Last updated on February 10th, 2022 , 02:14 pm

A bull put spread is an options strategy that consists of selling a put option while also buying a put option at a lower strike price.

Both options must be in the same expiration cycle. Additionally, each strike should have the same number of contracts (i.e. if selling two puts, two puts at a lower strike should be bought). Selling put spreads is similar to selling naked puts, but far less risky due to buying a put against the short put. As the name suggests, a bull put spread is a bullish strategy, as it tends to profit when the underlying stock price rises.

TAKEAWAYS

- Bull put spreads are best suited for bullish traders.

- The bull put strategy is comprised of: 1.) buy a put at strike price A 2.) sell a put at strike price B.

- The max profit for bull puts is the credit received.

- Max loss in this strategy is the difference between strike A and strike B, minus the net premium received.

- Breakeven for the bull put is strike B minus the net premium received when selling the spread.

Bull Put Spread Strategy Characteristics

Let’s go over the strategy’s general characteristics:

➥Max Profit Potential: Net Credit Received x 100

➥Max Loss Potential: (Width of Put Strikes – Credit Received) x 100

➥Expiration Breakeven: Short Put Strike – Credit Received

➥Other Known Aliases: Short Put Spread, Put Credit Spread

To gain a better understanding of each concept, let’s walk through a trade example.

Profits/Losses at Expiration for a Bull Put Spread

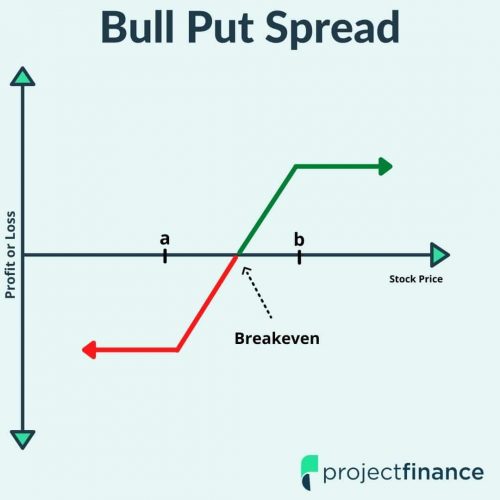

In the following example, we’ll construct a bull put spread from the following option chain:

Bull Put Construction

To construct a bull put spread, we’ll have to simultaneously sell one of these puts and purchase the same number of puts at a lower strike price. In this case, we’ll sell the 90 put and buy the 85 put. Let’s also assume that the stock price is $90 when selling the spread.

Initial Stock Price: $90

Short Put Strike: $90

Long Put Strike: $85

Premium Collected for the 90 Put: $5.09

Premium Paid for the 85 Put: $2.84

In this example, selling the 90 put for $5.09 and buying the 85 put for $2.84 results in a net credit received of $2.25 (since $5.09 is collected, and $2.84 is paid). Additionally, the “spread width” is the difference between the long and short put strike, which is $5 in this case. Based on a net credit of $2.25 on a $5-wide bull put spread, here are the position’s characteristics:

Max Profit Potential: $2.25 Credit x 100 = $225

Max Loss Potential: ($5-Wide Strikes – $2.25 Credit) x 100 = $275

Expiration Breakeven Price: $90 Short Put Strike – $2.25 Credit = $87.75

Probability of Profit:

This bull put spread example has a probability of profit slightly greater than 50% because the breakeven price is less than the initial stock price, which means the stock price can fall slightly and the position can still profit. Additionally, the maximum loss potential is greater than the maximum profit potential.

Position After Expiration

If the stock price is below 85 at expiration, both puts expire in-the-money. At expiration, an in-the-money long put expires to -100 shares, and an in-the-money short put expires to +100 shares, which nets out to no stock position for the put spread seller. If the stock price is between 90 and 85 at expiration, only the short put expires in-the-money, resulting in a position of +100 shares for the short put spread trader.

The following visual demonstrates the potential profits and losses for this bull put spread at expiration:

Bull Put Trade Results

Stock Price Above the Short Put Strike ($90):

Both the 85 and 90 put expire worthless. The profit on the short 90 put is $509, but the loss on the long 85 put is $284, resulting in a net profit of $225.

Stock Price Between the Short Put Strike ($90) and the Bull Put Spread’s Breakeven Price ($87.75):

The short 90 put expires with intrinsic value, but not more than the $2.25 credit received for the short put spread. Because of this, the bull put spread trader realizes a profit, but not the maximum profit since the position expires with some value.

Stock Price Between the Bull Put Spread’s Breakeven Price ($87.75) and the Long Put Strike ($85):

The short 90 put expires with more intrinsic value than the $2.25 credit the put spread trader collected when selling the spread. Because of this, the trader realizes a loss at expiration, but not the maximum loss.

Stock Price Below the Long Put Strike ($85):

The value of the $5-wide short put spread is $5. Since the spread was sold for $2.25, the trader realizes the maximum loss of $275.

Nice! You know how to determine the potential outcomes of a short put spread at expiration, but what about before expiration? To demonstrate how short put spreads perform before expiration, we’re going to look at a few examples of positions that recently traded in the market.

Bull Put Spread Trade Examples

In the following examples, we’ll compare changes in the stock price to a bull put spread on that stock. Note that we won’t discuss the specific stock the trade was on, as the same concepts regarding short put spreads apply to each stock. Additionally, each example represents one short put spread. The potential gains and losses scales proportionately to the number of put spreads traded.

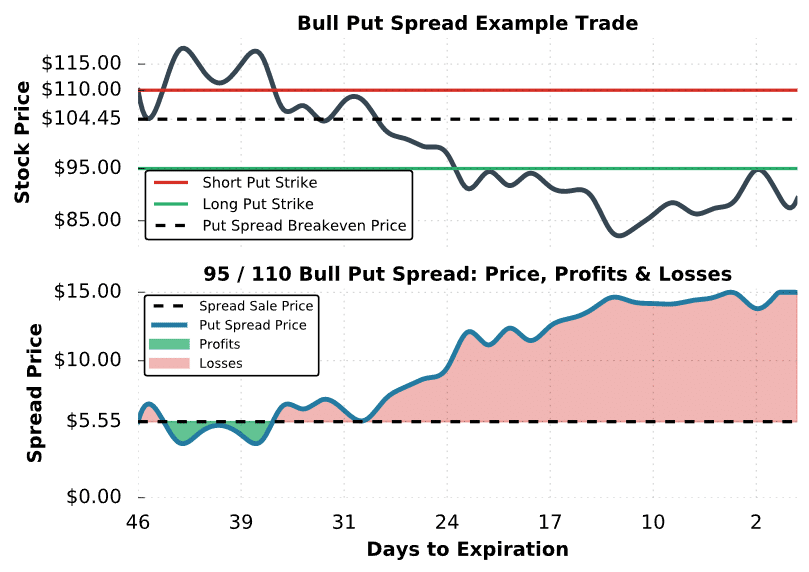

Trade Example #1: Maximum Loss Bull Put Spread

The first example we’ll investigate is a situation where a trader sells an at-the-money put spread. An at-the-money bull put spread consists of selling an at-the-money put and buying an out-of-the-money put. When constructed properly, the breakeven price is slightly below the current stock price. Here’s the setup:

Initial Stock Price: $109.96

Strikes and Expiration: Short 110 put expiring in 46 days. Long 95 put expiring in 46 days.

Net Credit Received: $9.22 received for the 110 put – $3.67 paid for the 95 put = $5.55.

Breakeven Stock Price: $110 short put strike – $5.55 net credit received = $104.45.

Maximum Profit Potential: $5.55 net credit x 100 = $555.

Maximum Loss Potential: ($15-wide put strikes – $5.55 credit received) x 100 = $945.

Let’s see what happens!

Bull Put #1 Trade Results

As you can see here, the value of the put spread increases as the stock price falls, which is not good for a short put spread trader.

At expiration, both put strikes are in-the-money, which results in the maximum loss of $945 for the short put spread trader: ($5.55 sale price – $15 expiration price) x 100 = -$945. Since a short put expires to +100 shares and a long put expires to -100 shares, no stock position is taken if the trader holds the in-the-money spread through expiration. However, it’s possible that the short put spread trader gets assigned on the short 110 put when it’s in-the-money with little extrinsic value.

Next, we’ll look at an example of a trade where the stock price is below the short put at expiration, but the position is still profitable.

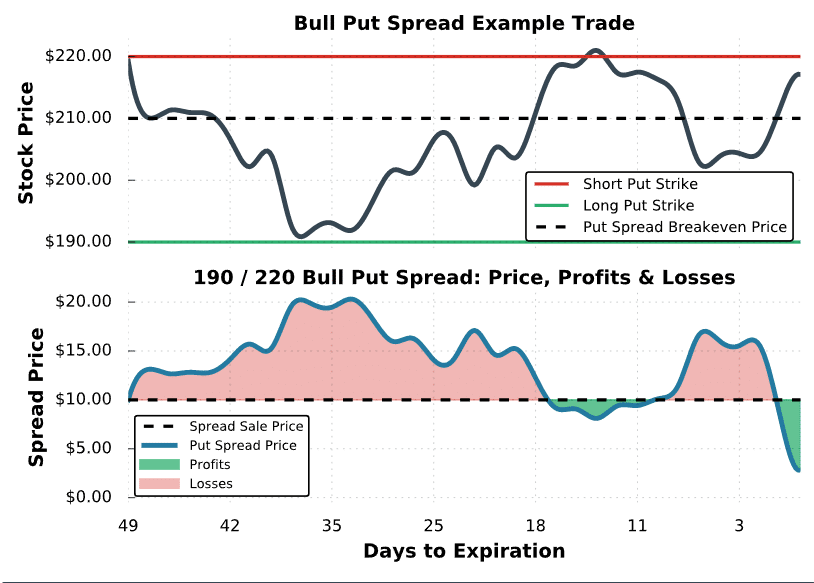

Trade Example #2: Partial Profit

In the next example, we’ll look at a situation where a trader sells an at-the-money put spread and does not realize the maximum profit potential.

Here’s the setup:

Initial Stock Price: $219.28

Strikes and Expiration: Short 220 put expiring in 49 days. Long 190 put expiring in 49 days.

Net Credit Received: $14.60 received for the 220 put – $4.60 paid for the 190 put = $10.

Breakeven Stock Price: $220 short put strike – $10 net credit received = $210.

Maximum Profit Potential: $10 net credit received x 100 = $1,000.

Maximum Loss Potential: ($30-wide put strikes – $10 credit received) x 100 = $2,000.

Let’s take a look:

Bull Put #2 Trade Results

As demonstrated here, the timing of the short put spread entry couldn’t have been worse. With just over 35 days to expiration, the put spread was trading for $20, which represents a $1,000 loss for a trader who sold the spread for $10.

However, since a short put spread has limited loss potential, let’s say the trader in this example held on to the position. Near expiration, the stock price rallied above the short put spread’s breakeven price of $210 and the put spread’s value fell. At expiration, the stock was trading for $217.11, which means the short 220 put was worth $2.89 and the 190 put was worthless. Since the trader sold the spread for $10, the expiration profit on the spread was $711: ($10 sale price – $2.89 expiration price) x 100 = +$711.

Alright, you’ve seen short put spread examples that break even and realize the maximum loss. In the final example, we’ll investigate a trade that winds up with its greatest profit potential.

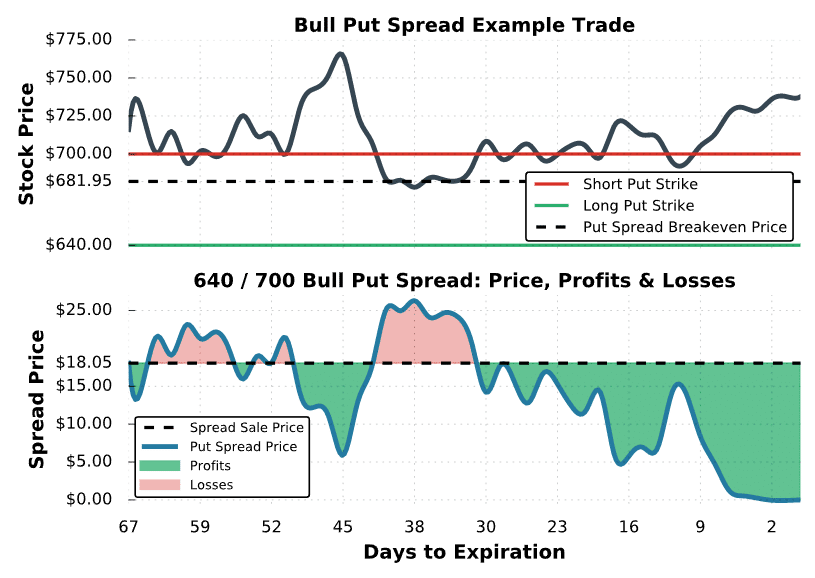

Trade Example #3: Maximum Profit Put Spread

In the final example, we’ll examine a bull put spread example that ends up with its maximum profit potential.

Here are the specifics of the final example:

Initial Stock Price: $716.03

Strikes and Expiration: Short 700 put expiring in 67 days. Long 640 put expiring in 67 days.

Net Credit Received: $30.20 received for the 700 put – $12.15 paid for the 640 put = $18.05.

Breakeven Stock Price: $700 short put strike – $18.05 net credit received = $681.95.

Maximum Profit Potential: $18.05 net credit received x 100 = $1,805.

Maximum Loss Potential: $60-wide put strikes – 18.05 net credit received = $4,195.

Bull Put Spread #3 Trade Results

When the stock price rises significantly, the value of the put spread falls, which is great news for the put spread seller. In this example, there were plenty of opportunities for the trader to take profits before expiration. To close a bull put spread, the trader can simultaneously buy back the short put and sell the long put. As an example, let’s say the trader wanted to take profits when the spread’s price fell to $10. When the trader buys back the spread for $10, they lock in $805 in profits: ($18.05 initial spread sale price – $10.00 closing price) x 100 = +$805.

At expiration, the stock is trading for over $725, and both the 700 and 640 put expire worthless. The resulting gain on the short 700 put is $3,020 and the loss on the long 640 put is $1,205. Therefore, the net profit on the position is $1,805 for the put spread seller, which is the position’s maximum profit potential.

Final Word

Congratulations! You now know how short put spreads work as a trading strategy. Lastly, let’s go over what we learned:

- In the short put spread, a trader wants BOTH options to expire worthless.

- This occurs when both the long and short option are out-of-the-money on expiration

- Time decay works to the advantage of short puts.