Last updated on March 27th, 2022 , 12:00 pm

Jump To

Investors sometimes borrow money to buy assets. Here’s how, why, and the pros/cons of each approach.

Buying a House With a Mortgage

The most mainstream example of borrowing money to buy an asset is taking out a mortgage to buy a home.

A mortgage is borrowing money from a bank to buy a home.

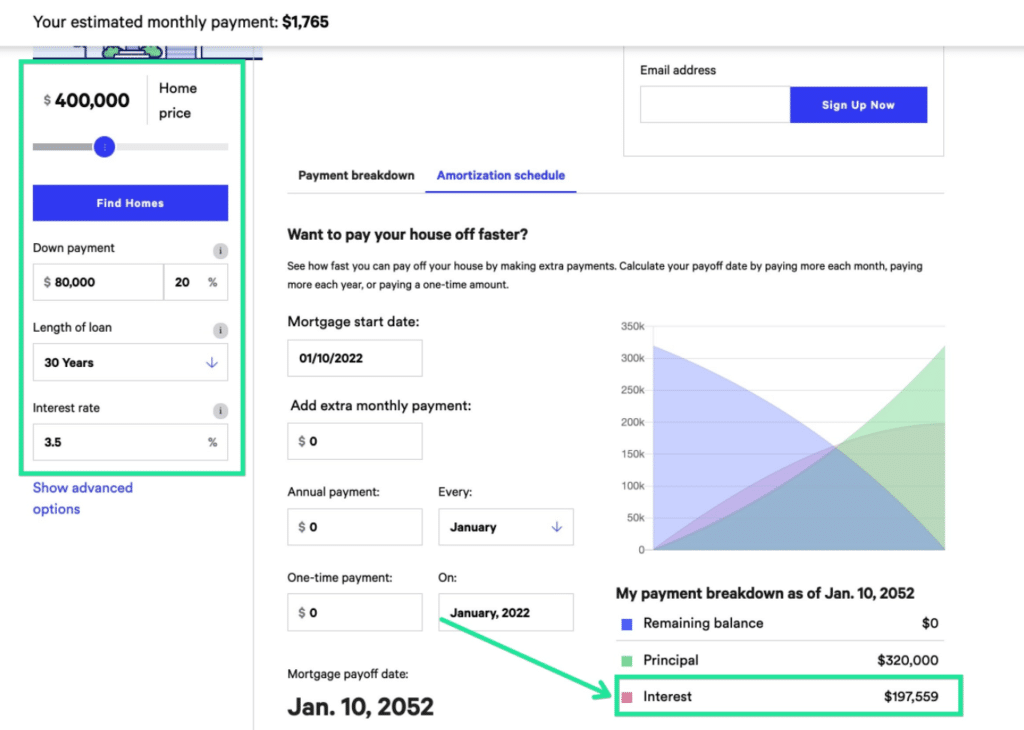

If you buy a $400,000 home with a 20% down payment, you’ll pay $80,000 upfront and borrow the remaining $320,000 to pay back over time (plus interest), commonly over 30 years.

According to the Bankrate mortgage calculator, a 30-year 3.5% interest rate mortgage would result in paying $197,000 in interest over the course of 30 years, which is the premium you’re paying the bank for lending you money.

Mortgages make expensive assets like homes affordable to many more people and also provide leveraged returns.

For instance, if you bought this $400K house with a 20% down payment, you’re leveraged 5:1.

$80,000 Down Payment / $400,000 Home Value = 20% Equity

$320,000 Loan / $400,000 Home Value = 80% Debt

Since you acquired the home while only paying for 1/5th of it, you’re leveraged 5:1.

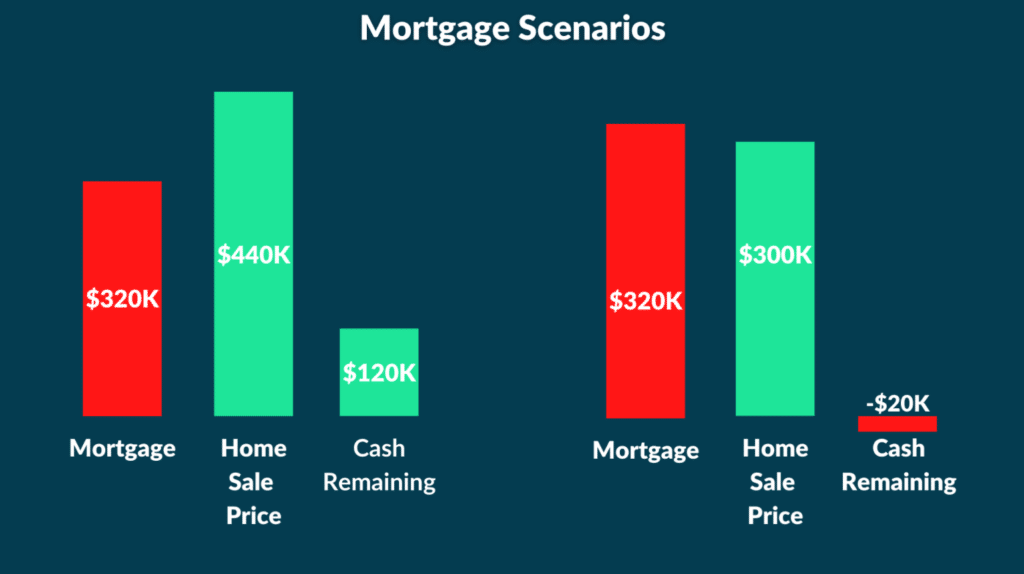

Let’s say the home value appreciates 10% to $440K in a year and you decide to sell it.

If you sell the house for $440K, you’ll make $40K on the home appreciation. Since you paid $80K to acquire the house, your return is 50% (less interest payments/taxes/additional equity).

The home price appreciated 10%, but you’re leveraged 5:1 so your return is +10% x 5 = +50%.

You will pay interest on mortgage payments and add more equity to your home which will reduce your total return. The important thing to know is that buying a house with a mortgage (borrowing money to buy a house) provides you with leveraged returns.

Real Estate Crash Scenario

In a real estate crisis, if the home value falls 25% to $300K in a year and you need to sell the house, you’ll lose $100K.

Since you borrowed $320K to buy the home and you sold it for $300K, you’re now in debt $20K because the proceeds from the sale of the home do not pay off your mortgage. The mortgage is “underwater.”

Fortunately, home prices have historically risen over the long-term, so if you maintain your ability to pay your mortgage payments you can hold onto the home through a short-term real estate crisis.

Buying Stocks on Margin

The second popular way investors borrow money to buy assets is “buying stocks on margin,” which means you’re borrowing money from your brokerage firm to buy stocks. You need a margin account to do this.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

The process is usually automatic and simple: buy a portfolio of stocks valued at more than the equity in your account.

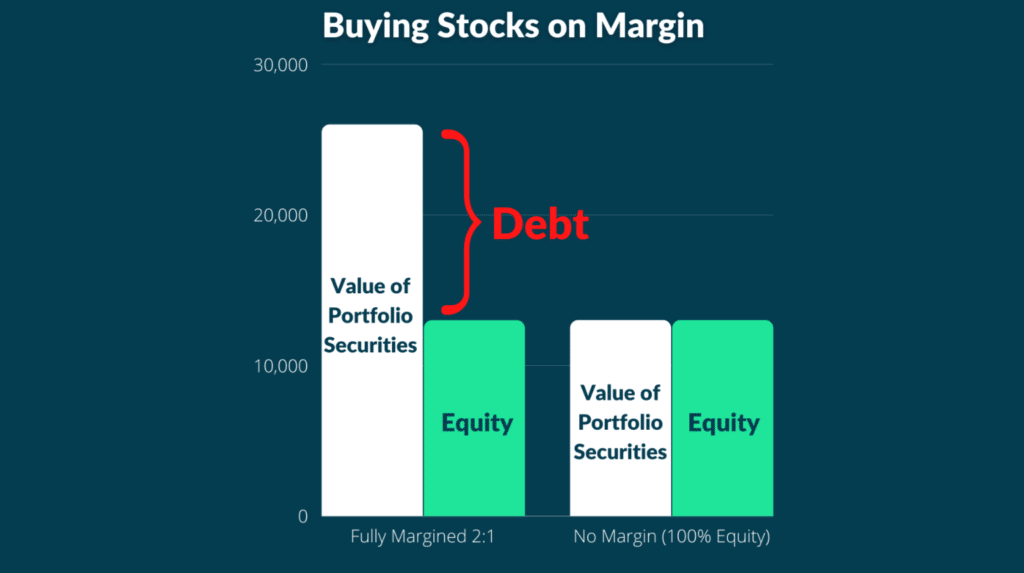

Usually, you can get 2:1 margin on stock purchases, meaning you can buy a portfolio of stocks that is 2x the value of your account equity (the portion of the account you own).

For example, if I deposit $13,000 into my margin account, I can buy $26,000 worth of stocks.

$13,000 is equity and $13,000 is debt.

If the stock portfolio increases 20%, my $26,000 portfolio will increase by $5,200 to $31,200.

Since I only had $13,000 of equity in the account before the stock price increase, a $5,200 return on my $13,000 equity translates to a return of 40%.

I could then sell $13,000 worth of shares and relieve my debt portion of the position, leaving $18,200 in my account, 100% of which is mine (equity).

If I did not buy shares on margin, I would have only been able to afford $13,000 in shares. The 20% stock return would have only generated $2,600 in profits for me as opposed to $5,200.

So borrowing money to buy stocks, or buying stocks on margin, increases leverage and therefore returns.

In the worst-case scenario, if I bought $26,000 worth of stock with $13,000 of equity in my account, and the stock price went to zero overnight, I now owe the brokerage firm $13,000 since I lost all of my money and the money they lent me.

In that case, I lose 200% of my investment and am now $13,000 in debt. I’ll need to repay the brokerage firm over time just like any other debt.

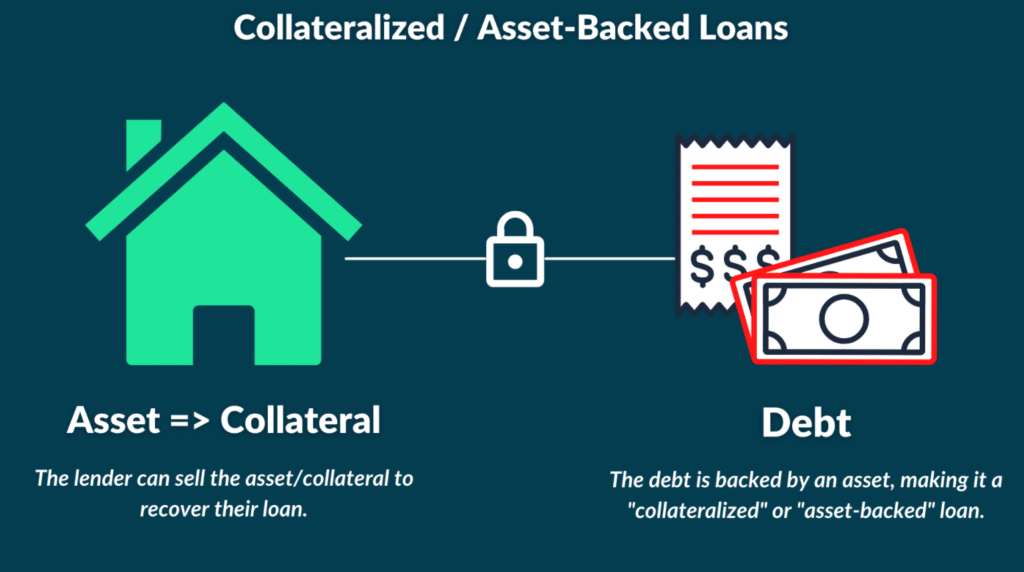

Collateralized Loans

Buying a home with a mortgage and buying stocks on margin are examples of collateralized/secured loans.

The money lent to you is backed/secured by an asset you are pledging as collateral.

A home bought with a mortgage can be sold to pay back the mortgage, which means the home is collateral. If you stop making your mortgage payments, the bank you borrowed from can sell your house to get their money back.

Stocks bought on margin can be sold by the brokerage firm to recover their loan to you, which means the stock positions are collateral. If you buy stocks on margin and the value of the stock position falls, the brokerage firm can sell your stock position to recover their loan.

So a collateralized or “asset-backed” loan means the lender can sell your asset to get their money back if they need to.

The downside to these two popular borrowing approaches is that the money you’re borrowing can’t be used freely to buy whatever you want. You are borrowing money to buy those specific assets (a home or stocks).

There are other examples of collateralized or asset-backed loans where the proceeds can be used freely.

Crypto Collateralized Loans

Crypto-backed loans are becoming very popular because many crypto investors are sitting on massive capital gains. If they sell their crypto now, they’ll pay 20%+ in capital gains taxes and lose some/all of their exposure to their crypto asset.

If a profitable crypto investor wants to access the money they’ve made but doesn’t want to pay capital gains taxes and/or also wants to keep holding their crypto, they can take out crypto-backed loans.

Here’s a concrete example using BlockFi:

Let’s say I have 1 BTC that I bought for $5,000 and is now worth $50,000.

I want to take out $10,000 for some short-term expenses and also don’t want to sell my BTC because I think it will continue increasing long-term. Selling an appreciating asset to pay an expense isn’t ideal based on my outlook.

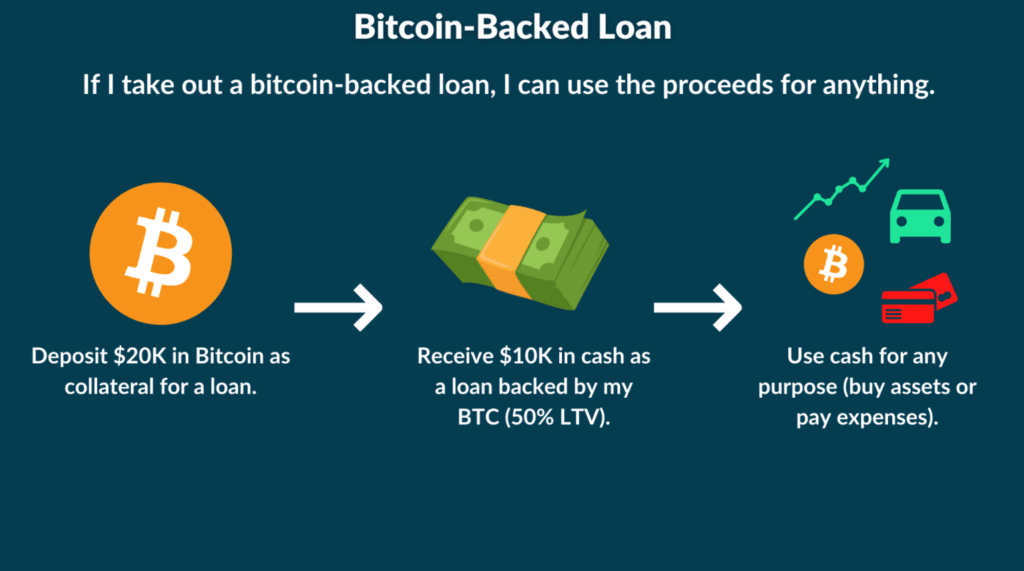

I can get $10,000 in cash by depositing some of my BTC at BlockFi as collateral.

If I take out a loan with a 50% loan-to-value ratio, that means I need to deposit $20,000 in BTC to take out $10,000 in cash.

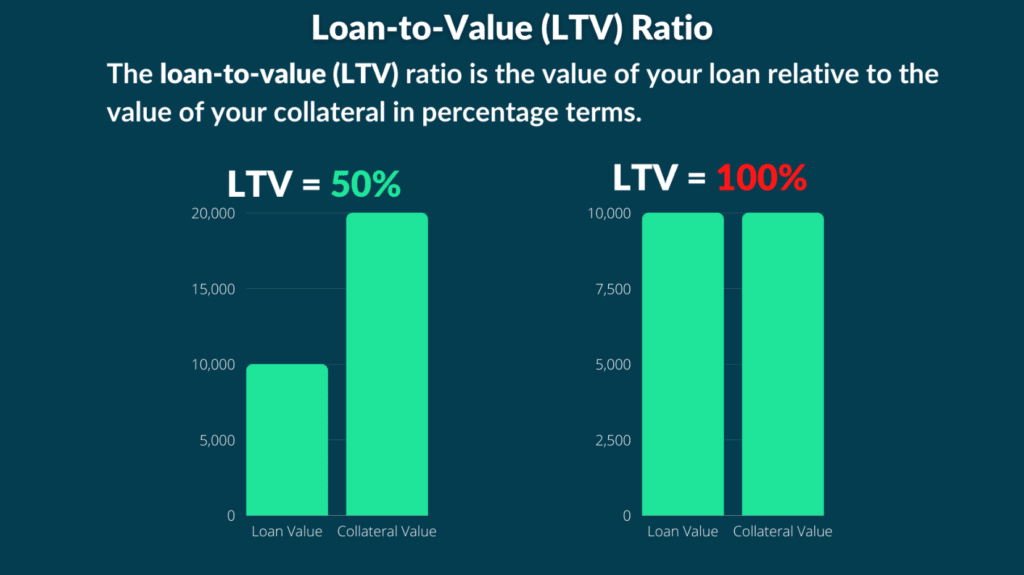

Loan-to-Value (LTV) Ratio => Your outstanding loan balance / the value of your collateral.

$10,000 Loan Balance / $20,000 BTC collateral = 50% LTV.

This is an “over-collateralized” loan because I’m pledging an asset with a value higher than the loan I’m taking out, which lenders require due to bitcoin’s high volatility.

If you take out a $10,000 loan against $20,000 of bitcoin, your LTV is 50%. If the value of your BTC falls to $15,000, your new LTV is 66%.

A higher LTV is bad because it means a higher percentage of your collateral needs to be sold to repay the loan. If your LTV exceeds 100% then liquidating your entire collateral position will not fully repay your loan. Bad news.

A lower LTV is good because it means a small percentage of your collateral can be sold to repay the loan.

The $10K in cash can be used for whatever I want. I could deposit it into my brokerage account and buy stocks with it, or buy more bitcoin with it (which leverages my bitcoin position since I’m buying more BTC with borrowed money).

I could also use the money to pay for rent or other living expenses.

I’ll have to pay back this $10K loan over time with interest, but I’ll keep my entire bitcoin position and not pay 20%+ in capital gains taxes.

Using a bitcoin-backed loan like this is a sound strategy IF I believe bitcoin will appreciate in the future, but there are big risks associated with BTC-backed loans (or any asset-backed loan).

If the value of BTC falls after taking out a loan, the value of your collateral (bitcoin) falls relative to the value of your loan.

Example: if you take out a $10K loan against $20K of bitcoin, your LTV is 50%. But if bitcoin falls 50% after taking out the loan, now your bitcoin collateral is worth $10K and your loan is $10K. The LTV is now 100%.

You will need to either add more bitcoin as collateral or pay down your loan to reduce your LTV. For instance, paying $5K towards the loan reduces your outstanding loan to $5K vs. your $10K bitcoin collateral value, reducing your LTV to 50% once again.

Or, if you add another $5K in BTC to your collateral account, your BTC collateral value goes to $15K. Your $10K loan vs. the $15K collateral value means your LTV is now 66%, a better situation than a 100% LTV.

If you do not reduce your LTV by paying down your loan or adding more collateral, the lender will sell your bitcoin to pay down your loan.

In that scenario, you’ll lose your bitcoin position and have to deal with the tax consequences.

Bitcoin Loan: Worse-Case Scenario

The value of your collateral falls to zero abruptly, leaving you with your loan and no collateral to pay it down if needed. So you’re left with a $0 asset and a loan to pay off with ordinary earnings.

So if you took out a $10K loan against $20K BTC and BTC went to zero overnight, you’d be left with a $10K loan to pay off and no BTC. It wouldn’t be such a bad situation if you still had the $10K cash in your checking account, but if you spent the money then you’d need to come up with that money to repay the lender over time.

Because of this, it may be better to take out a bitcoin-backed loan during a BTC decline as opposed to new all-time highs (ATH) because if BTC corrects from ATH, your LTV will increase, bringing you closer to a margin call.

Example: BTC at $70K and you deposit 1.0 BTC to take out a $35K loan.

Beginning LTV: $35K Loan / $70K BTC collateral = 50% (Good).

BTC falls to $50K.

New LTV: $35K Loan / $50K BTC collateral = 70% (Risky – Close to margin call).

If you take out a BTC-backed loan during a big decline and the value of BTC begins to rise after you take out a loan, your LTV will fall, bringing you further away from a margin call.

Example: BTC at $50K and you deposit 1.0 BTC to take out a $25K loan.

Beginning LTV: $25K Loan / $50K BTC collateral = 50% (Good).

BTC increases to $75K.

New LTV: $25K Loan / $75K BTC collateral = 33% (Great – significant BTC decline required for margin call).

It’s also wise to take out small loan-to-value loans, such as borrowing $10K against $50K bitcoin, or a 20% LTV, because it would take a much larger BTC correction to bring you into margin call territory.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Stock Collateralized Loans

Like a BTC-backed loan, which is just an asset-backed loan, you can take out loans against your stock portfolio. Any asset can be used as collateral, especially a highly liquid holding like a stock portfolio.

So if you had $100K in the S&P 500, you can take out a loan against the value of your stock portfolio (which we’ll explore in a later section).

Again, the idea would be to avoid selling your stocks and realizing capital gains taxes, reducing your stock market exposure and giving you a large tax bill to pay.

Unsecured/Uncollateralized Loans

All of the borrowing methods discussed thus far have been tied to an asset that is pledged as collateral, meaning the asset will be sold to recover the loan in the worst-case scenarios.

These asset-backed loans are “secured” or “collateralized” loans because the loan is backed by a valuable asset.

There are “unsecured” loans you can get which are not backed by anything other than your income. There is no asset pledged as collateral to be sold to recover the loan, making it a riskier loan for the lender to make because they’re trusting that your income allows you to make debt payments.

Because of the increased risk to the lender compared to an asset-backed loan, you’ll pay a higher interest rate on these loans.

The benefit of an unsecured/personal loan is that as long as you can make the payments, you will never be forced to sell an asset you purchased with the loan proceeds.

Benefit of Using Unsecured Loans to Buy Assets

The obvious downside of taking out an asset-backed loan is the forced liquidation of your asset/collateral if the value of that asset plummets. If the value of the asset falls significantly, the lender can sell the asset to recover their loan.

Of course, this means you’ll be selling your asset during a downturn, which is likely when you’d want to be acquiring more of that asset.

So the benefit of taking out an unsecured personal loan to buy an asset like a portfolio of stocks or bitcoin is that you won’t be forced to sell those assets if their values fall.

So as long as you can keep the bank happy by continuing to make the loan payments, you’ll be just fine.

Example: Say an investor takes out a $50,000 personal loan to buy bitcoin @ $50,000, then bitcoin falls 80% to $10,000. As long as the investor continues to make their loan payments, they will keep their bitcoin and can hold it to see if it recovers back to $50,000 and beyond.

Compare this to an investor who has $100,000 worth of bitcoin and they take out a $50,000 bitcoin-backed loan to buy more bitcoin. Their loan-to-value ratio is 50%.

Then bitcoin falls 50%, cutting the value of their bitcoin position to $50K. Their LTV is now 100% because their loan is $50K and the value of their BTC position is $50K.

In this scenario, the borrower must reduce their LTV by either:

Adding more bitcoin to the collateral account

Paying down some of the loan from other cash sources.

Both options will reduce the value of the loan relative to the collateral.

If they cannot do either, the lender will sell their BTC for $50K to recover the money lent out.

This leaves the investor with $0 in debt and $0 in bitcoin. Full liquidation.

The investor will then deal with the tax consequences and also have zero exposure to bitcoin, which would be tough to stomach if bitcoin’s value surged after liquidation.

Buy, Borrow, Die

How do the wealthy use the above information?

“Buy, borrow, die.” is how.

What the saying means is that you buy assets with your earnings over time, borrow against them to avoid capital gains and continue holding appreciating assets, then die. It’s a cheeky way of saying you’ll never sell the assets you accumulate.

The idea is to avoid selling assets at all costs because holding assets long-term protects you from inflation, eliminates capital gains taxes, and prevents interrupting long-term compounding.

If you can borrow against your assets at an interest rate lower than the long-term annual growth rate of the assets, you come out ahead.

A WSJ article quoted a 3.2% interest rate on asset-backed loans from Merrill Lynch for those with $1M+ in assets, or 0.87% for those with $100M+ in assets:

I ran a basic simulation of a stock portfolio worth $1M compounding at 8% per year. I compared selling 25% of the portfolio to come up with $250K in cash vs. borrowing $250K at 3.2% interest for 10 years.

The BankRate Amortization Calculator showed a $2,450 monthly payment for that loan with a total interest cost of $42,500 over the 10 years:

Of course, this means you’ll be selling your asset during a downturn, which is likely when you’d want to be acquiring more of that asset.

So the benefit of taking out an unsecured personal loan to buy an asset like a portfolio of stocks or bitcoin is that you won’t be forced to sell those assets if their values fall.

So as long as you can keep the bank happy by continuing to make the loan payments, you’ll be just fine.

Example: Say an investor takes out a $50,000 personal loan to buy bitcoin @ $50,000, then bitcoin falls 80% to $10,000. As long as the investor continues to make their loan payments, they will keep their bitcoin and can hold it to see if it recovers back to $50,000 and beyond.

Compare this to an investor who has $100,000 worth of bitcoin and they take out a $50,000 bitcoin-backed loan to buy more bitcoin. Their loan-to-value ratio is 50%.

Then bitcoin falls 50%, cutting the value of their bitcoin position to $50K. Their LTV is now 100% because their loan is $50K and the value of their BTC position is $50K.

In this scenario, the borrower must reduce their LTV by either:

Adding more bitcoin to the collateral account

Paying down some of the loan from other cash sources.

Both options will reduce the value of the loan relative to the collateral.

If they cannot do either, the lender will sell their BTC for $50K to recover the money lent out.

This leaves the investor with $0 in debt and $0 in bitcoin. Full liquidation.

The investor will then deal with the tax consequences and also have zero exposure to bitcoin, which would be tough to stomach if bitcoin’s value surged after liquidation.

It’s reasonable to assume an investor that has amassed $1M in assets would be able to easily afford this payment. If not, there is the option of slowly selling assets to meet the monthly payments, which will reduce the benefits below but will likely still be better than liquidating a huge chunk of the portfolio at the beginning.

Here are the outcomes of the two approaches:

Borrow $250K against a $1M stock portfolio at 3.2% interest for 10 years

Sell $250K of the portfolio

The investor who liquidated $250K at the beginning pays a 15% long-term capital gains tax (since I’m assuming accumulating a $1M stock portfolio took decades and most of the value of the portfolio is from capital gains).

To make things simple we’ll just use 15% of the entire $250K generated from the sale. If 50% of the $250K came from capital gains, then the capital gains tax would be $18,250 instead of $37,500. An insignificant difference in this comparison.

By borrowing $250K at 3.2% interest, the investor gets to hold the $1M in stocks for the entire 10-year period. Growing at 8% per year, the portfolio grows to $2,158,925. Total capital gains = $1,158,925. They pay $42,460 in loan interest.

The investor who liquidated $250K of their portfolio at the beginning experienced $869K in capital gains over the 10-year period. Their portfolio ended at $1,619,194.

So the investor who borrowed against their stock portfolio had a $2.16M portfolio vs. a $1.62M portfolio at the end of the 10-year period. The investor that borrowed against their assets to come up with cash experienced nearly $300K more in capital gains over the 10-year period compared to the investor who sold their stocks to come up with cash.

The simple way to interpret this is that investor #1 paid $42,500 in loan interest in exchange for increasing their 10-year capital gains by almost $300,000.

The key consideration here is each investor’s confidence in their ability to make loan payments. As long as the investor in scenario #1 can make the loan payments, they reap the benefits of holding onto their appreciating assets.

A big reason one might want to sell a portion of their assets vs. borrow against their assets is if they are not confident they’ll be able to make the debt payments or do not want any debt.

The point here is that debt isn’t always bad and can be used strategically to improve long-term financial outcomes, which is precisely what the wealthy do.

Disclaimer

I hope this post was informative and helped you understand the basics of borrowing money (asset-backed and unsecured).

I want to clarify that I’m not recommending or promoting taking out debt to buy assets, especially highly volatile assets like bitcoin. Debt is a risky thing because it increases leverage, which increases returns but increases losses as well. It also adds pressure to your finances because you increase your monthly payment obligations.

What you decide to do with your personal finances is your decision, but I hope this post broadened your awareness of what’s available to you.

The simple goal here is to increase financial literacy by making you more familiar with the tools available to you in the personal finance realm.

-Chris

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.