Last updated on April 6th, 2022 , 07:07 pm

Insurance is a fact of life in our money-driven world. Car insurance is necessary to protect your vehicle and yourself from the repercussions of a collision. Medical insurance is required to obtain reasonably-priced medical care, at least in the United States. Dental insurance, Vision insurance, Renters, or Homeowners insurance; are all crucial kinds of protection.

In general, the concept of insurance is simple. You pay a monthly premium to maintain coverage. If something happens to whatever you’re covering (your vehicle, your health, your teeth, your home), the insurance kicks in to pay for whatever damage or replacement is necessary.

What about life insurance?

The tricky part about life insurance is that it’s strangely positioned in our culture.

- It’s often viewed as something you don’t need to worry about until you’re old, when it may start paying out.

- It’s not legally mandated how health or car insurance coverage often is.

- It’s complex enough that many people don’t want to learn about it.

Life insurance sounds simple. You pay into a policy that, when you pass away, pays out to your family. This payout can help keep them financially stable as they seek to replace your income or cover funeral and other associated expenses. Of course, all too often, people don’t think about the repercussions of their passing.

There are many potential benefits to life insurance while you’re still alive, including the potential to cash in your policy for immediate financial help. The question is, how?

What Are The Benefits of Life Insurance?

There are quite a few benefits to life insurance, both for you and your family.

1. It’s tax-free when it pays out.

First and foremost are the tax implications. Inheritance and other forms of death-based windfalls are classified as income in some form or another and are typically taxed. Life insurance policy payments are not classified as taxable income, so your family won’t have to suffer an unexpected tax burden.

2. The money isn’t restricted.

When your loved ones receive a payout upon passing, that money is treated as ordinary money. They aren’t required to use it in one specific way; instead, they can use it for anything. This includes ongoing living expenses to a child’s college education, funeral expenses, and more.

This can be an extremely beneficial windfall for many. Considering that recent estimates place 64% of the population living paycheck to paycheck, having the insulation of a payout for many unforeseen costs relating to end of life can be highly beneficial.

Consider that the general recommendation for coverage is 7-10 times your annual income. This can mean 5-10 years of living expenses covered for your family, assuming a consistent standard of living and expenses.

3. You may be able to cash out your insurance policy early.

Living expenses and medical bills can pile up as you reach retirement age or older, while income generally doesn’t. The usual goal is to accumulate enough wealth in retirement savings throughout your life to live comfortably in retirement, but that’s not always possible.

You can use some forms of life insurance policy in various ways to support you in retirement, in your later years, or with specific end-of-life bills. How? Let’s discuss it in greater detail.

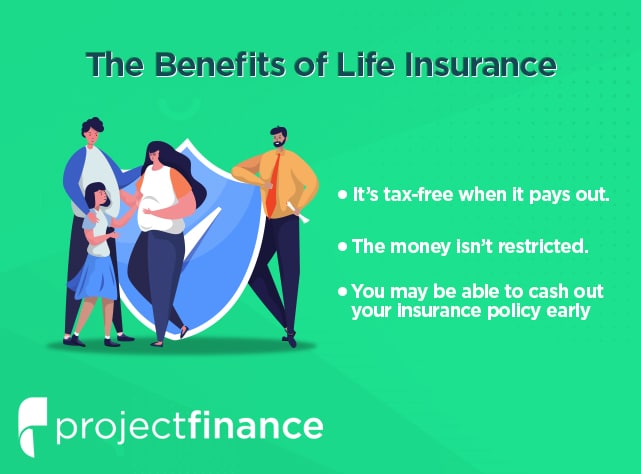

What Are The Different Types of Life Insurance?

If you’re hoping to get a payout for your life insurance policy while you’re still alive, you’ll need to understand the different types of life insurance and the kind of policy you have. Some types of life insurance have payouts, while others do not.

Here’s a brief rundown.

- Term Life Insurance. You buy a fixed-duration policy of anywhere from one year to 30 years annually. If you pass away during that time, your family receives a payout. If you don’t, the policy expires, and no one except the insurance company gets anything. These policies have higher payouts and lower premiums to balance this risk.

- Whole Life Insurance. You buy a policy that lasts until you die, whether that be five years from now or 40. You enroll, pay an annual premium, and are covered forever. You get a guaranteed return on your investment, and the policy accrues cash value as you pay into it.

- Variable Life Insurance. These are variations of life insurance tied to investment accounts – the cash value of the investment rises (or falls) according to the investment vehicle attached to the policy. However, the death payout remains static, as do the premiums.

There are other variations, but these are the main versions.

A key takeaway here is that “term life insurance” cannot be cashed out. To cash out your policy or receive money from it, it needs to have some cash value.

Term life insurance generally does not have a cash value attached, while whole life and variable insurance policies do. Term life insurance may be convertible into a permanent form of life insurance and thus enable being cashed out. Still, these policies require specific riders, usually when you’re signing up for them.

How Can You Get a Payout from Life Insurance?

Generally, there are three different ways you can get a payout from life insurance while you’re still alive. Each of these ways may have sub-options, so let’s discuss them.

1. Life Settlements

First up is the life settlement. A life settlement is selling your life insurance for a one-time payment. This payment is higher than the surrender value (which I’ll discuss later) but lower than the death benefit the policy would pay when you pass.

In other words, you’re transferring your policy from yourself to a third party, usually a company that specializes in precisely this transaction.

- The purchasing party becomes responsible for the premiums on the policy and receives the payout when you pass.

- You receive an immediate cash payout, tax-free, which you can use for your retirement and expenses.

The biggest downside to this option is leaving your family without those benefits when you pass. If you settle your policy and then use up all of the money on retirement living expenses, your family is left with nothing but your inheritance when you pass. Of course, if you have no living family, this is a moot point.

Unfortunately, one of the biggest reasons people cash out their policy is because the lower income they have during retirement means they can no longer afford the premiums. Other unexpected expenses can require more money on hand and the desire to sacrifice uncertain future benefits for immediate tangible benefits. Selling the policy early and taking a hit is better than not being able to pay and losing your coverage entirely.

2. Cash Value

As mentioned above, whole life insurance and several other kinds of life insurance, such as variable life insurance, have a cash value attached to them. Your premiums are higher, but part of your payments goes into an account that accrues value.

In variable, indexed, and other forms of life insurance, this may be more explicit, with the cash value riding in a market account and investing in the market through normal means, similar to retirement accounts.

There are three ways for a policyholder to access the cash value of their life insurance.

1.) Surrender is the first. This means, essentially, canceling your life insurance in exchange for a payout of the insurance’s cash value. You gain the cash value when you surrender your life insurance, minus a few minor processing fees. This money is then yours to do with as you will.

Surrender may have tax implications since it is weighed against the amount you have paid as premiums. Some policies also have repercussions and penalties if you cash out while still under a specific age limit, which varies per policy.

Of course, the biggest downside of surrender is the subsequent lack of life insurance. When you pass away, your policy is already gone, so your family does not receive a death benefit.

2.) The second option is a loan. Many policies allow you to take out a loan consisting of some of the policy’s cash value. You are encouraged to repay it as a loan, though there’s generally no set repayment schedule.

These loans accrue interest if you don’t repay them. Moreover, when you pass, the value of the loan plus its interest are deducted from the death benefit paid out by the policy. The death benefit may be reduced significantly depending on how long ago you took out the loan, how much value the loan had, and how much interest accrues.

3.) The final of the three options is withdrawal. Withdrawing is similar to a loan in that it can reduce the final death payout since the payout is generally the policy value plus the cash value. Pulling cash out earlier than expected will reduce that portion of the payout.

The cash value of a life insurance policy can also be used as “implicit income” by reducing expenses. Specifically, some policies allow you to use the cash value to pay the policy’s premiums, making them more or less self-sufficient until the cash value is gone. This process leaves you with more freedom to use the rest of your money in other ways.

3. Living Benefits

The third way to get value from your life insurance policy before passing away is using the living benefits riders on your policy (if it has them). There are three main ways these benefits can occur, but these may be riders you need to attach to your policy rather than options freely available to everyone. Be sure to talk to your insurance agent to see if you have these riders.

These riders are often called Accelerated Benefit Riders. They are usually optional and may not be available on all policies. Their payouts can range from 25% to 100% of the death benefit you would receive, either as a lump sum or as monthly payments. Typically, they increase the cost of the life insurance policy along the way.

The three riders are:

- Chronic Illness. If you suffer from an ongoing chronic illness and need significant help with daily tasks and ongoing expenses, you can get a chronic illness payout from your insurance. Chronic diseases include AIDS, heart disease, diabetes, asthma, high blood pressure, and more.

- Long-Term Care. LTC benefits are paid out when you require ongoing, long-term care such as assisted living or hospice care, nursing home care, or other forms of continuing care. The rider helps pay for that care as long as you need it.

- Terminal/Critical Illness. Sometimes, a doctor will diagnose an illness you have and estimate that you have less than 12 months to live based on similar cases and your overall health. In these cases, you can receive a terminal illness payout to help with end-of-life care and other expenses associated with that final year of life.

In general, you have to work with a doctor and meet specific requirements to access these early payment riders. If you don’t meet the criteria, you can’t get the money and will need to resort to one of the other options.

Should You Cash Out?

Whether or not to cash out your life insurance largely depends on personal circumstances, so there’s no one correct answer.

Typically, if you no longer have dependents or a family that would benefit from a death payout, receiving money early to live your own life is better than letting that money evaporate or go to the state.

Early payments may also be beneficial to maintain the quality of life and enjoy your retirement if you otherwise don’t have the money to do so.

In the end, the choice is yours.

Now, we turn to our readers. Are you weighing the pros and cons of cashing out your life insurance policy for retirement? What is your current situation? If you have any questions for us, please share them in the comments section below! We’d love to hear from you, and we make it a point to respond to our readers.

![Poor Man’s Covered Call [The Ultimate Beginner’s Guide]](https://www.projectfinance.com/wp-content/uploads/2022/03/1.png)