Last updated on April 25th, 2022 , 06:04 am

Option Buying Power Definition: The total amount of funds currently available to trade options with.

When trading stocks, options, or futures, you have to have the appropriate amount of cash available in your account to open a position.

The term “Buying Power” refers to the amount of money in your account that is readily available to allocate to new positions.

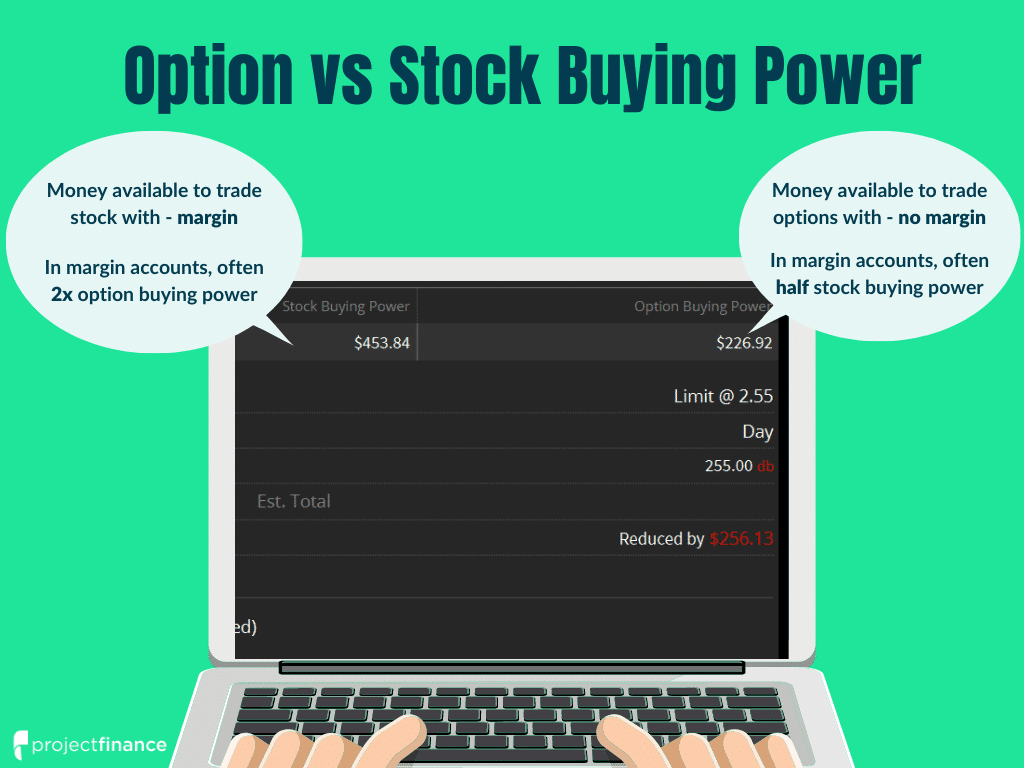

Stock buying power and option buying power differ, so let’s start with stock buying power.

Stock Buying Power

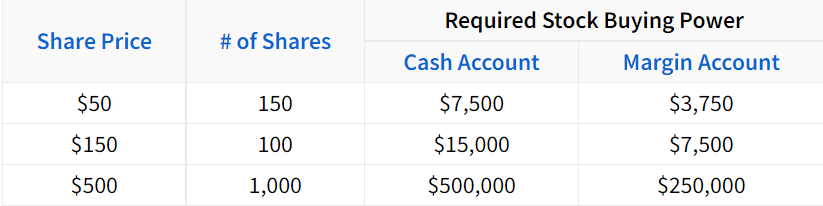

Depending on the type of account you have, your stock and option buying power may differ. For margin accounts, the margin requirements to trade stock is less than that of options.

If you have a standard margin account, your stock buying power will typically be 2x the amount of cash you have available in your account, as margin accounts have the ability to buy shares of stock with 50% of the position’s notional value (resulting in 2:1 leverage).

As an example, if you want to buy 100 shares of a $200 stock, the notional value is $20,000 ($200 per share x 100 shares = $20,000 value). In a cash account, you’d need $20,000 of available buying power to purchase those shares.

However, in a margin account with 2:1 margin capabilities, you’d only need $10,000 of available stock buying power to purchase $20,000 worth of stocks.

Here’s a table that quickly demonstrates the required stock buying power for certain stock purchases based on the account type:

In some margin trading accounts, the stock buying power can reach 4x the available cash in the account for intraday stock trading. As a result, traders can reach 4:1 leverage for stock trades that are opened and closed within a single trading day.

Care to watch the video instead? Check it out below!

Option Buying Power

Unlike stock buying power, options cannot be purchased on margin. As a result, option buying power is equal to the amount of cash in your account that is readily available to allocate to option positions.

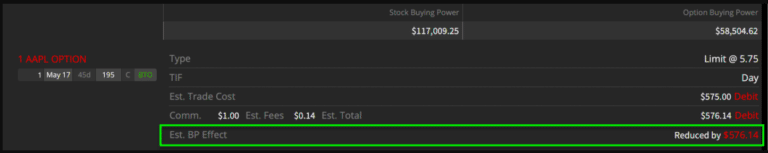

For example, let’s look at the “buying power effect” of buying to open an AAPL call option that’s trading for $5.75:

Software Used: tastyworks Trading Platform

As we can see, the buying power effect is “reduced by $576.14”, which means purchasing the AAPL call option for $5.75 reduces our available buying power by $576.14.

Why $576.14? Well, a $5.75 equity option is worth $575 in dollar terms ($5.75 Option Price x Standard Option Contract Multiplier of 100 = $575). The additional $1.14 in this case comes from the commission cost of entering the position.

When you purchase an option, the most you can lose is the value of that option (Option Price x Option Contract Multiplier). So, you’ll always have to have enough cash in your account to cover the entire cost of an option position.

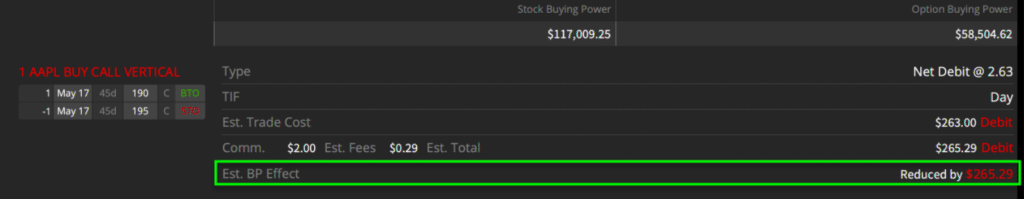

The same is true for option spreads you purchase. Here’s an AAPL put debit spread:

Software Used: tastyworks Trading Platform

The net cost of the spread is $2.63 ($263 in actual value), plus $2.29 in commissions. As a result, $265.29 in option buying power is required to purchase this put spread.

Option Buying Power Required to Sell Spreads

You know that to buy an option you need to have enough available cash in your account to cover the maximum loss and commissions associated with an option purchase. How much do you need in your account to sell options?

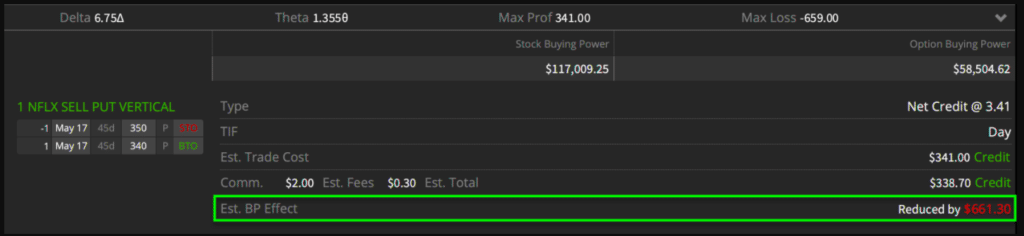

When it comes to limited risk spreads, you’ll need option buying power equal to the maximum loss of the spread, plus commissions. Here’s an example of the buying power required to sell a put spread in NFLX:

(Hint! Click to enlarge)

Software Used: tastyworks Trading Platform

In this example, we’re selling a $10-wide put spread for $3.41, which means the maximum loss on the spread is $659 ($3.41 Entry Credit – $10 Maximum Spread Value = -$6.59 x 100 = -$659). With $2.30 in commission costs, we’d need $661.30 in option buying power to sell this put spread.

Pretty simple!

Option Buying Power: Selling Naked Options

What about option positions with “unlimited” loss potential?

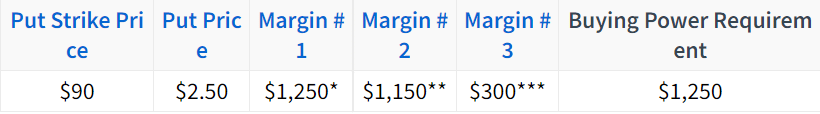

For option positions with substantial loss potential (short calls, short puts), the buying power requirement is commonly calculated as the greatest value of three calculations:

Calculation #1: 20% of the current stock price – the out-of-the-money amount + current value of the short option.

Calculation #2 (Call Options): 10% of the stock price + current value of call option.

Calculation #2 (Put Options): 10% of the strike price + current value of put option.

Calculation #3: $50 per option contract + current value of option.

As an example, here’s the estimated option buying power requirement for a put option on a $100 stock

*[($100 x 20%) – $10 OTM + $2.50] x 100

**[($90 x 10%) + $2.50] x 100

***$50 + ($2.50 x 100)

Based on the three margin values from the calculations, you would need $1,250 in option buying power to sell this particular put option.

Fortunately, you won’t have to ever make these calculations, as your brokerage firm will take care of the calculations for you!

Changes in Buying Power

For limited risk option positions (such as option spreads or outright option purchases), your buying power requirement will not change over the duration of the trade because the risk is always known.

However, for uncovered option positions (short calls and short puts), the buying power requirement will change as the stock price, option premium, and out-of-the-money amount change. As a result, it’s always a good idea to never “max out” your account’s option buying power, as an increase in the buying power requirement can lead to your brokerage firm forcing you out of positions if you can no longer meet the capital requirement.

Hopefully, this post has helped you learn about the required costs associated with opening new stock and option positions in your trading account (non-margin cash or regular margin).

Option Buying Power FAQs

In options trading, the buying power effect represents a transactions net effect on the future available funds to trade options. When you buy options, a debit is taken from your account (like stock). When you sell options, buying power is reduced because of the margin required to hold the trade.

Negative buying power implies you do not have adequate on-hand cash to hold all positions in your account. This may be indicative of a margin call. Best practice is to make cash available, or call your broker if the buying power calculation is faulty.

Stock typically takes 2 business days to settle; options usually take one business day to settle. After this time period, your buying power should free up.

What does “minimum equity requirement” mean?

Hi Toby!

Thanks for the question. Firms require their customers to have a certain amount of equity in their account before they allow them to trade on margin. In order to be a pattern day trader, an account must have total equity of 25k.