Last updated on March 30th, 2022 , 10:17 am

The best time to start saving for retirement was years ago, but the second-best time is now. If you’re seeking ways to squirrel away money for retirement, especially investment vehicles that offer significant returns over the years, you’ve probably encountered different options.

One such option is the SEP-IRA. Is a SEP-IRA a good option? Does it have any drawbacks?

Let’s discuss.

What is a SEP-IRA?

A SEP-IRA is a retirement account designed for employers and self-employed individuals. IRA stands for Individual Retirement Account, and SEP stands for Simplified Employee Pension.

In other words, it’s a retirement account aimed at individuals and small business owners as a simple vehicle for retirement that has fewer complications than a 401(k) or a traditional pension system. It’s a traditional non-ROTH IRA, which means the money you contribute is tax-deductible, and the disbursement in retirement is taxable as income.

SEP-IRA Eligibility Requirements

The SEP-IRA is not for everyone. Due to the investment rules with a SEP-IRA, they are best for small business owners with few or no employees and the self-employed.

Why? One rule. When contributing to a SEP-IRA, you must contribute an equal percentage to the accounts of your eligible employees. If you have ten employees, that can stack up quickly; conversely, if you have zero employees or work for yourself, you don’t have to worry about it.

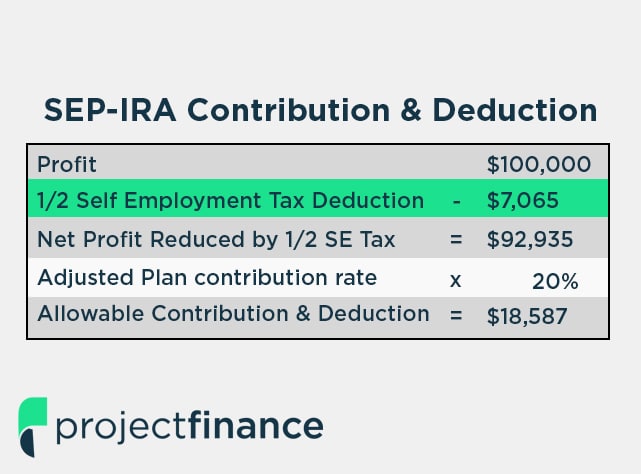

The equal contribution rule is based on the percentage of compensation. If you pay yourself $100,000 and pay your one employee $50,000 and want to contribute 10% of your income to your SEP-IRA, that’s $10,000 to your account. The equal percentage contribution rule requires you to contribute 10% of the employee’s compensation to their account, which is $5,000. Note that this is a simplified example, but the general rule remains.

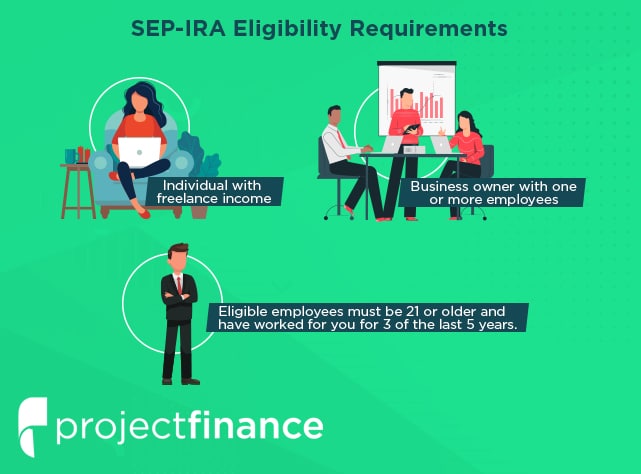

What are the eligibility requirements? To open a SEP-IRA, you must be either an individual with freelance income or a business owner with one or more employees. Note that a business owner with zero employees still counts themselves as one employee for this eligibility.

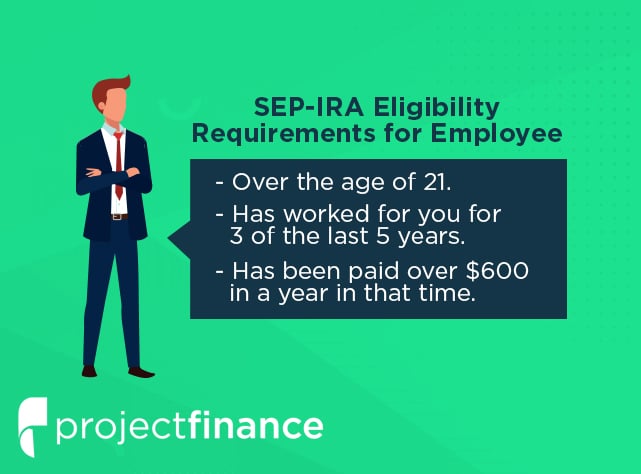

For employees, eligibility is based on income earned from the business. Eligible employees must be 21 or older and have worked for you for 3 of the last five years. Anyone meeting those requirements, and whom you have paid over $600 in a year between 2016 and 2020, or $650 from 2021 onwards, is eligible for a SEP-IRA. And by “eligible,” we mean “required”; you must open and contribute to employee SEP-IRA accounts if you have one for yourself.

Additionally, employees control their SEP-IRA accounts. You don’t get to make decisions about how they manage or use that money; you just have to contribute to it.

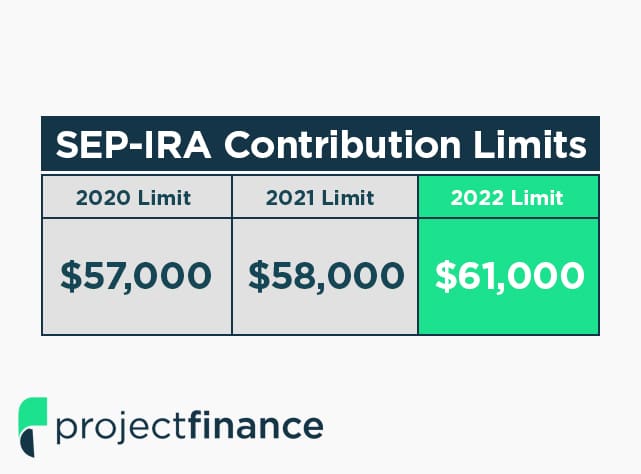

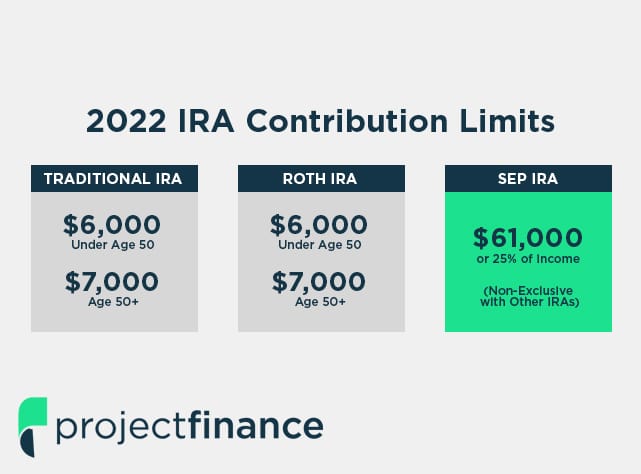

SEP-IRA accounts also have much higher contribution limits than traditional IRAs. A traditional or ROTH IRA typically has a contribution limit of around $6,000 (this changes from year to year; it was $5,500 in 2018 but was increased to $6,000 in 2019 and beyond).

In contrast, a SEP-IRA has a contribution limit of $61,000 in 2022, over 10x as much. However, there is a second limitation; contribution cannot exceed 25% of compensation. If you’re paying yourself $100,000, you cannot contribute more than $25,000 to your SEP-IRA account.

What Are the Benefits of a SEP-IRA?

The SEP-IRA is a powerful investment vehicle for small businesses and individuals, with many benefits. What are they?

1. Much Higher Contribution Limits

One of the most significant benefits of a SEP-IRA is the higher contribution limits. Taking 2022 as an example, you can contribute up to $6,000 to a traditional or ROTH IRA account. However, with a SEP-IRA, you can contribute over 10x as much… assuming you make enough money to do so. The 25% of compensation limit also kicks in. Anyone making less than $24,000 per year will have a lower contribution limit than a standard IRA.

Essentially, for anyone making between $24,000 and $300,000, give or take, a SEP-IRA can save much more money, much more quickly, than with another form of IRA. The increased contribution limits can be highly beneficial, particularly if you’re in your 30s or 40s and have relatively little savings in retirement funds. In a sense, it’s a way to “catch up” on investing.

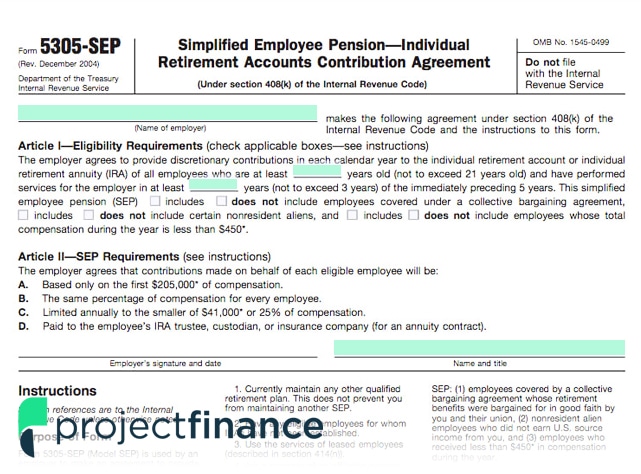

2. Easy to Set Up and Manage

In most cases, setting up a SEP-IRA is as simple as filling out some information with a brokerage and letting them handle the paperwork. You can set one up manually via the IRS, as well. It’s all quick to get the account set up and running.

Additionally, managing a SEP-IRA is simple through most firms. Usually, they’ll have a selection of pre-packaged and managed investments you can buy into, shuffle funds between, and watch grow. These portfolios are balanced according to target retirement ranges or other goals and include a variety of assets, stocks, and other investments. Since it’s all managed behind the scenes by the brokerage, you don’t have to fiddle with individual purchases or watch the markets yourself.

3. Variable Contributions

Another benefit of the SEP-IRA is that you don’t have to set a contribution rate and stick to it as you do with other forms of retirement. You can contribute a maximum of 25% of your compensation one year, but if the next year is leaner, you can choose to contribute less or even nothing at all.

The requirement to contribute the same you do for your employees can make this an ethical dilemma as a business owner, but there’s no legal requirement to contribute the maximum you can.

4. Contributions Are Tax-Deductible

Like a traditional IRA, the SEP-IRA contributions are tax-deductible as a business expense. This deduction includes your contributions and the contributions you make to your employee accounts – it can amount to a reasonably significant business expense write-off in the right situations.

Of course, if you’re self-employed or have zero employees, this isn’t meaningful compared to a traditional IRA. A small business with a small handful of employees can see quite a bit of benefit from the tax implications of those deductions.

5. Non-Exclusive with Other IRAs

There are no rules against having other kinds of IRA alongside a SEP-IRA. You can still maintain and contribute to a traditional or ROTH IRA. The only potential issues are traditional IRAs’ contribution limits and their deductions, which can get a little tricky at higher income levels.

Suppose that all of this sounds good to you – great! A SEP-IRA might be an excellent choice for your investment. However, there are a few downsides to the SEP-IRA format, which you should know before diving in.

What Are the Downsides of a SEP-IRA?

Many of the drawbacks of a SEP-IRA come down to it being a traditional IRA, though a few are specific to the SEP format.

1. All-Or-Nothing Employee Inclusion

First of all, if you’re a small business with a handful of employees and set up a SEP-IRA, you must set up accounts for eligible employees.

As a reminder, any employee who meets these requirements is eligible for inclusion in the SEP-IRA:

- Employees that are over the age of 21 are eligible.

- Employees that have worked for you for three of the last five years are eligible.

- Employees who have been paid over $600 in a year are eligible.

You cannot pick and choose to give only management, or only vested employees, access to the SEP-IRA. Your only other option is not to use a SEP-IRA at all.

2. Matched Contributions

Whatever percentage of your compensation you contribute to your SEP-IRA, you have to contribute equally to your employee’s accounts. You might be able to swing 20% of your income into contributions, but adding in 20% of each of your employees’ salaries can be more significant. While the all-or-nothing regulation doesn’t seem devastating, it becomes harsh when adding the matched contribution percentage described above.

Of course, since the contributions are tax-deductible, this isn’t as much of a burden as you might expect it to be. Generally, higher contributions are more beneficial, save for a few rare circumstances.

3. SEP-IRAs Lack Catch-Up Limits

With a standard IRA account, you have annual contribution limits of about $6,000. However, suppose you’re over the age of 50. In that case, that limit is increased to $7,000 for older people to save more for their impending retirement, to better take advantage of interest compounding in whatever short amount of time they have before retirement rolls around.

SEP-IRAs do not have this catch-up shift in contribution limits. Your limits are the same at age 21 as at age 65. With the much higher base contribution limits, this is rarely an issue; however, it’s still noteworthy for some older investors.

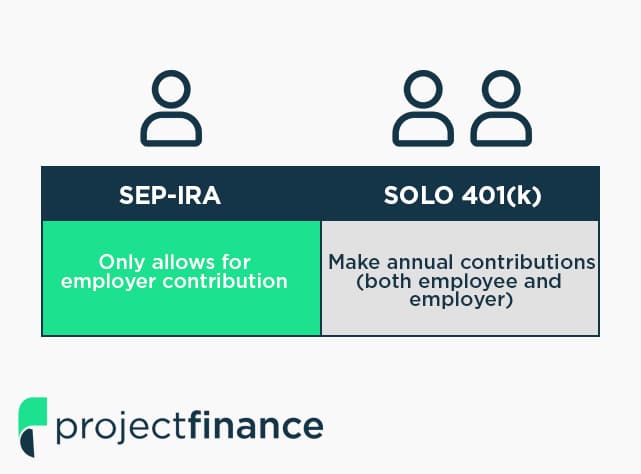

4. No Added Benefit for Employees

With a standard 401(k) retirement plan, one of the benefits to the employee is that they contribute from their paycheck, and their employer matches the contribution (up to a certain point, anyway). Feeding into the account from two directions gives the employee much more money to invest and build.

With a SEP-IRA, 100% of the money contributed to the account comes from the employer. The employee cannot add more funds to the account to further invest; they will have to find other forms of retirement savings to put their own money into.

Additionally, this places the burden of funding the account on the employer. You end up with many decisions to make regarding how much you contribute.

5. Early Disbursement Penalties

Investments typically come in three forms.

- Accounts you can freely add or remove money from at any time.

- Accounts you can withdraw money from at any time but may pay the penalty if you’re too young (under 59 ½ years old.)

- Accounts you cannot remove money from unless you demonstrate financial hardship.

SEP-IRA accounts fall into the second category. There are, generally, penalties if a younger individual tries to remove money from their SEP-IRA account. However, money may still be able to be rolled over to other IRAs. Additionally, individuals may qualify for certain exemptions from the penalty, depending on various factors specified by the IRS.

Additionally, you cannot take out a loan of your SEP-IRA funds in an emergency. A penalized withdrawal is the only option.

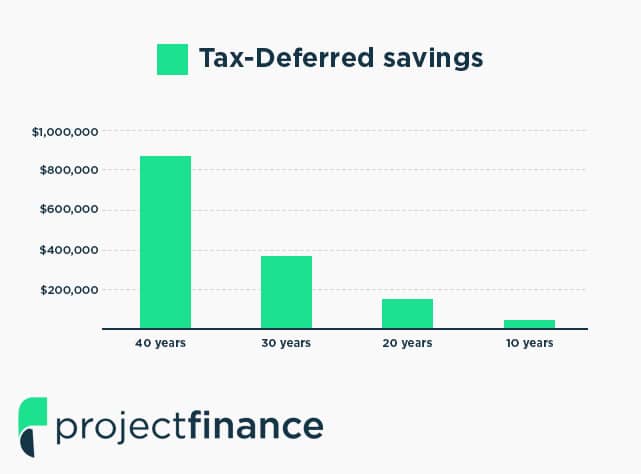

6. Deferred Taxes

Traditional IRAs and SEP-IRAs share the same tax implications. You can deduct contributions from your taxes when you contribute but pay taxes on the money you receive as a disbursement in retirement.

Deferred taxes can be a benefit or a drawback, depending on how you expect your income to scale. The decision between a traditional and a ROTH IRA is all about timing, tax brackets, and anticipated revenue. It can be challenging to decide, considering how few of us can plan even a few years, let alone decades.

Is a SEP-IRA Worth It?

Generally, yes, a SEP-IRA is a powerful investment tool for individual freelancers and small business owners. The larger your business grows, and the more employees you have, the less valuable a SEP-IRA plan is to you. However, should you plan to remain a sole proprietor or a freelancer, a SEP-IRA can be a great way to invest a significant amount of money in a relatively short amount of time to build up compounding interest.

Additionally, many businesses can benefit significantly from the tax deduction involved in contributing to their and their employees’ SEP-IRA accounts. Talking to a financial advisor about your specific situation is ideal, but a SEP-IRA is an excellent choice in many cases.

Often, the decision will come down to choosing between a SEP-IRA and some form of 401(k). In this case, the decision is more complex; 401(k)s have higher contribution limits as well, but dual contributions have the potential to be more valuable. Again, consider speaking with a financial advisor about your specific situation to help you make an informed decision.

Are you considering a SEP-IRA for your retirement account? Do you have any employees, and how does this affect your decision? Do you have any questions for us about opening a SEP-IRA? Please share with us in the comments section below, and I’ll do my best to point you in the right direction!