Last updated on February 10th, 2022 , 01:44 pm

The bear call spread (selling a call spread – also known as a “short” call spread) is a bearish options strategy that consists of simultaneously selling a call and buying a call at a higher strike price (same expiration cycle).

The strategy builds on a naked short call by purchasing a call at a higher strike to reduce the risk of the position.

TAKEAWAYS

- The short call spread is a great strategy for risk-conscious traders who are either bearish or neutral on the market (and sometimes mildly bullish).

- The long call portion of this strategy caps losses.

- On a short call spread, the max loss is the difference between the strike prices minus the net credit received.

- The short call strategy profits from time decay on the short strike price.

Bear Call Spread Strategy Characteristics

Let’s quickly go over the strategy’s general characteristics:

➟Maximum Profit Potential: Credit Received x 100

➟Maximum Loss Potential: (Width of Call Strikes – Credit Received) x 100

➟Expiration Breakeven Price: Short Call Strike Price + Credit Received

To better understand each of these characteristics, we’re going to look at a basic short call spread example.

Bear Call Spread Profit/Loss Potential at Expiration

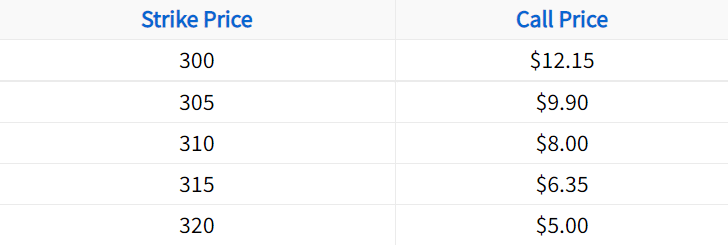

In the following example, we’ll construct a short call spread from the following option chain:

In order to construct a short call spread, we’ll have to sell a call while also purchasing a call at a higher strike price. In this example, we’ll sell the 310 call for $8 and purchase the 320 call for $5. Let’s also say that the stock price is trading for $300 at the time of selling the spread:

Initial Stock Price: $300

Call Spread Setup: Sell 310 call for $8, Buy 320 call for $5

Call Spread Sale Price: $8 Received – $5 Paid = $3 Net Credit

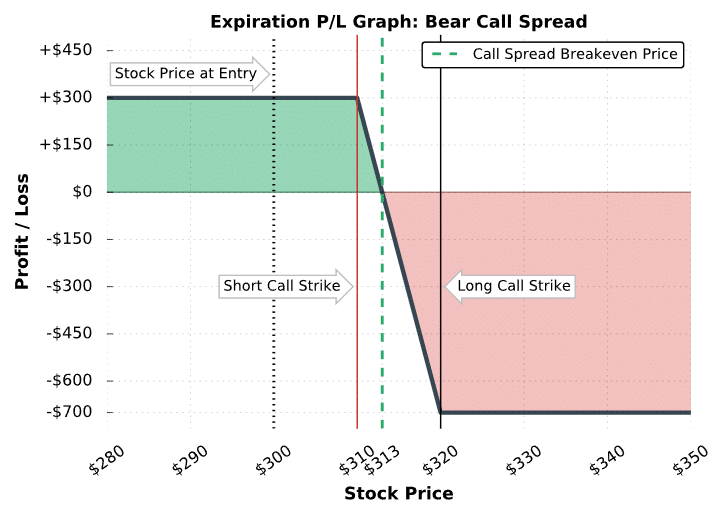

If a trader sells this call spread, their potential profits and losses at expiration are described by the following visual:

Bear Call Spread Chart

The following table describes various scenarios of this bear call spread example at expiration:

Stock Price Below the Short Call Strike Price (Below $310)

Both call options in the spread expire worthless, resulting in an $800 profit on the short 310 call, and a $500 loss on the long 320 call. The net profit for the call spread seller is $300: ($3 initial spread sale price – $0 spread price at expiration) x 100 = +$300.

Stock Price Between the Short Call Strike Price and the Breakeven Price (Between $310 and $313)

The short 310 call expires with intrinsic value, but not more than the $3 credit that was collected from selling the spread. Because of this, the short call spread position is partially profitable. Additionally, the trader will be assigned -100 shares of stock for $310 per share if the short call is held through expiration.

Stock Price Between the Breakeven Price and the Long Call Strike Price (Between $313 and $320)

The short 310 call expires with more intrinsic value than the call spread was initially sold for, and therefore the position realizes losses. Additionally, the trader will be assigned -100 shares of stock for $310 per share if the short call is held through expiration.

Stock Price Above the Long Call Strike Price (Above $320)

The 310/320 call spread is worth its maximum value of $10, and therefore the seller of the call spread realizes the maximum loss potential. Since the spread was initially sold for $3, the loss is $700: ($3 sale price – $10 spread price at expiration) x 100 = -$700.

Great job! You know the potential outcomes for a short call spread at expiration, but what about before expiration?

To demonstrate to you how short call spreads perform over time, let’s look at some historical trade examples so you can see how the strategy performs in different scenarios.

Bear Call Spread Trade Examples

To visualize the performance of various short call spread positions, let’s look at a few real examples. Before we start, it’s important to note that we don’t specify the stock the trade was on, as the concepts in each case transfer to other stocks in the market.

Additionally, each example uses a trade size of one call spread. To convert the profits and losses to a larger position, just multiply the profits and losses by an increased number of spreads.

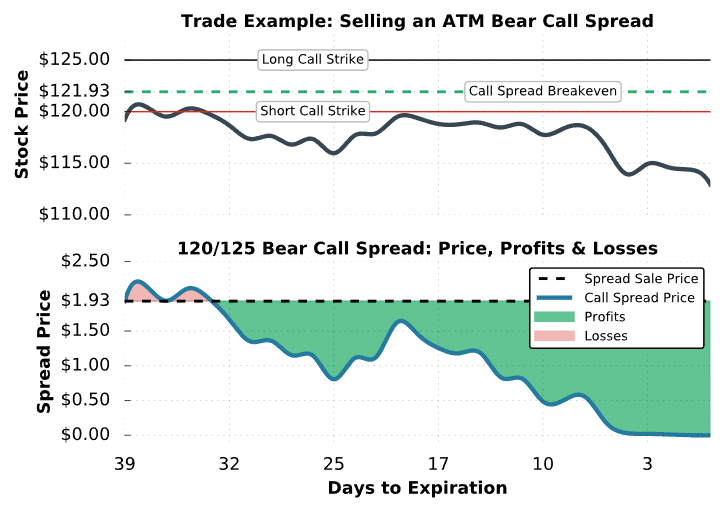

Trade Example #1: Profitable Short Call Spread

The first example we’ll look at is a scenario where a hypothetical trader sells an at-the-money call spread and the stock price gradually decreases, leading to a profitable trade.

Here are the trade details:

Initial Stock Price: $119.24

Call Strikes and Expiration: Short 120 call for $3.43; Long 125 call for $1.50; Both options expiring in 39 days

Call Spread Sale Price: $3.43 Received – $1.50 Paid = $1.93 Net Credit/Price Received

Breakeven Price: $120 short call strike + $1.93 credit received = $121.93

Maximum Profit Potential: $1.93 credit received x 100 = $193

Maximum Loss Potential: ($5-wide strikes – $1.93 net credit) x 100 = $307

Let’s see how the trade performed:

Short Call Spread #1 Trade Results

One of the most important things to note about this graph is that the value of the call spread changes directly with the stock price. When the stock price rises, the call spread becomes more valuable. When the stock price falls, so does the value of the call spread.

Because of this, bear call spread traders benefit when the stock price falls, and are harmed by stock price increases. In this case, the stock price did fall, and the trader profited from the decrease in the value of the call spread.

Additionally, when time passes, and the call spread is out-of-the-money, the call options will slowly decay towards $0, leading to a lower and lower spread price over time. Because of this, the seller of a call spread can make money from the passage of time without any changes in the stock price.

In this particular example, the call spread seller benefited not only from the falling stock price, but also the decay of the options as time passed.

With the price of the call spread below $1.93 for a majority of this trade, the short call spread trader had many opportunities to close the spread for a profit before expiration. To close a short call spread before expiration, simultaneously buy back the short call and sell the long call.

If the trader closed the position for a $1.00 debit (bought the spread back for $1.00), they would have locked in a $93 profit: ($1.93 spread sale price – $1.00 spread purchase price) x 100 = +$93.

At expiration, the call spread expired worthless, which led to the maximum profit of $193 for the call spread seller.

Next, we’ll look at another profitable bear call spread example, except this time we’ll investigate a scenario where profits occur rapidly from a favorable move in the share price.

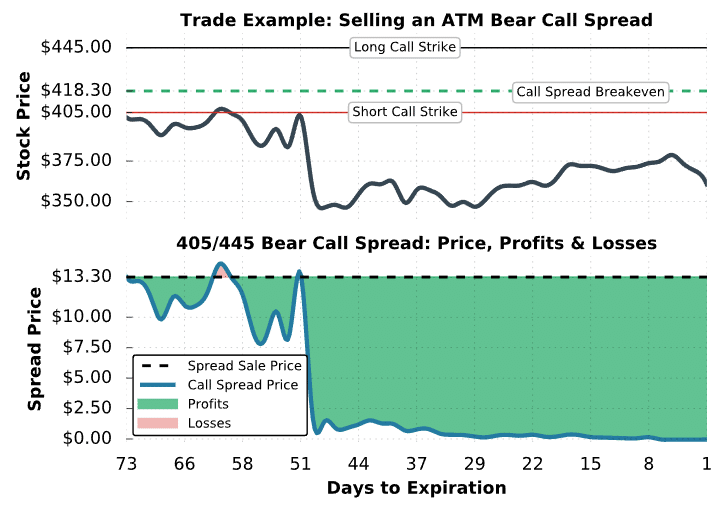

Trade Example #2: Rapid Short Call Profits

In the previous example, we examined a gradual stock price decrease. In this next example, we’ll look at a situation where the stock price unexpectedly collapses after an at-the-money call spread is sold.

Here are the trade details:

Initial Stock Price: $401.92

Call Strikes and Expiration: Short 405 call for $19.83; Long 445 call for $6.53; Both options expiring in 73 days

Call Spread Sale Price: $19.83 Received – $6.53 Paid = $13.30 Net Credit

Breakeven Price: $405 short call strike + $13.30 credit received = $418.30

Maximum Profit Potential: $13.30 credit received x 100 = $1,330

Maximum Loss Potential: ($40-wide strikes – $13.30 net credit) x 100 = $2,670

Let’s see how the trade performed!

Short Call Spread #2 Trade Results

In this example, we can see that the stock price trades around the short call strike in the first 20 days of the trade. As a result, the call spread’s value decayed only slightly. However, with around 51 days to expiration, the stock price collapsed from $405 to $350. Because of this, the price of the 405 / 445 call spread fell to nearly $0.

Consequently, the bear call spread trader had almost the full profit of $1,330 on the spread with 50 days remaining until expiration.

In this scenario, it’s likely that the trader buys back the short call spread after the drop in the stock price. With the spread nearly worthless, the trader has little left to gain from holding the position but still has everything left to lose if the stock price regains its losses.

When presented the opportunity to close a trade before expiration near maximum profit, it’s usually a wise move to do so.

If the trader did decide to hold the spread until expiration, they would have also realized the maximum profit potential of $1,330 because both calls expired worthless.

In the final example, we’ll look at an unprofitable bear call spread example.

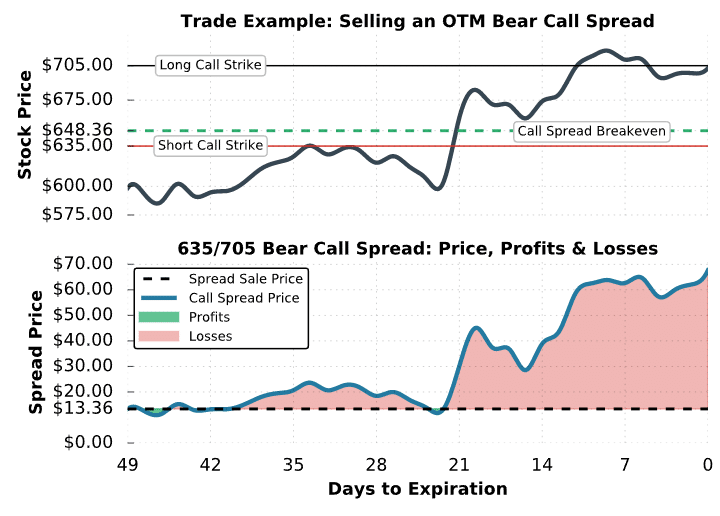

Trade Example #3: Selling a Call Spread Gone Wrong!

In the final example, we’ll examine an out-of-the-money short call spread position on a stock that ends up rallying significantly.

Here are the trade details:

Initial Stock Price: $598.50

Call Strikes and Expiration: Short 635 call for $16.35; Long 705 call for $2.99; Both options expiring in 49 days

Call Spread Sale Price: $16.35 Received – $2.99 Paid = $13.36 Net Credit

Breakeven Price: $635 short call strike + $13.36 credit received = $648.36

Maximum Profit Potential: $13.36 credit received x 100 = $1,336

Maximum Loss Potential: ($70-wide strikes – $13.36 net credit) x 100 = $5,664

Let’s see what goes wrong with this trade:

Short Call Spread #3 Trade Results

As we can see, the stock price increased significantly over the 49-day period. As a result, the value of the 635/705 call spread also increased, which translated to losses for the call spread seller.

At expiration, the stock price was trading for $702.80, and the 635/735 call spread was worth $67.80. With an initial sale price of $13.36 the loss for the call spread seller is equal to: ($13.36 initial sale price – $67.80 spread price at expiration) x 100 = -$5,444.

While the loss on this position was significant, it’s always possible to get out of a trade before expiration. For example, if the short call trader didn’t want to be in the trade after the stock price traded up to the short 635 call, they could have bought back the spread for just over $20. Buying back the spread for $20 would lock in a loss of $670, but would be much better than the maximum loss of $5,664.

In the heat of the moment, it’s difficult to make the decision to close a position for a loss, but it’s always an option (pun intended).

Final Word

You’ve reached the end of the guide! Hopefully, you feel much more comfortable with the bear call spread options strategy after reading through this guide and seeing each example.

Let’s go over the highlights:

- The bear call spread is a risk defined strategy that can profit in any market, but mostly neutral and bearish markets.

- The maximum profit on a bear call is always the credit received.

- As time passes and the stock price remains the same, the short call will decay, causing a profit for the short call spread.