Last updated on March 24th, 2022 , 07:16 am

TAKEAWAYS

- In order to trade options, investors must first apply for and be granted options trading approval.

- Option trading levels vary by the broker; some have only 3 levels of options trading approval (tastyworks) while other brokers have 5 levels (Fidelity).

- Selling naked options always falls under the last tier, as this strategy has the greatest risk.

- Brokers look at both a customer’s financial condition and investing history before making a decision to accept or reject an options approval request.

- If an investor’s request for options trading approval is rejected, that investor can reapply at a later date.

Options trading can be a precarious endeavor. It is not a “one-size-fits-all” business.

Certain options strategies, such as the “short call”, introduce traders to infinite risk.

Because of this risk, specific strategies are not suited for everyone.

In order to protect both customers and brokers from this risk, “Options Trading Approval Levels” were introduced. Investors must apply and be approved for options trading before they can trade even the most basic options strategies.

Unfortunately, there are no standardized levels of options approval. The broker gets to choose what strategies fall under what tiers.

To make things more complicated, many brokers have different “tiers” of options approval. Most have 3, but others have 5. You can call your broker and request their specific option approval documentation at any time.

Jump To

How Do You Get Options Approval?

In order to trade options in your account, you must apply for options trading approval with your broker. Part of this process involves receiving a copy of a publication from the Options Clearing Corporation entitled the “Characteristics and Risks of Standardized Options.”

This document is very important for new traders to read. Among other helpful bits of information, it contains:

- Basic information on the characteristics of call and put options.

- Descriptions of the risks that come with trading various options strategies.

- Overview of the “exercise and assignment” process.

- Tax considerations in options trading.

It generally takes 1-3 business days for your broker to review and either accept or decline your request.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

What is Required to Get Options Trading Approval?

Just because you apply for options trading approval does not necessarily mean you will get it. According to the SEC, you must meet certain criteria to trade options.

Your broker will ask you many personal questions about your trading history and financial condition. Some of these include your:

- Investment Objectives (capital preservation, income, growth, or speculation)

- Trading Experience (how long you have traded stocks/options, what size you trade and general investing knowledge)

- Personal Financial Situation (liquid net worth, total net worth, annual income, and employment status)

A lot of this is very personal indeed! So how does your broker know if you’re making your answers up? They generally won’t. With that being said, to avoid financial ruin, it is best to stick with trading what you know and understand. That is the aim of this process.

You can always apply later on to “upgrade” your approval after you gather the necessary trading knowledge, or bankroll!

General Option Trading Levels

Before we start comparing the different approval levels offered by popular brokers, let’s review the most common “3 tier” option trading level structure, as well as the different strategies permitted in these levels.

Please keep in mind these levels are focusing on basic margin accounts; we will get into options trading approval for cash and IRA accounts later on.

Level One Options Approval

● Buying call options and buying put options (sometimes)

Level Two Options Approval

● All level one strategies

● Cash-secured naked puts

Level Three Options Approval

● All level one and level two options strategies.

● Undefined-risk spreads

Option Trading Approval Levels by Broker

Brokers are required to create their own option approval levels. Because of this, there are no standardized options trading approval tiers.

Most brokers currently offer 3 levels of options approval, with “Level 1” being the most basic (covered calls) and “Level 3” the most advanced (selling options naked). However, most traders will find everything they need under “Level 2”.

We can’t list every broker on this list, but we will try and cover the various options trading levels offered by the most popular brokers.

Tastyworks Option Approval Levels

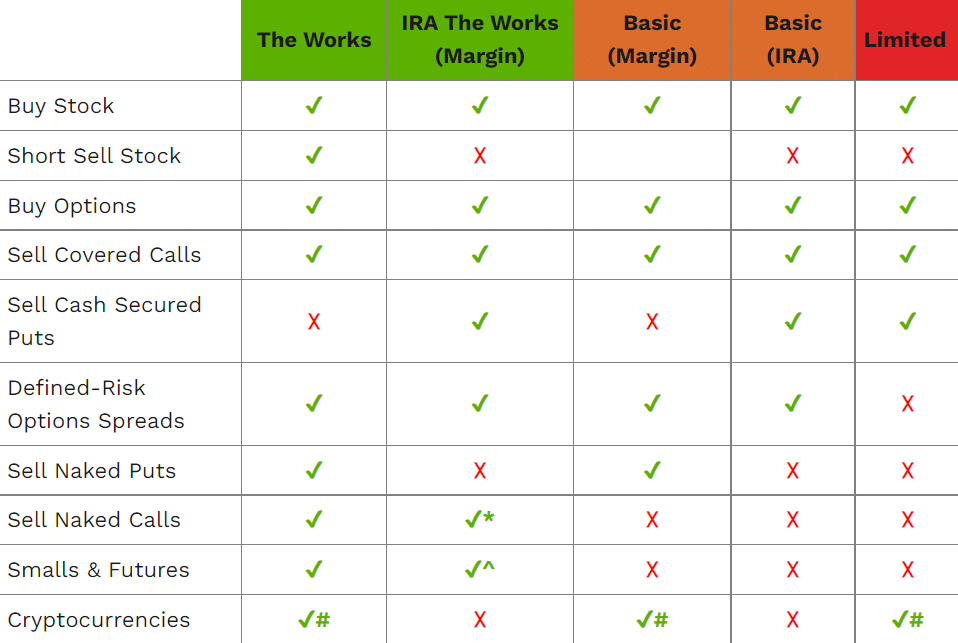

tastyworks offers three different levels of options trading. Unlike other brokers, they use more fun verbiage, such as “Limited” (level one) “Basic” (level two) and “The Works” (level three). As we can see below, they offer different features depending on the account type (margin vs IRA).

Fidelity Option Approval Levels

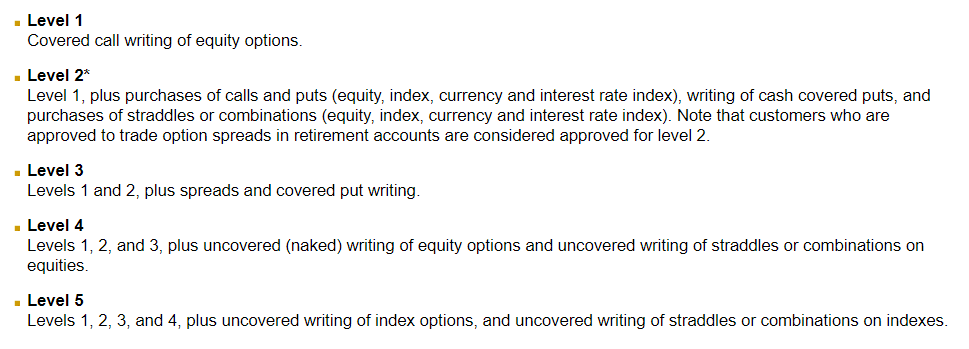

Fidelity has 5 different option approval levels. This makes the process a little more complicated and is just another reason why tastyworks is our preferred broker.

The below screenshot, taken from Fidelity Investments, shows what is included in their various tiers of options approval.

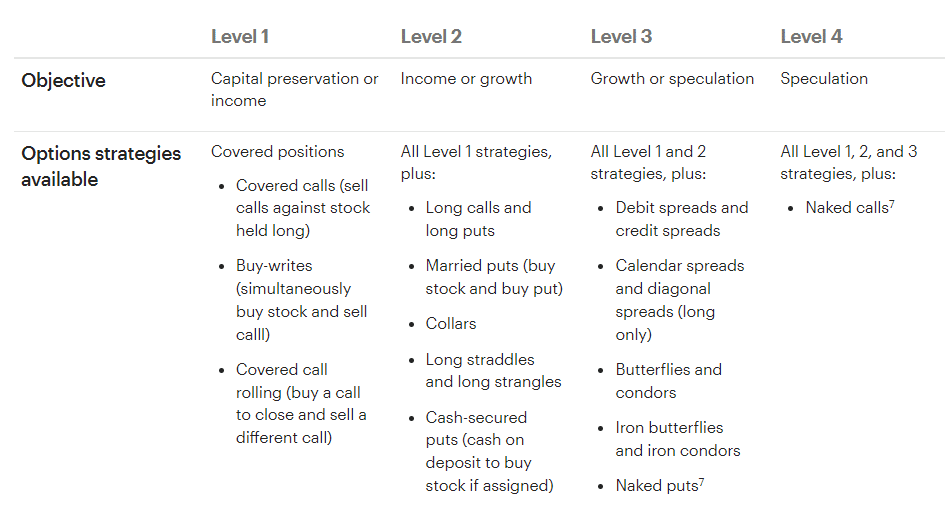

E*TRADE Option Approval Levels

E*TRADE has 4 different levels of options trading approval. Like almost all levels on our list, naked options come under the last tier.

Because of the great risk that comes with selling options, this tier is usually the hardest to get approved for.

Robinhood Option Approval Levels

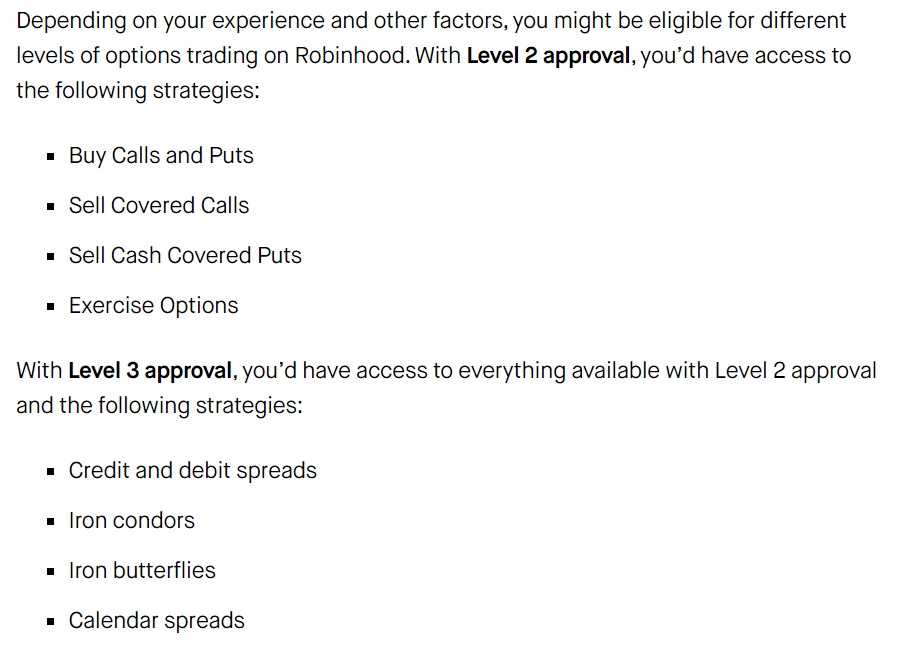

Robinhood has only two tiers of options approval. Additionally, Robinhood does not allow their customer to sell options naked or trade undefined risk spreads!

The below image shows what options strategies are available at Robinhood and their corresponding tiers:

TD Ameritrade (thinkorswim) Option Approval Levels

thinkorswim/TD Ameritrade (soon to become Charles Schwab) offers four levels of options approval. Like other brokers on our list, the type of options approval you can qualify for at TD will depend on your type of account.

When compared to IRA and cash accounts, margin accounts always offer more flexibility in terms of strategies.

Option Approval FAQs

Many brokers allow for options trading in an IRA account. The strategies offered in IRA accounts are often limited. Since only so much can be contributed to an IRA every year, options strategies with undefined risk are not permitted in an IRA account. This includes selling naked call options. How would an investor compensate their broker if a trade were to move against them beyond the limits of their account value?

Some brokers allow options trading in cash accounts while other do not. When compared to margin accounts, cash accounts approved for options trading have far fewer options in terms of strategies.

In order to get approved for a higher option trading approval level, you must apply with your broker. Many times, these request are denied due financial conditions or a lack of investment knowledge. However, investors can reapply at a later date.