Last updated on February 10th, 2022 , 01:52 pm

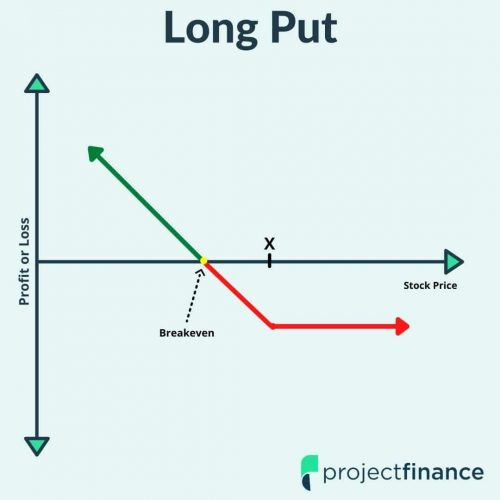

Buying a put option (sometimes referred to as a “long put option”) is a bearish strategy that benefits from a drop in the stock price or an increase in implied volatility. Buying a put option is similar to shorting shares of stock, except buying puts has limited loss potential and a lower probability of profit since the breakeven price will be lower than the current stock price.

Jump To

TAKEAWAYS

- Long put options are very bearish trades.

- Max profit on a long put is the strike price (minus) premium paid.

- Max loss on a long put is always the debit paid.

- The long put is a low probability, high reward trade.

Long Put General Characteristics

➥Maximum Profit Potential: (Put Strike Price – Premium Paid) x 100

➥Maximum Loss Potential: Premium Paid for Put x 100

➥Expiration Breakeven Price: Put Strike – Premium Paid for Put

➥Estimated Probability of Profit: Less than 50%

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Expiration Profits/Losses for a Long Put Position

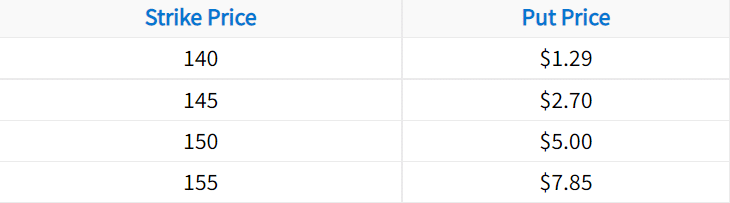

In the following example, we’ll construct a long put position from the following option chain:

In this case, we’ll buy the 150 put for $5.00. Let’s also assume the stock price is trading for $150 when we buy the put.

➥Stock Price: $150

➥Put Strike Price: $150

➥Put Purchase Price: $5

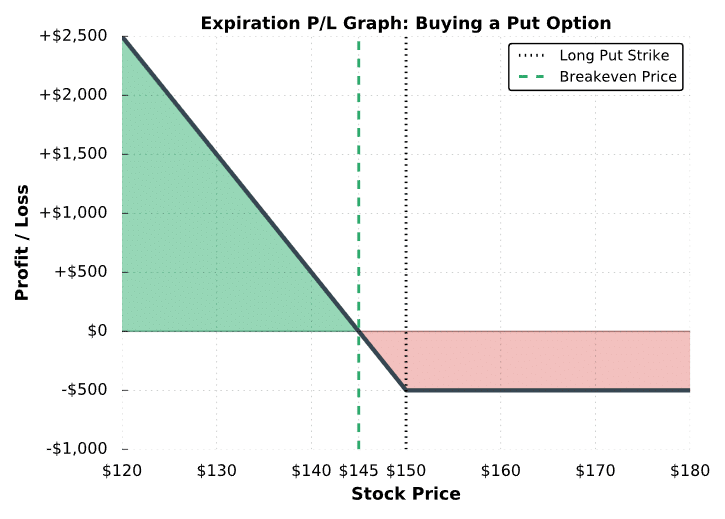

If a trader buys this put option, their potential profits and losses at expiration are described by the following visual:

The following explains each of the scenarios illustrated above:

Stock Price Below the Put Breakeven Price ($145):

The 150 put expires with more intrinsic value than the put buyer paid for the option. Consequently, the trader’s position is profitable.

Stock Price Between the Put’s Breakeven Price and the Put’s Strike Price ($145 to $150):

The 150 put expires with intrinsic value, but not more than the $5 that the trader paid for the option. As a result, the trader realizes partial losses on the position.

Stock Price Above the Put’s Strike Price ($150):

The 150 put has no intrinsic value, and therefore expires worthless. The put buyer realizes the maximum loss potential of $500.

Long Put Option Trade Examples

To visualize the performance of long put positions, let’s look at a few examples of real puts that recently traded. Note that we don’t specify the stocks in each case, as the underlying concepts transfer to other stocks in the market.

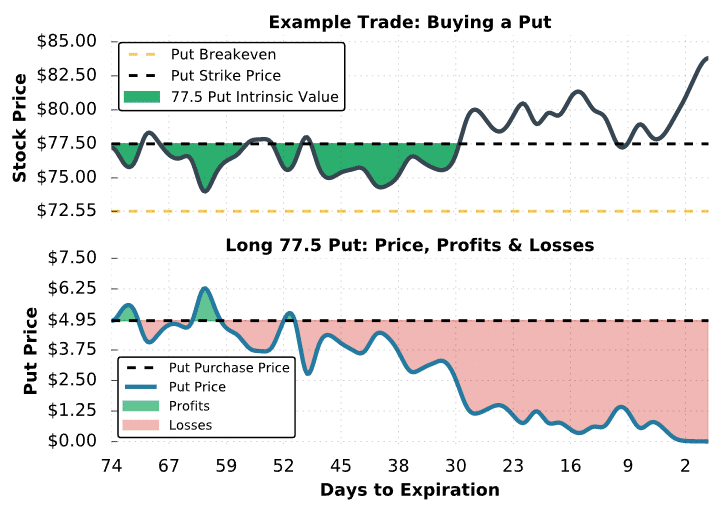

Trade Example #1: Buying an At-the-Money Put

The first example we’ll look at is a situation where a trader buys an at-the-money put option (strike price near the stock price).

Here are the trade details:

Initial Stock Price: $77.21

Put Strike and Expiration: 77.5 put expiring in 74 days

Put Purchase Price: $4.95

Put Breakeven Price: $77.5 strike price – $4.95 debit paid = $72.55

Maximum Profit Potential: $72.55 x 100 = $7,255 (stock price goes to $0)

Maximum Loss Potential: $4.95 put purchase price x 100 = $495

In the case of buying an at-the-money put, you’ll notice that the breakeven price is lower than the stock price, which means the stock price must fall for the strategy to be profitable at expiration (and is therefore a low probability trade). If the stock price does not fall quickly enough, the put price will decay slowly until expiring worthless at expiration.

Let’s see what happens!

Long Put #1 Trade Results

As we can see here, the stock price never made the necessary downside move to generate significant profits for the long 77.5 put. Since the stock price was at or above the put’s strike price as time elapsed, the put’s price decayed towards $0. The losses from the passage of time are expressed by the put’s negative theta position.

Additionally, implied volatility fell from 37% to 24% over the trade period, which indicates a significant collapse in option prices on this stock. Because of this, the 77.5 put fell in price from time decay (theta) and a decrease in implied volatility. To offset these two factors, the stock price would have had to fall significantly.

At any point in this trade, the long put trader could have locked in the current profit or loss by selling the put they bought. For example, if the trader sold the put back for $2.50, they would have locked in a loss of $245. On the other hand, if the trader sold the put for $5.50, they would have locked in a profit of $55. So, there’s always an opportunity to close a long put position if you do not wish to be in the trade any longer.

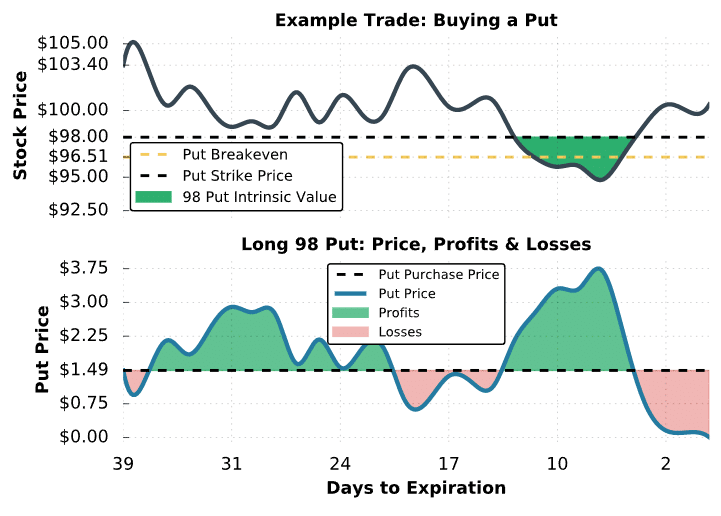

Trade Example #2: Buying an Out-of-the-Money Put

In this next example, we’ll look at a situation where a trader buys an out-of-the-money put option.

Here are the trade details:

Initial Stock Price: $103.40

Put Strike and Expiration: 98 put expiring in 39 days

Put Purchase Price: $1.49

Put Breakeven Price: $98 strike price – $1.49 debit paid = $96.51

Maximum Profit Potential: $96.51 x 100 = $9,651 (stock price goes to $0)

Maximum Loss Potential: $1.49 put purchase price x 100 = $149

Let’s see how this put option performs over time!

Long Put #2 Trade Results

In this example, you can see that the put’s strike price and breakeven is significantly below the initial stock price of $103.40. When buying out-of-the-money puts, quick and significant decreases in the stock price, or increases in implied volatility are required to profit. Fortunately, the stock price fell from $103.40 to nearly $98 in the first 8 days of this trade.

Now, when stock prices fall quickly, implied volatility tends to increase as well because more investors are willing to pay more for insurance. In this case, implied volatility increased from 26% to 31% when the stock price fell from $103.40 to $98. As a result, the price of the 98 put increased from $1.49 to $3.00, which results in a 100% return for the long put trader. However, it’s important to note that these profits are not permanent since the 98 put is still out-of-the-money.

As we can see, from 31 to 14 days to expiration, the stock price was still above the put’s strike price of $98. Because of this, all of the put buyer’s initial profits eroded. Fortunately, the stock price fell again, this time to $95. The put’s price shot up to $3.75 ($3 of it being intrinsic value), creating yet another opportunity for the put buyer to take over 100% profits on the position.

At expiration, the stock was trading for $100, and the 98 put expired worthless. If the put buyer didn’t take profits in one of the profitable periods, the trader would have realized the maximum loss of $149.

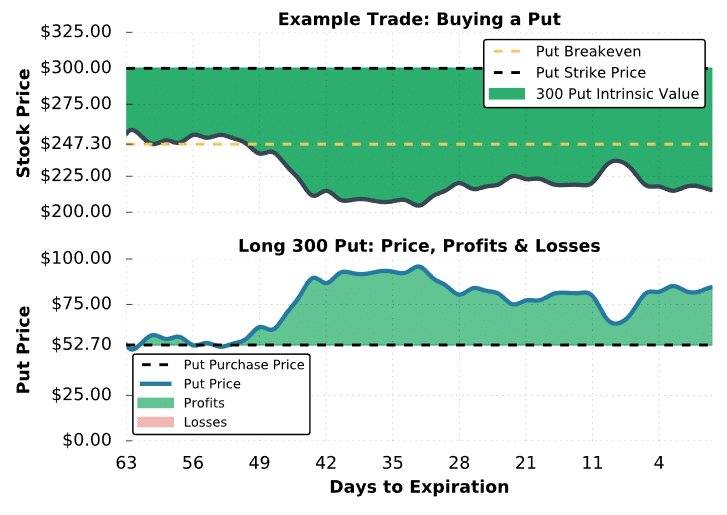

In the final example, we’ll look at a situation where a trader buys a deep-in-the-money put option.

Trade Example #3: Buying an In-the-Money Put Option

In this final example, we’ll look at the performance of a deep-in-the-money put option. When purchasing a deep-in-the-money option, most of the option’s value is intrinsic, which is not subject to losses from time decay or decreases in implied volatility. However, the loss potential is more significant than at-the-money or out-of-the-money options due to the larger premium paid.

Here are the trade details:

Initial Stock Price: $254.51

Put Strike and Expiration: 300 put expiring in 63 days

Put Purchase Price: $52.70

Put Breakeven Price: $300 strike price – $52.70 debit paid = $247.30

Maximum Profit Potential: $247.30 x 100 = $24,730 (stock price goes to $0)

Maximum Loss Potential: $52.70 put purchase price x 100 = $5,270

Let’s see how this put performs over time:

Long Put #3 Trade Results

As we can see in this example, the long 300 put was profitable the entire period because the stock price was below the put’s breakeven price. Additionally, in-the-money options are less exposed to time decay and decreases in implied volatility because most of the option’s value is intrinsic.

In this example, the put’s initial delta was -0.75, which represents an expected $75 profit with each $1 decrease in the stock price, which is almost the same as being short 100 shares of stock. In fact, this trader would automatically end up with a short stock position of -100 shares if the 300 put was held through expiration. So, buying in-the-money options is essentially a stock replacement strategy, which explains why the put’s value moves almost one-for-one with the stock in the example above.

Why would a trader purchase an in-the-money put as opposed to shorting shares of stock? Well, even though the loss potential when buying an in-the-money put is significant ($5,270 in this case), the position still has less risk than shorting shares of stock. Consequently, the margin requirement for buying an option may also be significantly less than shorting stock.

Final Word

In conclusion, we have learned:

- Long puts are generally unprofitable because of the effects of time decay.

- If the underlying stays the same or goes up in value, long puts will lose money.

- For very bearish traders with small accounts, buying a put could be a nice alternative to selling stock.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.