Last updated on February 14th, 2022 , 09:23 am

Long Put Option Strategy for Beginners

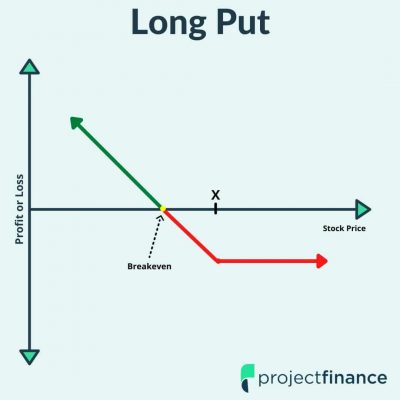

The above graph represents the profit/loss of a long put option at expiration, where X is the strike price.

Best For: Very Bullish Investors

What Is a Long Put?

In finance, a long put option is a derivative which gives the owner the right, but not the obligation, to sell a certain amount of a security (generally stock) at a specified price (strike price) by a specific date (expiration date). Let’s take a look at what this actually means.

If you understand what a long call is, the concept of a long put should be relatively simple to grasp, as everything is simply flipped on its head. A long call option gives the owner the right to purchase stock; a long put option gives the owner the right to sell stock. If a long call option benefits when a stock price increases in value, then a long put option benefits when a stock falls in value.

Therefore, the owner of a put option is bearish overall on the market. Some investors use long put options to hedge a portfolio of long stock, not unlike how an insurance policy on your car protects your vehicle in the event of a crash.

Tip! New options traders are often surprised to learn that a long put doesn’t always go up in value when the stock drops. This is due to time decay and implied volatility.

Unhedged Long Put

This example, however, is going to focus on unhedged long puts, as most investors trade puts as a method of bearish speculation.

To understand this better, just think of owning the car insurance on someone else’s car. If the car wrecks, you will make money. If the car doesnt wreck, you will lose the premium paid. That is essentially what a put option is, but instead of betting on the wreck of a car you don’t own, you are betting that a particular stock/index will fall in value.

Long Puts Explaines

A long put option is great for a very bearish investor because of the leverage it offers. The cost of a long put is often just a fraction of what it would cost in margin to sell short 100 equvalent shares of the underlying stock.

However, this leverage does come with a downside.

If you short a stock and the stock is unchanged in 3 months, you won’t lose a penny. If you buy an out-of-the-money put option that expires in 3 months and the stock hasn’t changed during this same time, you’re going to lose all of your premium. Long put holders need the market to go down hard and fast in order to realize a profit. This is because time decay slowly eats away at the premium.

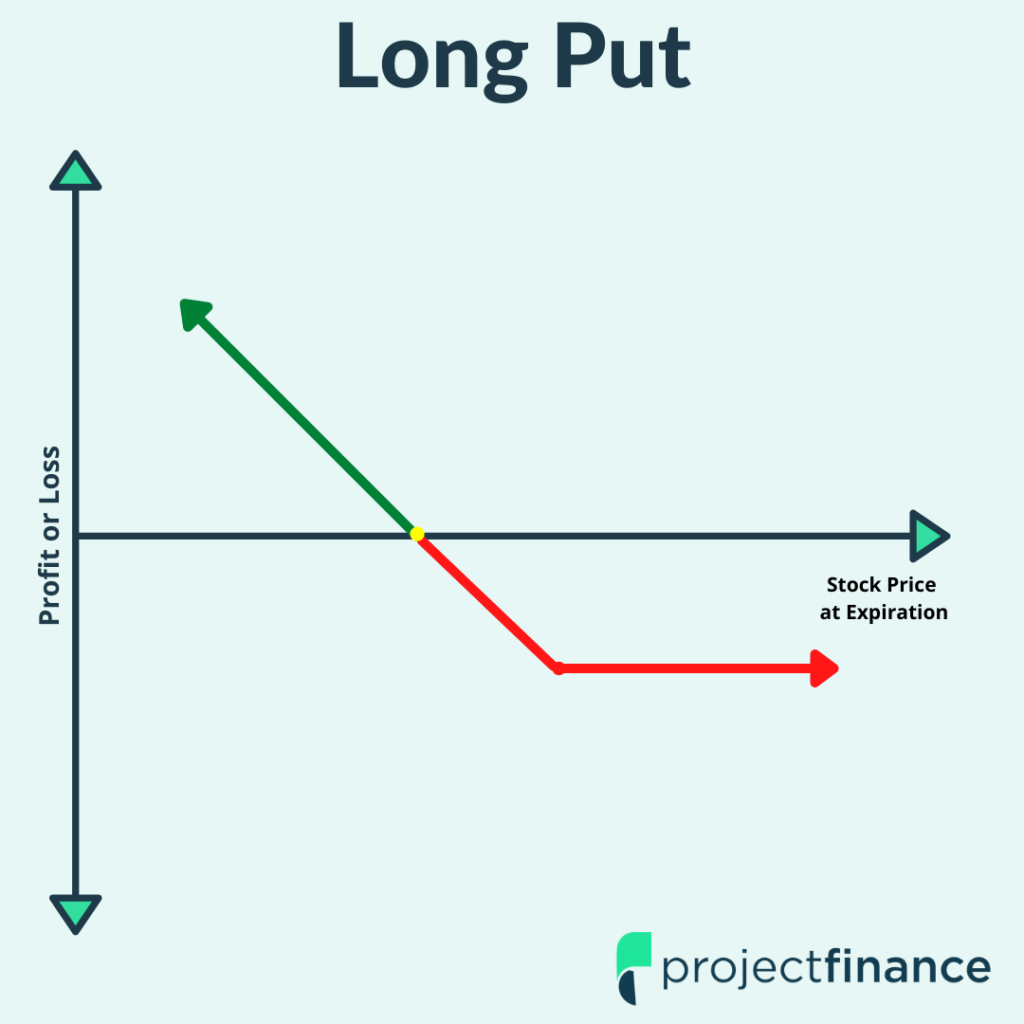

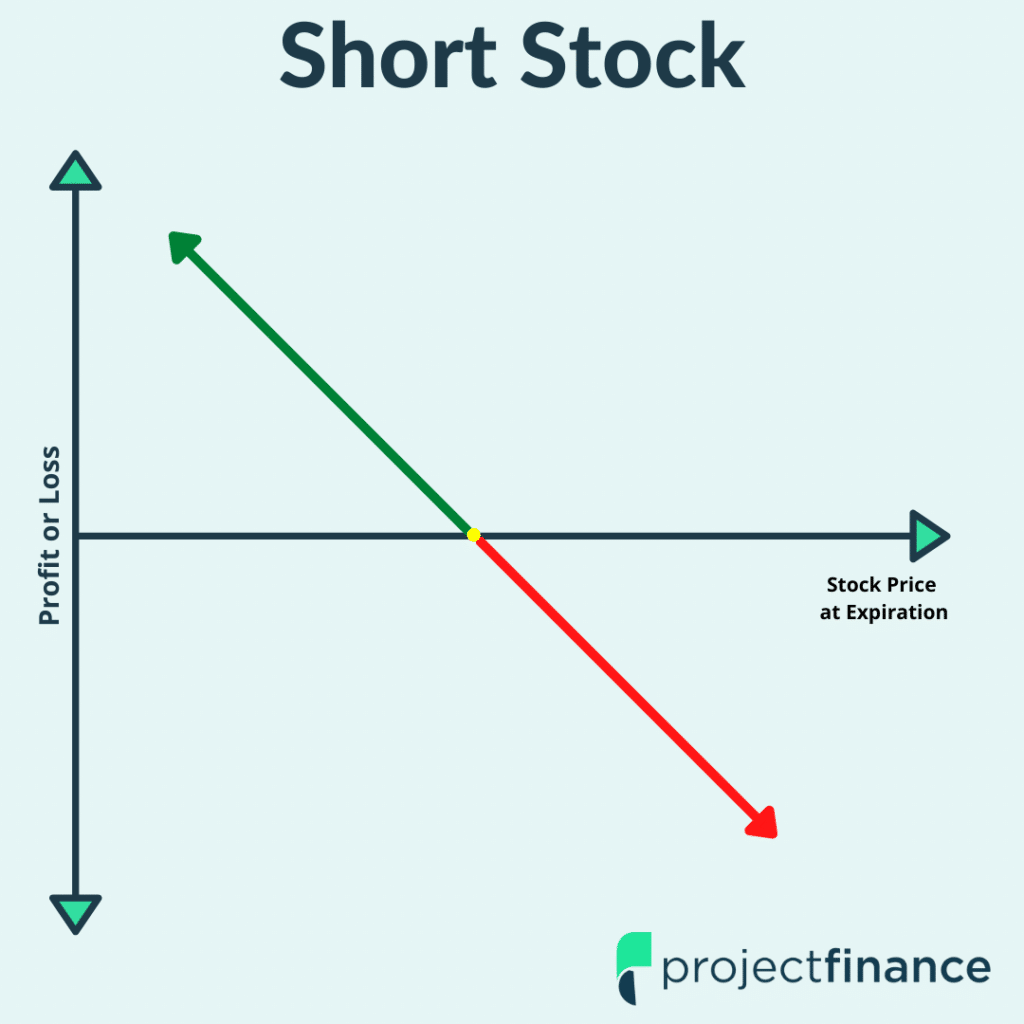

With that being said, long puts do offer less risk than selling an equivalent amount of shares. Why? When you buy a put, your risk is limited to the premium paid. When you sell a stock, that stock could in theory go to infinity. Take a look at the below graphs to better understand this.

Short Stock vs Long Put

Before we look at a few examples, let’s examine the characteristics of the long put strategy.

Put Option Characteristics

Maximum Profit

- Entire strike price minus premium paid

Maximum Loss

- The maximum profit on any long option contract is always the premium paid.

Breakeven

- Strike price - premium paid

Scenario 1

Let’s assume today is May 21st. In two weeks, on June 4th, the US Labor Department will release the May jobs report. You believe the market has been outperforming the actual economy, and you speculate that in the time leading up to and following the release of this report, the market will enter a correction.

You are therefore very bearish. Your trading account, however, only has $1,000 in buying power. You can short a few shares of stock, but this won’t give you as much downside exposure as you want.

Knowing the great leverage that options offer, you decide to purchase a put option. Since you think all stocks will go down, you choose to buy an out of the money put on a broad market ETF – SPY, which represents the S&P 500. Below are the details of your trade.

SPY Trade Details

Stock Price: $417

Put Purchase Price: 2.80

Put Strike Price: 410

Put Expiration: June 4th (13 days away)

Max Loss: $280

Max Gain: $40.720

Breakeven Price: $407.20

Let’s assume two weeks have passed and the jobs report was released. This is also the date our option expires. The jobs number was not good. From the date we bought the put to its expiration, the stock fell $6 in total to a value of $411 per share at expiration.

How did our put do?

Not well. Since the stock closed above our strike price of 410, the option will expire worthless and we will have lost the entire premium of 2.80, or $280.

Tip! Remember, one option contract represents 100 shares of stock, so whenever an option is quoted, move the decimal point two places to the right to get its true value.

Some wonder how this is possible: the stock went down from when we bought the put, from $417 to $411 per share – don’t put options make money when the stock drops?

They do, but you’re not betting on a binary outcome of the underlying as you would with short stock; you’re betting the stock is going to fall below a particular strike price by a particular date.

For every day the option doesn’t move in our direction, time decay and implied volatility eat away at the premium. The majority of out of the money options expire worthless for this reason.

Scenario 2

Let’s revisit our above trade with a different outcome. This time, the jobs report was a huge miss. As a result, the market tanked. Here is a reminder of our position:

Long 1 June 4th 410 strike price put @ 2.80

On the tail of this report, SPY plummeted in value to $401 per share. How did our put do this time?

The easiest way to determine the profit on a long put is first to determine where we break even. Our breakeven stock price was 407.20. Now, simply take the difference between the breakeven stock price and the current stock price. 407.20 – 401 = 6.2. That’s a profit of $620 on our option, not bad! What do we do now?

Let’s take a look now at the 3 different ways an investor can close a long put position:

Closing a Long Put

- If the long put is out of the money at expiration, it will expire worthless and no action is required.

- Sell the long put in the marketplace before expiration. However, never use market orders, and be careful with stop orders on options!

- If you do not sell an in-the-money long put by expiration, your broker will likely auto-exercise your right to either a.) sell stock (for equity options) b.) cash settle (index options). The vast majority of option traders will exit in-the-money options before expiration to avoid having short shares in their account.

Tip! If an option is zero bid, it may be impossible to sell as no one will be willing to buy.