Last updated on April 27th, 2022 , 07:44 am

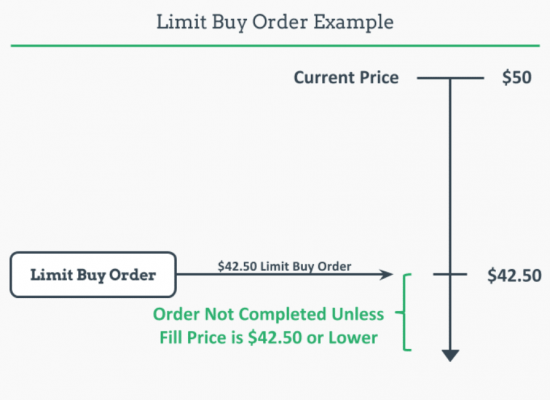

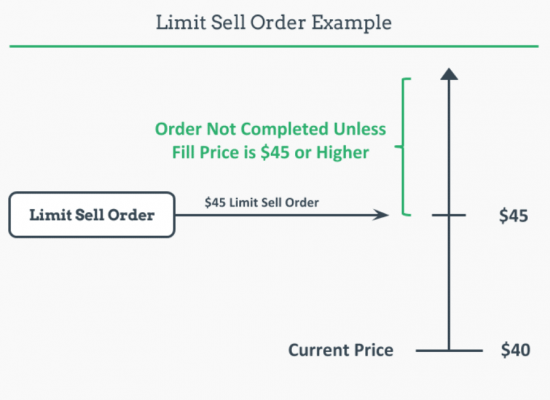

Option Limit Order Definition: In options trading, a limit order is placed by a trader to either buy or sell an option. This order type instructs the market makers that a customer is only willing to accept a fill at or better than the limit price specified.

In options trading, there is only way smart order type used to enter and exit trades: the limit order.

Why?

Unlike other order types (stop-loss, trailing stop-loss, and market order), the limit order guarantees you will get filled at or better than the limit price you set.

Are there downsides to using limit orders? Of course! But at the end of the day, this is the only order type I have ever used when trading options.

Let’s go in-depth to see why.

TAKEAWAYS

- A limit order placed on an option (or stock) will always get filled at or better than the limit price set.

- For buy limit orders, you will get filled at or below your set limit order.

- For sell limit orders, you will get filled at or above your set limit order.

- Unlike like market and stop-loss orders, limit orders do not guarantee you will get filled.

- Limit orders are generally used to enter trades and lock in a profit target.

- The “stop-limit” order combines the stop and limit order and is a smart way to target a downside exit.

Limit Order in Options Explained

A limit order can be used in virtually any type of security. This includes stocks, futures, and cryptocurrencies. This article, however, is going to focus on limit orders in options trading.

So why are limit orders so important in options? It’s all about liquidity.

Liquidity in Options Trading

Options markets are notoriously illiquid. Why is this? There are too many of them!

If you wanted to trade the SPY ETF, liquidity would not be a problem. But there are thousands of different options on SPY! Fewer market participants mean lower open interest/volume and a wider bid-ask spread.

It is because of this “Market” and “Stop-loss” orders (which are essentially the same) are dangerous.

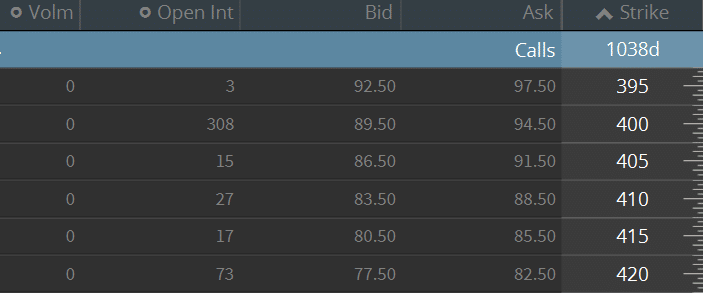

Take a look at the below image from the tastyworks platform, which shows the current market for SPY LEAP (long-term) call options.

SPY Call Options

Let’s look at the 400 call option here. Notice the huge spreads and the low volume/open interest?

The current bid price is 89.50 while the current ask price is 94.50.

If we used a market order to buy this option, we may very well get filled at 94.50. If we wanted to turn around and sell that option immediately, a market order may fill us at the bid of 89.50.

➥ 94.50 – 89.50 = 5

That means right off the bat we’re starting with a $500 loss!

Now if we used a limit order instead to buy that option at the mid-point (92), we’d be much better off. Sure we may not get filled, but that’s better than losing $500 dollars!

Option Buy Limit Order Example

There are two primary reasons why a trader would use the buy limit order:

- Enter an initial trade.

- Place a profit target for a short option(s).

Buy Limit to Enter an Option Trade

As we learned in the SPY example above, the limit order is the best (and perhaps only) way to enter option positions. The buy limit applies to all options strategies, not just single options.

You can use a limit order to enter vertical spreads, iron condors, butterflies and virtually any other type of option spread.

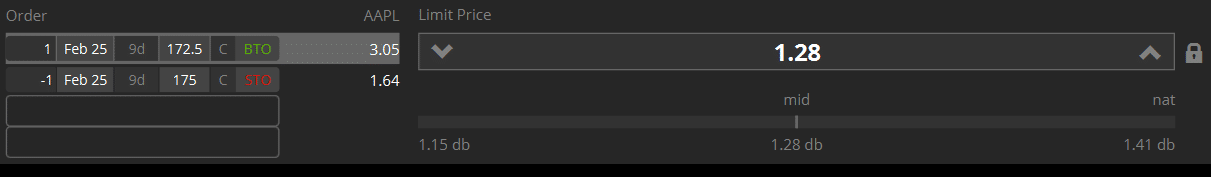

Let’s take a look at a buy limit on an Apple (AAPL) spread in tastyworks:

Spread details:

- Bid Price: 1.15

- Ask Price: 1.41

- Mid Price: 1.28

The above limit order is set up to buy at the mid-price of 1.28. Always try the mid-price first! I get filled at the mid-point about half of the time. You can always work the trade up in nickel intervals if you don’t get filled immediately.

Since we are using a limit order to buy, we know we will never get filled at a price worse than our upper debit limit.

Buy Limit to Exit an Option Trade

If you sell an option(s), it is wise to have a profit-taking buy-limit order in place.

Let’s say we are short a put option on Google (GOOGL) and want to buy back that short put option if it falls to a certain price. Here are the details of our open trade.

➥ Short GOOGL 2500 Put @ $3

If we wanted to buy back this put option when it falls to $1 in value (locking in a profit of $2) we would place a buy limit order on the option at $1.

It’s that simple!

Option Sell Limit Order Example

Just as with buy limit order, the sell limit order is mostly used in two scenarios:

- Enter an initial short trade.

- Place a profit target for a long option(s).

Sell Limit to Enter an Option Trade

Just as with stocks, you can both buy and sell options. When you are selling an option(s) to open, you want to receive as much credit as possible for that call or put (or spread).

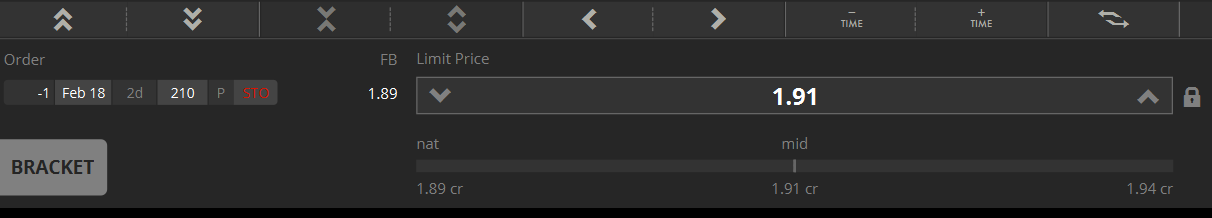

Let’s say we want to sell a call on Meta Platforms Inc (FB) at the 210 strike price.

- Bid Price: 1.89

- Ask Price: 1.94

- Mid Price: 1.91

A limit order in this scenario would afford us the opportunity to possibly get filled better than the bid price of 1.89. Here, that mid-price is ≈ 1.91

Sell Limit to Exit an Option Trade

Limit orders are used mostly for this purpose.

If you buy an option(s), it is wise to have a profit-taking strategy in place. This can be accomplished by placing a Good Til Canceled (GTC) sell limit order. Let’s say we are long a call option in the QQQs:

➥ Long QQQ 350 Call @ $5

Let’s also assume we want to take a profit when that option rises to $7 in value.

Instead of watching that option every moment of every day to reach that level, we can simply put a GTC sell limit order in at $7.

If the option trades at or above that price we will (mostly likely) get filled.

Pros and Cons of Limit Orders in Options

There are more pros than cons in limit orders – remember that. Professional traders rarely use stop-loss or market orders on derivatives. It is often throwing money away. With that in mind, here are some advantages and disadvantages of the limit order.

👍 Limit Order Pros

- Guarantees fill price.

- Traders are not required to monitor positions.

- Protects against illiquid option markets.

👎 Limit Order Cons

- Fills are not guaranteed in limit orders; if the market doesn’t trade there, limit orders will not get filled

TIF Order Types

In limit orders, you also need to consider the TIF designation. TIF (time-in-force) orders can be designated in numerous different ways. These communicate to a broker when and for how long a trade should remain working. Some of these include DAY, GTC, GTD, EXT, GTC-EXT, MOC, LOC. Read more about these order types in our article on TIF order types here!

Option Limit Order FAQ's

Limit orders are visible to market makers. This is unlike stop-loss orders, which brokers hold until the price is breached, at which point the order gets sent to the exchanges/marker makers.

With a limit order, you will only ever get filled at your limit price or better. With a stop-loss order, fill price is unknown.

A stop-loss order is simply a market order waiting to get triggered. See above for the differences.

This depends on whether or not you have the limit order tagged as “DAY” or “GTC”.

DAY orders are only good for the day, GTC (Good Til Cancelled) orders stay working in your account until you cancel them.