Last updated on February 18th, 2022 , 08:35 am

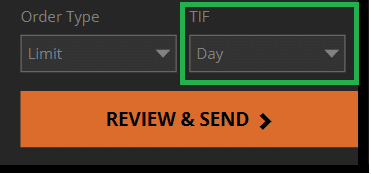

When trading stocks, options, and futures, brokers generally offer investors several different Time if Force (TIF) options to choose from.

In addition to determining the order type (market, stop-loss, limit), traders must also specify to their broker the time and duration they want that order working. This is known as TIF order designation.

The most popular TIF order types are DAY orders (good for the day only) and GTC orders (good til cancelled). But there are so many more! EXT, MOC and LOC are a few.

Knowing the differences between these order types can be vital to get filled. Here’s what each one means.

TAKEAWAYS

- The TIF order designation communicates to a broker the time and duration for an order to be working.

- All orders default to “DAY”.

- GTC (good til canceled) orders generally remain working for 90 days, or until the order is filled or canceled by the customer.

- EXT (extended-market) orders ONLY work outside market hours.

- Most brokers work EXT orders from 7 AM to 8 PM, though the formal NYSE Extended Market Hours extends these bounds.

- When compared to MOC (market on close) orders, LOC (limit on close) orders can guarantee fill price, but not fill execution.

DAY Order Explained

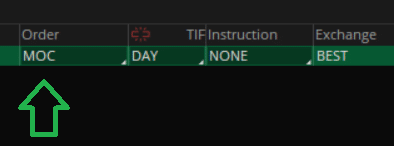

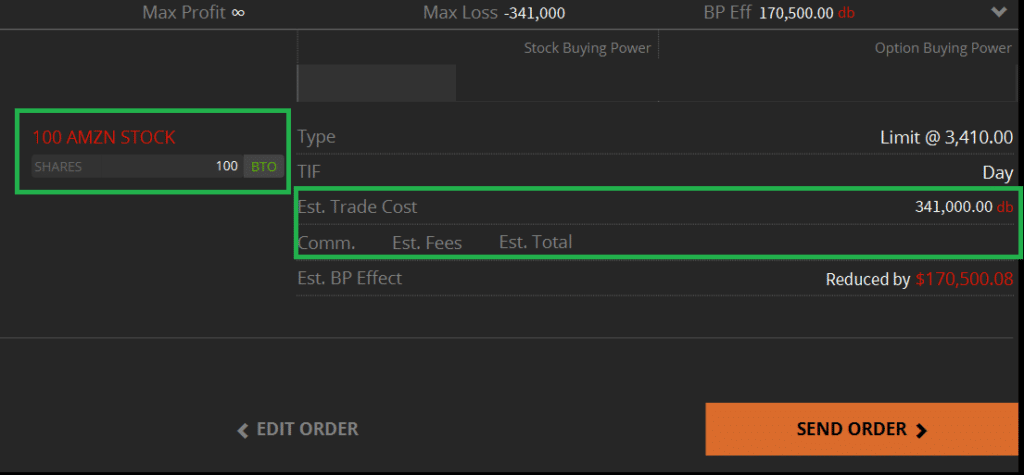

DAY Order Definition: The TIF label DAY instructs a broker that a trade will only stay working during the current (or upcoming) market day. DAY orders are canceled after the market close.

- DAY orders are only working during market hours.

- If sent after the closing bell, a DAY order will be working for the following trading day.

- All DAY orders are canceled at the closing bell.

For just about all brokers, the “DAY” order is the default TIF order type. This simply means that the order is working for the day only.

If you send a day order before the market opens, that order will only be activated with the opening bell. Not before. If you want to work an order outside market hours, you’ll want to tag it EXT (Extended Market).

If you send a day order 5 minutes before the closing bell, that order will only be working for 5 minutes.

Day orders apply to the current trading day. Not the day after. Therefore, if you submit a day order directly after the market closes, that order will be active for the next trading day.

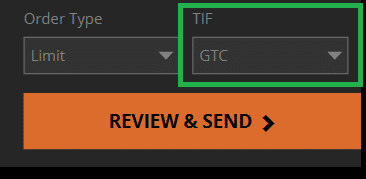

GTC (Good Til Cancelled) Order Explained

GTC (Good Til Cancelled) Order Definition: A GTC order is an order placed by an investor to either buy or sell a security that stays working until the order is filled or canceled by the customer (or broker).

- GTC (Good Til Cancelled) orders remain working in the customer account until the customer cancels the order.

- GTC orders do not work in the extended market.

- Best practice is to periodically check and make sure the order is working, as brokers sometimes cancel GTC orders in error. Some brokers cancel these orders after 90 days.

- Best for long-term traders who don’t monitor the market.

The GTC (Good Til Cancelled) order is the second most popular type of TIF order. This designation communicates to the broker that an order should stay working indefinitely, or until filled.

Sometimes, brokers cancel GTC orders without communicating this information to clients. This can happen either due to back-end issues, or simply because the GTC order was working for too long.

For set-it-and-forget-it traders, it is wise to periodically check to make sure GTC orders are still working.

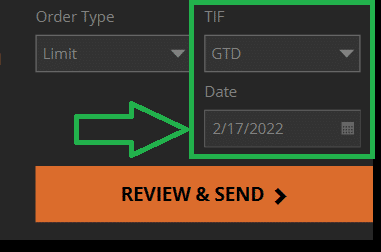

GTD (Good Til Date) Order Explained

GTD (Good Til Date) Order Definition: A GTD order type instructs a broker that a buy or sell order stays working until a specified date is reached. If the order is not filled by this date, it will be canceled.

- GTD (Good Til Date) orders remain working in the customer account until the order is filled, canceled, or the pre-determined date is reached.

- The GTD order type can help investors navigate volatile times (such as earnings) without having to monitor their accounts.

- Best for long-term traders who don’t monitor the market closely.

The GTD (Good Til Date) is a great TIF order for investors who don’t have the ability to closely monitor their accounts.

Let’s say you’re long FB stock, which is due to report earnings next week. If you’re not able to check your account on this day, you can tag a sell-stop order with the GTD tag to cancel your order on the day before earnings are released. This will allow you to stay in the stock during the volatile post-earning swings.

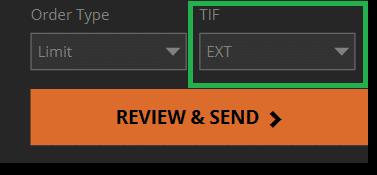

EXT (Extended-Market) Order Explained

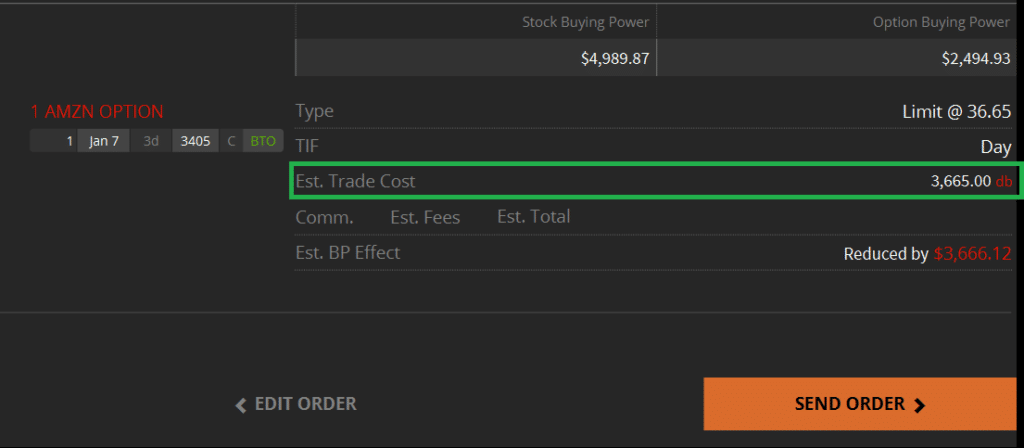

EXT (Extended Market) Order Definition: A EXT (Extended-Market) order instructs your broker that you want an order working in the extended market; this order will NOT be working during the normal trading hours.

- The EXT (extended market) tag designation instructs a broker that a buy or sell order is only to remain working in the extended market.

- Many brokers allow EXT trading from 7 A.M. until 8 P.M. (not counting market hours). However, the NYSE extended market hours are technically between 4:00 A.M. TO 9:30 A.M. ET and 4:00 PM to 8:00 P.M. ET.

- Trading in extended markets allows traders to capitalize on the large swings that exist in these markets.

- Unless tagged GTC (Good Til Canceled), EXT TIF orders will only stay working for one session.

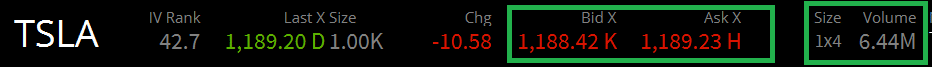

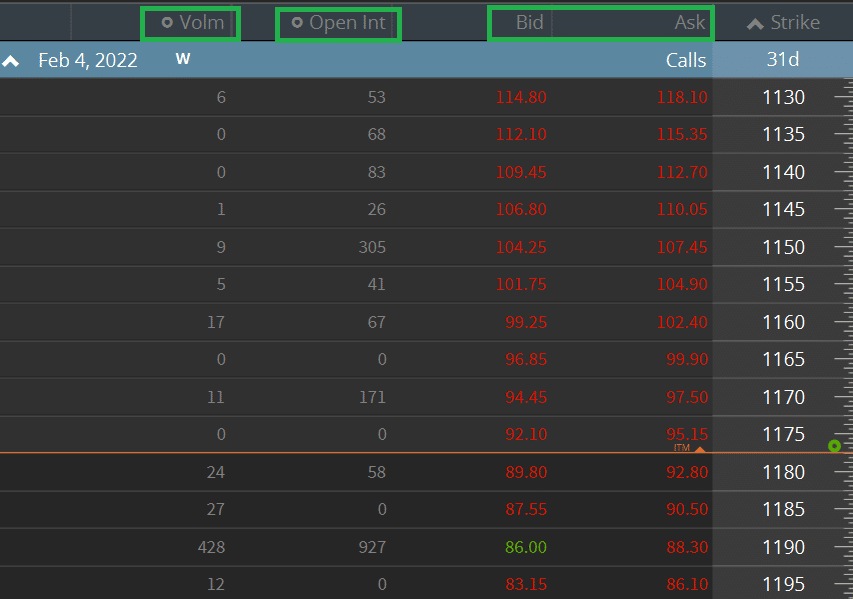

Extended markets are notorious for their illiquidity. Bid-ask spreads can widen enormously and stocks can fly.

However, these swings can also provide investors with great opportunities.

If you are long Amazon (AMZN) stock that pops $400 in the after-hours market post-earnings, you can sell your stock in the extended market by marking your order EXT. If you’re happy with the gains, why risk waiting another day?

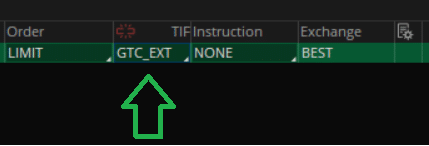

GTC - EXT (Good Til Cancelled - Extended Market) Order Explained

GTC_EXT (Good Til Cancelled Extended Market) Order Definition: A GTC-EXT order instructs a broker that a buy or sell order will remain working in the extended market until the order is filled or cancelled; this order will NOT be working during the normal trading hours.

- The GTC-EXT order combines both a GTC order and EXT order.

- This order type works in the extended market until filled or canceled by the customer (or broker).

- The GTC-EXT is NOT working during normal stock market hours.

The GTC-EXT order TIF allows a trader to work a stock order in the extended market indefinitely. As we said before, the formal NYSE extended market is between 4:00 A.M. TO 9:30 A.M. ET and 4:00 PM to 8:00 P.M. ET.

However, most brokers only allow trading from 7 A.M. until 8 P.M.

If you’re trading illiquid stocks that have huge market moves in the after-hours market, a GTC-EXT may allow you to take advantage of these moves without interrupting your dinner.

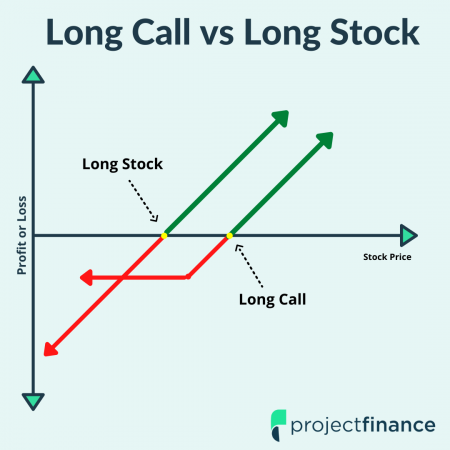

MOC (Market On Close) Order Definition: A “Market-0n-Close” order is a buy or sell order placed with a broker to trade at the market close.

- Market-On-Close (MOC) orders trade at the very end of the day.

- These order types allow investors to trade out of positions at day end without having to monitor their accounts.

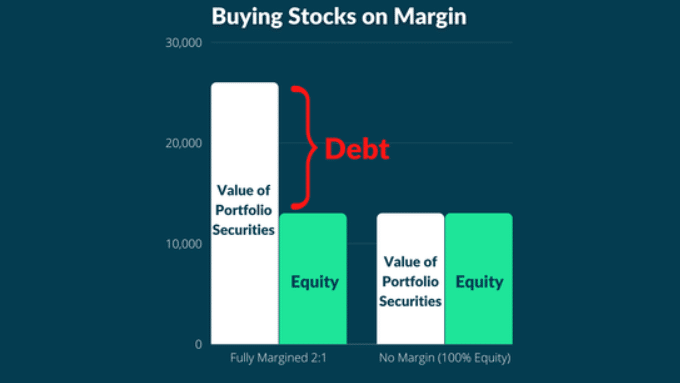

- MOC orders in thin markets can result in poor fills.

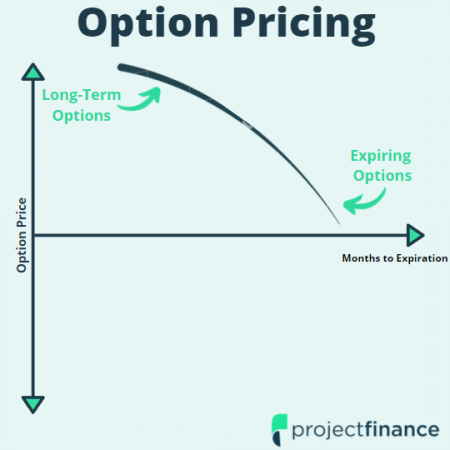

The MOC (Market On Close) order TIF is a handy tool for day traders. This order type fills buy or sell orders on stocks, options, and futures at the very end of the trading day.

The order fills as close as possible to a securities final daily trading price.

The downside here is liquidity. If you’re trading options or thin stocks, try to avoid market orders at all costs!

But don’t worry – there is an alternative. Let’s read about the limit-on-close order next.

LOC (Limit On Close ) Order Explained

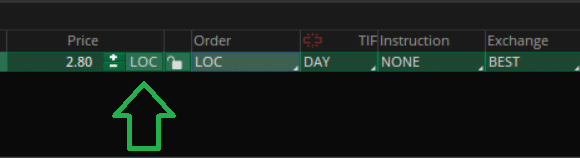

LOC (Limit On Close) Order Definition: A buy or sell limit order placed with a broker with instructions to activate at the very end of the trading day.

- Like MOC (Market On Close) orders, a LOC (Limit On Close) order goes live in the final seconds of trading.

- Unlike MOC orders, the LOC order is not guaranteed to get filled.

- LOC orders are great for liquid stocks.

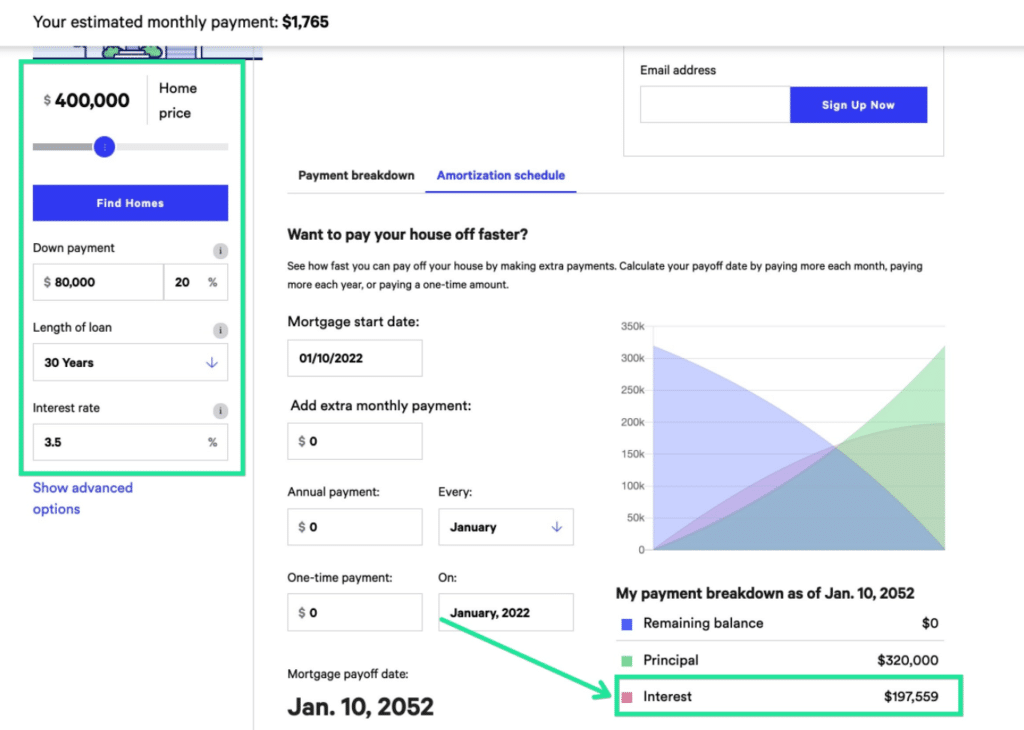

A downside of MOC order types lies in the uncertainty of the fill price.

Limit orders guarantee fill prices. If you’re trading option or thin stock, MOC orders can be dangerous. LOC orders hedge against poor fill prices.

The downside of LOC orders (when compared to MOC orders) is that they are not guaranteed to get filled. If the order can’t be filled at your limit or better, you will not be filled.

Final Word

That wraps up our lesson on the 7 most popular TIF order types.

There are indeed many more orders types, but these are rarely offered by brokers.

When I worked with brokers in the SPX pit, we had AON (All or None) orders as well as FOK (Fill or Kill) orders.

➥AON (All or None) orders communicate you want to either get filled on all of the order or none of it.

➥FOK (Fill or Kill) orders communicate you want to get filled immediately, or not at all. What a nice acronym that is!

Order Type FAQs

Most GTC (good til cancelled) orders stay working for 90 days, though this varies by broker.

The vast majority of DAY orders expire at the closing bell. Some options, however, trade until 4:15 PM.

GTC (good til cancelled) orders remain working in a customers account until 1.) the trade is filled or 2.) the customer or broker cancel the order.

DAY orders only remain working for ONE trading day.

A LOC order activates a limit order at the very end of the trading day; a MOC order activates a market order at the end of the trading day.

MOC guarantees a fill while LOC guarantees a fill price.