Last updated on April 25th, 2022 , 09:04 am

Credit Spread Definition: A credit spread is a derivative strategy that involves the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same underlying stock or ETF. In order to be a “credit” spread, the net position effect will be a credit. “Debit spreads” result in a net debit.

Credit spreads are very common among traders who trade options for income, as credit spread option strategies can profit in more than one way. Additionally, credit spreads have limited loss potential, which means losing trades won’t break the bank if sized properly.

Credit spreads profit from time decay or theta. Over time, options tend to go down in value. Being a net seller of options helps to capitalize on this.

In this post, we’ll cover our picks for the top 3 credit spread option strategies for generating income.

Care to watch the video instead? Check it out below!

Jump To

What is a Credit Spread?

Before getting to the strategies, let’s cover what a credit spread is.

A credit spread option strategy collects premium when the trade is entered. In other words, the options that are sold bring in more premium than what’s paid out for the options that are purchased.

For example, if we sell a put option for $3.00 and buy another put option at a different strike price for $2.00, we’ll be collecting $3.00 from the option we sold and paying out $2.00 for the option we bought.

The net result is that the trade is entered for a $1.00 “credit” since we’re collecting more premium than we’re paying out.

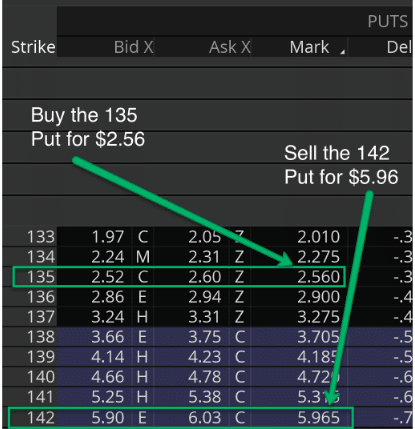

Let’s look at a real example of a put spread that is entered for a net credit:

In this example, if we sell the 142 put for $5.96 and buy the 135 put for $2.56, we collect a net credit of:

$5.96 Collected – $2.56 Paid = $3.40 Credit

The trade in this example is sometimes called a “put credit spread,” but is also referred to as a “short put spread” or “bull put spread.”

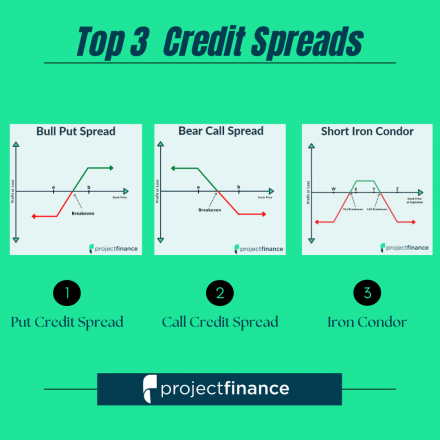

The Top 3 Credit Spread Option Strategies

Now that we’ve covered what a credit spread is, let’s get to the fun stuff!

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Option Strategy #1: Put Credit Spread

The first options strategy on our list is the put credit spread, which is constructed by selling a put option and purchasing another put option at a lower strike price. This strategy is both market neutral and bullish.

Both options for the put credit spread should use the same quantity and expiration cycle.

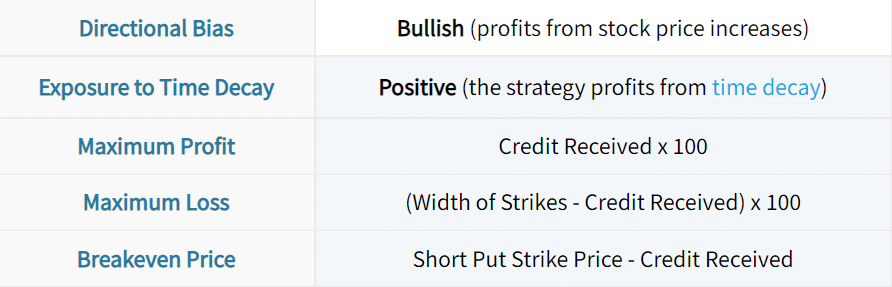

The following table summarizes the key characteristics of the put credit spread strategy:

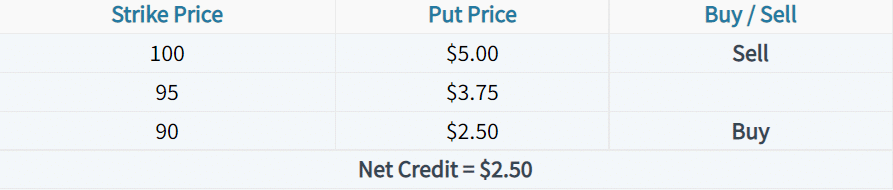

Consider the following trade example:

Here are the trade’s characteristics:

As long as the stock price remains above $97.50 as time passes, the position will start to see profits from the decay of the options in the spread. If the stock price is above $97.50 at the expiration date, the position will be profitable. If the stock price is above $100 at expiration, the profit will be $250 per put credit spread.

The worst-case scenario is that the stock plummets through the put spread. If the stock price is below the long put strike at expiration, the put credit spread will realize the maximum loss.

Put Credit Spread Example Trade

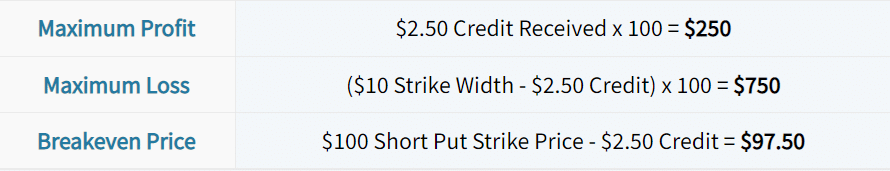

Let’s take a look at a put credit spread example trade so you can see how the strategy performs as the stock price changes. In this example, the 700 put is sold and the 640 put is purchased for a net premium of $18.05.

As a result, the maximum profit potential is $1,805 and the maximum loss potential is $4,195. Let’s see how the trade performed over time:

As we can see, the spread does well when the stock price rises or remains flat over time, and the spread loses money when the stock price falls quickly. In this case, the spread was maximally profitable at expiration, as both puts expired worthless.

So, the put credit spread is a great trade to use when you believe a stock will remain above a certain price, but you want limited loss potential if you’re wrong.

Option Strategy #2: Call Credit Spread

The second credit spread option strategy on our list is the call credit spread, which is constructed by selling a call option and purchasing another call option at a higher strike price. This strategy is both market neutral and bearish. Both options use the same quantity and expiration cycle.

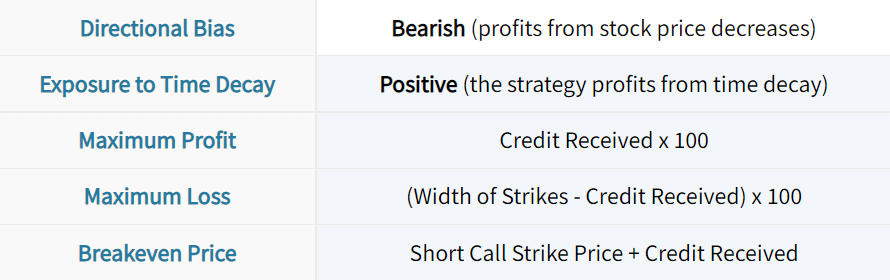

Here are the call credit spread’s trade characteristics:

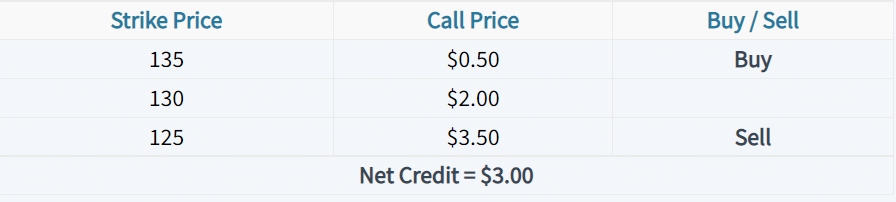

Let’s take a look at an example trade:

Here are the characteristics of this particular call credit spread:

In this case, the call credit spread will be profitable as long as the underlying asset (stock price) remains below the breakeven price of $128 as time passes. If the stock price is below $128 at expiration, the spread will be profitable. If the stock price is below $125 (the short call’s strike price) at expiration, the spread will expire worthless and the spread seller will keep all of the premium.

If the stock price rises substantially and is above the long call strike at expiration, the call credit spread will realize the maximum loss potential.

Call Credit Spread Example Trade

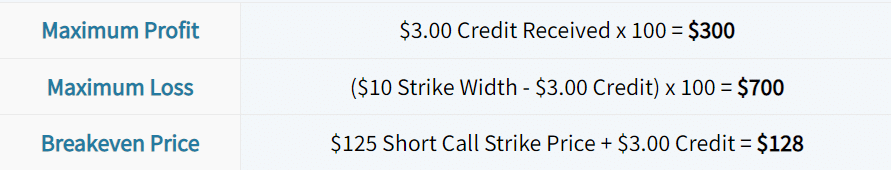

Let’s look at a successful call credit spread trade so that you can see how the spread works in relation to changes in the stock price.

In this example, we’ll look at a call credit spread in which the 120 call is sold and the 125 call is purchased for a net credit of $1.93. In this case, the maximum profit potential is $193 and the maximum loss potential is $307:

As we can see, the strategy starts losing money when the stock price increases after the spread is sold. However, as long as the stock price is below the breakeven price of the spread as time passes, the position will start to see profits from the decay of the options.

As a result, the call credit spread is a great strategy to use when you believe a stock will remain below a certain price, but want limited loss potential if you’re wrong.

Like put credit spreads, call credit spreads are impacted negatively by rises in implied volatility.

Option Strategy #3: The Iron Condor

The third and final credit spread option strategy we’ll discuss is the combination of the first two strategies!

The short iron condor option strategy consists of a call credit spread and a put credit spread. As a result, the position is directionally neutral, and profits when the stock price remains between the two spreads as time passes.

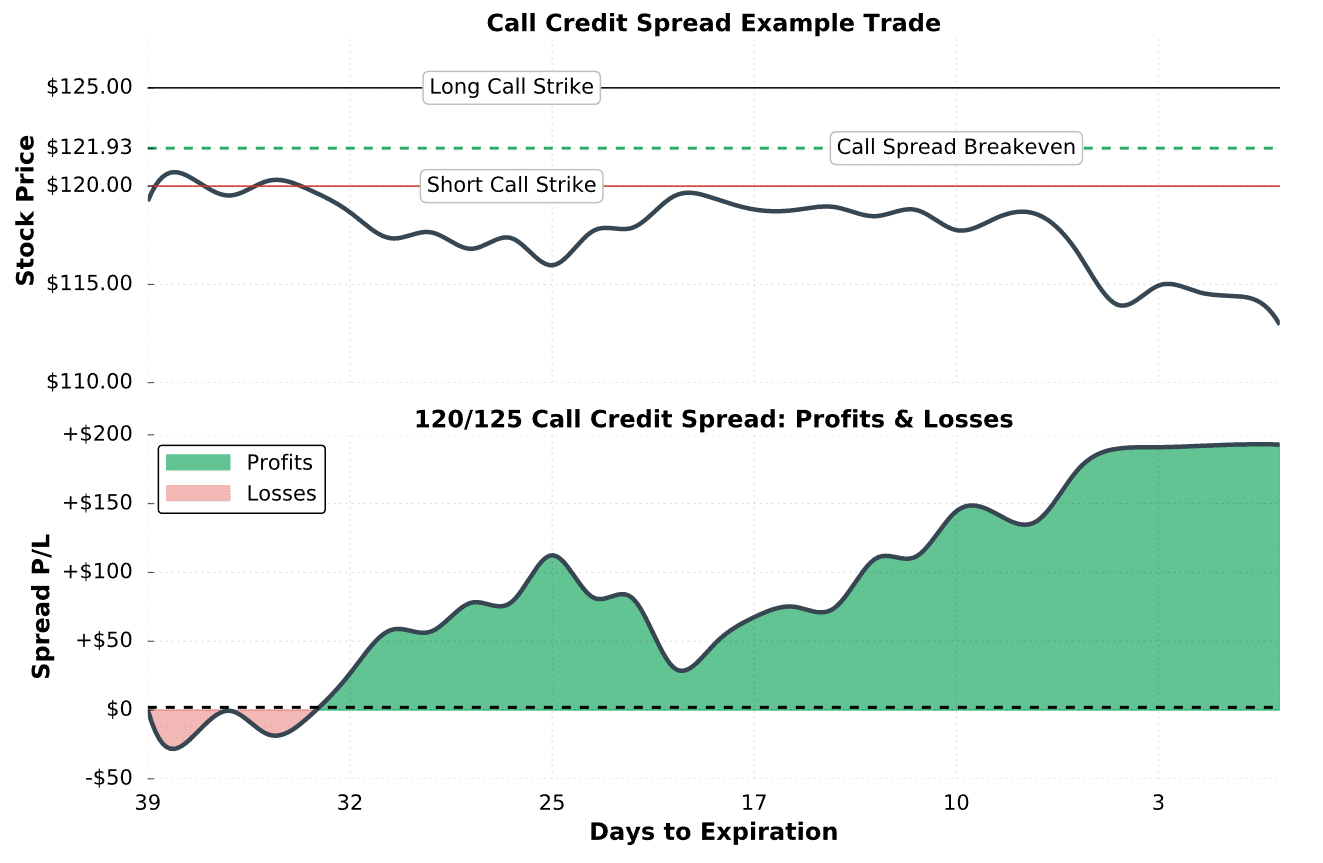

Here are the key characteristics of the iron condor strategy:

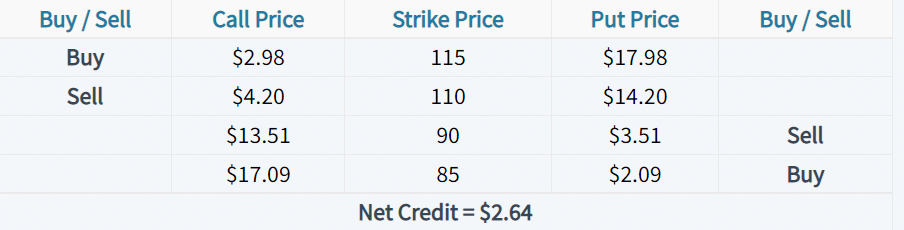

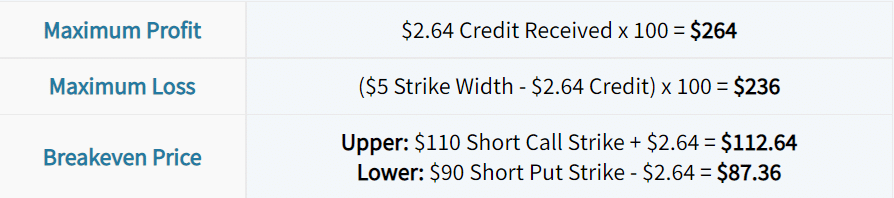

Here’s an iron condor example trade:

Based on the strikes, entry credit, and strike widths, here are the trade’s profit/loss characteristics:

In this case, the 110 call is sold and the 90 put is sold. As a result, the trade’s maximum profit zone is between $90 and $110 at expiration. However, as long as the stock price remains between the breakeven prices of $87.36 and $112.64 as time passes, the spread will begin to see profits from the decay of the options.

The maximum loss potential is $236 per iron condor, which occurs when the stock price is beyond the long call strike price or long put strike price at expiration.

Iron Condor Example Trade

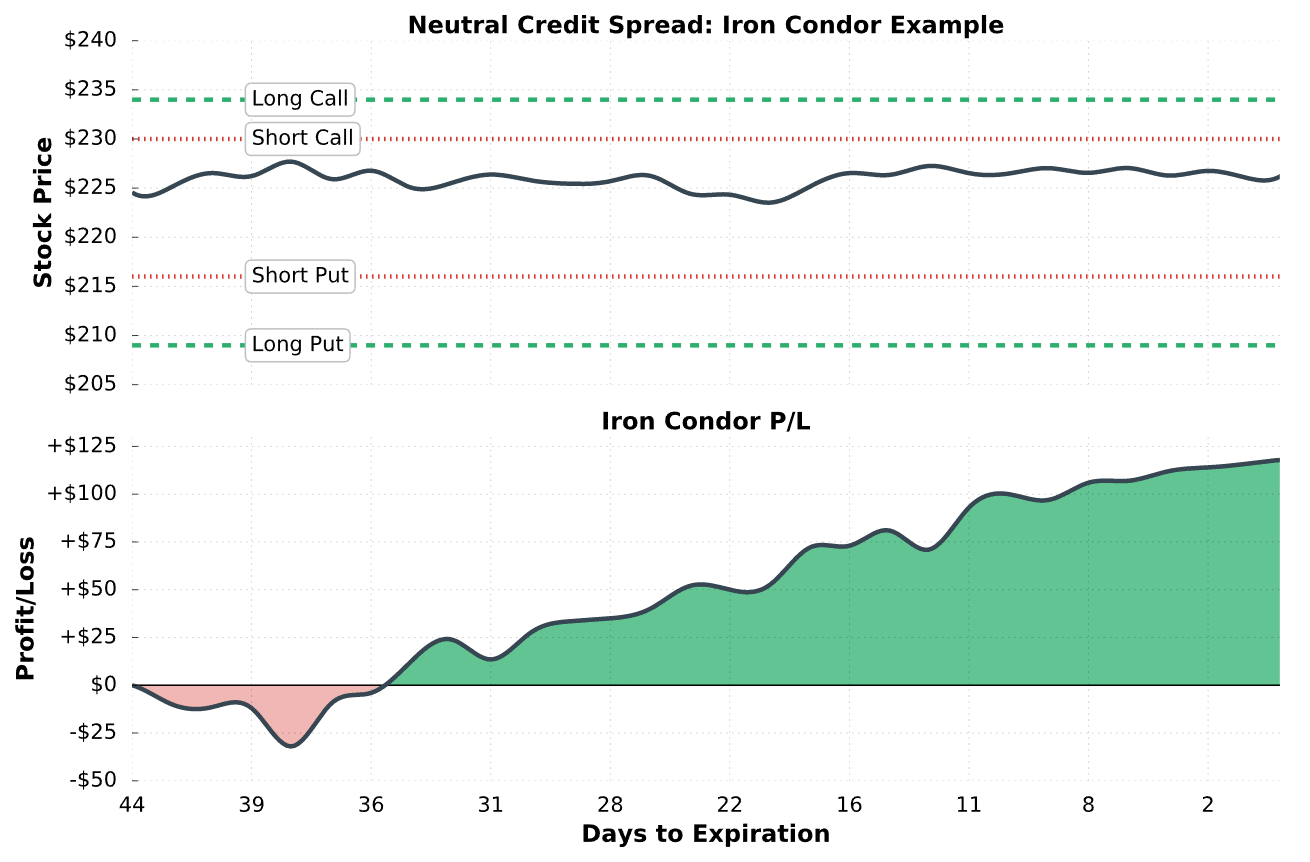

Let’s finish by looking at a successful iron condor trade so you can see how the strategy performs relative to changes in the stock price.

In this particular example, we’ll look at an iron condor comprised of a 216/209 put credit spread and a 230/234 call credit spread. The net credit in this case is $1.18.

Here’s how the trade performed:

In the beginning of the period, the stock price starts to rise towards the short call strike price of $230, and the trade starts to lose money. However, the stock comes back down and trades between the short strikes as time passes, leading to steady profits for the iron condor seller.

Summary of Main Concepts

We’ve covered a lot of ground here, so here are the key points to remember from this post:

•Credit spread option strategies are strategies that collect more premium from the sold options than what’s paid out for any purchased options.

•Credit spreads are very common among traders who trade options for income, as credit spread strategies can profit in more than one way (making them high probability trades), and have limited loss potential.

•Put credit spreads profit when the stock price remains above the spread’s breakeven price as time passes, and lose money if the stock price falls quickly and significantly.

•Call credit spreads profit when the stock price remains below the short call strike price as time passes, and lose money when the stock price increases quickly and significantly.

•The short iron condor option strategy consists of a call credit spread and a put credit spread. As a result, the position is a neutral strategy that profits when the stock price remains between the two spreads, but loses money when the stock price moves substantially in either direction.

Note! Trading options (particularly short options) come with significant risks. In order to better understand the risks of standardized options, read this guide from the OCC.

Credit Spreads FAQs

Credit spreads profit when the spread narrows. Over time, options tend to decay in value. This decay in value helps credit spreads become profitable.

On a credit spread, the maximum profit is limited to the credit received.

An example of a call credit spread can be seen in AAPL. If a trader believes AAPL will stay below $160/share, that trader could sell a 165 call and buy a 170 call for a net credit of $1. If AAPL is trading under 165 at the time these options expire, that trader will realize a profit of $1, or $100.

Next Lesson

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.

2 thoughts on “3 Best Credit Spread for Income Options Strategies”

So a put credit spread and a call credit spread make an iron condor. Is it possible to leg into an iron condor by entering a call and a put credit spread at different times?

Hi Lana!

Thanks for the question. You can definitely leg into an iron condor. Just remember, both the call spread and put spread must be 1.) of the same width, and 2.) of the same expiration cycle.

Happy trading!

Mike