Last updated on April 14th, 2022 , 11:32 am

Saving is something many of us do throughout our careers. These savings are often divided between long-term and liquid investments, the latter of which can help pay for immediate expenses.

General financial advice is to have 3-6 months’ worth of expenses tucked away in savings. The more liquid these funds are, the easier they can be withdrawn for emergencies. These funds can be used to pay for immediate needs, such as vehicles and sudden medical expenses. Alternatively, you can use these funds to cover the ongoing costs of living in the event of a loss of income, giving you leeway to find a new job.

Does this advice still hold once you reach retirement age? Probably not.

- In retirement, your income drops and stabilizes; you begin to get payouts from your retirement accounts, social security, and similar sources.

- More importantly, in retirement you no longer have penalties for withdrawing money from your retirement accounts beyond the loss of principal for the still-accumulating growth.

Meanwhile, other expenses can start to ramp up. Medical bills grow more common and more significant as we get older and our bodies wear.

Is having a 3–6-month emergency fund still relevant in this period of our lives? Should you have more cash on hand or less when you can pull from your retirement accounts as needed?

What Does Cash Mean?

Before we dig too deep, let’s take a moment to discuss what “in cash” means. As a retiree, you want to have money accessible when you need it.

Three forms of “cash” get tossed around interchangeably, but they have slightly different implications.

- The first is actual physical cash. Most of the time, no one is advocating keeping cold, hard cash on hand. You may want some physical cash for everyday expenses, particularly if you travel to places where businesses may less commonly accept cards, but that’s pretty minimal these days. Keeping physical cash around was more of a habit for those who lived through the Great Depression, where investments bottomed out. Today, hoarding physical cash can even be risky; plenty of vendors no longer accept cash, preferring to handle everything digitally.

- The second is easily accessible savings. A savings account can have money pulled from it whenever you like and is often tied to a debit card for immediate purchasing power. This definition of cash is what most often what people talk about when they mention cash; it’s liquid, not tucked away in an account which you can only access indirectly, and it’s not there to linger and earn interest.

- The third is a cash reserve account. Cash reserve investments are generally tied to a currency’s value. These accounts can have interest rates ranging from near-nothing (keeping your dollar value 1:1 with the value of a dollar) or rising in times of economic hardship. Federal reserve rates have sometimes been as high as 5%, offering modest growth while the money is still reasonably accessible.

For today’s post, we’re looking primarily at #2, though #1 also qualifies. The idea is to draw a line between investments that earn interest and cash on hand. You can spend these funds immediately on anything from living expenses, medical bills, and leisure purchases.

Do You Still Need an Emergency Fund?

The point of an emergency fund is two-fold.

- First, it serves as insulation against hardship. If you lose your income or have a sudden considerable expense, you need to cover it without defaulting on other payments or letting unfortunate events cascade. Losing a job can quickly shift into losing a vehicle or housing if you don’t have funds to keep paying those bills while you search for new income.

- The other purpose of an emergency fund is to have money on hand that you can tap into without touching your long-term investments. Before retirement age, if you want to tap into your assets, you can take out a loan against them (and kick the financial hardship can down the road until you have to repay it), or take an early withdrawal and pay a penalty fee for doing so.

Once you reach retirement age, though, do you still need that protection? You don’t need to take a loan against your retirement accounts; you can pull money from them with no penalty. Does it not, then, serve as an emergency fund itself?

Yes. You still want to avoid pulling from your long-term investments for a straightforward reason: growth.

You know by now that the point of long-term investing is to build up as much money as possible in your portfolio so that interest can compound. The more money you have, the more interest makes that money grow. The more interest makes money grow, the more money you have. It feeds back on itself.

When you pull money from your long-term investments, you lose that compounding growth. When you’re pulling out your income in retirement, the idea is for your investment to remain stable for as long as possible; you only pull from interest, so your core investment stays the same, and thus the interest stays the same.

The trouble happens in two ways.

- Firstly: tapping into the principal reduces the core amount of money that is earning interest. This reduces the amount of interest, further reducing your regular income. Tapping into your principal can start a dangerous loop, forcing you to reduce your investments until you eventually drain your account.

- Secondly: what happens if an economic downturn hits, as it did in 2008, or temporarily in 2020 due to Covid? Interest rates and growth plummeted during these periods. However, you need to keep paying your bills and cost of living. If you’re relying on your investments to pay your way, you have to tap into your principal. If you keep cash around, on the other hand, you can use these funds instead and ride out the financial hardship without worrying about making your investment position worse.

How Much Cash Should You Keep On Hand?

It’s impossible to give general numbers as to how much cash you should keep on hand in retirement. It all comes down to an examination of your expenses. Someone living in a home they own in a rural area in Tennessee will have significantly different costs from someone living in the Bay Area in a rented unit.

To calculate how much cash you should keep on hand, you first need to have a solid idea of your monthly expenses. Maybe you’re spending $3,000 per month on typical living expenses. Perhaps that number is closer to $10,000 for other people. Keep in mind that this number is likely to rise over time. The cost of living keeps going up in 2022, and everything from energy to food to medical care is most likely going to grow more costly.

The second thing you need to know is what other sources of income you may have. Even though you’re retired, you may have additional income streams.

Income can come in a few forms:

- If you’ve worked a career that has accrued a pension, that pension will pay out once you retire, with a fixed amount each year. Pensions are less common than they used to be, but they aren’t entirely gone quite yet.

- Social Security. As a government-managed and public program, social security is a basic income for anyone of retirement age. Some people don’t qualify for social security income – exceptions include a variety of relatively narrow categories of people – but it still provides a consistent, if low, income for most retirees. There’s some doubt whether social security will still be available in a few more decades, but if you’re retiring now, you should have it.

- Supplementary income. Many retirees pick up hobbies they can monetize (for example, selling handicrafts online) or pick up a part-time job to have both preoccupation and income. You should count this income as well.

Now that you know how much it costs to live and how much you’re pulling in from various non-investment sources of income, what category do you fall in?

- Under-covered. This scenario is by far the most common position. Your expenses are higher than your income. These expenses are paid with disbursements from your investments.

- Your income and expenses balance out, so you can leave your investments alone.

- Over-covered. You make more than enough from your non-investment sources; you don’t need to worry about running out of money right away.

Generally, it would help to calculate your necessary cash on hand based on the discrepancy between income and expenses.

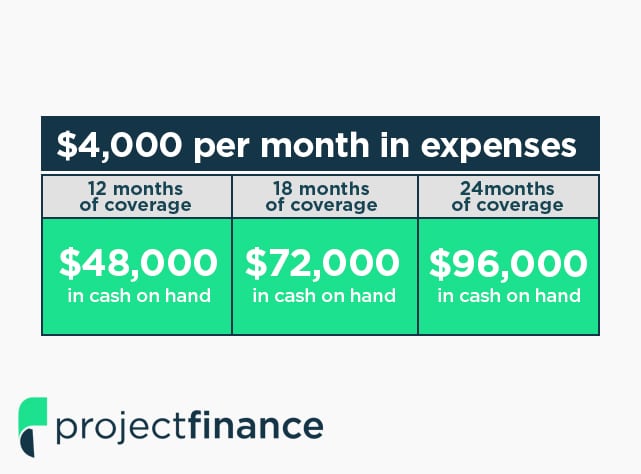

For example, suppose that your costs of living sum up to $7,500 per month. Your income covers a little under half of your expenses, leaving $4,000 per month to come from somewhere else, typically your investments.

Let’s say you have $2,000 per month in a pension, $1,000 per month in social security, and $500 per month in part-time income.

To calculate your emergency fund, decide how many months you want to be covered. Pre-retirement, the general recommendation is 6-12 months. In retirement, opinions differ. Some financial advisors say 12-18 months, while others say 24+ months.

Consider this: the larger your cash on hand, the more insulated you will be from economic hardship by adjusting your investments. The markets can take between 6 and 18 months (or sometimes longer) to recover from a downturn, so you want at least that much set aside to pay expenses to avoid tapping into your investments which you’d be selling for a low value.

Moreover, different investment portfolios may take more or less time to recover. An investment made of half stocks and half bonds, for example, can take up to 40 months to fully recover from a downturn.

In our example, with $4,000 per month in expenses not covered by a stable income, you would want:

- Twelve months of coverage, or $48,000 in cash on hand.

- Eighteen months of coverage, or $72,000 in cash on hand.

- Twenty-four months of coverage, or $96,000 in cash on hand.

So, somewhere between $50,000 and $100,000 is the right number in this hypothetical scenario. Your numbers will vary quite a bit depending on your unique living situation.

Just because you retired doesn’t mean you want to cash out all of your investments. Long-term investments can continue to grow as long as you have the luxury to let them. You never know how long you’re going to live after retirement or what unexpected expenses mar arise.

You want your investments to stay as large and as stable as possible for as long as possible and only tap into them in the case of an unavoidable emergency.

Remember, as well, that you may have other sources of funds in an emergency. You may be able to leverage a home equity line of credit, the funds in a Health Savings Account, or other credit lines if you need them before tapping into your retirement accounts.

Using Your Best Judgment

No one can predict what the markets will do. Over the long run, historically, they’ve gone up. Once you hit retirement age, you can no longer rely on long-term recovery from short-term downturns. To avoid financial hardship, it would help if you found the right balance of income and savings from various sources to insulate yourself from downturns.

Everyone’s financial situation is unique. The best you can do is create a plan based on what you know and make the best judgment about your future. It may be worth talking to a financial advisor directly, considering all of the unique factors in your life.

Are you close to retiring, or have you already retired? What is your primary intention for wanting to keep cash on hand? Do you have any questions for us on maintaining your retirement funds and maintaining an emergency cushion that you can access quickly? Please share with us in the comments section, and we’ll get back to you with a thoughtful answer to point you in the right direction!