Last updated on May 6th, 2022 , 03:48 am

What is a Poor Man's Covered Call?

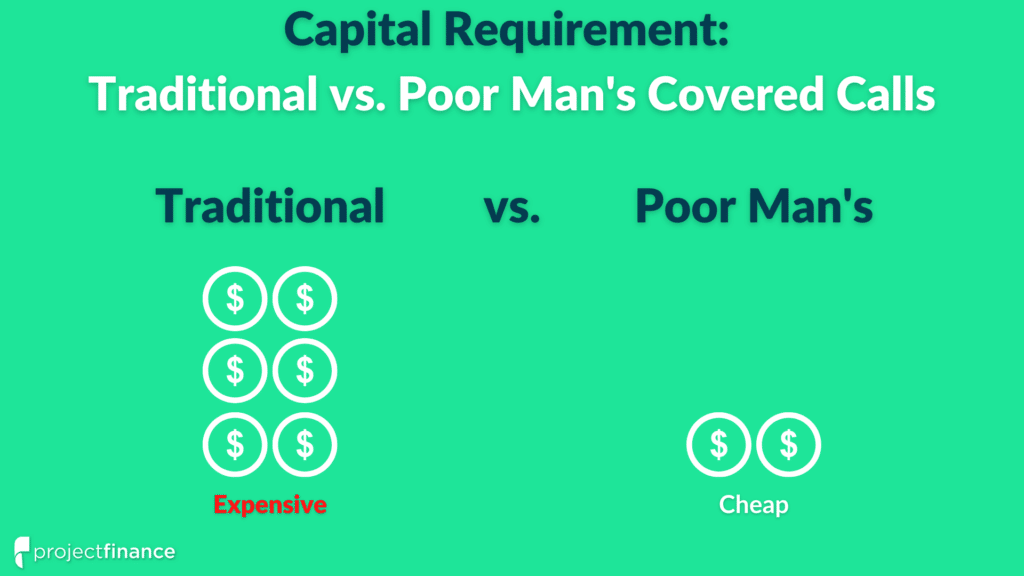

The poor man’s covered call (PMCC) is a bullish options strategy that is an alternative to the covered call strategy requiring significantly less capital to trade.

The PMCC strategy reduces the capital/margin requirement of a traditional covered call by replacing the long stock with an in-the-money call option purchase in a long-term expiration cycle.

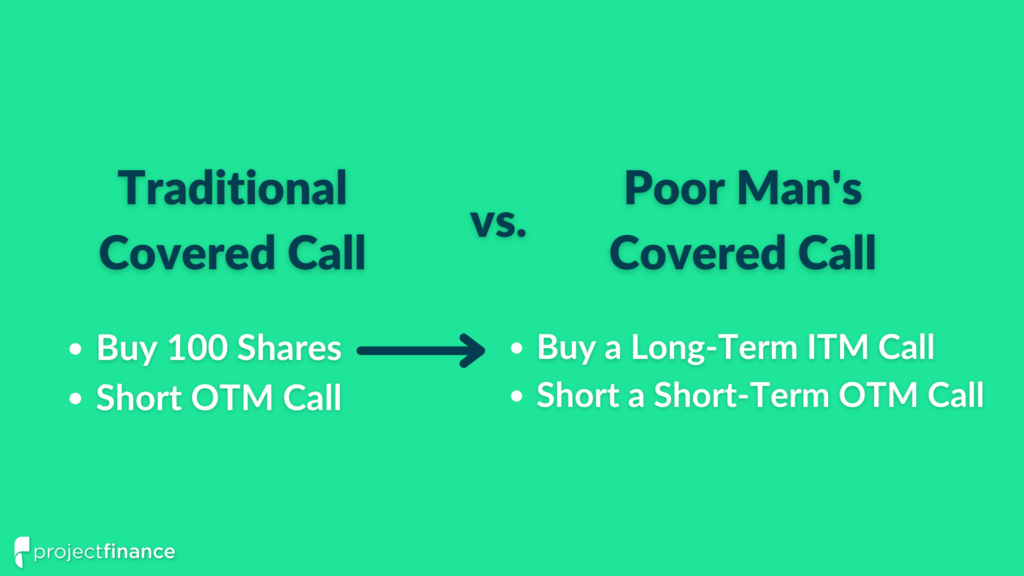

In a traditional covered call, an investor:

Buys 100 shares of stock

Shorts/writes an out-of-the-money (OTM) call option against the shares.

But buying 100 shares of stock requires significant investment.

In a PMCC, the 100 shares of long stock are replaced with an in-the-money long call in a longer-term expiration cycle than the short call.

Buying an in-the-money call option requires less capital than buying 100 shares of stock, reducing the margin requirement and maximum loss potential of the strategy.

The poor man’s covered call strategy allows options traders to gain similar exposure to a covered call at a fraction of the cost of a traditional covered call position.

The PMCC is technically a “diagonal debit spread,” which is a call spread with options in two different expirations instead of one expiration (which is the case for a vertical spread).

How to Set Up a Poor Man's Covered Call (Example)

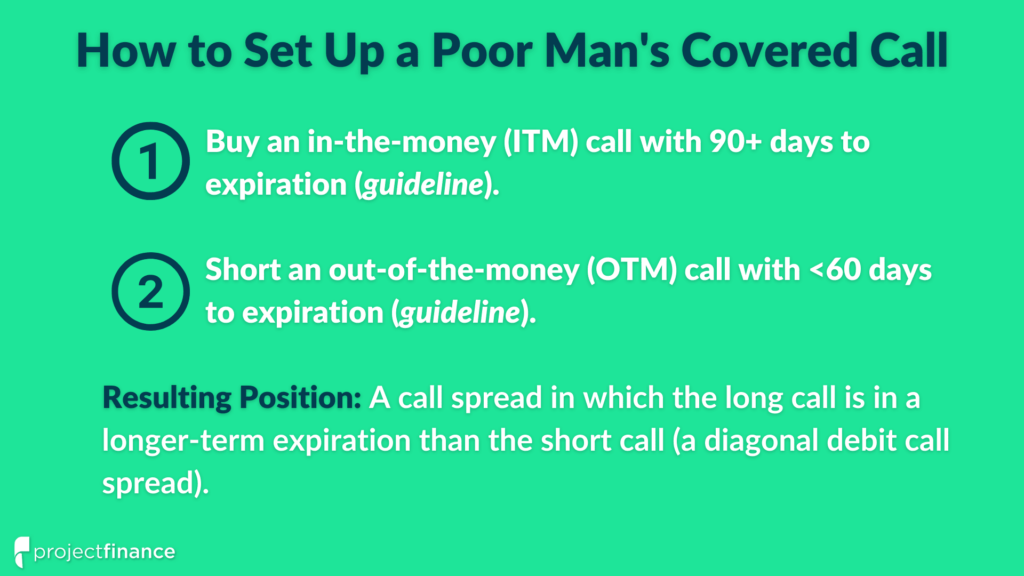

To set up a poor man’s covered call, a trader will:

Buy a deep in-the-money call option in a long-term expiration cycle (90+ days to expiration or DTE as a guideline).

Short an out-of-the-money call option in a near-term expiration cycle (fewer DTE than the long call).

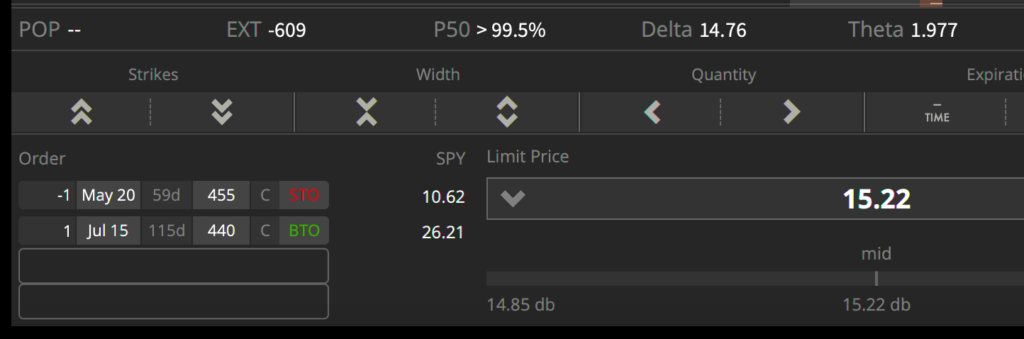

Let’s create a real PMCC using AAPL options.

Setting Up a PMCC in AAPL

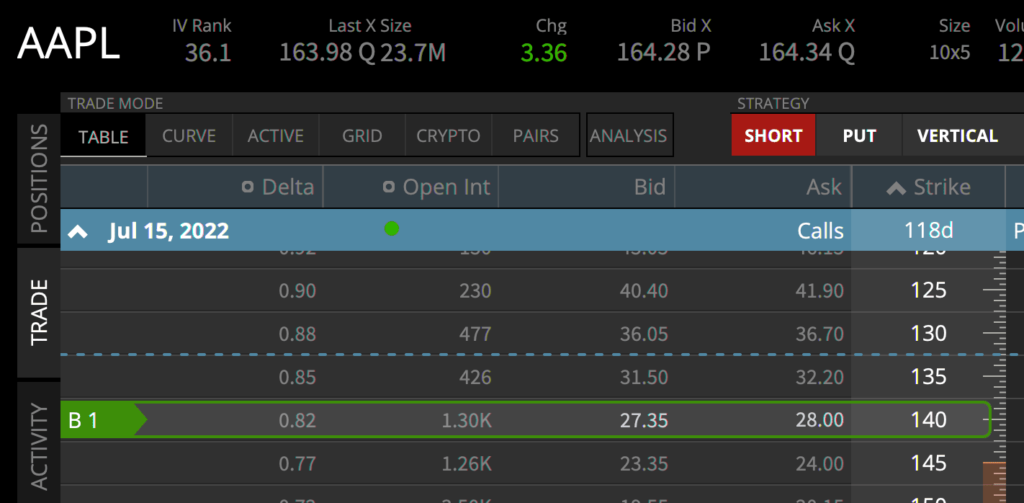

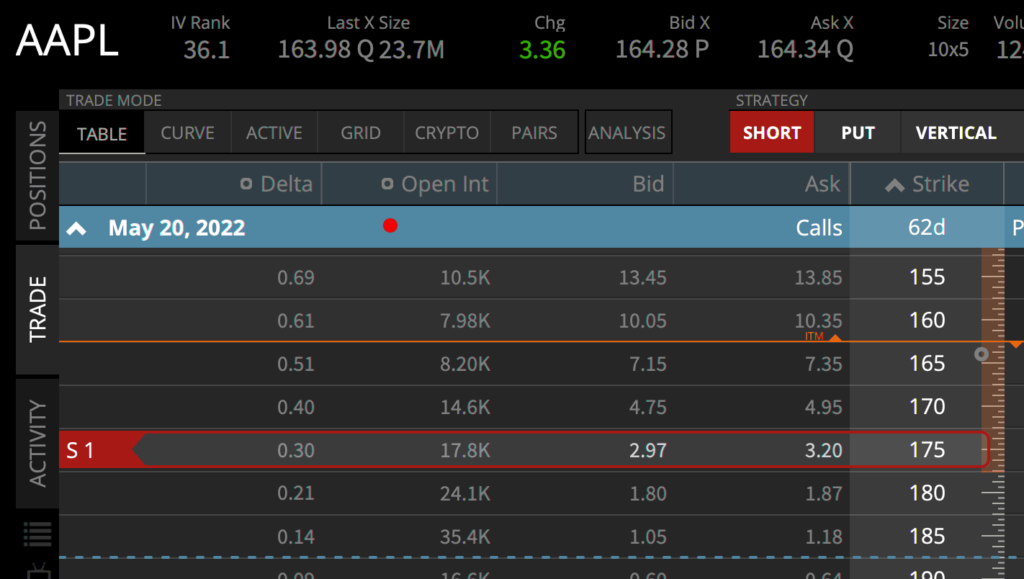

As of this writing, the current price of AAPL is $164.

To set up a PMCC, a trader could:

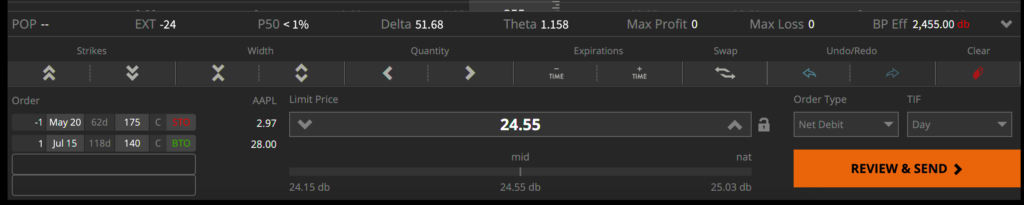

1) Buy the 140 call option in the July 2022 expiration cycle (118 DTE), paying $27.65 for the option (capital outflow of $2,765).

2) Short the 175 call option in the May 2022 expiration cycle (62 DTE), receiving $3.10 for the option (capital inflow of $310).

Poor Man’s CC Trade Cost => $2,455 ($2,765 outflow – $310 inflow).

If we constructed a normal covered call, we’d need to buy 100 shares of AAPL at $164 (paying $16,400 if no margin is used) instead of buying the July 2022 call.

Traditional CC Trade Cost => $16,090 ($16,400 outflow – $310 inflow).

The significantly lower capital requirement relative to a normal CC is where the poor man’s covered call gets its name.

The above images were taken on tastyworks, our preferred options trading brokerage.

Max Profit Potential

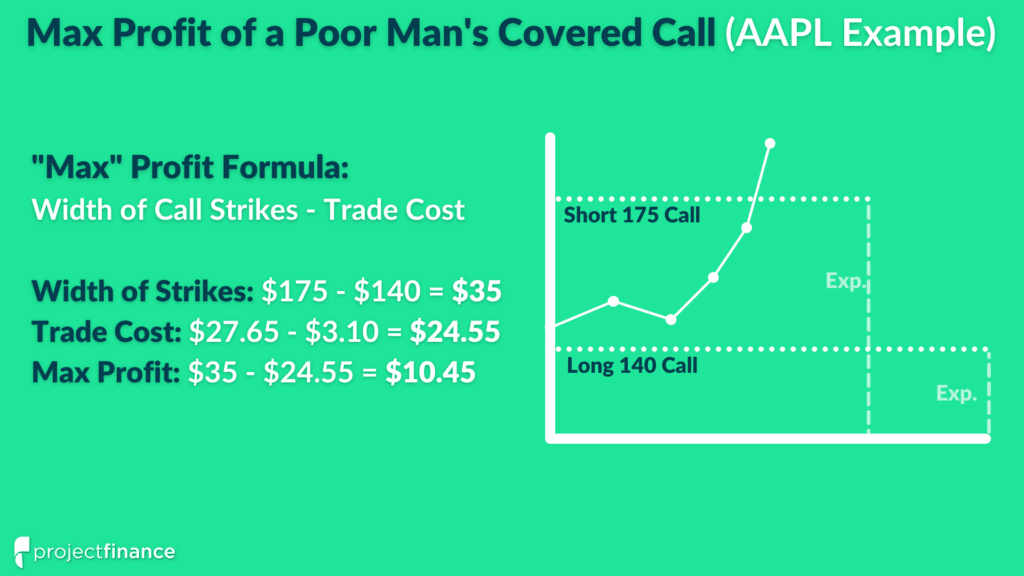

The “simple” maximum profit calculation of a poor man’s covered call is the same formula as a bull call spread’s max profit:

Max Profit: Width of Call Strikes – Trade Cost

In an exaggerated scenario, if AAPL shot up to $300/share shortly after trade entry, both calls would be deep ITM and would consist mostly of intrinsic value.

The 140 call would have $160 of intrinsic value and the short 175 call would have $125 of intrinsic value. The position’s price would be $35 if both options had no extrinsic value, and the trade’s profit would be $10.45 (trade price increases to $35 from a trade cost of $24.55).

But because the strategy consists of two options with varying expiration dates, the true maximum profit potential depends on how the position is managed.

In a PMCC, the short call expires sooner than the long call. If the PMCC trader allowed the short call to expire OTM and continued holding the long call, they would be left holding a naked long call and therefore have unlimited profit potential.

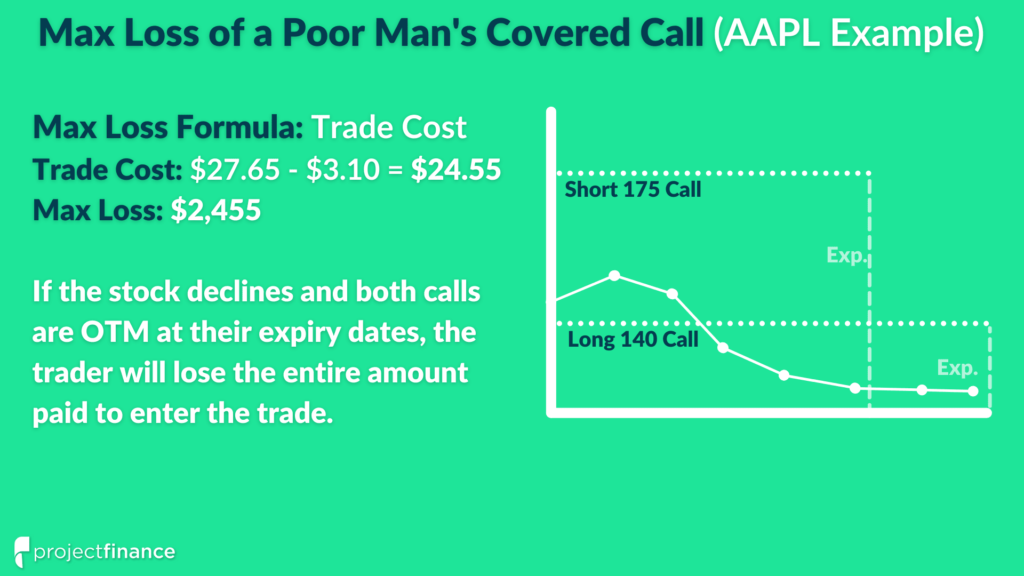

Max Loss Potential

The maximum loss potential of a poor man’s covered call is the cost to enter the trade.

In the above AAPL example, the total trade cost was $24.55 (a capital outlay of $2,455).

Therefore, the maximum loss of that position would be $2,455.

If AAPL’s share price remained below the call strikes of 140 and 175 through both expiry dates, both options would expire worthless and the trader would experience the following profits and losses on each leg of the trade:

Profit of $310 on the short 175 call

Loss of $2,765 on the long 140 call

Total Loss => $2,455 (initial trade cost)

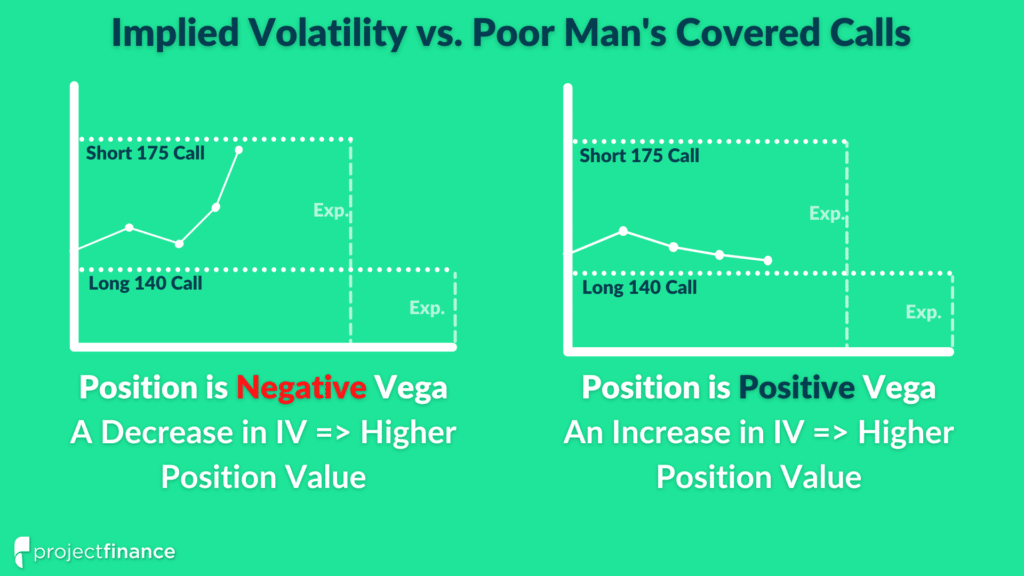

Implied Volatility vs. Poor Man's Covered Calls

What’s the ideal change in implied volatility (IV) when trading PMCCs?

The visual below describes the favorable changes in IV when trading PMCCs:

If the underlying stock price moves to or above the short call’s strike price, you want IV to fall.

Why? A decrease in IV is synonymous with a decrease in extrinsic value.

If the stock price rises to the short call strike, the long call will have mostly intrinsic value and little extrinsic value.

A decrease in IV will increase the trade’s profits driven by a drop in the short call’s value that exceeds a minuscule (or no) drop in the long call’s value, as intrinsic value is immune to changes in IV.

If the underlying stock price moves to or below the long call’s strike price, you want IV to increase.

Why? An increase in IV is synonymous with an increase in extrinsic value.

If the stock price falls to the long call strike, the long call and short call will be 100% extrinsic value.

An increase in IV will increase the trade’s price (reducing your loss) driven by an increase in the long call’s value that exceeds the increase in the short call’s value.

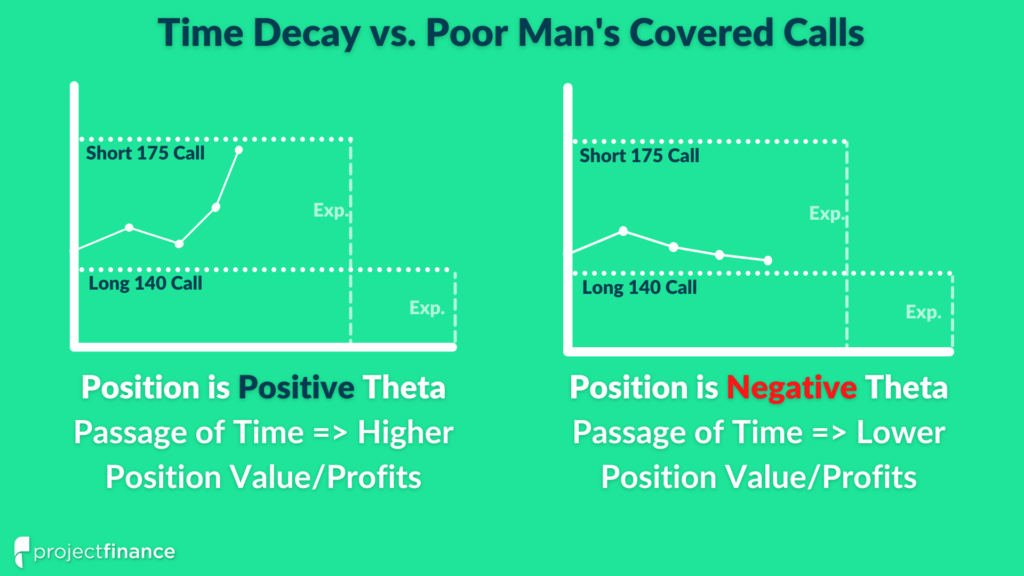

Time Decay vs. Poor Man's Covered Calls

Is time decay good or bad for poor man’s covered call positions?

The visual below describes how the position’s theta will change depending on where the stock price is relative to the call strikes:

If the stock price declines to the long call strike, the passage of time will drive losses in the trade (the position will have negative theta).

In this situation, both calls in the trade will consist of mostly or all extrinsic value.

The long call will be notably more valuable than the short call, meaning the long call will lose more value than the short call as time passes (negative theta).

If the stock price increases to the short call strike, the passage of time will drive profits in the trade (the position will have positive theta).

In this situation, the long call will have mostly intrinsic value and little extrinsic value, while the short call will have mostly (or all) extrinsic value.

Since intrinsic value does not decay, owning a deep ITM call with little extrinsic value and having a short ATM/OTM call with purely extrinsic value results in positive theta (profits from time passing).

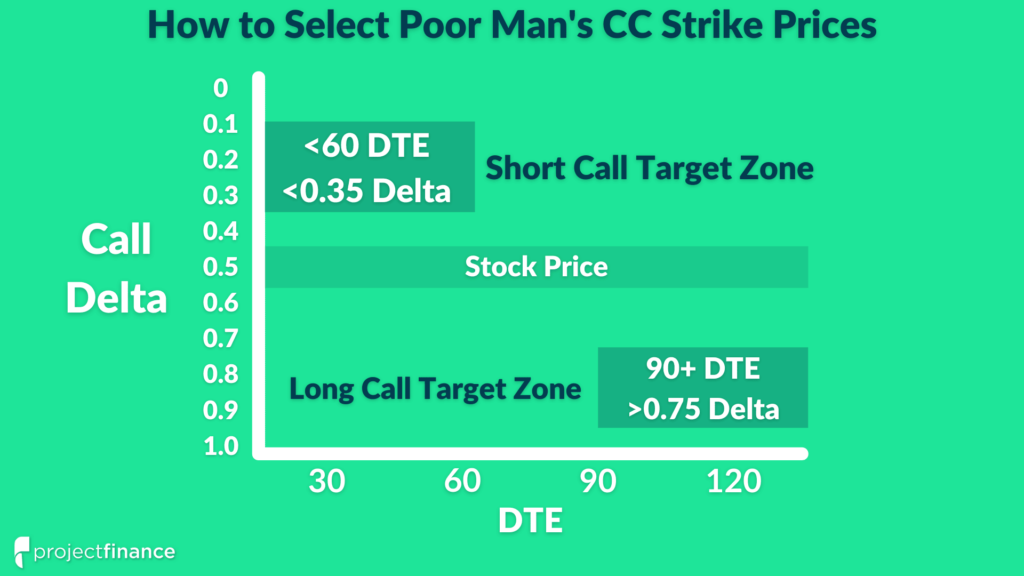

How to Choose Strike Prices

Selecting strike prices can be an overwhelming process for beginner traders because there are so many options to choose from on the options chain.

Here are some rough guidelines that will help you choose call strikes for your PMCC trades:

1) Buy a call with a delta over 0.75 (a “deep” ITM call) with 90+ DTE.

2) Short a call with a delta below 0.35 (an OTM call) with <60 DTE.

Again, these are rough guidelines that can be adjusted in your specific trades. Don’t interpret the above guidelines as hard rules.

Here’s a visual representation of the target strike prices and days to expiration:

Let’s talk about why these guidelines are helpful.

Guideline #1: Buying a Deep ITM Call With 90+ DTE

Buying a deep ITM call results in owning an option with lots of intrinsic value and little extrinsic value.

Options lose extrinsic value as time passes, which is referred to as “time decay.” Intrinsic value does not decay.

As the owner of the option, we don’t want the option to lose value over time, which means buying an option with mostly intrinsic value won’t experience much time decay.

Compared to an at-the-money (ATM) or OTM call, an ITM call will have a lower theta value, indicating a lower amount of time decay with each passing day.

Longer-term options also have lower theta values than shorter-term options, further protecting us from time decay.

Lastly, by purchasing a call with a delta of 0.75 or higher, the call’s price will change similarly to owning 100 shares, helping us replicate a covered call without an actual long stock position.

Guideline #2: Short an OTM Call With <60 DTE

Shorting an OTM call results in betting against an option with 100% extrinsic value.

Short option traders profit when the option value falls, benefiting from time decay.

An OTM option’s price will fall to zero if it is still OTM at its expiration date.

Shorter-term options decay faster than longer-term options, which is why a shorter-term expiration cycle is used for the short option in a PMCC position.

A call with a delta of <0.35 will have a strike price decently higher than the share price, allowing for more upside profit potential compared to shorting a call that’s closer to the stock price.

Be Careful of the Entry Cost

It is essential that the entry cost is notably less than the width of the strikes.

Otherwise, the position’s max profit potential will be minuscule (or negative).

tastytrade’s guideline is that the trade cost is less than 75% of the width of the strikes. I agree with this guideline.

In our earlier AAPL example, the width of the strikes was $35 and the trade cost was $24.55 (70% the width of the strikes).

The guideline is important because, should the stock price surge, the position’s price will trend towards the width of the strikes.

Because we are trading two options in different expiration cycles, it’s possible to pay more than the width of the strikes:

How to Manage a Poor Man's Covered Call

If the short call remains OTM as time passes/expiration nears, the trader can buy back the call for a profit and short a new call in the next expiration cycle to collect more premium and continue the strategy.

Eventually, the trader will need to close/roll the ITM call once it gets close to expiration, but the longer-term call won’t need to be managed as frequently as the shorter-term short calls.

If the stock price surges and both calls are ITM, the trader needs to decide if they want to continue the strategy.

In the case of the stock price being above the short call’s strike, the passage of time will continue to drive profits in the trade.

Once the short call’s extrinsic value drops close to zero, the position will be at its maximum profit potential with the current setup. The trader can then close the entire trade.

How to Close a Poor Man's Covered Call

To close a PMCC position, buy back (cover) the short call and sell the long call. Sell what you own and buy what you’re short.

In our previous example of entering a PMCC in AAPL by purchasing the JUL 140 call and shorting the MAY 175 call, a trader can close the position by:

Selling the long JUL 140 call

Buying/covering the short MAY 175 call

You can complete these transactions with one order.

If you decide to “unwind” the position with separate orders, start by buying back the short call, then sell the long call.

Early Assignment Risk When Trading PMCCs

Is there early assignment risk when trading PMCCs?

Yes, because there is a short option component in the position.

If the stock price moves above the short call’s strike price, the trader may get assigned short stock if a counterparty trader exercises the call option.

But don’t worry! Assignment risk is low unless the short call is ITM with close to zero extrinsic value, which happens when:

The short call option has little time to expiration, and/or:

The short call option is deep ITM.

The further ITM a call option is, the less extrinsic value it will have.

The less time to expiration an option has, the less extrinsic value it will have.

So if you’re trading a PMCC and the short call is ITM with multiple dollars of extrinsic value, you do not need to worry about early assignment risk.

The only other thing to watch out for is if the stock has an upcoming dividend payment. In that situation, any ITM short calls with extrinsic value less than the amount of the dividend are at risk of early assignment.

Tax Implications When Trading PMCCs

There are tax considerations that options traders need to be mindful of when trading poor man’s covered calls.

In a traditional covered call, the trader will own 100 shares of stock, which have no expiration date and can be held forever. Once the shares are held for more than one year, any gains on the shares will be taxed at the long-term capital gains rate.

In a poor man’s covered call, the trader uses an ITM call option instead of stock, forcing the trader to sell/roll the long call once it reaches expiration.

If the trader bought a call with 120 DTE, they would need to sell the call before expiration and buy a new ITM call to continue the trading strategy.

Consequently, any gains on the initial call would be taxed at the trader’s short-term capital gains rate because they held the option for less than one year.

Conclusion

The poor man’s covered call is becoming a popular options strategy for those with limited capital.

The strategy significantly reduces the capital requirement (and max loss) of a traditional covered call by replacing long stock with a deep ITM call option. The lower buying power requirement also boosts the potential return on capital.

However, it is much easier to lose 100% of your investment with a PMCC compared to a traditional CC, making it a more aggressively bullish strategy.

Compared to a traditional covered call, a PMCC will require more active management as the strategy is composed purely of options contracts.

There are also greater tax implications when trading PMCCs because each trade component will typically be held for less than one year, pushing all gains into short-term capital gains taxation.

But for those interested in gaining exposure to covered calls with less money, the poor man’s covered call is an option (pun intended).

*Before trading options, traders should read the Characteristics and Risks of Standardized Options, or the Options Disclosure Document (ODD).*

Next Lesson