Last updated on April 25th, 2022 , 11:59 am

Investing for Beginners in 2022

The world of investing is an intimidating place for beginners. I know how it feels.

Sadly, the finance industry is full of complex terminology that confuses beginners and makes them feel like they aren’t smart enough to manage their own money, so they leave it to the professionals.

That changes today. In this comprehensive guide, you will learn how to think about investing and discover the popular ways you can start investing your money.

Why Invest?

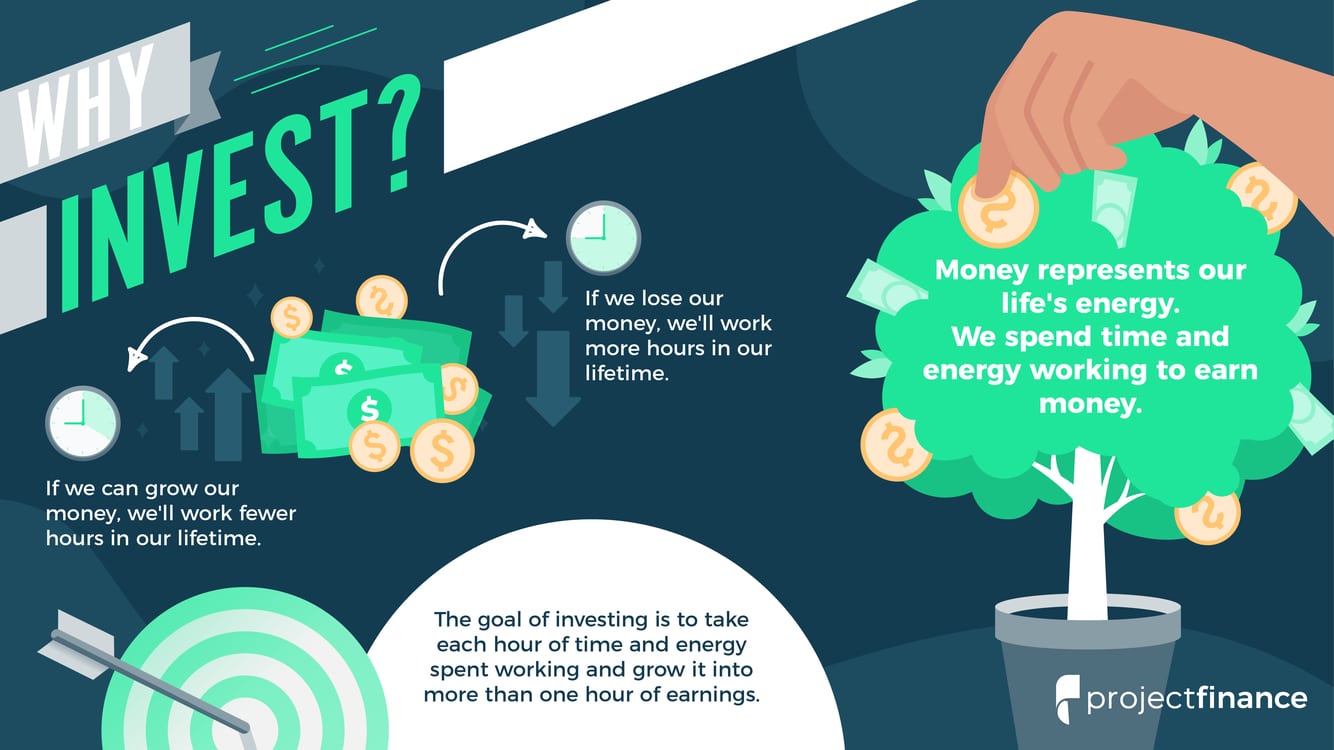

The obvious goal of investing is to grow your money. But it helps to think about what that means on a deeper level.

Money represents our energy. We spend time working at our jobs to earn money that we can use to spend, save, or invest.

In that sense, we convert our life energy (time and effort spent working) into monetary energy (money to use for whatever we want later on).

If We Grow Our Money...

If we grow our money, we amplify the time and energy we've spent working.

If We Lose Our Money...

If we lose our money, we destroy the time and energy we've spent working.

The goal of investing is to take each hour of time and energy spent working and grow it into more than one hour of earnings.

If we succeed, we can work fewer hours in our lifetime. If we fail, we’ll need to work more hours in our lifetime, leaving less time to do the things we truly love.

Example: Let’s say I earn $20/hour and work 100 hours. I earn $2,000. If I invest that money and grow it into $4,000, I have 200 hours of earnings when I only spent 100 hours working. The result is 100 hours that I get to spend doing interesting things other than working.

If I lose my $2,000 of earnings, I worked 100 hours and have zero hours of earnings. I’ll have to work another 100 hours just to get back to even, resulting in working 200 hours for only 100 hours of earnings.

I hope putting money management in this perspective helps motivate you to learn and make better decisions with your money.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Investing Pre-Requisites

What do you need to start investing? Of course, you’ll need cold, hard cash available to invest.

The second thing you’ll need is an account at the financial institution you’re going to use. The type of investing you want to do will determine what type of account you’ll need, and where.

A brokerage account is a popular type of investment account that allows you to invest on your own. If you want to buy shares of AAPL or TSLA, a brokerage account is what you’ll need.

There are many popular brokerage firms you can choose from that will allow you to do the same thing: buy and sell financial products such as stocks, options, and futures.

I trade and invest with tastyworks, a Chicago-based brokerage firm specializing in options trading. Since I do a lot of options trading, tastyworks works for me (pun intended). I can also buy and sell stocks commission-free with tastyworks.

How Much Money Do You Need to Start Investing?

What’s the ideal amount of money you need to start investing? Good news: not much!

Many new investors feel that they need thousands of dollars to start investing, which isn’t the case. In fact, I believe it’s good to learn with a small amount of money. That way, mistakes early on won’t lead to catastrophic losses.

With just a few hundred dollars, you can start investing in low-cost funds that give you exposure to hundreds of different companies. We’ll discuss how that works later in this guide.

Invest Yourself or Use a Robo-Advisor?

As a beginner investor, you can choose to invest yourself (self-directed investing), or you can use a platform that makes it easy to invest without much thought.

If you want to invest your money yourself, such as buying shares of AAPL or a stock market index exchange-traded fund (ETF) like VOO, you’ll use your brokerage account we talked about earlier.

If you want to automate your investing and don’t want to think about it, you can use a “robo-advisor” like Wealthfront.

There’s no right or wrong answer!

You can always have an account where you have fun investing in individual companies you know and love, while also using a robo-advisor like Wealthfront for a portion of your investments.

How Do Robo-Advisors Work?

Robo-advisors like Wealthfront are very easy to use.

It takes a few minutes to sign up for an account. During the signup process, they’ll ask you about your risk-tolerance, like if you want to follow a high-growth, high-risk approach, or a low-risk wealth preservation approach.

After that, simply deposit money into your Wealthfront account and they will buy a portfolio of low-cost funds for you.

You don’t have to think about investing for one second because a robot is making the decisions. All you have to do is deposit money into your account, which you can automate by setting up recurring deposits.

I love these mindless investing approaches because I tend to forget that it’s happening—which is the point.

By using an automated investing strategy with a robo-advisor, you can invest following Warren Buffett’s advice of buying stocks as often as possible.

Assuming you want to invest on your own, you’ll need to learn about the types of things you can invest in.

What to Invest In? Exploring Asset Classes

Well done! You’ve successfully opened up your first brokerage account and you’re excited to start investing. But what do you buy? It’s time to explore the world of financial assets to learn the types of investments you can make.

In finance, an “asset class” is a group of investment products with similar characteristics. For example, shares of AAPL and MSFT are in the “stocks” asset class because they are both publicly-traded stocks.

Bitcoin and Ethereum reside in the “cryptocurrency” asset class.

In the following sections, I’ll walk you through stocks, bonds, real estate, cryptocurrency, and cash/savings accounts.

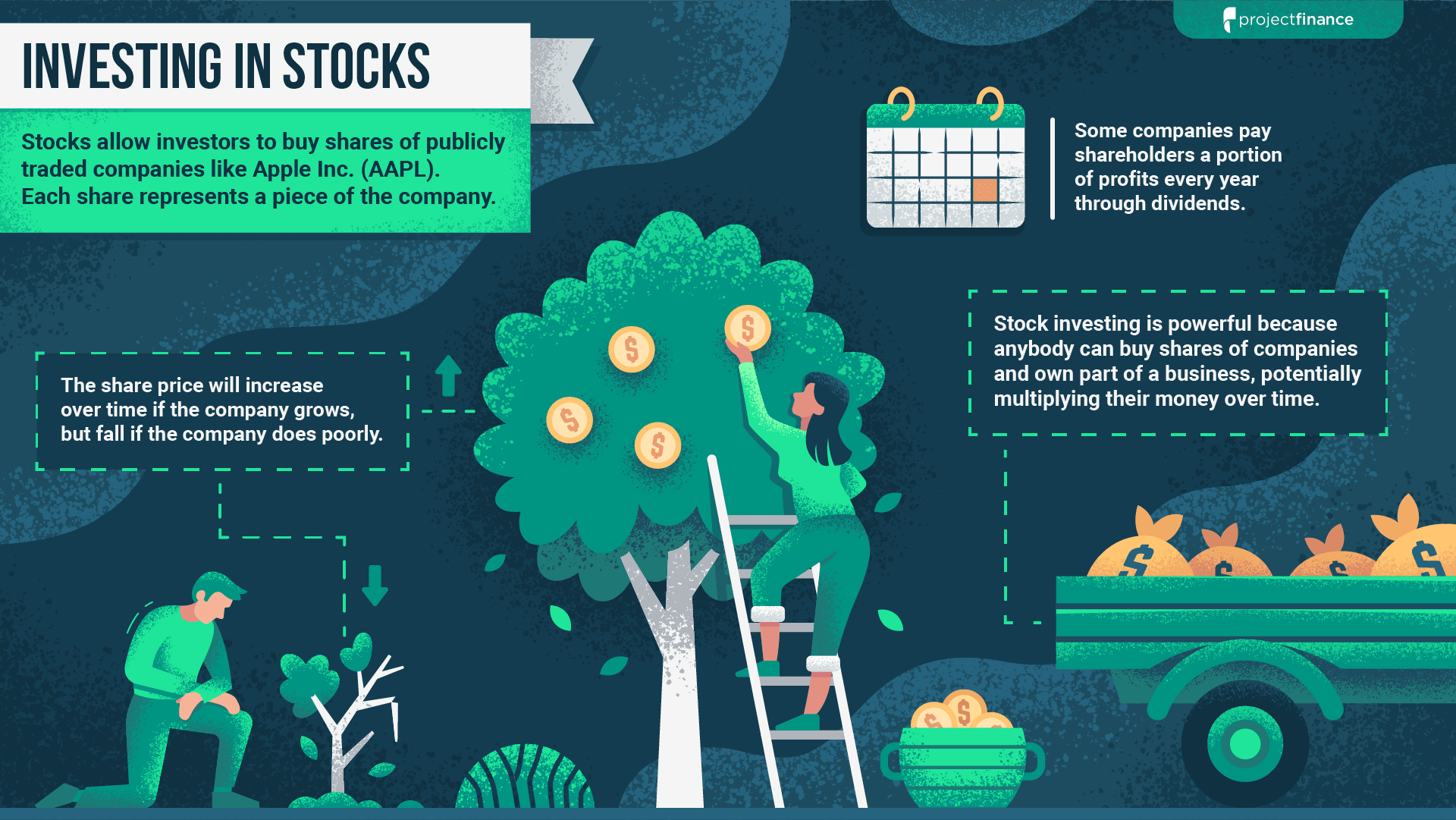

Investing in Stocks

In the early 1600s, the Dutch East India Company was the first company to issue shares of stock for public investors. Since then, stocks have been at the heart of the investing world.

Stocks allow individual investors to buy part ownership in companies.

By purchasing shares of NVIDIA (NVDA), you’ll be a small owner of the company.

If NVDA performs well over time, the stock price will increase and your investment will grow. If NVDA doesn’t do so well, the stock price will decrease and your investment will lose money.

Fortunately, NVDA investors have done well in recent history. In late 2016, NVDA shares were trading for $15/share, increasing 15x to $220 in August of 2021.

Price Appreciation and Dividends

There are two ways to make money buying stocks: share price appreciation and dividends.

Price Appreciation

If you buy a stock for $100 and the stock price goes up to $110, you've made a 10% return on your investment.

Stock Dividends

Many public companies pay dividends to their shareholders. If a company pays a $2.50 annual dividend, you'll earn $2.50 for every share you own. If the stock price is $100, the "dividend yield" is 2.5%.

The Power of Stock Investing

The wealthiest people in the world obtained their wealth by having massive upside from getting paid in percentages—such as sales commissions or owning shares of a company they started.

The beauty of stock investing is that anyone in the world can buy shares of a publicly-traded company and “get paid in percentages.” Warren Buffett made his billions by purchasing shares of companies and holding them long-term.

Own Something

Stock investing allows anyone to own a piece of a company and potentially build life-changing wealth. One way to manage your money like the wealthy is to own stocks.

Investing Basics: Mutual Funds and ETFs

When I was first learning about investing, I paid a lot of attention to mutual funds.

My dad worked at Fidelity, and I remember spending hours on the Fidelity website looking at mutual funds when I visited him in Boston. I’d daydream about all the money I could make from pouring money into well-performing mutual funds.

Too bad I was a broke 20 year old.

In this section, you’ll learn about mutual funds and exchange-traded funds (ETFs). They are similar, but there are key differences to know about that can save you lots of money and headaches.

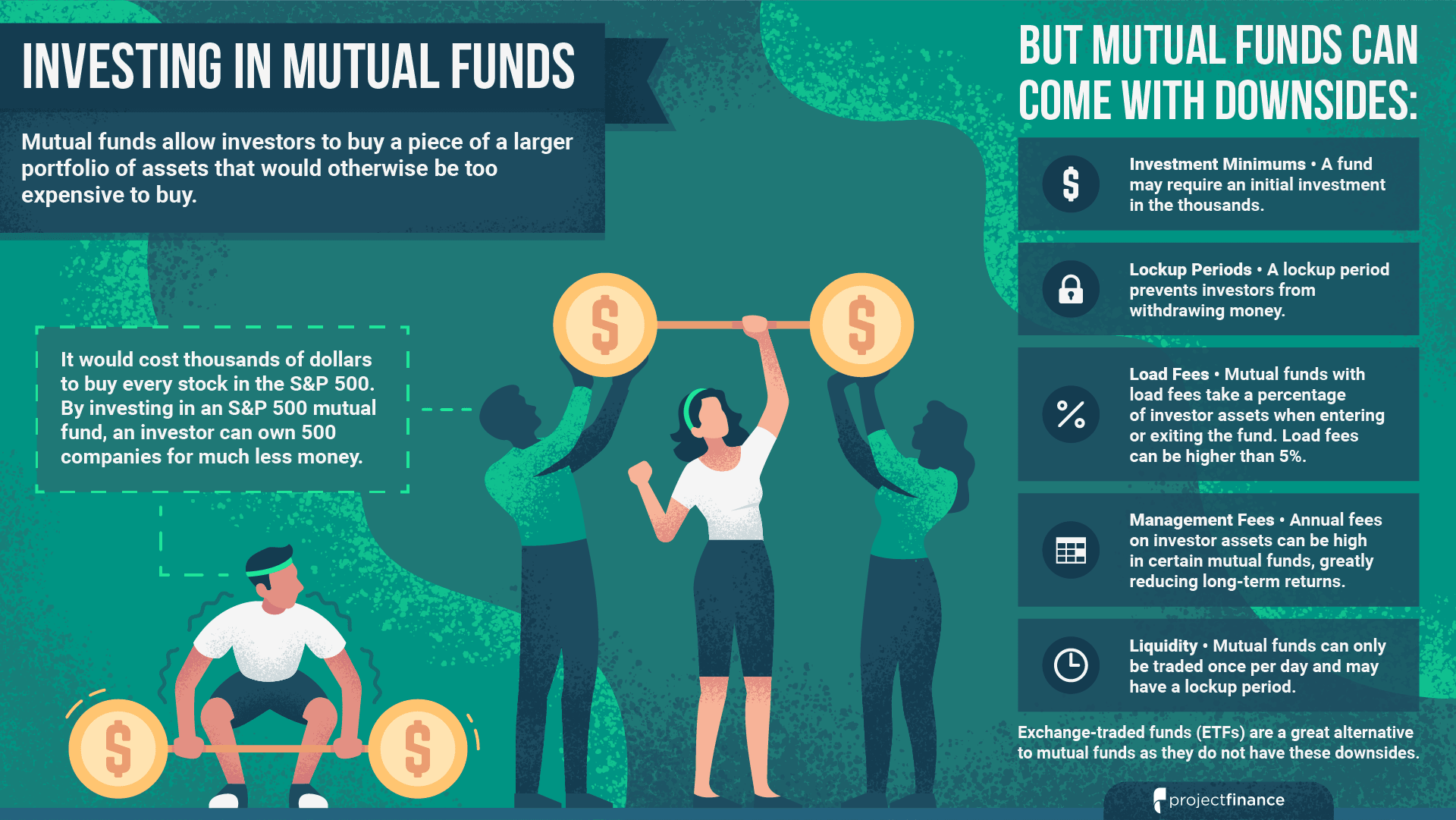

What Are Mutual Funds?

A mutual fund is a pool of money from many investors that is invested in specific assets. If you have a 401(k) plan, chances are your money is sitting in mutual funds.

How do they work? Mutual funds collect money from investors around the world, giving each investor part ownership of the fund’s total assets.

The benefit is that individual investors can invest in diversified portfolios of assets without needing a pile of money to buy up all the assets in the fund themselves.

Why Invest in Mutual Funds?

By pooling together money from lots of investors, each person owns a share of a portfolio of assets that would otherwise be too expensive to buy.

Let’s create our own fictitious mutual fund to illustrate how it works.

Say 100 investors from around the world each deposit $1,000 into the mutual fund, giving the fund $100,000 to invest.

The mutual fund’s objective is to invest in 100 of the largest technology companies in the U.S.

The fund manager will invest the $100,000 into each of these stocks to create a diversified portfolio of U.S. technology stocks.

Since each investor put $1,000 into the fund, each of them owns 1% of the fund from the start.

Let’s say things go well and the tech portfolio grows to 40% to $140,000. Since each investor owns 1% of the fund, their investments are now worth $1,400 each.

If the portfolio doesn’t perform well and falls 20% to $80,000, each investor’s 1% share would be worth $800.

Pooling together money from lots of individuals allows each investor gain exposure to a large basket of stocks without much money. In our example, each person wouldn’t be able to buy 100 different technology stocks with $1,000, which is why mutual funds are so powerful.

However, mutual funds can come with big downsides: investment minimums, lockup periods, high management fees, and load fees.

Minimums

Some funds require a minimum deposit, such as $2,500, to get started.

Lockup Periods

A lockup period of six months means an investor cannot withdraw their funds until six months after deposit.

Expense Ratio and Load Fees

An "expense ratio" of 1% means the fund will take 1% of your assets each year as a management fee. A "load fee" is a lump sum fee the fund takes when you enter (front load fee) or exit the fund (deferred load fee). A 5% front load fee means the fund takes 5% of your assets when you make your initial deposit.

Fortunately, there’s a solution to the dark side of mutual funds: exchange-traded funds (ETFs).

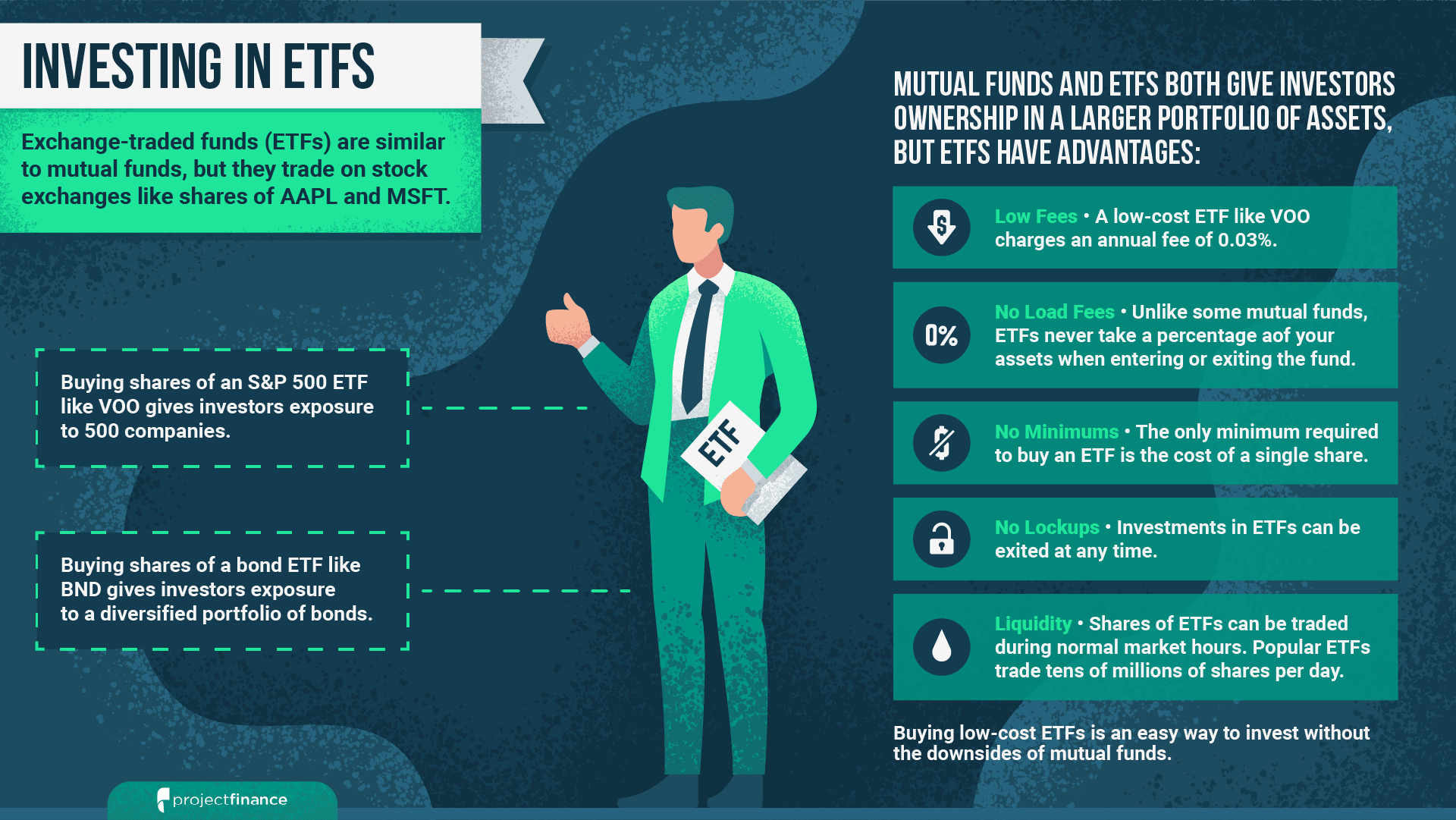

What Are Exchange-Traded Funds (ETFs)?

As the name suggests, exchange-traded funds (ETFs) are funds that are traded on exchanges. They are similar to mutual funds, as ETFs offer shareholders part ownership of the fund’s assets.

Shares of ETFs trade on stock exchanges like shares of AAPL and NVDA.

Mutual funds do not trade publicly. You need to set up an account directly with the mutual fund company to buy their funds, which can only be traded once per day.

ETFs offer investors the same benefits as mutual funds without the downsides:

Low Fees

Many ETFs have expense ratios close to 0% and no load fees. The Vanguard S&P 500 Index ETF (VOO) charges investors 0.03% in management fees each year.

No Investment Minimums

There are no minimum investment requirements to buy ETFs aside from the cost of a single share.

Liquidity

Mutual fund investors can only trade once per day. ETF holders can trade shares during normal market hours. The average daily trading volume of popular ETFs can be in the 10s of millions of shares.

Efficient Pricing

Institutions called Authorized Participants keep ETF share prices close to their Net Asset Value (NAV).

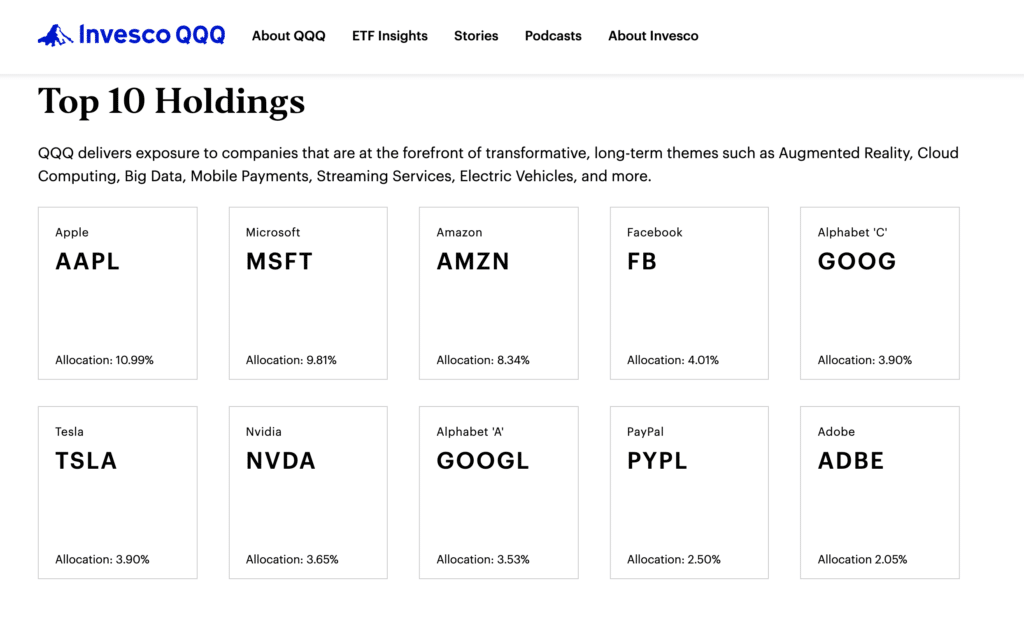

As an example, for $375, you could buy one share of QQQ, the Invesco Nasdaq-100 index ETF.

QQQ offers investors ownership of the 100 largest non-financial companies listed on the Nasdaq Stock Exchange:

Unlike mutual funds, ETFs do not have any of the sinister load fees or lockup periods mentioned earlier. Many ETFs have expense ratios or annual management fees close to 0%.

Lastly, since ETFs trade like shares of MSFT, you can buy and sell shares of ETFs during normal stock market trading hours. You can only buy or sell mutual funds once per day.

Popular Stock Market Index ETFs

Popular stock market ETFs include:

DIA — Dow Jones Industrial Average

VTI — Vanguard Total Stock Market

Check out each of the fund pages above to learn more about each one. It’s a good practice to learn how to navigate fund websites!

Investing in Bonds

Bonds are the next asset class to learn after stocks. Bonds typically come with lower levels of risk compared to investing in stocks, but not always!

Recent data estimates the global value of the bond market to be around $120 trillion, so they’re kind of a big deal.

What is a Bond?

A bond is a form of debt where the issuer receives money up front—effectively a loan, pays a fixed income stream each year, then returns the initial investment to the buyer.

On the other side, the buyer acquires the bond with a lump sum payment up front and receives the fixed interest payments each year until the bond reaches maturity—the end of its life.

A bond is debt to the issuer because they must pay the bondholder interest payments each year and return the initial investment to the buyer upon maturity.

A bond is an asset to the buyer because they receive regular interest payments each year and, hopefully, get their money back when the bond matures.

Bonds are referred to as “fixed-income” due to the regular interest payments of equal amounts that the bondholder receives.

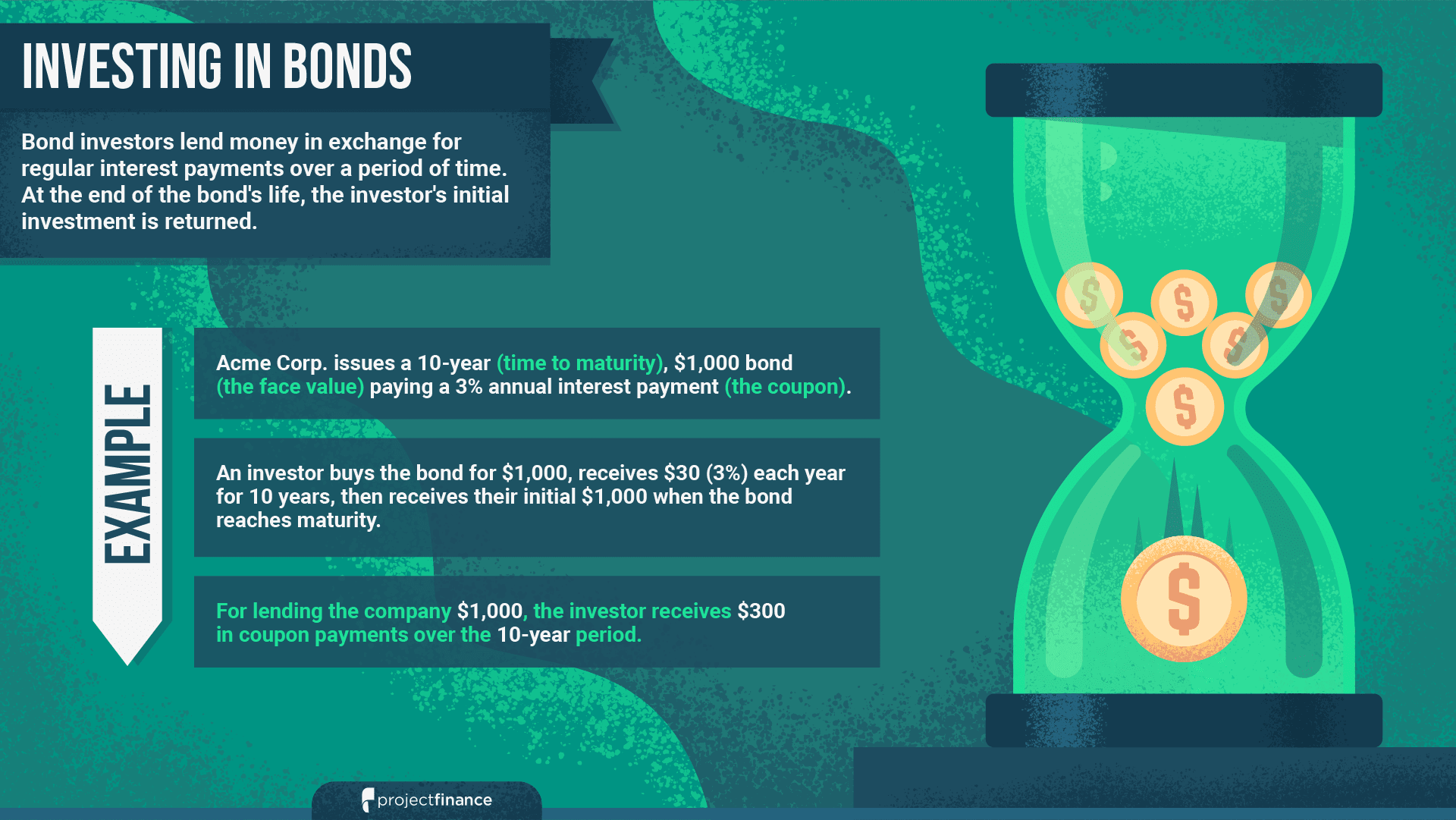

Bond Investment Example

Let’s walk through a simple example together to understand how it works and learn the lingo.

Example: Acme Corp. issues (creates) a 10-year, $1,000 bond paying a 3% coupon payment.

Here are the key bond terms to know:

Par Value / Face Value

The bond's "par value" or "face value" is the amount the investor receives when the bond reaches the end of its life. In our example, the par value of the bond is $1,000.

Maturity Date

A bond's maturity date is when the bond reaches the end of its life and the par value is returned to the investor. In our example, the maturity date is 10 years from the day of issuance.

Coupon Payment

The coupon payment is the amount of interest paid each year to the bondholder. In our example, that's 3% of $1,000, or $30. Coupon payments are typically paid twice per year, so the bondholder would receive $15 every 6 months.

If I buy this bond for $1,000, I’ll receive $30/year for the next 10 years, then I’ll get my $1,000 back.

My benefit is a stream of income on my cash. The benefit to Acme Corp. is $1,000 they can use to fund their business operations. It’s a win-win.

Total Return

A total return in investing is the combination of profits and losses that an investment can produce.

What’s the total return from my bond purchase in our example?

Coupon Payments: $30/year x 10 years = +$300

Profit/Loss on Bond Price: Paid $1,000 then Received $1,000 = $0

My total return over the course of 10 years would be $300, or 30% on my initial $1,000 investment.

When Should You Buy Bonds?

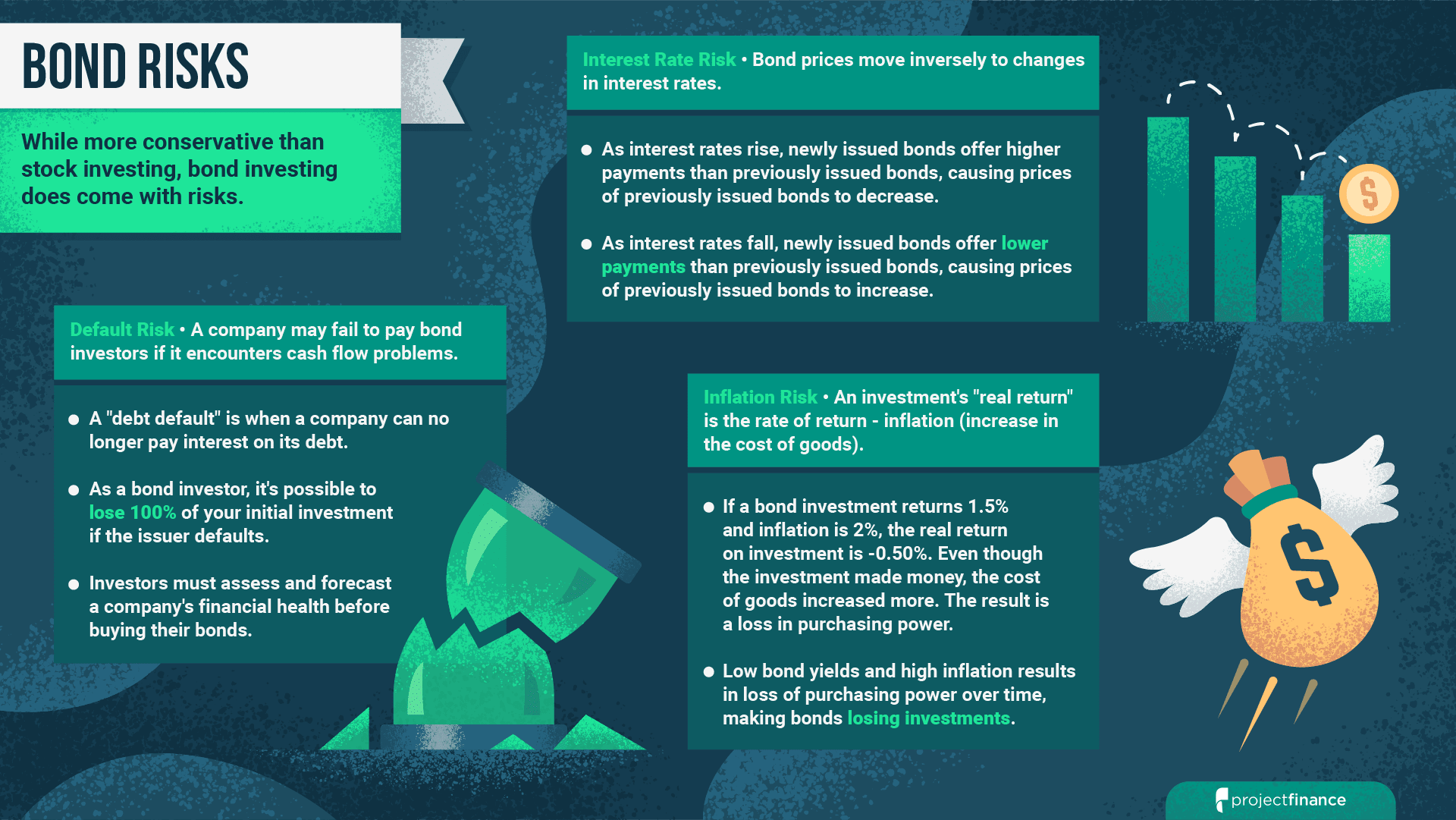

While buying a bond for the income stream sounds wonderful, there are investment risks you need to know about. The biggest risks bond investors face are default risk, interest rate risk, and inflation risk:

Default Risk

If a company's performance declines and they "default" on their debt, they can no longer pay back the debt they owe. As a bond buyer, you risk losing your investment if a company goes bust.

Interest Rate Risk

Bond prices are sensitive to changes in interest rates. If I buy a bond and rates increase, newly-issued bonds will be more attractive to investors and my bond's price will fall. If I buy a bond and rates fall, newly-issued bonds will be less attractive to investors and my bond's price will increase.

Inflation Risk

If prices rise, the real return on a bond will fall. If I purchase a bond with a 1.5% yield and inflation soars to 3.5%, the real return is -2% because my bond returns are lower than the growth in prices.

Before investing in bonds, you should consider the type of bonds you’re buying, the interest rate environment, and inflation expectations.

Bond investing in 2021 is tricky because we are in a low interest rate environment with high inflation. If you buy bonds now and the Federal Reserve starts increasing the Fed Funds Rate, bond prices will fall (yields will rise). And if inflation runs hot, bond investors will suffer negative real returns as prices of goods and services outpace the returns on their bond positions.

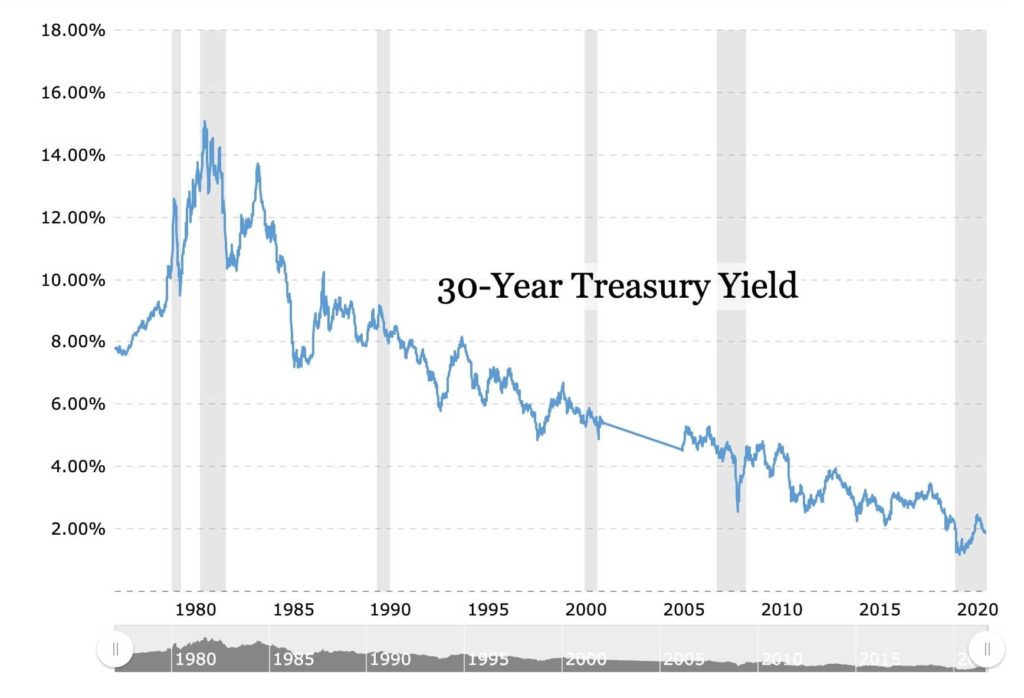

Source: MacroTrends

Since the 1970s, U.S. Treasury investors enjoyed much higher returns on their investments compared to now, as yields were above 5% until the 2000s. Additionally, falling yields over time meant bond prices were increasing as newly-issued bonds offered lower coupon rates than older bonds issued in a higher rate environment.

How to Buy Bonds

You’re probably wondering how you can buy bonds.

To buy bonds directly, you need to have an account with a bond broker. You can buy bonds directly from the U.S. government on the treasurydirect.gov website.

If that doesn’t sound like fun, you can buy bonds by purchasing shares of bond ETFs. We’re saved by ETFs yet again!

By purchasing shares of a bond ETF, you’re buying ownership in a basket of bonds held by the fund. The ETF share price will change as the bond prices change, and they’ll pay you the bond coupons through dividends.

Popular Bond ETFs

There are many ETFs you can use to invest in bonds. Here are a few of the popular ones:

BND — Vanguard Total Bond Market Fund

HYG — High-Yield Corporate Bond Fund

TLT — 20+ Year U.S. Treasury Fund

BND invests in a broad basket of various investment-grade (low default risk) bonds.

HYG invests in high-yield corporate bonds, which have higher risk of default because the issuing companies do not have the strongest financials.

TLT invests in 20+ year U.S. Treasuries, which have virtually no risk of default as they are issued by the U.S. Government.

Click on each fund’s link above to learn more about each ETF.

Investing in Real Estate

We’ve all heard stories of people getting wealthy from real estate investing. Figures such as Robert Kiyosaki (Author of Rich Dad, Poor Dad) have long been proponents of buying real estate.

Traditional real estate investing offers many benefits, including:

- Leverage

- Expense Deductions

- Tax Strategies

- Owning a hard asset that generates cash flow

But traditional real estate investing can be inaccessible to those without lots of cash in the bank and time to manage properties.

Fortunately, there are modern ways to invest in real estate without buying physical property. One way to do so is by purchasing shares of a real estate ETF or investment trust. Another accessible approach to buying real estate is using a crowdfunding platform like Fundrise.

What is a Real Estate Investment Trust (REIT)?

A REIT is a publicly-traded fund that holds real estate properties that produce income. When you buy shares of a REIT, you participate in cash flows generated by the properties held in the REIT’s portfolio. Each year, REITs must pay out 90%+ of real estate income to shareholders through dividends.

Popular Real Estate ETFs

The following funds are REIT ETFs, meaning they invest in a broad basket of REITs, offering more diversification than investing in specific real estate trusts.

Investing in Cryptocurrency

Cryptocurrencies are the newest asset class on the block.

In January 2009, Bitcoin was born. Created by a pseudonymous figure named Satoshi Nakamoto, Bitcoin aims to provide everyone in the world equal access to sound money that is trust-minimized and borderless.

The native currency of the Bitcoin network, bitcoin (lowercase ‘b’), has averaged triple-digit-percentage annual returns since its creation in 2009. As of August 2021, each bitcoin is worth nearly $50,000, giving bitcoin a total market capitalization of $900 billion.

The creation of bitcoin was the catalyst for the invention of thousands of other cryptocurrencies with various use-cases.

While cryptocurrencies can spark controversy, there’s no denying that investors globally have been warming up to the idea of cryptocurrencies having a spot in their investment portfolios.

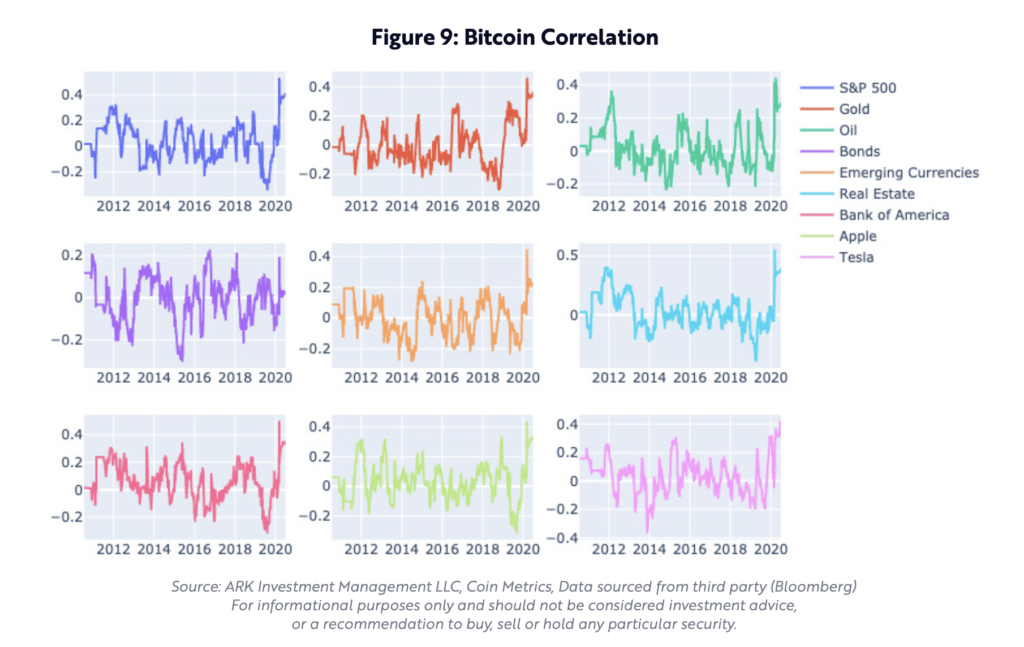

Historically, bitcoin’s correlation to the S&P 500 stock market index has been low:

Source: ARK Invest

Adding a historically low-correlation, high-return asset like bitcoin to a portfolio may help improve portfolio returns.

Bitcoin is often compared to gold as a store-of-value asset because bitcoin has all the money properties of gold, but better in many categories:

1) More divisible

2) More transportable

3) Safer to secure

4) Inelastic, capped supply

5) Can be sent anywhere in the world in minutes

The total market value of gold is somewhere around $10 trillion, while the market value of bitcoin is currently around $900 billion. Many believe bitcoin will eventually become larger than gold, suggesting a bitcoin price of $500,000+ per coin.

Whether bitcoin ultimately ends up being worth $0 or millions, there won’t be an in-between. Bitcoin is an asymmetric return bet (exponentially higher return potential compared to risk), making it an attractive consideration for investors globally.

Investors can also gain access to bitcoin via ETFs, such as BITO by ProShares. These funds, however, come not without risks.

How to Buy Bitcoin

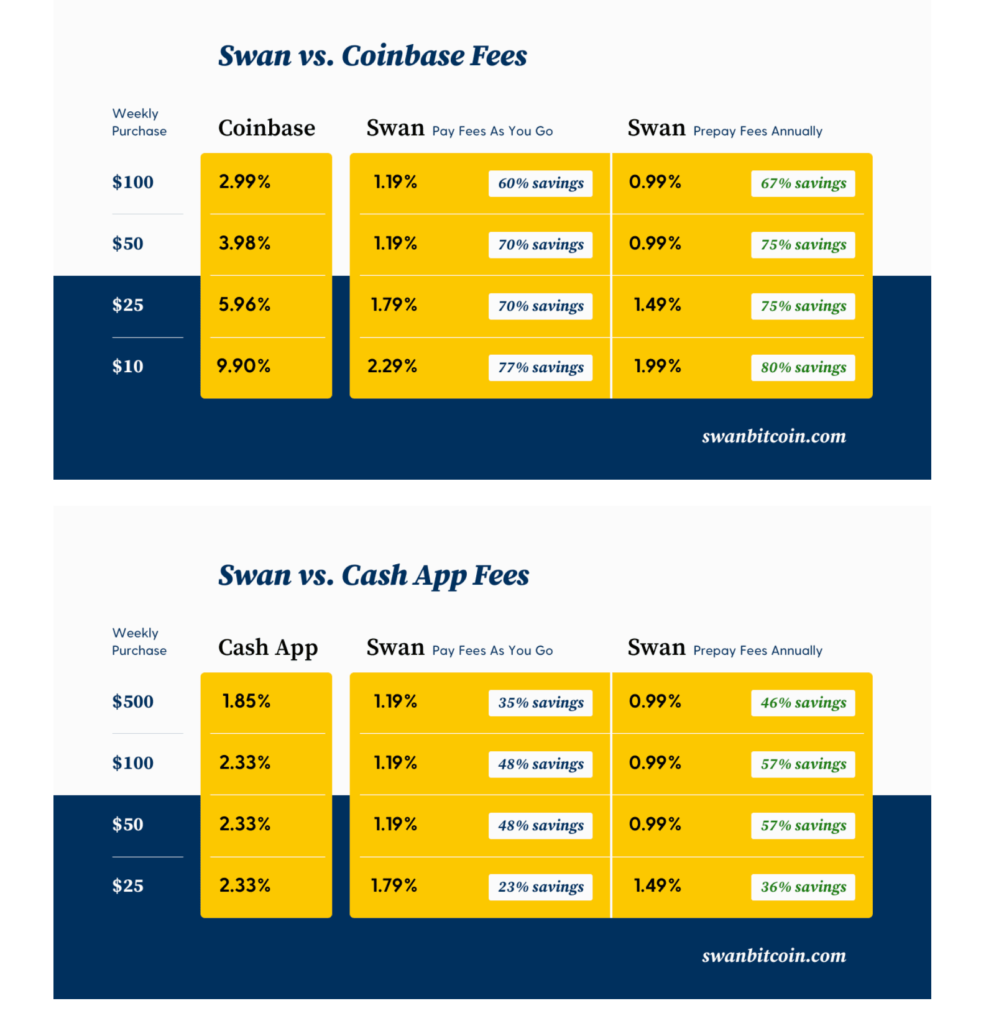

So how do you buy cryptocurrencies such as bitcoin? The most common way to buy cryptocurrencies is to set up an account at crypto exchanges such as Coinbase or Gemini. Or, you can setup recurring bitcoin purchases with low fees using Swan Bitcoin. Click here to learn more about Swan Bitcoin and earn $10 of free bitcoin when you sign up.

Small crypto purchases are costly. I use Swan to buy bitcoin everyday because they have a great fee structure for recurring purchase plans.

Some stock trading brokerages offer crypto trading functionality, but many of them do not yet allow you to send your crypto to different wallet addresses. You have to keep your crypto with the brokerage firm, which is not good practice with large investment positions. If you do want to transfer your crypto out, you’ll have to sell your position, move the cash elsewhere, then repurchase the crypto asset. Doing so isn’t ideal because you’ll realize capital gains if you have profits on your position, increasing your year-end tax bill.

For now, the popular options for buying crypto are using exchanges like Coinbase or Gemini, and/or using a recurring purchase platform like Swan Bitcoin (bitcoin only).

Savings Accounts

Savings accounts have historically been a way for people to generate low-risk income on their savings.

Unfortunately, even the best savings accounts offer interest rates near 0%.

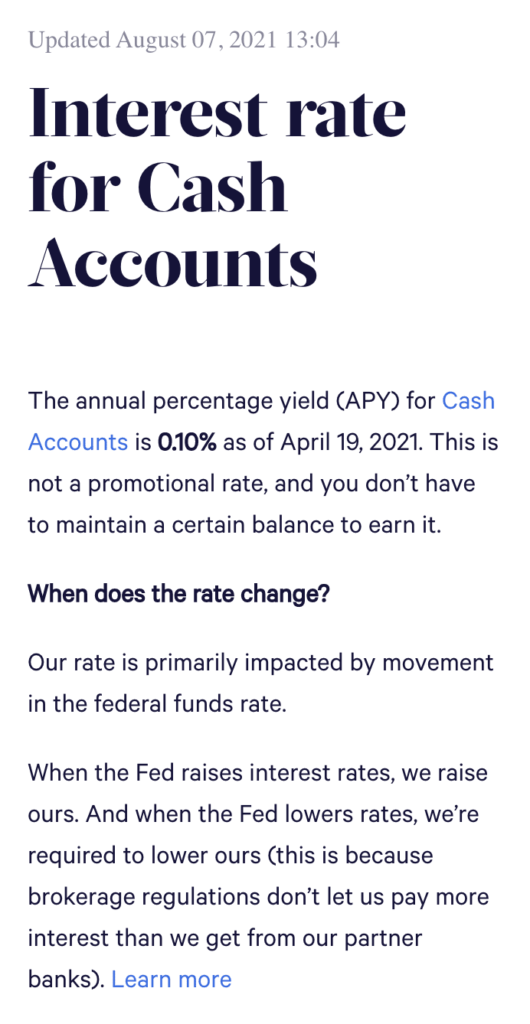

As of April 2021, Wealthfront’s Cash Account was yielding 0.10% interest per year.

That means if you deposit $10,000 into this savings account, you’d generate $10 in income after an entire year. Ouch!

Remember when we talked about bonds and I mentioned the concept of “real” returns?

A savings account earning 0.10% has negative real returns if inflation is 2% because the return is lower than the increase in prices (inflation).

Inflation of 2% means a basket of goods/services costs $100 today and $102 in a year.

If my $100 savings account generates 0.10%, then my $100 in savings is worth $100.10 next year. Since I didn’t grow my money to $102, I lost purchasing power.

The bottom line: savings accounts are basically checking accounts in this low interest rate environment. The name of the game in investing is to grow purchasing power. Growing purchasing power means our money grows faster than the prices of our everyday purchases.

Unfortunately, in a near-zero interest rate environment, we have to invest in riskier assets if we want a chance at returns that beat inflation. If we don’t, we’ll see our hard-earned money degrade in value, effectively wasting some of the time we spent earning that money.

What's Your Risk Tolerance?

If you’ve made it this far, give yourself some credit! We’ve gone through a ton of investing content thus far.

Now that you’ve learned about the various asset classes you can invest in, which ones are right for you?

That ultimately comes down to your risk tolerance, age, and wealth.

There isn’t a “one-size-fits-all” approach to investing. Everyone is different.

Risk vs. Reward

In life, everything has a risk and a potential reward. The key is to know when the risk is worth the potential reward.

Risk and reward have a direct relationship: the higher the risk, the higher the potential reward; the lower the risk, the lower the potential reward.

In July of 2016, I quit my first job out of college. I spent three years working at a company creating presentations and performing data analysis on options trading strategies.

I always knew I would one day do something on my own, but I didn’t yet have any knowledge about anything. After three years learning about the stock market and options trading, I had the confidence to go off on my own to create my own online business/brand.

Quitting my job in 2016 was risky: I chose an uncertain path and deleted my predictable income stream.

But the potential reward was high: the opportunity to work for myself, make whatever content I wanted, create my own schedule, work from anywhere, and have virtually no limit to how much money I could make.

Fortunately, after many years of a ton of work and making no money, things turned around. The risky decision turned into a rewarding situation.

"Hard choices, easy life. Easy choices, hard life."

Jerzy Gregorek

Taking risks doesn’t always work out, which is why it’s risky! It’s essential to analyze when a risk is worth taking. Some aren’t.

Age and Wealth

In an investing context, an 18-year-old college student named Charlie and a 65-year-old retiree named Jane will have different risk tolerances and goals.

Charlie can swing for the fences and take big risks because he has decades of earnings to recover any early investing losses. Charlie also doesn’t have much money to lose because he’s just starting to build his wealth from ground zero.

Young investors can afford to take higher risks with their money because they have decades of earnings ahead of them and not much to lose.

Jane, on the other hand, is 65 with $1,000,000 in the bank. She’s saved and invested well over the course of her career. Having built a fortune, she can’t afford to take big risks because she has a lot to lose.

Older investors with sizable wealth can't afford to take high risks with their money because they have a lot to lose and not many years of earnings ahead of them.

Comparing these two scenarios, Charlie has little to lose and a lot of time, allowing him the opportunity to take big risks. If Charlie was a Tesla and Apple fanatic, he might want to invest all of his early earnings in TSLA and AAPL stock.

But Jane has a large portfolio of assets, and it wouldn’t be wise to put all of her money into TSLA and AAPL stock. Instead, a wise approach for Jane is to diversify her portfolio into many different asset classes.

What is Diversification in Investing?

Diversification in investing is allocating your portfolio in many different assets. A well-diversified portfolio will have small allocations to many different asset classes, even multiple assets within each asset class.

"Don't put all your eggs in one basket."

Buying an S&P 500 ETF is an example of stock diversification because you’re buying 500 different companies. If one of the 500 companies goes to zero, the basket of 500 companies won’t collectively go to zero.

If Jane is diversified and one asset class in her portfolio does poorly, she won’t lose everything.

Wealth preservation is the name of the game when you have a lot of money. It can take a lifetime of investing and risk-taking to build wealth. It doesn’t take much time to lose wealth.

A diversified portfolio consists of positions in many asset classes, and even many different positions within each asset class. Some investors like to keep it very simple and buy a few ETFs that have diversified holdings instead of buying hundreds of assets themselves.

The Downside of Diversification

While diversification is great for wealth preservation, it hinders explosive growth. Charlie, our 18-year-old friend who is just starting to invest, may not want to diversify too much because he wants the opportunity to grow his money quickly. Fast growth can only happen with concentrated bets.

In fact, when we analyze the world’s wealthiest people, it turns out they didn’t build their wealth buying broad stock market index funds.

Jeff Bezos earned over $100 billion by holding nearly all of his wealth in Amazon (AMZN) stock for over 20 years.

Elon Musk has a majority of his wealth in Tesla Inc. (TSLA) stock, which started from nothing and is now a $700 billion company.

Starting a business is a concentrated bet.

Even Warren Buffett has spoken against diversification:

"Diversification is protection against ignorance. It makes little sense for those who know what they're doing."

Warren Buffett

The truth is, while diversification prevents you from losing all of your money in one position, it’s impossible to build wealth quickly investing in a broadly diversified portfolio like the S&P 500.

So when you’re considering what to invest in, think about your risk tolerance, age, and current wealth. The lower your age and wealth, the higher the risks you can afford to take. The higher your age and wealth, the lower the risks you can afford to take.

Conclusion

Learning how to invest can be an anxious task. Like learning anything else, it takes time. The more you think and learn about investing, the more prepared you’ll be to take advantage of life’s opportunities.

“The mind, once stretched by a new idea, never returns to its original dimensions.”

Ralph Waldo Emerson

I hope this guide stretched your mind beyond its original dimensions. It can be slightly uncomfortable, so don’t forget to rest after absorbing all of this content!

I had a lot of fun writing this up, and I hope you learned a lot.

Recommended Reading

Additional Resources

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.