Last updated on March 25th, 2022 , 09:01 am

The covered put writing options strategy consists of selling a put option against at least 100 shares of short stock.

By itself, selling a put option is a highly risky strategy with significant loss potential. However, when combined with a short stock position of 100 shares, selling a put option adds no additional risk, and creates a way to profit when the share price remains flat or even increases slightly.

Additionally, the credit received from the put option provides protection against increases in the stock price. The true “cost” of selling a put against short stock is that the potential profits of the short shares will be capped below the strike price of the put that is sold.

Covered Put Strategy – General Characteristics

Let’s go over the strategy’s general characteristics:

Max Profit Potential: (Share Sale Price + Credit Received for Put – Short Put Strike) x 100

Max Loss Potential: Unlimited

Expiration Breakeven: Share Sale Price + Credit Received for Put

Approximate Probability of Profit: Greater Than 50% (assuming the stock and put are sold at the same time)

To gain a better understanding of these concepts, let’s walk through a hypothetical trade example.

Profit/Loss Potential at Expiration

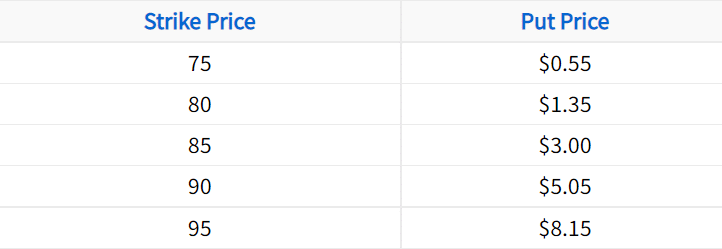

In the following example, we’ll construct a covered put position from the following options chain:

In this example, let’s assume that we sell the 85 put for $3.00, and that the stock is trading for $90 when we short the shares:

Share Sale Price: $90

Put Strike Sold: $85

Premium Collected for the 85 Put: $3.00

Here are this particular position’s characteristics:

Max Profit Potential: ($90 share sale price + $3 premium received – $85 short put strike) x 100 = $800

Max Loss Potential: Unlimited

Expiration Breakeven Price: $90 share sale price + $3 credit received = $93

Probability of Profit: Greater than 50% because the stock price can increase $3 and the position can break even (no loss).

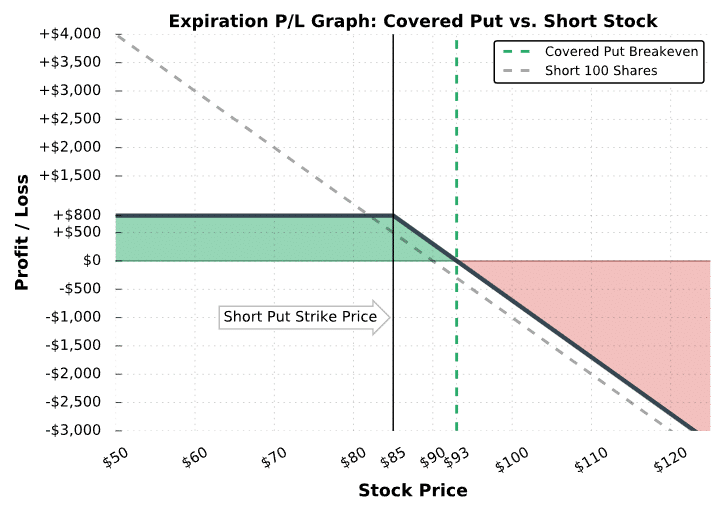

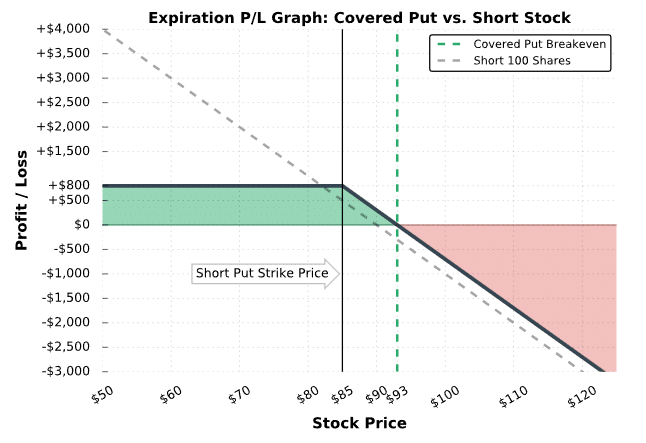

The chart below visualizes this position’s profit and loss potential based on various stock prices at expiration:

As you can see, selling 100 shares of stock at $90 and selling the 85 put for $3 reduces the risk of the position compared to just shorting stock. Since premium is collected for selling the put, the sale price of the shares is effectively increased by the sale price of the put. Therefore, the breakeven price of a covered put position is the effective sale price of the shares. The benefit of a higher breakeven price comes at the cost of lower profit potential when the shares decrease.

In this graph, we’ve also added the profits and losses for a short stock position as a comparison. Compared to the short stock position, the covered put has less loss potential and more profit potential at most stock prices at expiration. However, if the stock price falls significantly below the short put strike, then the short stock position without a short put against it will produce more profits.

Because of this, a covered put writer is usually not extremely bearish on the stock price.

Nice job! You know the potential outcomes of a covered put position at expiration, but how does the position perform over time before expiration? To demonstrate this to you, we’re going to look at a few trade examples using real option data.

Covered Put Trade Examples

In the following examples, we’ll compare changes in the stock price to a covered put position on that stock. Note that we won’t discuss the specific stock the trade was on, as the same concepts apply to other stocks in the market. Lastly, each example uses a trade size of one covered put (-100 shares of stock against one short put).

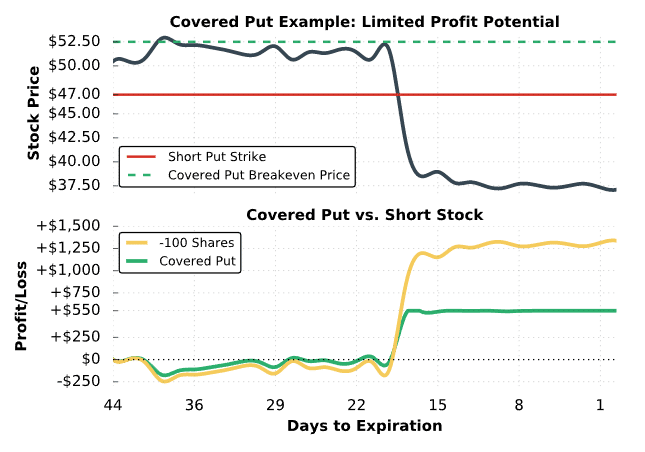

Trade Example #1: Maximum Profit Covered Put Position

First, let’s examine a situation where covered put writing is less lucrative than just shorting shares of stock.

Here are the trade details:

Initial Share Purchase Price: $50.47

Strike Price and Expiration: Short 47 put expiring in 44 days

47 Put Sale Price: $2.03

Breakeven Stock Price (Effective Share Sale Price): $50.47 share sale price + $2.03 credit received from put = $52.50

Maximum Profit Potential: ($52.50 effective share sale price – $47 short put strike) x 100 = $550

Maximum Loss Potential: Unlimited

Let’s see what happens!

As illustrated here, a covered put position has limited profit potential. In this example, the stock price collapses from $52.50 to $37.50, resulting in over $1,250 in profits for the short stock position. However, the covered put has a short 47 put, which caps the position’s profits at any stock price below $47. With an effective share sale price of $52.50 and a short put strike of $47, the maximum profit of this covered put position is $550.

Another important note about this particular trade is that the position does not need to be held to expiration to realize profits. In this example, maximum profit occurs with around 18 days to expiration. The trader could lock in profits at this point by simultaneously buying back the short shares and the short put, thereby closing the covered put position.

At expiration, the short put is in-the-money, which means the covered put trader would be assigned +100 shares of stock at the put’s strike price of $47. Since the trader is already short 100 shares of stock, the assignment effectively forces the trader out of their stock position. To avoid assignment, the trader could buy back the 47 put before expiration. However, keep in mind that it’s always possible to be assigned early on an in-the-money short put, especially when the put has little extrinsic value remaining.

Next, we’ll look at an example of when covered put writing works out much better than just shorting stock.

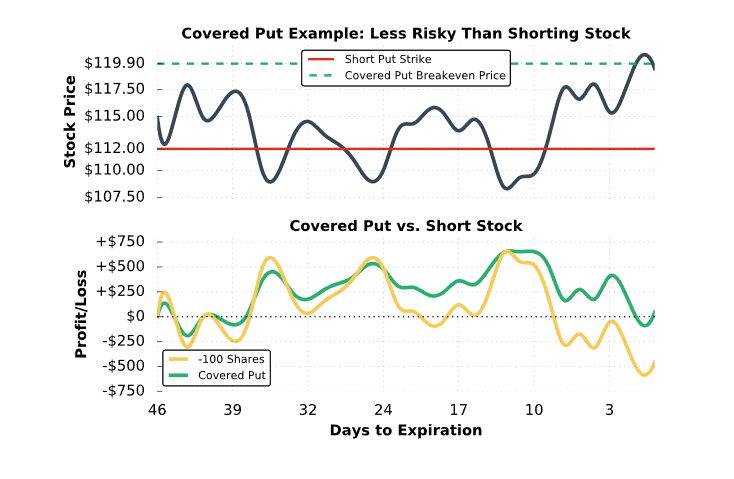

Trade Example #2: Covered Put Outperforms Short Stock

In the next example, we’ll look at a situation where the stock price increases slightly over a 46-day period after a covered put position is entered. We’ll compare the position’s performance to a short stock position.

Here are the trade details:

Initial Share Purchase Price: $114.88

Strike Price and Expiration: Short 112 put expiring in 46 days

112 Put Sale Price: $5.02

Breakeven Stock Price (Effective Share Sale Price): $114.88 share sale price + $5.02 credit received from put = $119.90

Maximum Profit Potential: ($119.90 effective share sale price – $112 short put strike) x 100 = $790

Maximum Loss Potential: Unlimited

Let’s see how the covered put performs!

In this example, you’ll notice that the covered put position performs better than the short stock position as long as the stock price doesn’t fall significantly. Most importantly, this covered put position doesn’t lose money even though the stock price increases from the short stock entry price because the profits from the short put offset the losses on the short shares.

As mentioned in the previous example, a covered put writer can buy back their position to lock in profits or losses before expiration. In this example, the trader had many opportunities to close the position for profits over $500, which represents nearly 66% of the maximum profit potential.

At expiration, the covered put writer doesn’t have to worry about assignment because the put is out-of-the-money. Additionally, the trader could sell another put in the following month to collect more premium and increase the breakeven price of their short stock position even further.

In the final example, we’ll look at a covered put position that realizes a significant loss.

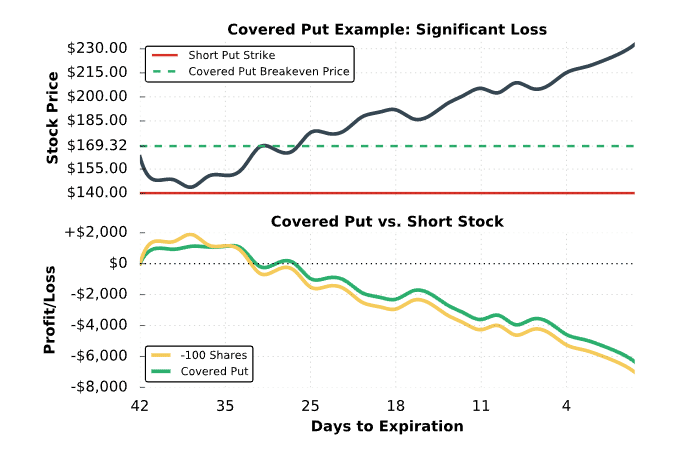

Trade Example #3: A Covered Put Gone Wrong!

In the final example, we’ll look at a scenario where a covered put position is unprofitable but better off than just shorting the stock.

Here are the trade details:

Initial Share Purchase Price: $162.60

Strike Price and Expiration: Short 140 put expiring in 42 days

140 Put Sale Price: $6.72

Breakeven Stock Price (Effective Share Sale Price): $162.60 share sale price + $6.72 credit received from put = $169.32

Maximum Profit Potential: ($169.32 effective share sale price – $140 short put strike) x 100 = $2,932

Maximum Loss Potential: Unlimited

Let’s see what happens!

As we can see here, the covered put position did not perform well because the stock price increased significantly above the breakeven price of the position. However, since the 140 put expired worthless, the covered put position was $672 better off than the short stock position by itself. Because of this, selling puts against short stock positions reduces the losses when the stock price rises.

At expiration, the covered put trader would not have to worry about assignment since the 140 put was out-of-the-money.

Congratulations! Hopefully, you are now much more comfortable with how covered put writing works! In the next section, we’ll discuss how to go about selecting which put to sell.

How to Select a Put Strike to Sell

At this point, you know how covered put writing works, as well as when you might use the strategy. However, with so many different put strikes available, how do you choose which one to sell? We’ve put together a simple guide that may help the strike price selection process easier.

Determine Your Outlook

Before selecting a put strike to sell, it’s crucial to determine an outlook for the shares of stock that you’re short.

Here is a quick guide that demonstrates how to select a put strike based on various outlooks.

Put Selling Guidelines Based on Various Stock Price Outlooks

Share price will increase significantly

With such a bullish outlook, shorting shares of stock or trading covered puts is probably not the right strategy in the first place. However, if you must trade a covered put, selling an at-the-money or even an in-the-money put option would provide the most upside protection.

Share price may remain relatively flat, or even decline slightly

With a neutral to bearish outlook, selling puts with strike prices closer to the stock price (-0.40 to -0.50 delta puts) may be logical. Selling at-the-money puts provides the greatest profit potential from the decay of the put’s extrinsic value, as well as the most protection from share price increases.

Share price will fall significantly

With such a bearish outlook, selling puts against a short stock position may not be logical since the profit potential will be capped. However, if you insist on trading a covered put, then selling a put with a lower probability of expiring in-the-money (-0.15 to -0.25 delta) may be logical.

The sections above serve as a guideline for selecting a put to sell. When trading covered puts, there isn’t a “one-size-fits-all” approach. The put that is sold depends on the investor’s outlook for the stock price in the future.