Last updated on February 11th, 2022 , 06:57 am

Covered calls (aka “buy-writes”) and long calls are very different types of options trading strategies.

In a nutshell, call options are speculative investments that profit when a stock rises substantially in value. Covered calls, on the other hand, are a combination of 100 shares of long stock and a short call. This latter strategy has less market risk (but greater principle risk), and a greater chance of profitability. Additionally, covered calls can profit in any market direction.

Let’s first take a look at the textbook definition of the two, then dive into a few examples.

TAKEAWAYS

- Long calls profit in very bullish markets.

- The covered call strategy is ideal for market-neutral traders.

- A long call consists of buying a single option; the covered call consists of selling one call option AND purchasing 100 shares of stock.

- The maximum loss on a long call is the entire premium paid.

- The maximum loss on a covered call resides on the stock side, and is calculated by stock purchase price – option premium collected.

What is a Long Call?

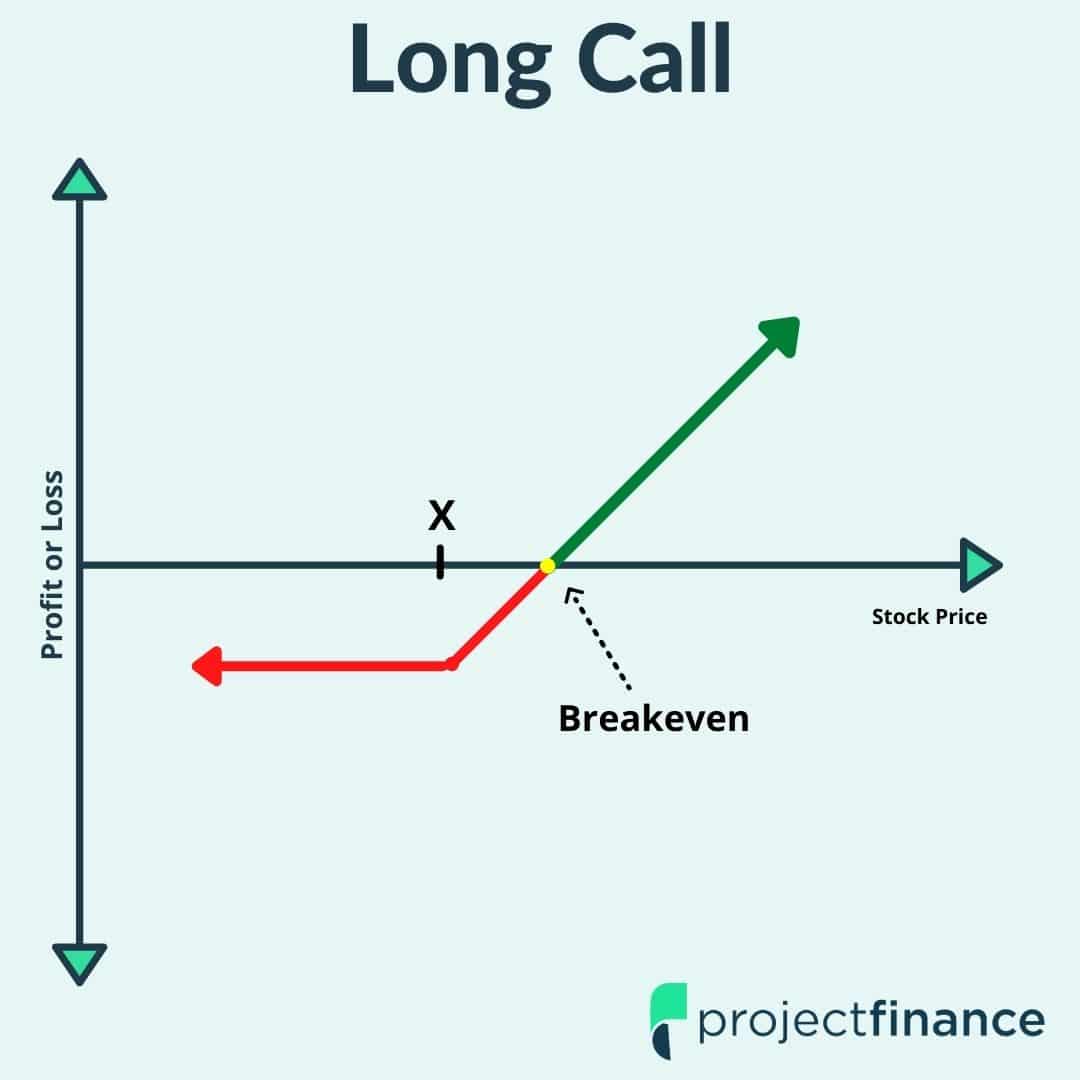

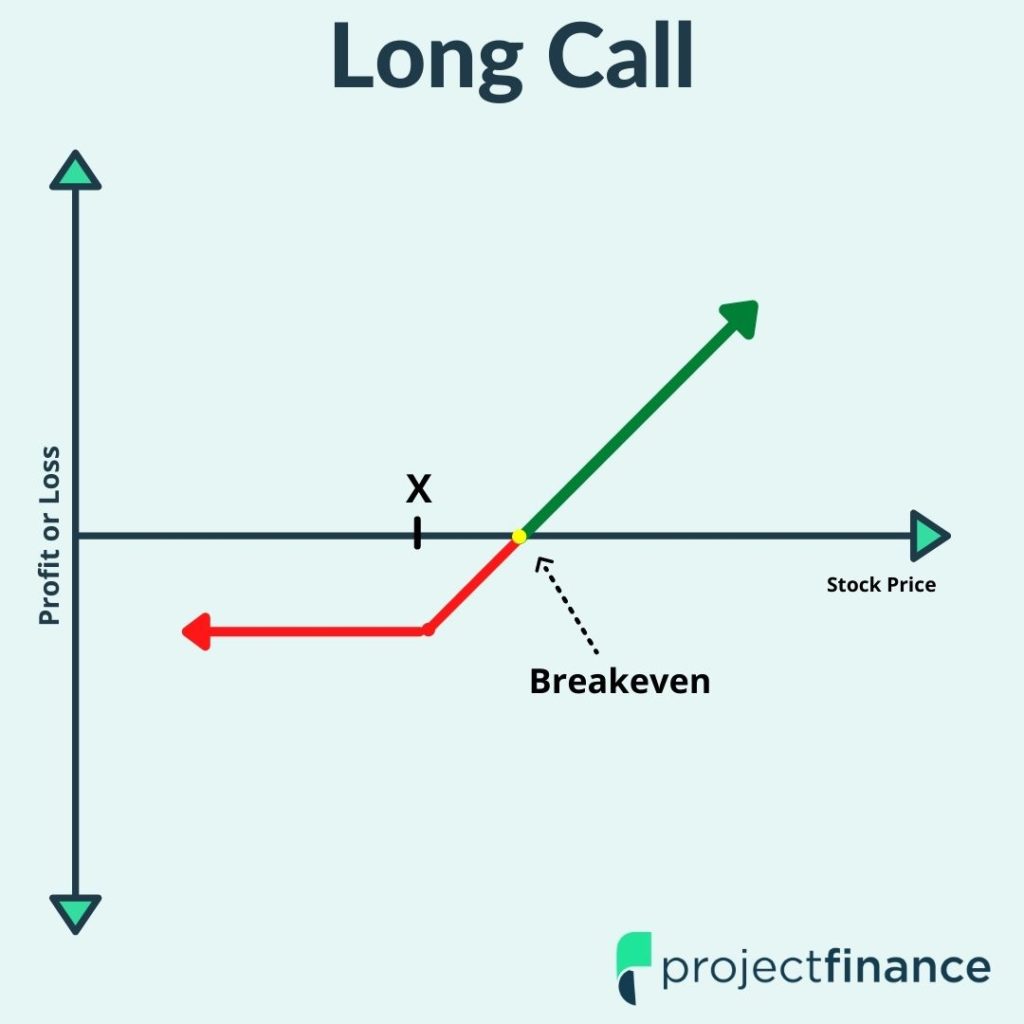

Long Call Definition: A long call gives the owner the right, but not the obligation, to purchase 100 shares of stock at a specified strike price on or before a specified expiration date.

Long Call Components: Long call at strike price X.

Long call options provide very bullish investors with great upside potential. When compared to stocks, options are leveraged at a ratio of 100 shares per 1 option contract. This “multiplier effect” magnifies both risk and reward.

Long Call Example

Let’s say Apple is trading at $170/share. You believe that in two weeks, following their earnings report, AAPL will be trading at $185/share.

Here are the details of the call option you purchase:

Initial Trade Details:

➥Stock Price: $170

➥Call Strike Price: $180

➥Call Cost (premium): $2 ($200)

➥Call Expiration: 14 Days Away

So lets say that 2 weeks have passed. Following earnings, the price of AAPL stock soared. How did our trade do? Let’s see.

Trade Details at Expiration:

➥Stock Price: $170 –> $185

➥Call Strike Price: $180

➥Call Value: $2 (200) –>$5 ($500)

➥Call Expiration: Today

As we can see, with the stock trading at $185 on expiration, our call option netted us a nice profit of $300! We purchased this option for $2 and on expiration, it is trading at $5. The difference between these two figures tells us our profit. This value is all intrinsic value.

If the stock was trading under our strike price of $180 on expiration, we would have lost the entire premium of $2 ($200) that we paid.

What is a Covered Call?

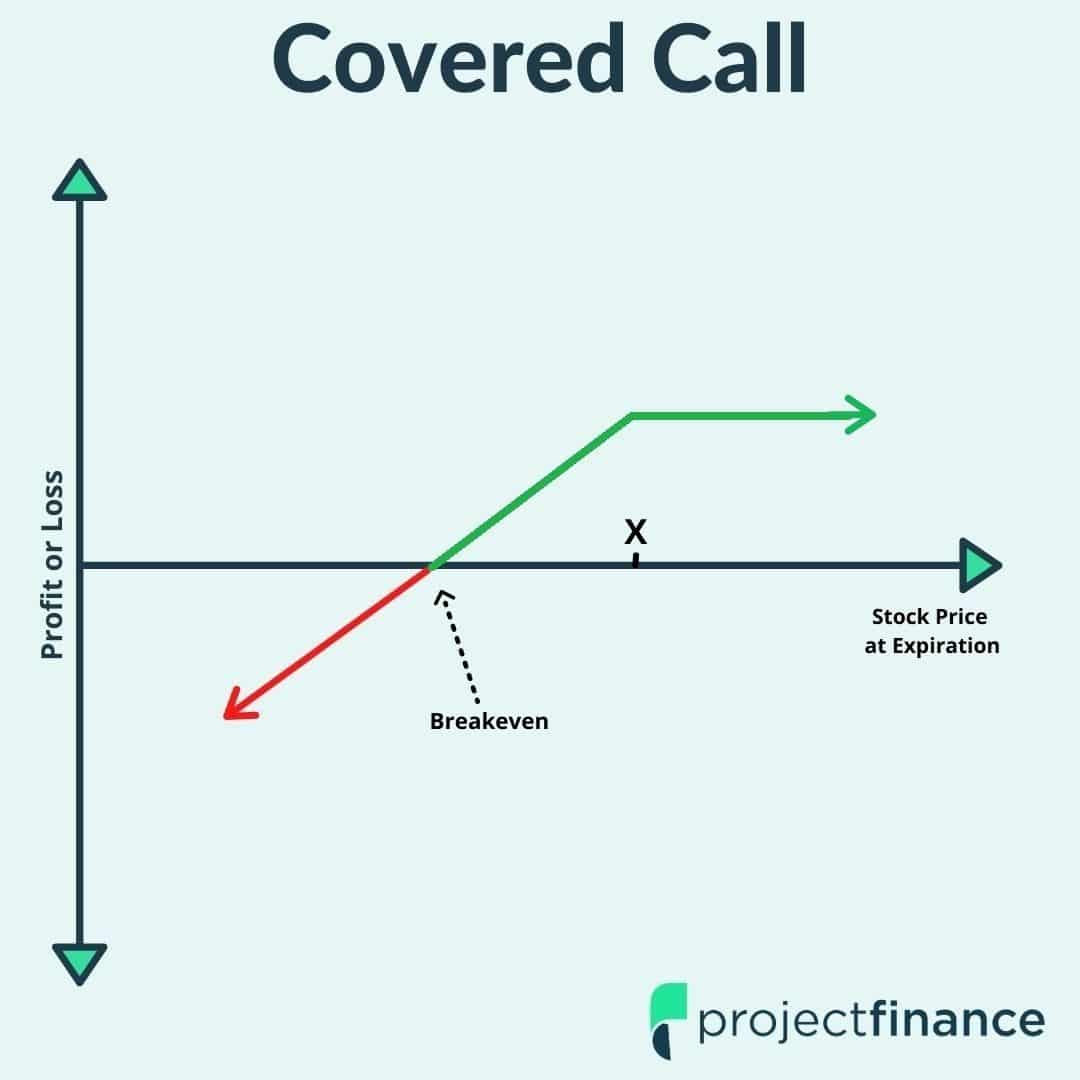

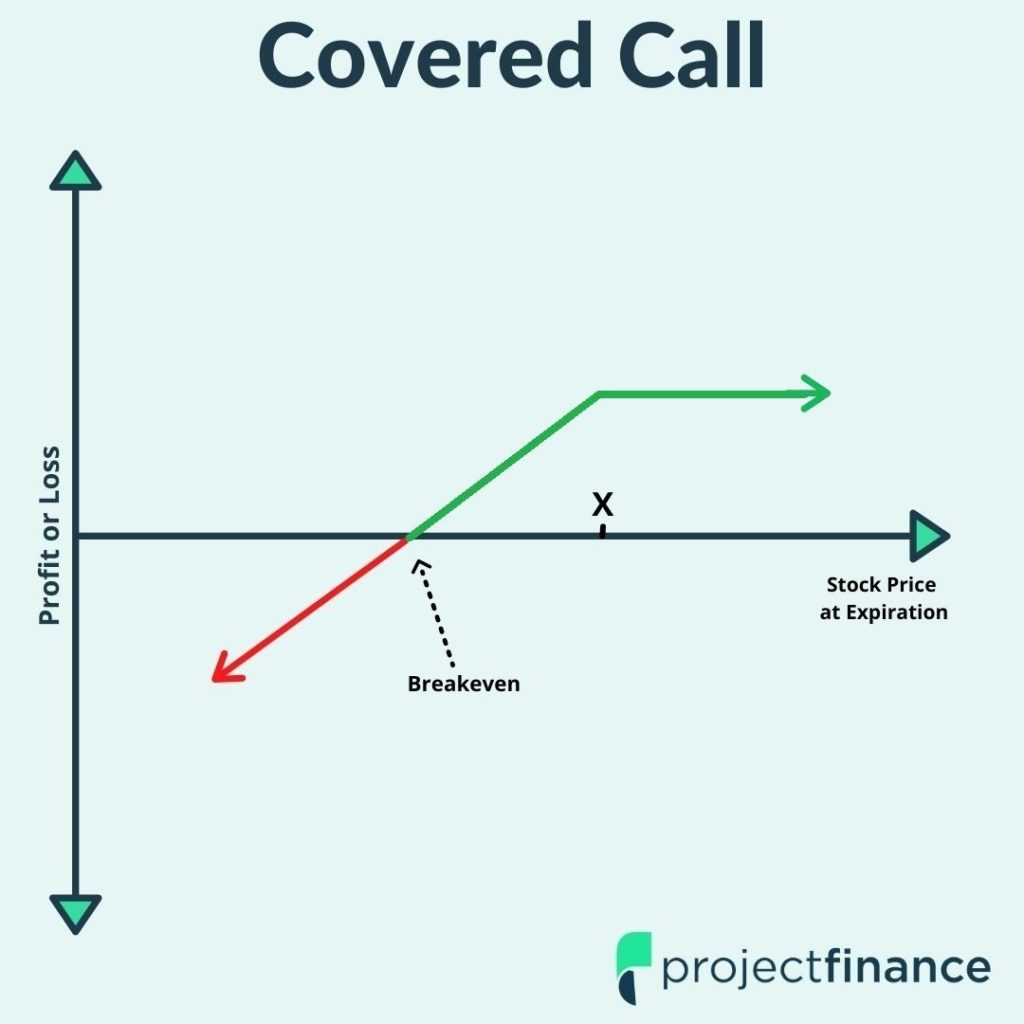

Covered Call Definition: A covered call is an income generation options strategy that allows investors to profit from their long shares in a stagnating market.

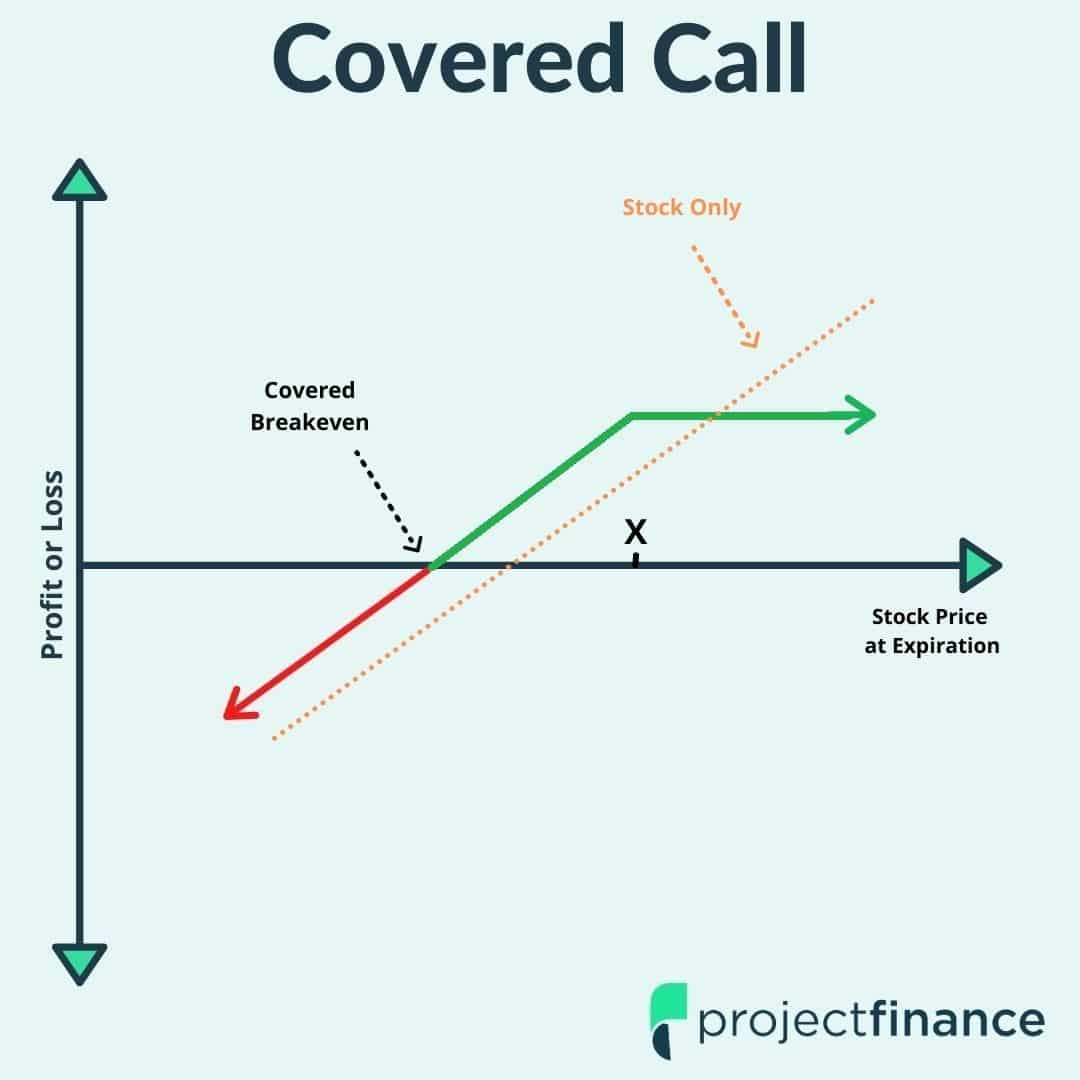

Covered Call Components: Long 100 Shares of Stock AND Short 1 Call Option

If an investor is either neutral, mildly bullish or mildly bearish on a stock they own, that investor could sell an out-of-the-money call option on that stock to generate income.

As long as the stock price is trading under the strike price of the call sold on the option’s expiration, the investor will collect the entire premium of the option sold.

Selling a call against stock does, however, limit upside potential. If the stock rallies beyond the strike price + value of premium collected, the short call will act as ballast on the long stock, preventing further gains.

Covered Call Example

Lets re-visit our above AAPL trade, but this time, we don’t think AAPL is going to go anywhere.

Unlike our long call option strategy, the covered call must include a short call and 100 shares of long stock. So we will assume we have 100 long shares of AAPL in our account today.

We believe AAPL will be trading under $180 in two weeks. It is currently trading at $170. To generate income from our stock, we will sell an out-of-the-money call. Here are the details of our trade:

Initial Trade Details:

➥Stock Price: $170

➥SHORT Call Strike Price: $180

➥Premium Collected: $2 ($200)

➥Call Expiration: 14 Days Away

So let’s say 14 days have passed. We were right this time – AAPL closed at $176 on the expiration day, below our short call strike price of $180.

Unlike buying calls, when an investor sells a call, they want that call option to go down in value. Here is how our trade played out:

Trade Details at Expiration:

➥Stock Price: $170 –> $176

➥SHORT Call Strike Price: $180

➥Closing Option Value: $2 –> $0

➥Call Expiration: Today

This was an ideal outcome for us. We made $7 per share on the long stock AND collected the full premium of the option sold ($200).

Now, what if the stock rallied instead to $190 on expiration instead? In this scenario, our short call would prohibit additional stock profit at the strike price + premium sold level ($180 + $2 = $182).

In this second outcome, the call option is in-the-money on expiration; an investor can choose to do nothing, and the short call will be exercised, forcing them to sell 100 shares at the strike price of $180/share. The result would be a flat position.

Long Call vs Covered Call: Head-to-Head

Long Call | Covered Call | |

When to Trade? | The long call is best suited for traders who are extremely bullish on an underlying security. | The covered call is a great way for investors to collect income on a stock that they believe will change little in the future. |

Maximum Profit Potential | Unlimited (there is no cap on how high a stock can go) | Short Call Strike Price - Stock Entry Price) + Option Premium Collected |

Maximum Loss Potential | Entire Premium Paid | Stock Entry Price - Option Premium Collected |

Breakeven | Strike Price + Premium Paid | Stock Price - Short Call Premium Collected |

Time Decay Effect | As time passes, and both implied volatility and stock price stay the same, a long call option will persistently shed value. | As time passes, and both the implied volatility and stock price stay the same, the short call portion of a covered call will shed value, which is desirable as a short option profits when its value falls. |

Ideal Market Direction | Bullish | |

Tips | In the long run, buying call options is usually a losing battle. For out-of-the-money calls, you need the stock to go up in value - by a lot. Time is NOT on your side here. | The covered call is a great way for all investors to make a little extra money from their stock in a neutral market. Over the long run, however, owning the stock outright is usually more advantageous. |