Last updated on February 10th, 2022 , 01:46 pm

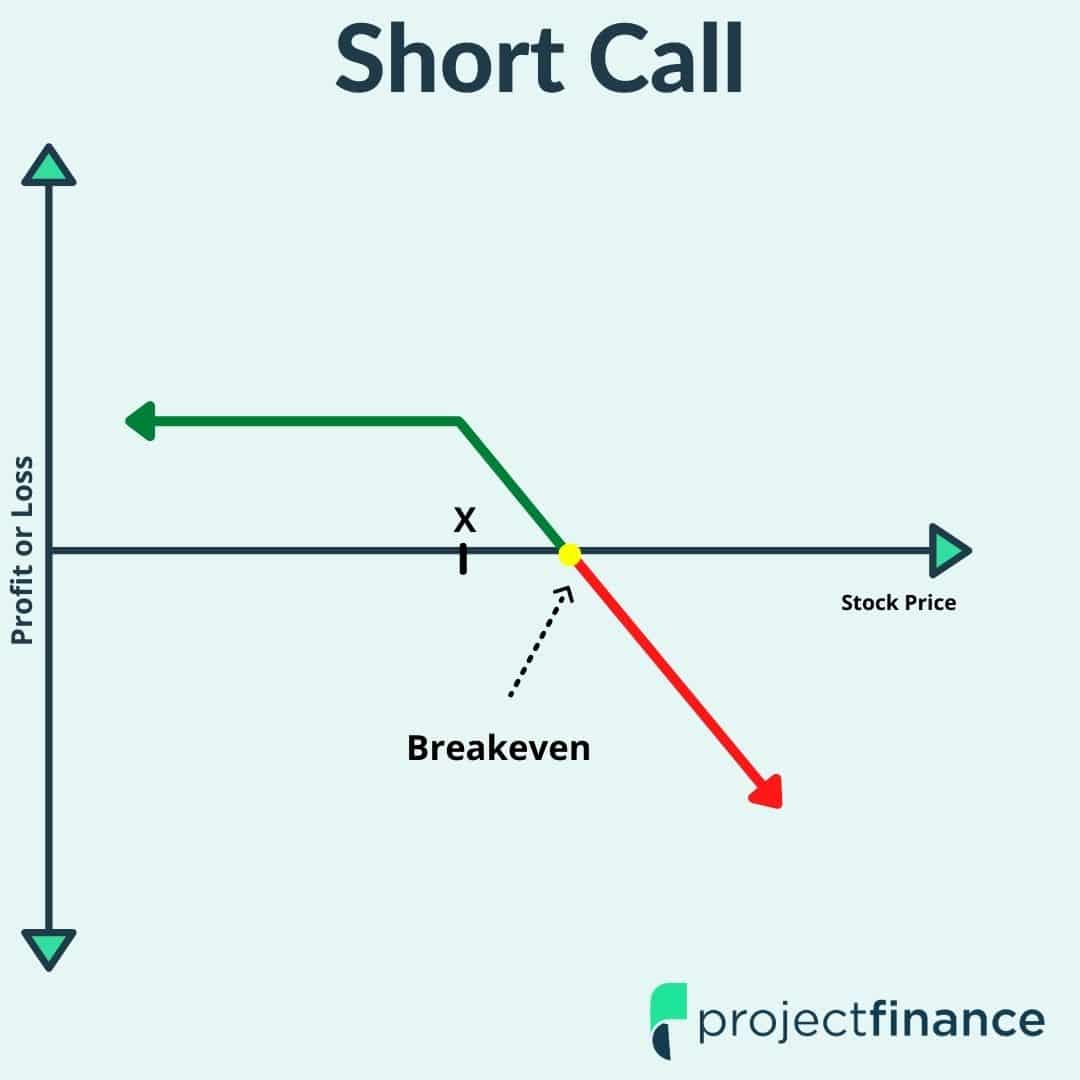

The “short call” options strategy (selling a call option) is a bearish options strategy that consists of selling a call option on a stock that a trader believes will decrease in price (or not increase to a level above the call’s strike price before expiration).

TAKEAWAYS

- The short call is best suited for bearish and neutral markets.

- The maximum profit here is the total credit received.

- Maximum loss on a short (naked) call is unlimited.

- Breakeven for short calls is strike price + credit received.

- Short calls can profit in any market, including minorly bullish markets.

Short Call Strategy Characteristics

Let’s go over the strategy’s general characteristics:

➟Maximum Profit Potential: Credit Received x 100

➟Maximum Loss Potential: Unlimited

➟Expiration Breakeven Price: Call Strike Price + Credit Received

➟Estimated Probability of Profit: Greater than 50%

Profit/Loss Potential at Expiration

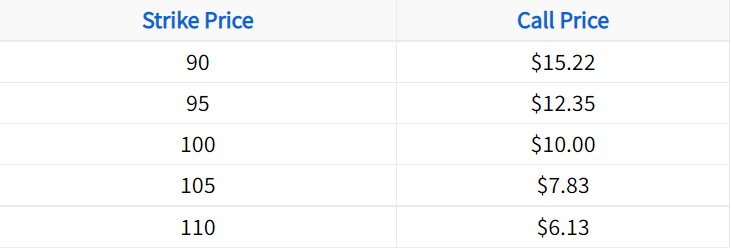

In the following example, we’ll construct a short call position from the following option chain:

In this case, we’ll sell the 100 call for $10. Let’s also assume that the stock price is trading for $100 when we sell the call option.

Initial Stock Price: $100

Call Strike Price: $100

Call Sale Price: $10

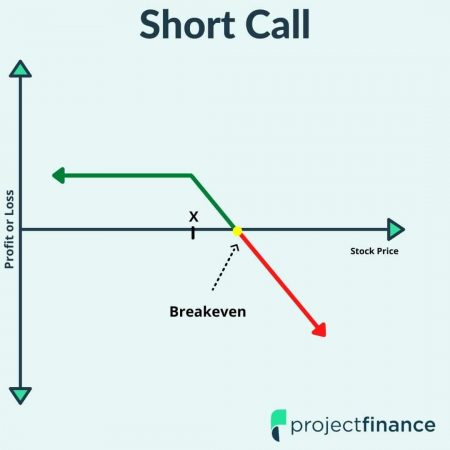

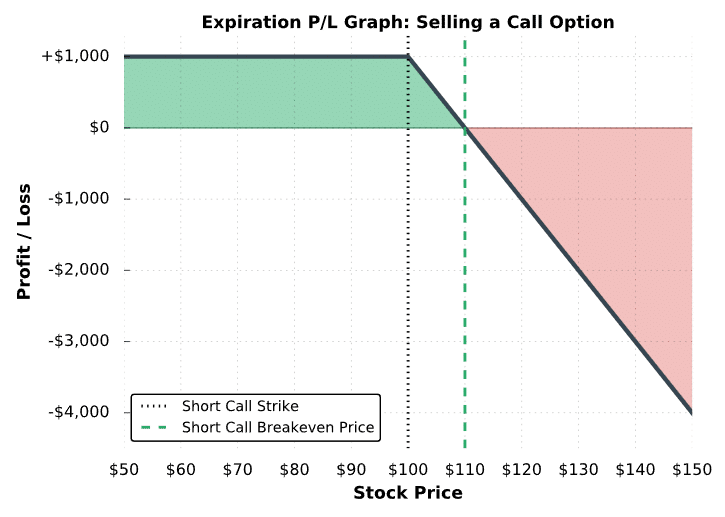

If a trader sells this call option, their potential profits and losses at expiration are described by the following visual:

Covered Call Profit/Loss

The following table describes various scenarios of this short call position at expiration:

Stock Price Below the Short Call Strike (Below $100):

The call expires worthless, and therefore the short call trader realizes the maximum profit potential of $1,000.

Stock Price Between the Short Call Strike and the Breakeven Price (Between $100 and $110):

The call expires with intrinsic value, but not more than the initial $10 sale price of the call. As a result, the short call trader realizes partial profits at expiration. If the call is held through expiration, the trader will be assigned -100 shares of stock per call contract.

Stock Price At Breakeven Price (At $110):

The call expires with $10 of intrinsic value. Since the call was initially sold for $10, the short call trader breaks even. If the call is held through expiration, the trader will be assigned -100 shares of stock per call contract.

We’ve just covered the basics of the short call options strategy. Next, let’s take a look at some real trade examples to see the strategy’s performance in different historical scenarios.

Short (Naked) Call Trade Examples

To visualize the performance of various short call positions, let’s look at a few real examples. Before we start, it’s important to note that the specific stock will not be specified, as the concepts in each example are transferable to other stocks.

Additionally, each example assumes a size of one call contract. To convert the profits and losses to a larger position, just multiply the profits and losses by an increased number of call contracts.

Trade Example #1: Profitable Short Call Trade

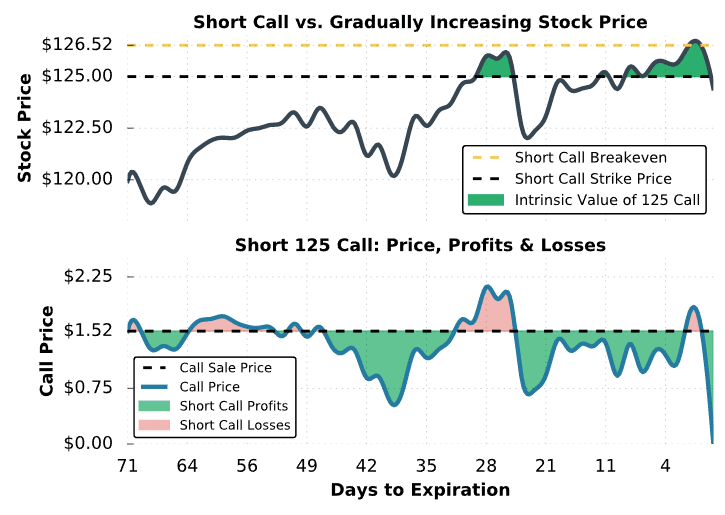

The first example we’ll look at is a scenario where an out-of-the-money call is sold, the stock price gradually increases towards the short strike, but the trade works out in the end.

Here are the trade details:

Initial Stock Price: $119.94

Initial Implied Volatility: 23%

Call Strike and Expiration: 125 call expiring in 71 days

Call Sale Price: $1.52

Call Breakeven Price: $125 call strike + $1.52 credit received = $126.52

Maximum Profit Potential: $1.52 credit received x 100 = $152

Maximum Loss Potential: Unlimited

Let’s see how the trade performed:

Short Call #1 Trade Results

As we can see in this example, the stock price gradually increased from $120 to $126, and the short 125 call never experienced significant losses. In fact, with 11 days to expiration, the stock price was actually above the short call’s strike price of $125, and the position had small profits.

Overall, the stock price increase was gradual, and time decay was able to fight against any directional losses. Additionally, implied volatility fell from 23% to 16% over the entire period, which also helped the short call position (implied volatility change not visualized here).

The decrease in the call’s price from $1.52 presented the short call trader with many opportunities to buy back the call for a profit before expiration. For example, around 40 days to expiration, the 125 call’s price fell below $0.75, which represents a $77 profit for the call seller at that moment. To lock in the profit/loss at any given moment, a short call trader can just buy back the call they are short.

If the trader decided to hold the short call position, they would have been just fine. At expiration, the stock price was below the short call’s strike price, and the option expired worthless. Because of this, the hypothetical short call trader realized the maximum profit of $152.

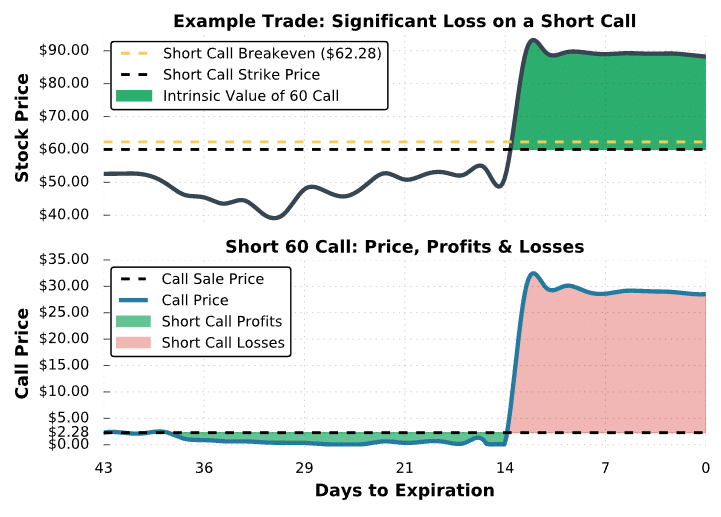

Trade Example #2: Significant Short Call Loss

In the previous example, we examined a gradual stock price increase. In this next example, we’ll look at a situation where the stock price unexpectedly gaps up through the short call strike.

Here are the trade details:

Initial Stock Price: $52.58

Call Strike and Expiration: 60 call expiring in 43 days

Call Sale Price: $2.28

Call Breakeven Price: $60 call strike + $2.28 credit received = $62.28

Maximum Profit Potential: $2.28 credit received x 100 = $228

Maximum Loss Potential: Unlimited

Let’s see what goes wrong:

Short Call #2 Trade Results

As we can see here, the short 60 call was nearly worthless in the first 30 days because the stock price fell as time passed.

However, with around 13 days to go, the stock price gapped up from $50 to $90. As a result, the 60 call went from being worth $0 to over $32. Why? As the share price increases further and further above the call’s strike price, the call’s ability to purchase shares of stock at the lower strike price becomes more valuable, resulting in a higher call price.

With an initial sale price of $2.28, the short call’s price rising to $32 translates to a loss of $2,972 for the short call trader. This example serves as a demonstration of the significant risk involved with selling a call option.

In reality, it’s unlikely that a trader who sold this call didn’t close the position before the gap up in the stock price. As we can see, the call was nearly worthless between 30 and 14 days to expiration, presenting a 16-day window to close the call for near the maximum profit before the large upside move.

When selling options, the cheaper the option price gets, the less reward there is to be made, but there’s still all of the risk. In the event the option’s price gets close to $0, it becomes very logical to close the position and secure the profits to eliminate the potential of a big reversal (and therefore big losses), as exemplified here.

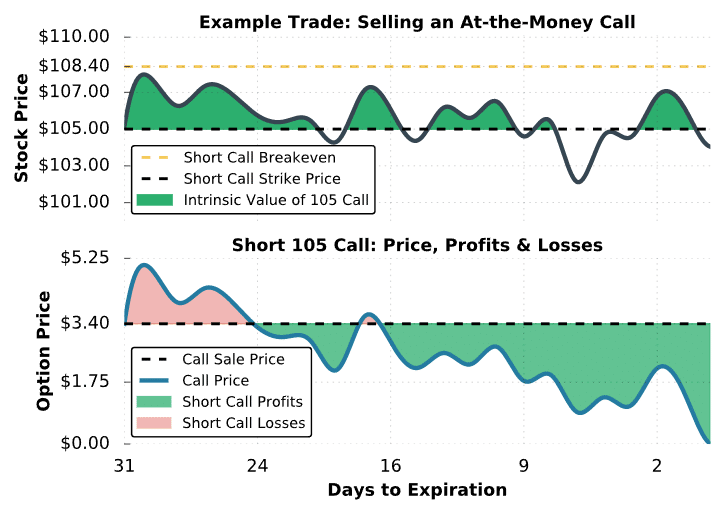

Trade Example #3: Steadily Profitable Call Sale

In the final example, we’ll examine an at-the-money short call position on a stock that remains in a tight range.

Here are the trade details:

Initial Stock Price: $105.13

Call Strike and Expiration: 105 call expiring in 31 days

Call Sale Price: $3.40

Call Breakeven Price: $105 call strike + $3.40 credit received = $108.40

Maximum Profit Potential: $3.40 credit received x 100 = $340

Maximum Loss Potential: Unlimited

Let’s see what happens!

Short Call #3 Trade Results

As we can see in this example, the stock price never gapped up through the breakeven price, but it also never crashed significantly. Because of this, the short call position experienced slow and steady profits through time as the option’s extrinsic value decayed.

At expiration, the stock price was below the short call’s strike price and the call expired worthless, leaving the position with the maximum profit of $340.

Final Word

Congratulations! You’ve made it to the end of the guide. Hopefully, this guide on selling call options has left you feeling much more comfortable with how the strategy works. Let’s go over what we learned:

- The short call is a high probability, high risk trade.

- Since a stock can in theory go to infinity, the losses on a short call are infinite.

- The less credit received for a short call, the less reward.