Last updated on September 15th, 2022 , 01:11 pm

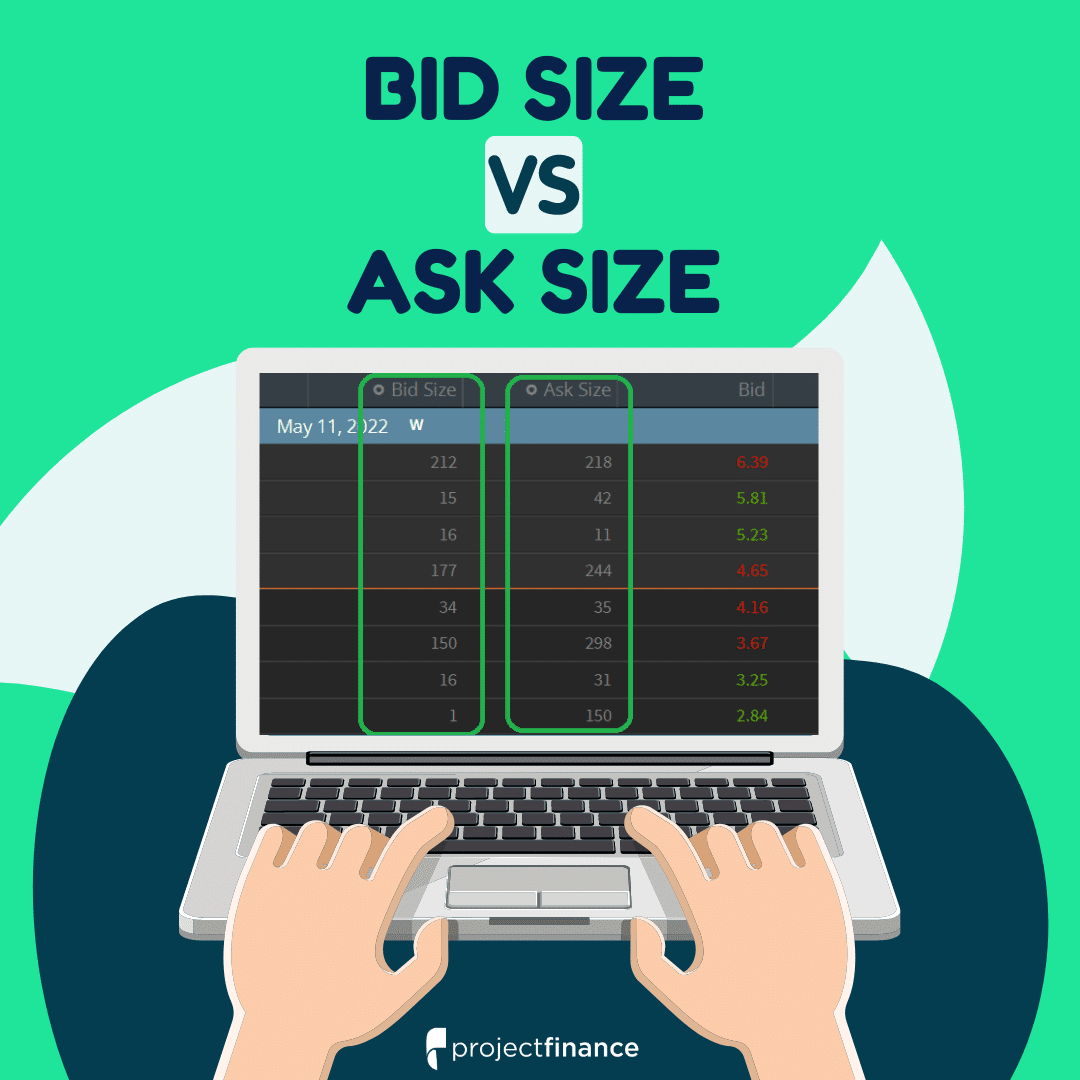

Bid And Ask Size Definition: The total quantity of shares/options that can be sold (bid) or bought (ask) at the current market prices.

In options trading, liquidity refers to the ease at which an option can be opened and closed. Unlike stocks, options can have very wide markets.

There are numerous measures available for traders to gauge the liquidity of an option. Among these is the “bid size” and “ask size”.

The bid size tells us how many options we can sell at a quoted price. The ask size tells us how many options we can purchase at a quoted price.

For those trading large positions, this metric is crucial. In this article, projectfinance is going to show you why.

Liquidity Measures In Options Trading

Before we get into bid size vs ask size, let’s first review a few other important measures of option liquidity in financial markets.

- Option Volume: The number of contracts traded so far on a given day.

- Open Interest: The number of contracts currently in existence for a particular option.

- Option Bid-Ask Spread: The difference between the bid price and the asking price.

- Stock Volume: The number of shares of stock traded on a given day.

Ideally, you want to trade options with high volume and open interest. Additionally, you want the stock volume to be high as well. Why?

Market Makers hedge the options they buy and sell with stock. High stock volume generally means the stock is liquid, which means they can hedge easier, therefore giving you better fill prices.

Option spreads (the difference between the bid and ask price) in derivatives should also be tight. I have seen some options with a bid of $1 and an ask of $3. This means, that if you were to get filled on a buy order at the market price, you would lose $2 if you sold immediately. The tighter the spread, the less slippage to you.

But sometimes option markets can be misleading. A market maker may bid an option at $2, but how many options is that market participant willing to purchase from you at $2? 1? 200?

This is where bid size and ask size come into play.

Bid Size And Ask Size In Stock

Bid Size Definition: The quantity of a security a market maker or investor is willing to purchase at a specific price.

Ask Size Definition: The quantity of a security a market maker or investor is willing to sell at a specific price.

Let’s first look at an example of bid size vs ask size in the stock market.

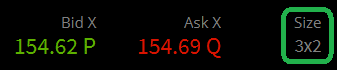

The above image (taken from the tastyworks trading platform) shows the current market for AAPL stock. We can currently sell AAPL for 154.62 and buy AAPL for 154.69.

The spread here is 0.07, the difference between the bid and the ask price. If we were to buy and immediately sell this stock, we would lose 0.04. Of course what we lose, the market maker gains.

But how many shares can we sell at the bid stock price 150.62? And how many can we buy at 154.69? A gazillion?

This is where the “size” of the bid and ask come into play. The current size of AAPL stock is circled in green above. In the stock market, bid size and ask size represent 100 shares of stock. Therefore, a bid size of “1” really means 100 shares.

In our AAPL example, we can see that there is 300 shares bid at 154.62 and 200 shares offered at 154.69.

Bid Size And Ask Size In Options

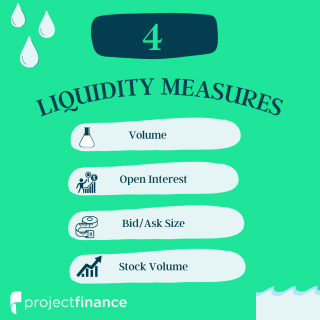

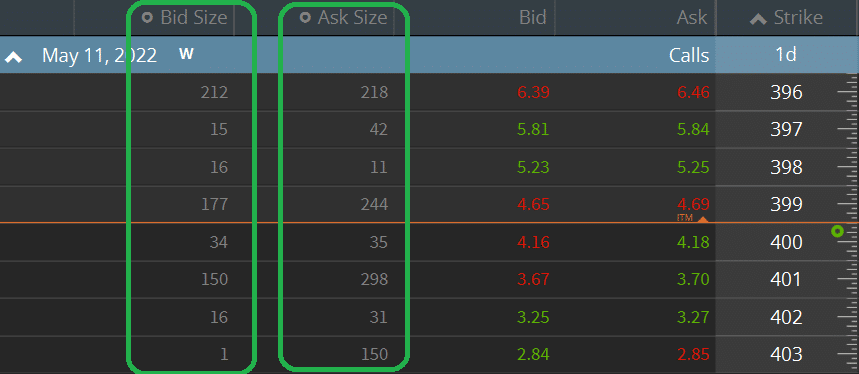

Just as with stock, options have bid sizes and ask sizes. Let’s jump right into an example by looking at call options on SPY, an S&P 500 index-tracking ETF.

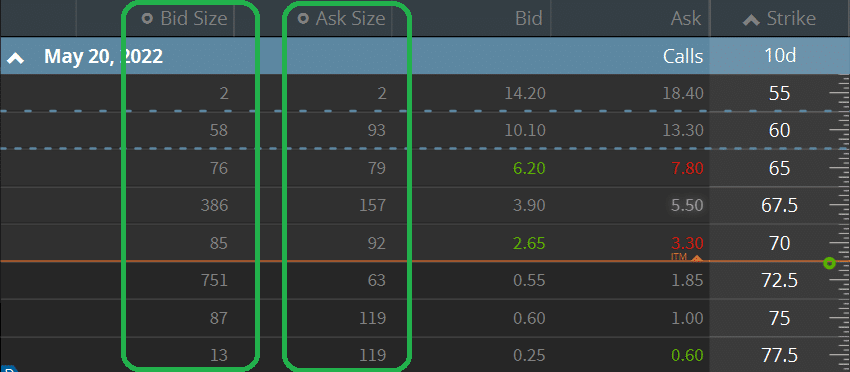

In the above options chain, we can see the various bid and ask sizes for different SPY call options with an expiration date of May 11th.

Unlike stock, the bid and ask sizes for options do not represent 100 contracts. If an option contract has a bid size of 34, that means 34 options are available to sell at the quoted price.

Bid and ask sizes are in constant flux with the market. If you watch a live options chain on a liquid product like SPY, these numbers will change several times a second.

Bid Size And Ask Size In Illiquid Options

In our above example, we looked at the bid and ask size on SPY, which just happens to be the most liquid security in the world. Let’s now check out the bid and ask sizes on a less liquid security, Ryder System – R.

Ryder Systems - Bid/Ask Size

So far today, Ryder Systems has traded 230k of stock. Spy, on the other hand, has traded 40 million. A stock that has high volume is usually indicative of decent option liquidity.

R is therefore far less liquid than SPY. When comparing the bid/ask size of R with SPY, we can see that R has many more options both bid and offered at various strike prices than SPY.

One may think that more liquid stocks have higher bid/ask sizes, but that is not always the case. Why?

We must look at the actual spread of the options. With SPY, the options are about a nickel wide. R, on the other hand, has spreads ranging from 0.80 to 4 wide!

Market makers in R, therefore, have a much better chance of profiting in these wider spreads than those in SPY. Because of this, they are willing to both buy and sell greater quantities of options in R than SPY.

Bid Size And Ask Size: Why It Matters

So why does this matter to you? Let’s jump right into an example to see why.

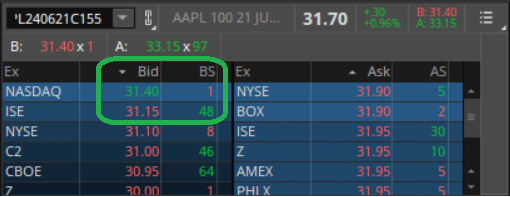

Let’s assume you own 10 LEAP call options on AAPL. You are happy with your profits and, not knowing that LEAP options are very illiquid, you place a market order to sell your long calls.

You see a quoted bid price of 31.40, and presume you will get filled at this price. After hitting send, you discover only one contract was filled at 31.40, while the others were filled at 31.15! Why did this happen?

Because only one contract was bid at 31.40. The others were bid at 31.15.

So how do we know what the next best price will be? By putting the option code into the trade grid, as I have done below:

This is a perfect example of why it is very important to only use limit orders in options trading. The current ask price and current bid price do not guarantee you will get filled here. This is particularly true in high volatility environments and illiquid products.

Though you may not get filled right away using limit orders in both buy orders and sell orders, they do ensure the best fill price – if/when you actually get filled. You can even work limit orders downward or upward until you get filled.

Bid Size And Ask Size FAQs

When the ask size exceeds the bid size, this can be a sign that a stock will fall as a result of oversupply. On the other hand, when the bid size is greater than the ask size, this can be a sign that demand is greater than supply. When this happens, the underlying stock price may soon rise in value.

The ask price is the price at which a market maker is willing to sell you an option. Therefore, this is the price at which you will purchase an option.

The bid price is the price at which a market maker is willing to buy an option. Therefore, this is the price at which you can sell an option.

Both the ask size and the bid size of options are in constant flux with the market. Market makers determine the quantity at which they will both buy and sell options by looking at factors such as stock price and supply and demand. Because of this, the ask size is rarely the same as the bid size.