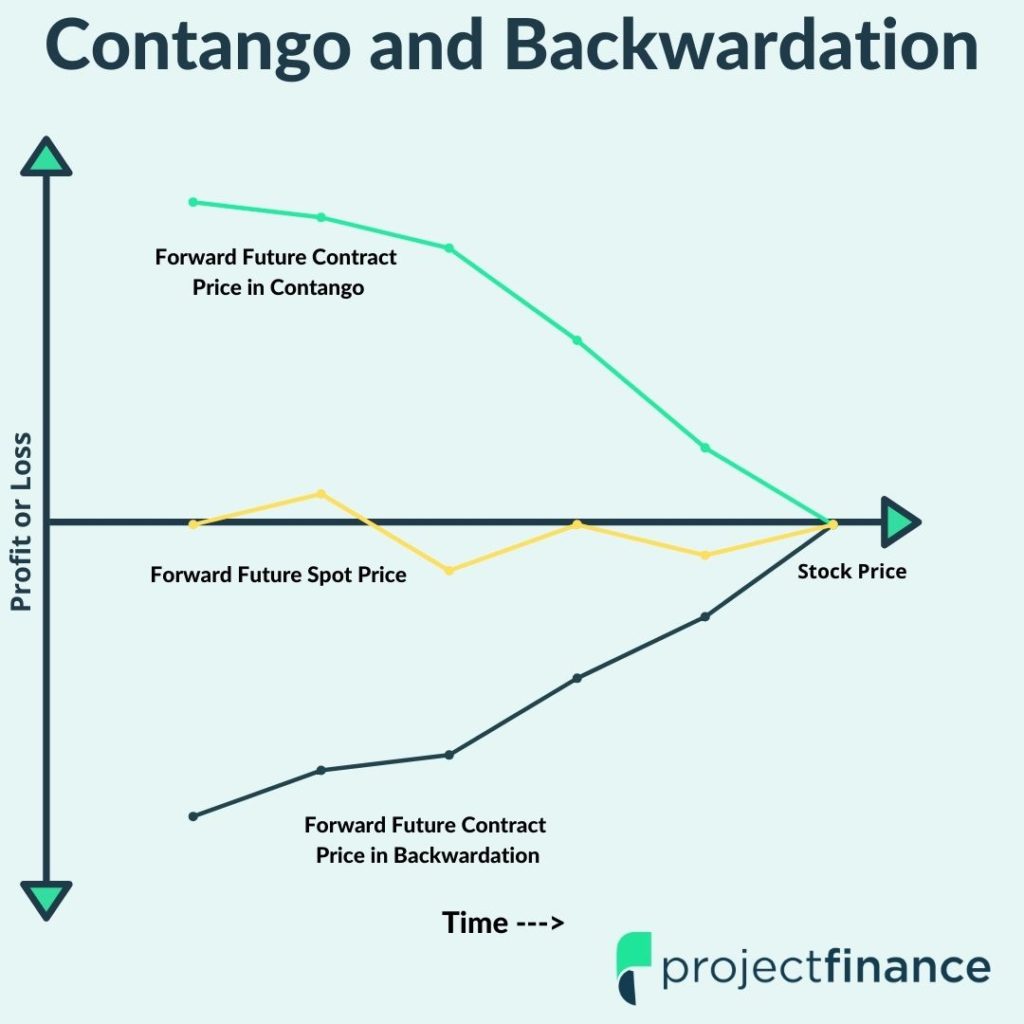

- Contango occurs when an expiring futures contract trades at a premium to the spot price.

- UVXY charges a very high expense ratio of 0.95%.

What is UVXY and What Does It Track?

As stated in the fund’s prospectus, ProShares UVXY ETF aims to provide investors:

Important to note here is that the UVXY ETF (technically an exchange-traded note ETN) is correlated to VIX Futures and NOT the VIX Index. Is there a material difference here?

Absolutely!

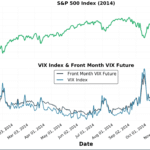

Though both the VIX Index and VIX futures have a negative correlation to the equity market, huge differences exist. The most important difference is the performance of the two.

VIX Index vs. VIX Futures (UVXY): Performance

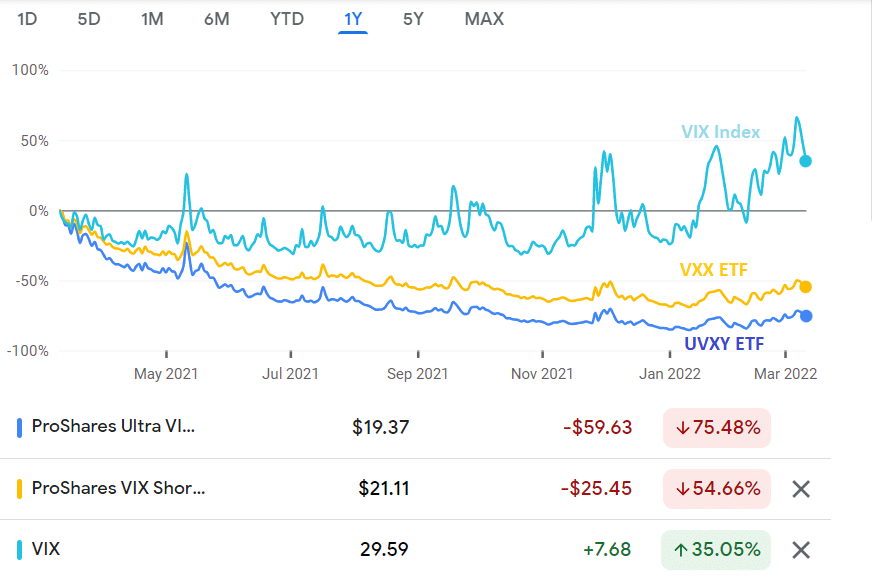

The below image (taken from spglobal.com) shows just how dramatic the performance of the VIX Index and VIX futures deviates over a 9 year period:

So why the huge difference?

Spot vs Futures: Rolling UVXY

The VIX Index is a spot index. Unlike VIX futures (which UVXY tracks on a leveraged basis), no underlying products (like shares) trade on spot indices.

This means that the VIX Index product does not need to be “rolled” to a different expiration to stay alive. Though options trading does occur on indices, since there is no tradable underlying security, contracts are settled in cash instead of shares.

Futures indices do indeed offer tradable securities. Since all future contracts expire, they must be “rolled” to the next month to stay alive.

During calm/”normal” market periods, VIX futures contracts often trade at a premium to the VIX Index.

This premium is known as “contango.” Here’s why contango in the VIX futures market causes UVXY to bleed value over time.

UVXY: Contango vs Backwardation

When the VIX futures contracts are trading at a premium to the VIX index, the VIX futures are in contango.

UVXY tracks the daily performance of the two nearest monthly VIX futures, such as February and March in the above example.

UVXY in Backwardation

So do we have any idea how fast, or at what rate ETFs like UVXY will decay? Maybe, and that leads us to the VIX Term Structure.

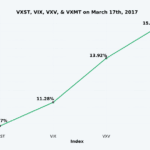

UVXY and VIX Term Structure

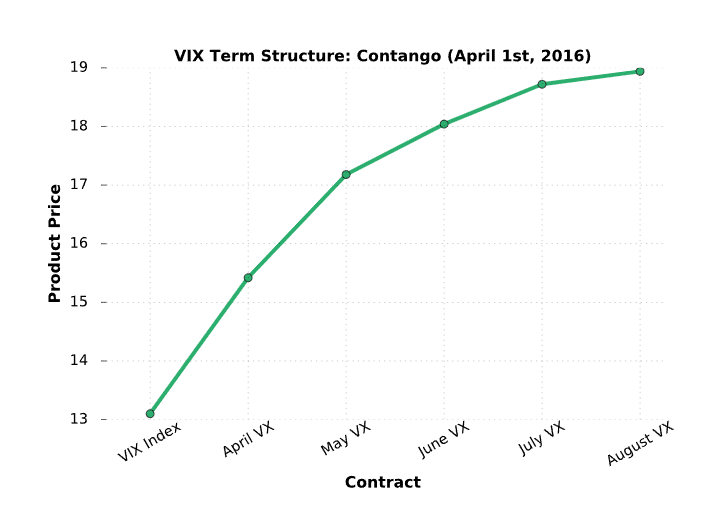

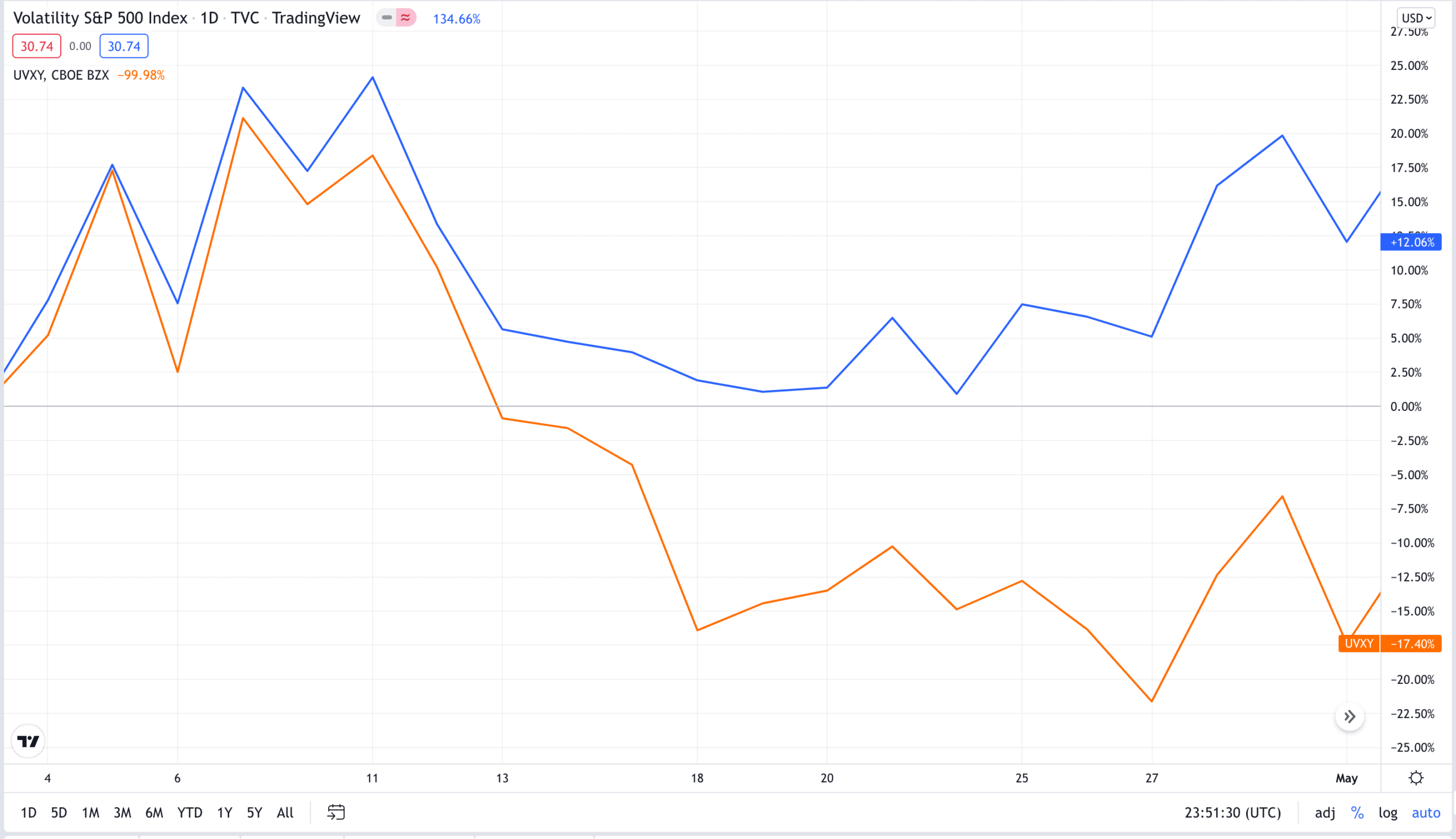

Understanding the VIX term structure can help us predict the rate at which products like UVXY will decay. Take a look at the below visual, which shows the historical prices of the VIX futures contracts on April 1st, 2016:

We can see the VIX index was trading at 13. We can also see that the VIX futures contract expiring in August is trading at 19.

In this snapshot in time, UVXY would have been tracking the daily performance of the April and May VIX futures, which were at approximately 19% and 32% premiums to the VIX index.

If the VIX index remained at 13 over time, the April and May VIX futures would both fall from their 15.5 and 17.1 levels to 13. Since UVXY tracks the daily percentage changes of these contracts, UVXY would bleed value.

But what actually happened?

Over the following month, the VIX index rose 12%, but UVXY lost 17.4% because the April and May VIX futures were trading at such large premiums to the VIX index and lost substantial value over the 30-day period:

It should also be noted that at the time, UVXY had 2x leverage, tracking 2x the daily percentage change of a weighted basket of these two VIX futures contracts.

For instance, let’s say UVXY was tracking a 50% weighting in the April contract and a 50% weighting in the May contract in the middle of the roll period.

If the April contract gained 10% and the May contract also gained 10% on the same trading day, UVXY would have gained 20%.

Today, the same daily changes in the VIX futures contracts (assuming the same weightings on the trading day in question) would result in a 15% UVXY gain after its leverage was reduced to 1.5x in 2018.

UVXY: Positions and Holdings

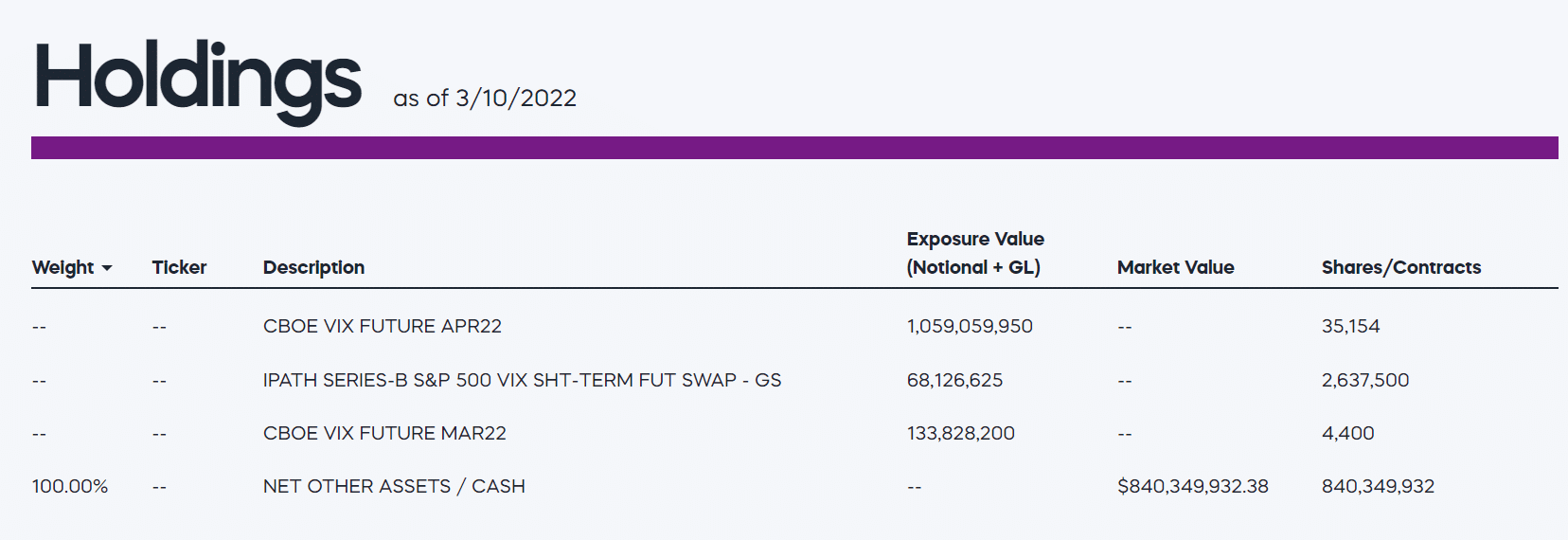

The below visual (taken from UVXY’s issuer ProShares) shows the funds current holdings:

Notice the fund has exposure to both March and April futures.

Why two months? The UVXY ETF attempts to track a 30-day VIX futures contract, but since there’s not always a futures contract with exactly 30 days to settlement, they hold a specific weighting of the nearest monthly contracts that gives them a weighted 30-day portfolio.

Put more simply, if the March contract had 15 days to settlement and the April contract had 45 days to settlement, a 50% weighting in each contract would give them a “weighted 30-day VIX futures contract.”

15 Days to Settlement x 50% Weight = 7.5 Days to Settlement

45 Days to Settlement x 50% Weight = 22.5 Days to Settlement

7.5 + 22.5 = 30 Days to Settlement.

The proportion of front month and next month futures are in a state of perpetual flux. As March settlement approaches, ProShares will increasingly shift its holdings to the April contract, reaching a 100% weighting when the March contract settles.

But what about that short-term swap? This is where the leverage comes into play.

UVXY's 1.5X Leverage: SWAPs

Many savvy investors are familiar with options trading. Options provide traders with great leverage.

But sometimes these derivatives are not feasible for leveraged funds.

Instead, swaps are used.

Swaps are non-standardized contracts. Swaps are exceedingly opaque for this reason. We truly don’t know how ProShares obtains its 1.5x leverage, but the secret is in the sauce of that swap – whatever it may contain!

UVXY: Expense Ratio

Future-based ETFs are notoriously expensive. Why?

All that rolling is costly from both manpower and commission-based perspective. This leads to the current expense ratio for UVXY:

UVXY Fee's

ProShares UVXY management fee of 0.95% comes in at about twice the average expense ratio of other ETFs.

When added to the cost of contango, UVXY could be a huge drag on your account.

UVXY: Historical Returns

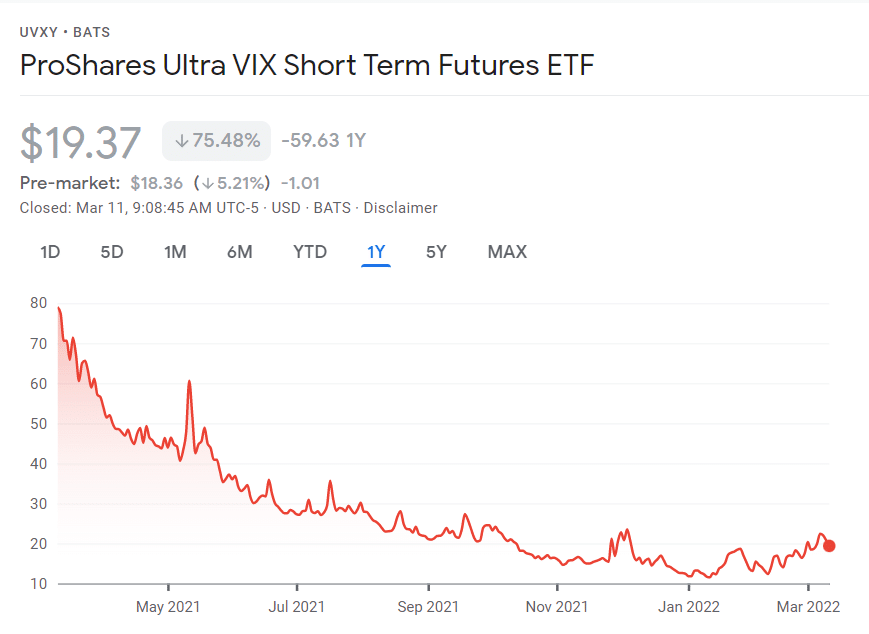

We said before that UVXY is reserved for short-term traders. Hopefully, the below one-year chart of UVXY will drive that point home.

UVXY: 1 Year Chart

Source: Google Finance

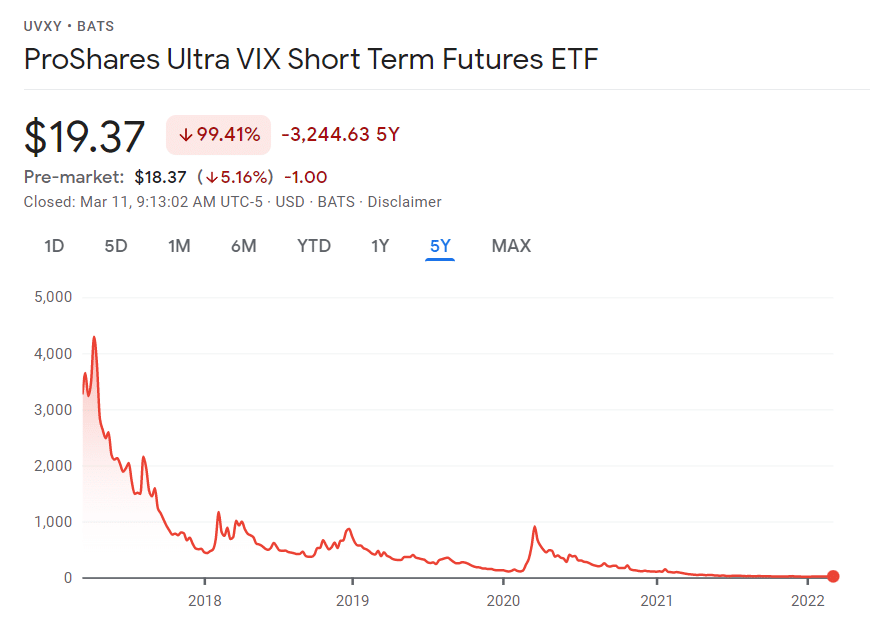

Let’s take this one step further and look at a 5 year chart of UVXY:

UVXY: 5 Year Chart

Source: Google Finance

So we can all agree that UVXY over the long run is a horrible idea (pending an economic apocalypse).

But UVXY is a leveraged ETF; how does this product compare to unleveraged ETFs (like VXX) that track VIX futures?

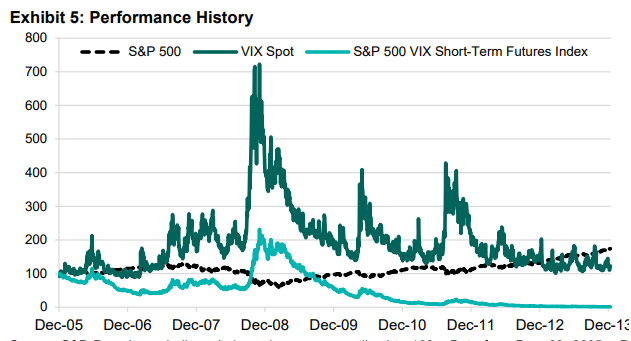

UVXY vs VXX vs VIX

The below image compares UVXY to the VIX index as well as VXX. VXX, issued by Barclay’s, is similar to UVXY in that they both track futures on the VIX. However, VXX is not leveraged as UVXY is.

Consequently, VXX will gain less than UVXY in times of increasing VIX futures, and will lose less than UVXY in times of decaying VIX futures.

Let’s see how the performance between these products looks over one year (ending in March 2022).

UVXY vs VXX vs VIX: 1 Year Chart

Source: Google Finance

As we can see, the leverage that UVXY provides has hurt the fund over the long run when compared to the VIX. Additionally, the normally present contango in the VIX futures curve has hurt both VXX and UVXY.

Now seems like a good time to quickly recap three reasons why UVXY is not a good product to trade for more than a day:

3 Reasons UVXY is NOT Worth the Risk

- Contango contributes to the massive decay in ProShare’s UVXY leveraged ETF.

- UVXY uses swaps to achieve its leverage – leveraged ETFs decay faster than non-leveraged ETFs (VXX), particularly in adverse markets.

- UVXY charges a very high management fee of 0.95%.

When Should you Trade UVXY?

Proshares UVXY ETF (sometimes referred to as an ETN) is best suited for traders who:

1. Want to speculate on a rise in the price of VIX futures.

2. Want to hedge equity positions in the event of a market downturn.

3. Have a very short duration for both speculation and hedging.

Does UVXY Pay A Dividend?

Since UVXY does not hold any equity, this product does not pay a dividend.

Final Word

Futures-based ETFs are inherently risky. Add leverage to the mix, and you have even more risk.

I personally only use leveraged ETFs to hedge against imminent market news, such as jobs reports and the release of inflation data.

ProShares designed UVXY to be held for a very short duration, typically a day only. To see why, revisit one of those charts we looked at above!

If you’d like to learn more about leveraged ETFs, feel free to check out our video below!

UVXY FAQs

UVXY experiences profound contango. Rolling futures in this ETF can result in monthly losses exceeding 5%.

Both UVXY and SVXY are futures based ETFs. However, UVXY profits during times of heightened volatility and SVXY profits during times of low volatility.

Traders can purchase UVXY in both the normal market and extended market. To trade UVXY in the extended market, make sure to tag your order with the correct ” EXT” TIF Designation.

UVXY goes up in value during times of heightened volatility. If short-term VIX futures are up 1% in value, UVXY aims to be up 1.5% in value because of its leverage.

You can hold UVXY for any time period, including overnight. However, holding UVXY for long periods of time is not advised due to contango.

UVXY is technically an ETN (exchange-traded note), though its issuer, ProShares, refers to it as a ETF (exchange-traded fund).

Thanks for the article!

Just curious – is there any advantage to trading UVXY over VXX?

Thanks!

Thanks for the question Eileen!

UVXY is a leveraged ETN while VXX is a non-leveraged ETN. This means that UVXY will be more sensitive to changes in volatility than VXX. UVXY is leveraged on a 1.5 basis. The leverage is small, but over time it really has an impact!

Also, Barclays recently stated they will suspend further issuance of VXX.

Mike

I’m really glad I came across this article! Thank you for posting it. In terms of price degradation over time due to contango – would a stronger leveraged product like UVIX (2x VIX) experience a higher degree of price degradation over time than UVXY?

Thank you!

-Kyle

Hi Kyle!

Thanks for reading the post! I’m glad it was helpful.

Yes, a more leveraged product will experience more decay (and also increases) over time. For instance, if the VIX remained low at 15 for a year, VIX futures would be in a constant state of contango and a leveraged long vol product will lose more value than an unlevered/less leveraged long vol product.

-Chris