Last updated on February 11th, 2022 , 06:38 am

Buyers of options have the right to exercise their option at or before the option’s expiration. When an option is exercised, the option holder will buy (for exercised calls) or sell (for exercised puts) 100 shares of stock per contract at the option’s strike price.

Conversely, when an option is exercised, a trader who is short the option will be assigned 100 long (for short puts) or short (for short calls) shares per contract.

TAKEAWAYS

- Long American style options can exercise their contract at any time.

- Long calls transfer to +100 shares of stock

- Long puts transfer to -100 shares of stock

- Short calls are assigned -100 shares of stock.

- Short puts are assigned +100 shares of stock.

- Options are typically only exercised and thus assigned when extrinsic value is very low.

- Approximately only 7% of options are exercised.

The following sequences summarize exercise and assignment for calls and puts (assuming one option contract):

Call Buyer Exercises Option ➜ Purchases 100 shares at the call’s strike price.

Call Seller Assigned ➜ Sells/shorts 100 shares at the call’s strike price.

Put Buyer Exercises Option ➜ Sells/shorts 100 shares at the put’s strike price.

Put Seller Assigned ➜ Purchases 100 shares at the put’s strike price.

Let’s look at some specific examples to drill down on this concept.

Exercise and Assignment Examples

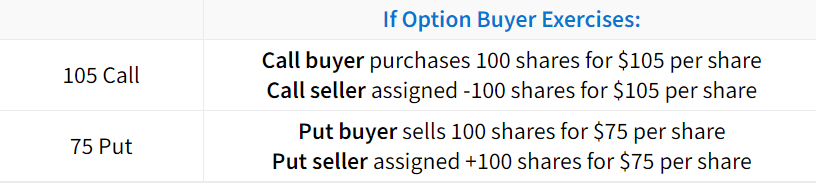

In the following table, we’ll examine how various options convert to stock positions for the option buyer and seller:

As you can see, exercise and assignment is pretty straightforward: when an option buyer exercises their option, they purchase (calls) or sell (puts) 100 shares of stock at the strike price. A trader who is short the assigned option is obligated to fulfill the opposite position as the option exerciser.

Automatic Exercise at Expiration

Another important thing to know about exercise and assignment is that standard in-the-money equity options are automatically exercised at expiration. So, traders may end up with stock positions by letting their options expire in-the-money.

An in-the-money option is defined as any option with at least $0.01 of intrinsic value at expiration. For example, a standard equity call option with a strike price of 100 would be automatically exercised into 100 shares of stock if the stock price is at $100.01 or higher at expiration.

What if You Don't Have Enough Available Capital?

Even if you don’t have enough capital in your account, you can still be assigned or automatically exercised into a stock position. For example, if you only have $10,000 in your account but you let one 500 call expire in-the-money, you’ll be long 100 shares of a $500 stock, which is a $50,000 position. Clearly, the $10,000 in your account isn’t enough to buy $50,000 worth of stock, even on 4:1 margin.

If you find yourself in a situation like this, your brokerage firm will come knocking almost instantaneously. In fact, your brokerage firm will close the position for you if you don’t close the position quickly enough.

Why Options are Rarely Exercised

At this point, you understand the basics of exercise and assignment. Now, let’s dive a little deeper and discuss what an option buyer forfeits when they exercise their option.

When an option is exercised, the option is converted into long or short shares of stock. However, it’s important to note that the option buyer will lose the extrinsic value of the option when they exercise the option. Because of this, options with lots of extrinsic value remaining are unlikely to be exercised. Conversely, options consisting of all intrinsic value and very little extrinsic value are more likely to be exercised.

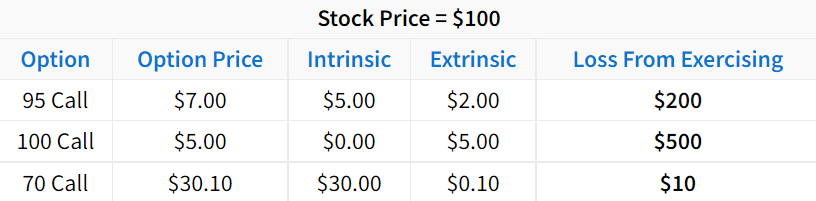

The following table demonstrates the losses from exercising an option with various amounts of extrinsic value:

As we can see here, exercising options with lots of extrinsic value is not favorable.

Why? Consider the 95 call trading for $7. Exercising the call would result in an effective purchase price of $102 because shares are bought at $95, but $7 was paid for the right to buy shares at $95.

With an effective purchase price of $102 and the stock trading for $100, exercising the option results in a loss of $2 per share, or $200 on 100 shares.

Even if the 95 call was previously purchased for less than $7, exercising an option with $2 of extrinsic value will always result in a P/L that’s $200 lower (per contract) than the current P/L. F

or example, if the trader initially purchased the 95 call for $2, their P/L with the option at $7 would be $500 per contract. However, if the trader decided to exercise the 95 call with $2 of extrinsic value, their P/L would drop to +$300 because they just gave up $200 by exercising.

7% Of Options Are Exercised

Because of the fact that traders give up money by exercising an option with extrinsic value, most options are not exercised. In fact, according to the Options Clearing Corporation, only 7% of options were exercised in 2017. Of course, this may not factor in all brokerage firms and customer accounts, but it still demonstrates a low exercise rate from a large sample size of trading accounts.

So, in almost all cases, it’s more beneficial to sell the long option and buy or sell shares instead of exercising. We like to call this approach a “synthetic exercise.”

Congrats! You’ve learned the basics of exercise and assignment. If you’d like to know how the exercise and assignment process actually works, continue to the next section!

Who Gets Assigned When an Option is Exercised?

With thousands of traders long and short options in the market, who actually gets assigned when one of the traders exercises their option?

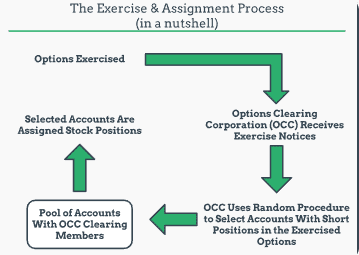

In this section, we’ll run through the exercise and assignment process for options so you know how the assignment decision occurs.

If a trader is short a single option, how do they get assigned if one of a thousand other traders exercises that option?

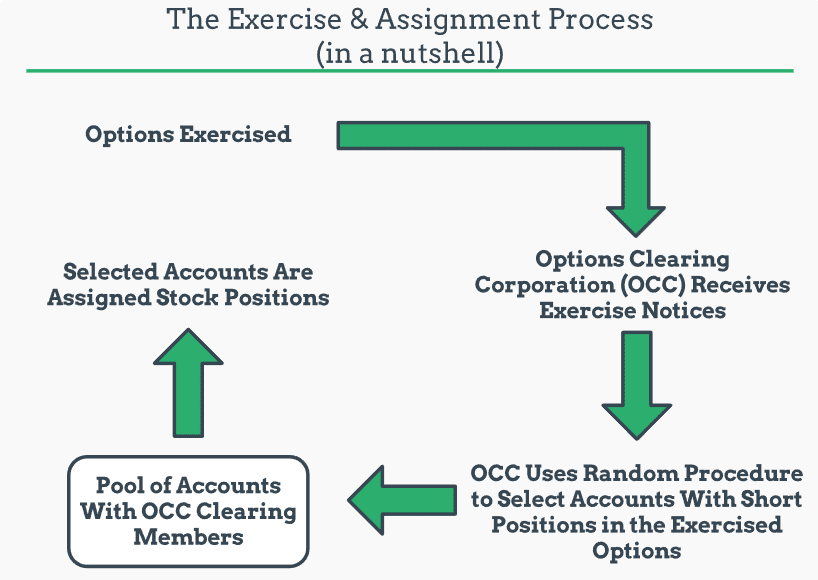

The short answer is that the process is random. For example, if there are 5,000 traders who are long a call option and 5,000 traders who are short that call option, an account with the short option will be randomly assigned the exercise notice. The random process ensures that the option assignment system is fair

Visualizing Assignment and Exercise

The following visual describes the general process of exercise and assignment:

If you’d like, you can read the OCC’s detailed assignment procedure here (warning: it’s intense!).

Now you know how the assignment procedure works. In the final section, we’ll discuss how to quickly gauge the likelihood of early assignment on short options.

Assessing Early Option Assignment Risk

The final piece of understanding exercise and assignment is gauging the risk of early assignment on a short option.

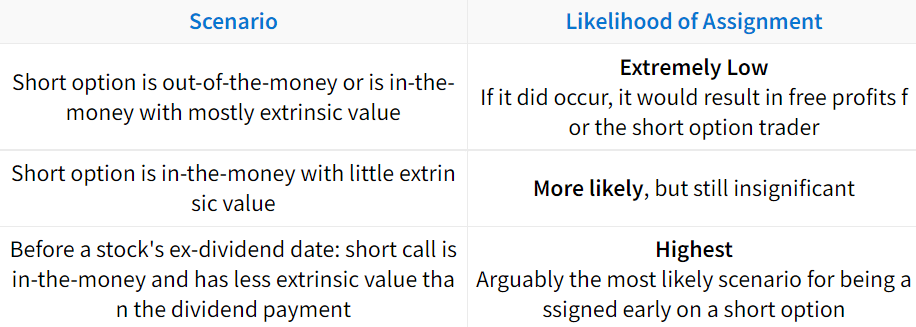

As mentioned early, only 7% of options were exercised in 2017 (according to the OCC). So, being assigned on short options is rare, but it does happen. While a specific probability of getting assigned early can’t be determined, there are scenarios in which assignment is more or less likely.

The following scenarios summarize broad generalizations of early assignment probabilities in various scenarios:

In regards to the dividend scenario, early assignment on in-the-money short calls with less extrinsic value than the dividend is more likely because the dividend payment covers the loss from the extrinsic value when exercising the option.

Final Word

All in all, the risk of being assigned early on a short option is typically very low for the reasons discussed in this guide. However, it’s likely that you will be assigned on a short option at some point while trading options (unless you don’t sell options!), but at least now you’ll be prepared!

Next Lesson

Additional Resources